Are 2,000 companies right or are 500 companies wrong?

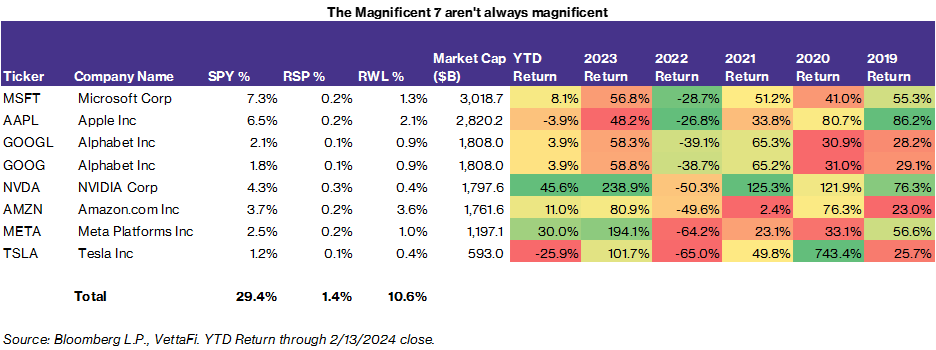

Unlike the large-cap indexes, which are all dominated by the “Magnificent 7” – a group of seven mega-cap tech companies that include Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG, GOOGL), Tesla (TSLA), Nvidia (NVDA) and Meta (META) – the Russell 2000 reflects the performance and outlook of the broader U.S. economy.

Small-cap stocks tend to be more sensitive to changes in economic conditions, consumer demand, and interest rates than large-cap stocks, which have more global exposure and stable cash flows. The Russell 2000 has been underperforming the large-cap indexes – as it often can do when the market favors the tech sector or when the economic outlook is uncertain – both of which are true at the moment.

In 2023, the Russell 2000 gained only 4.4%, while the S&P 500 rose 26.9% and the Nasdaq surged 21.4%. The Russell may face more headwinds in 2024, as the Federal Reserve plans to raise interest rates and taper its bond-buying program, which could hurt the profitability and liquidity of small-cap companies. However the index could also benefit from the strong U.S. economic recovery, the Infrastructure Spending Bill, and the potential rebound in sectors such as Energy, Financials, and Industrials, which have a larger weight in the Russell than in the large-cap indexes.

The Russell fell back below 2,000, 10% off the all-time highs and has not gotten back over that line (significantly) since early 2022 while the M7-driven indexes have all made new highs but, if we strip out those 7 stocks, all the indexes would be lined up – still struggling to break higher in a rough economy.

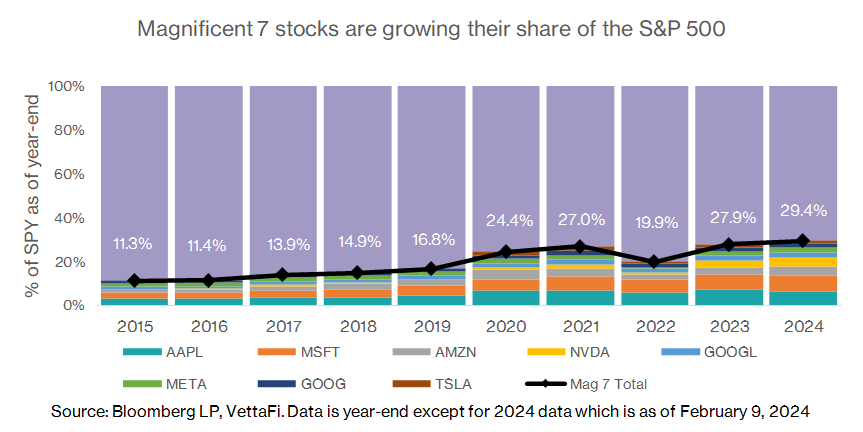

Keep in mind the Magnificent 7 are now almost 1/3 of the S&P 500 which means that index will live by the 7 but it will also, one day, die by the 7 as everything has a season – at some point…

At PhilStockWorld, we pumped up our portfolio protection last week when we did our February Portfolio Reviews because having a year like we had in 2022 with these 7 stocks, would now be a greatly magnified disaster – especially if the other 493 stocks in the S&P fail to pick up the slack.

We hear from NVidia this evening and hopefully they don’t disappoint but revenues are expected to be up 800% – so it’s going to be hard to outperform as well and the stock, which was at $207.54 last year and closed last night at $694.52 with a $1.7Tn valuation, up from $500Bn last year so that’s a $1.2Tn gain in 12 months, which is 3% of the entire S&P 500s value ($40Tn) and that has led NVDA to be priced at 390 TIMES 2023’s $4.36Bn in earnings.

HOWEVER, NVDA has a very odd fiscal year and today’s report is the LAST Q of 2024 for them and the past 3 quarters have been $2Bn, $6.2Bn and $9.2Bn in profits and, if we assume $10Bn more in Q4, that’s $27.4Bn so that’s “only” 1/62 of the market cap and certainly they are not slowing down so let’s say they go $45Bn over the next 4 Qs (whatever year they call it) – that’s only 37x so NVDA is not too outrageous – unless someone else announces better, faster, cheaper chips in the next two years – then they collapse, which is something that often happens to leading chip companies.

