Despite soaring stocks, money-market fund assets soared to yet another fresh record high for the third straight week, adding $31BN to $6.11TN (over $100BN in three weeks)…

Source: Bloomberg

But, but, but, ‘money on the sidelines’ and stuff?

In a breakdown for the week to March 13, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.97 trillion, a $34.3 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets fall to $1.016 trillion, a $3.33 billion drop, driven by an exodus from the institutional side.

Institutional funds saw a large $23.5BN inflow while Retail funds saw $7.8BN inflow…

Source: Bloomberg

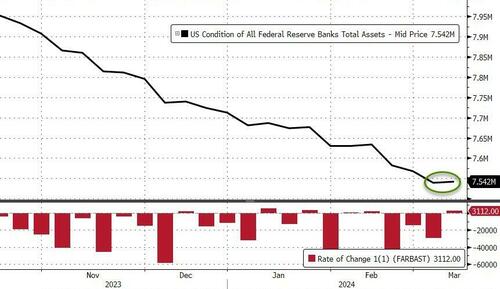

The Fed’s balance sheet expanded last week by $3.1BN (the biggest weekly expansions since mid-January)…

Source: Bloomberg

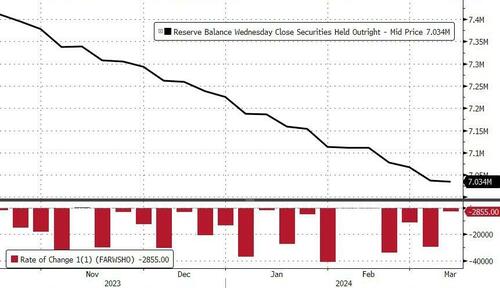

QT continued but at a much more glacial pace, down just $2.85BN last week…

Source: Bloomberg

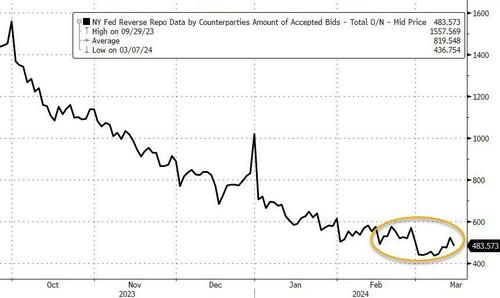

The Fed’s Reverse Repo facility has – for now – seen liquidity withdrawals stabilize a bit…

Source: Bloomberg

Bank reserves at The Fed were flat on the week with equity market cap as dramatically decoupled as it was in July of last year…

Source: Bloomberg

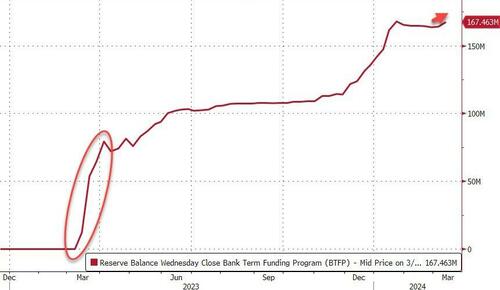

The final week of the facility saw it increase by over $3BN to $167BN.

$167BN of loans remain on this facility and those loans will start to mature now – the next four weeks will see $79BN of those loans mature and banks forced to secure other funds to fill that gap…

Source: Bloomberg

So now we watch the Discount Window for signs of distress in the banking system as they are forced to source new funds.