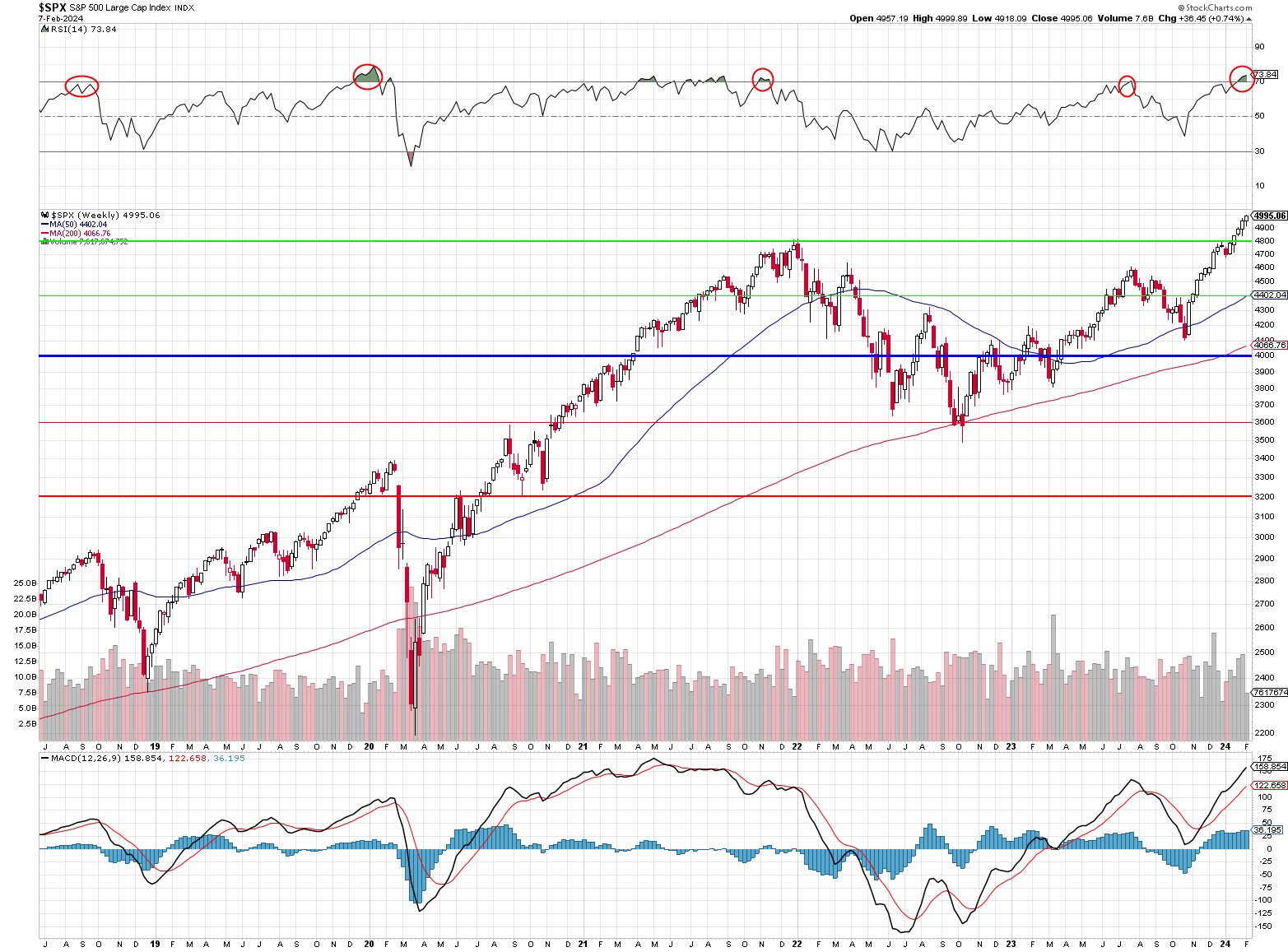

So close!

Technically it’s just a number – there’s nothing actually significant about S&P 5,000 as it is, in THEORY, just an aggregate accounting of what should be millions of individual decisions that are made by traders each day on the 500 individual stocks that make up the index BUT the psychological impact of such milestones cannot be understated. In the world of investing, these round numbers often serve as symbolic markers, capturing the attention of both the media and the market participants, thereby influencing sentiment and behavior.

Market participants often assign emotional and psychological significance to these round numbers, viewing them as targets or barriers. When an index nears such a milestone, it can trigger a flurry of activity, with some investors seeing it as a signal to take profits, while others may view it as a bullish sign to buy more. This can lead to increased volatility around these levels.

Moreover, the near-reach of S&P 5,000 occurs within a context that includes not just the raw numbers, but also the narrative around the market’s health, the economic outlook, and the performance of key sectors. It prompts a deeper analysis beyond the surface-level enthusiasm or skepticism. For instance, the current climb towards this milestone is happening amidst a backdrop of earnings adjustments, shifts in consumer debt behavior, and a complex global economic environment. These factors add layers of meaning to the index’s performance, influencing how investors interpret the significance of the 5,000 mark.

Yesterday’s run (momentarily) over 5,000 came amidst a backdrop of choppy bonds and a flat USD, influenced by fluctuating yields and concerns around New York Community Bancorp (NYCB) following a downgrade. However, updates on NYCB’s executive changes and liquidity have somewhat alleviated these concerns (but it remains to be seen how traders react as panic doesn’t follow logic).

As we discussed last month, a cautionary note is sounded on the recent earnings surprises, suggesting they be viewed with skepticism due to significant pre-season estimate reductions. This implies that the market’s euphoric optimism might be built on shaky foundations, with adjustments in expectations rather than genuine financial health driving perceived successes (as noted yesterday).

A dramatic shift in consumer behavior is highlighted by a stunning collapse in credit card debt change, even as the average Annual Percentage Rate (APR) on credit cards hits a new all-time high. This suggests a growing consumer reluctance to incur debt amidst rising costs of borrowing, potentially signaling a cautious or strained consumer base as evidenced in yesterday’s almost flat Consumer Credit numbers – $15Bn below consensus and down $22Bn since November:

If the consumers are running out of credit, how exactly are we planning to expand the economy? The significant reduction in credit card debt, coupled with high APRs, points to a consumer base that is becoming increasingly wary of taking on high-cost debt. This could have broader implications for consumer spending, which is a critical driver of economic growth. Furthermore, the skepticism around earnings surprises suggests that investors should look beyond headline numbers to understand the true financial health of companies.

The current market scenario presents a dichotomy between the surface-level optimism seen in stock market performance and underlying economic indicators that suggest caution. The near breach of the S&P 500 to 5,000 points reflects strong market sentiment, particularly in leading sectors. However, the backdrop of earnings adjustments and consumer debt behavior indicates potential vulnerabilities.

For our PSW Members – understanding the technical and psychological dimensions of such milestones can offer valuable insights. While there are reasons for optimism, particularly in specific sectors, there are also significant risks and uncertainties. A strategy that balances exposure to high-performing sectors with caution about underlying economic indicators and consumer behavior may be prudent.