$1,340,816!

$1,340,816!

That is down $17,043 from our March 13th review but the S&P 500 was at 5,247 that day and now it's 5,061 (-3.5%) so losing just 1.2% in our paired portfolios indicates our hedges are indeed working. Overall, we are still almost double our $500,000 + $200,000 start back on May 16th of last year so we're in month 11 and up about 100% - I'd call that a good first year for our new portfolios!

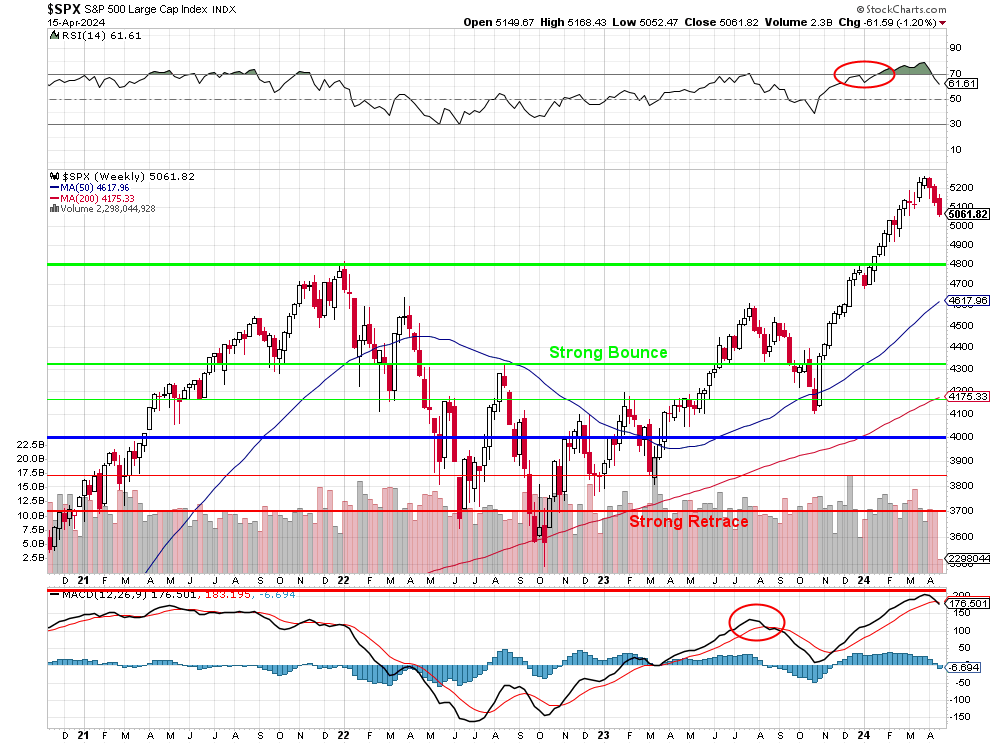

Of course, we can't assume this will go on forever. Our goal is to make 30-40% annually so we're miles ahead of schedule and, at this stage, it's more important to lock in our gains than to "go for it" as we now have a lot to protect. Last month, we were clearly overbought on the S&P 500 as the RSI had been over 70 for 2 months and that just came to a screeching halt but, as you can see - we're still miles away from oversold and still 200 points (3.9%) above the 4,800 line that we still feel should be the top of the range - not the middle!

Still, we're certainly not worried about a 4% drop and that rising 50-day moving average means we are likely to find support at that 4,800 line so we'll just have to see how the next few weeks play out and that means we're going to head into earnings season with a fairly neutral stance in our portfolios.

We just reviewed our $700/Month Portfolio last week and, after 20 months, we're up 54.5% and that's also MILES ahead of our plan of making 10% per year. That's our most conservative, non-margin portfolio so I'd say we're going to be in very good shape with the rest:

Money Talk Portfolio Review: I just did the show on March 27th and we were at $427,611 at the time, which was up 327.6% from our $100,000 start on Nov 13, 2019.