HBI/Stock - Hmm, I guess we'll have to pull the trigger on them since that may be a sign something is up.

HBI was our 2nd choice for Stock of the Year because our first choice, LB, had already snapped higher by Thanksgiving, when we officially make our pick. Both are out of favor at the moment and we already picked up LB but now we can add some HBI to our Portfolios as well:

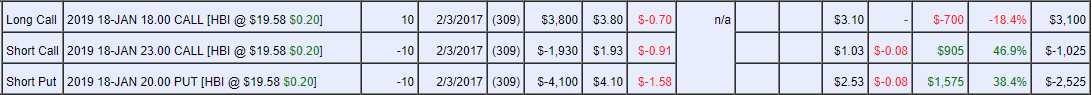

Note our old LTP play from 2/3/17 had a rough ride:

Submitted on 2017/02/03 at 7:46 am

HBI/Rexx – If they go down 30% I will dump other stocks so I can load up the truck. Goes back to what I try to teach you guys about the absolute value of a company. This isn't some dot.com with a blown business model or a retailer with too many stores and too few customers, this is a brand clothing company in an age where it take hundreds of millions to build each brand and you get Maidenform, Bali, Playtex, Hanes, JMS/Just My Size, Lilyette, Wonderbra, Donna Karan, DKNY, Champion, Polo Ralph Lauren, L'eggs, Hanes Beefy-T, Gear for Sports, Duofold, DIM, Nur Die/Nur Der, Lovable, Shock Absorber, Abanderado, Zorba, Rinbros, Kendall, Sol y Oro, Fila, Bellinda, Edoo, and Track N Field AND $5Bn in sales AND $400M in profits for $8Bn. If you don't understand the value in that – stick to TA!

Submitted on 2017/02/03 at 12:54 pm

HBI/Pstas – $25 seems about right. As to 44% of sales, so the 3 largest retailers sell 44% of something that pretty much every retailer (including AMZN) sells? That's nothing to worry about. If you don't get your Leggs from WMT it's because you're getting them at WBA or AMZN or whatever but you are still getting Leggs and HBI doesn't care WHERE you buy their stuff.