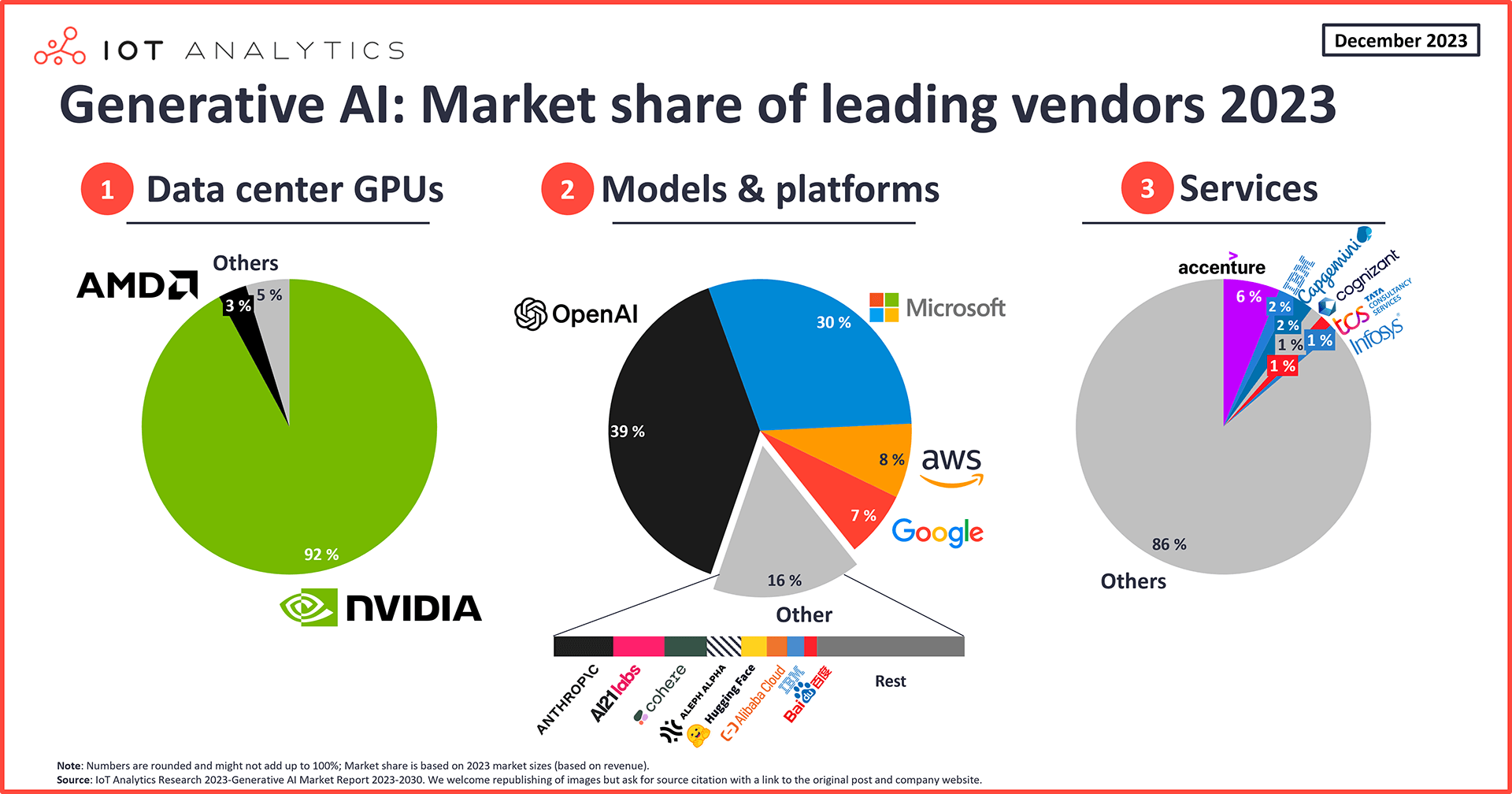

NVDA is “winning” because they were already designing 3D graphic chips for games and the people who were designing AI systems said “Hey! Those would be great for our AI systems” and NVDA just happened to be in the right place at the right time with the right product but that was two years ago and that’s two years that their very well-funded rivals and their even more well-funded customers have had to work on alternatives to NVDA’s very expensive (and scarce) solution.

Intel (INTC) used to look like NVDA at one time but now they are just one of many chip companies as the competition caught up. It takes several years for a chip company to design and produce a new chip and that works to NVDA’s advantage at the moment but it won’t if someone comes up with something better and they need to re-tool – and that will happen eventually.

In early December, AMD announced the release of its Instinct MI300 Series accelerators, which are cheaper than NVIDIA’s comparable accelerators and, as AMD claims, faster. AMD’s CEO, Dr. Lisa Su, forecasted at least $1 billion in revenue in 2024 through this chip alone, and Microsoft, Meta, and OpenAI stated they would use the Instinct MI300X in their data centers. AMD also recently launched ROCm 6.0 to provide developers with an ecosystem that is equally attractive to CUDA.

In May 2022, Intel’s Habana Labs released its second generation of AI processors, Gaudi 2, for training and inferencing. Though not as fast as NVIDIA’s popular H100 GPU, it is considered a viable alternative when considering price to performance. Meanwhile, in July 2023, startup chipmaker Cerebras announced it had built its first of nine AI supercomputers in an effort to provide alternatives to systems using NVIDIA technology. Cerebras built the system, Condor Galaxy, in partnership with the UAE, which has invested in AI research in recent years.

This is not to say AI will not be huge and AI companies will not dominate but, once upon a time in America, there was AOL, Worldcom, Excite, Netscape, Infoseek, Yahoo!, Lycos, Global Crossing, Prodigy, MP3.com, AltaVista, DoubleClick, UUNet, Transmeta… Not many of the original magnificents are still around today – are they?

Speaking of originals, Amazon is hot and Walgreens is not so the Dow is once again refreshing itself because what’s the point of having a tracking index if you don’t keep changing all the components to make it look better, right?