Sometimes we forget the basics.

Sometimes we forget the basics.

In our video series, there's a lesson called "The Secret to Consistent 20-40% Annual Returns on Stocks" and I hope you've seen it. Although the low implied volatility of the market has made it a rough year for option selling, we were still able to scratch out just over 40% profits in four months in our paired Long-Term and Short-Term Portfolios. Our other virtual portfolios are also performing very well with the Options Opportunity Portfolio up over 30% in 2016 and, surprisingly, our very conservative Butterfly Portfolio is up over 60% due to some not very conservative bullish adjustments we made in the February dip. On the whole, though, we accomplished all this by following the BASIC strategies we teach at Philstockworld, not by gambling!

Not that we're adverse to gambling, gambling is fun – but fun means fun, which means it's a small part of our total investing portfolio while the vast bulk of our money is SENSIBLY INVESTED in safer strategies that are designed to grind out consistently good returns over many years. We have discussed the long-term advantages of compounding annual growth in "How to Get Rich Slowly" and now we'll begin discussing some basic strategies that will help you generate those consistent annual returns to put you on a path to a healthy, wealthy retirement.

In the "7 Steps" video, we're discussing a basic covered call strategy and we delve into the Fundamentals of stock selection. At the time (Sept 2013), we were using ABX, which was trading at $19.15 and we sold the November $19 calls (45 days out) for $1.30. The simple instructions were to wash, rinse and repeat to make up to 40% a year by simply selling calls against the stock.

As you can see, ABX has dropped as low as $6.57 since then, down about 65% BUT, had you followed through and kept selling calls, we had a lovely 12-month period in which it stayed in our range and that would have given us 8 opportunities to collect at least $1 for $8 back before the stock turned down in September of 2014. That would have dropped the net outlay below $10 and stopping out at $15 would have been a 50% gain for the year – even as the stock dropped 22% (from $19.15 to $15).

Even if we stuck with the stock as it kept going lower, there were 15 more months of flat or dropping action in which, even if we collected just 0.50 per month, it's another $7.50 off our basis, bringing it down below $2.50 and eventually stopping out at $7 would be a 180% gain – despite the stock going 65% in the wrong direction! Now are you interested in learning more about this "boring" system?

You can't get more basic than this – just mindlessly selling covered calls every month or two and, even when the stock ends up being a dog – 180% returns! There's nothing fancy here other than our selection of a range-bound stock which, of course, we stop playing when it falls out of our range.

You can't get more basic than this – just mindlessly selling covered calls every month or two and, even when the stock ends up being a dog – 180% returns! There's nothing fancy here other than our selection of a range-bound stock which, of course, we stop playing when it falls out of our range.

ANYONE can learn how to trade this way (and we go over all the strategies in our book, of course) yet, unfortunately, a lot of traders tend to FORGET how EASY it is to make money by just sticking to the basics.

As with the Dark Side, it is easy to be seduced by the allure of quick and "easy" money using options for leverage and trying to beat the market for a big win based on some "tip" you got, be it from a friend or a guy on TV or even someone like me. THAT'S GAMBLING!!!

Never forget that that's gambling and you will be OK. Gambling is NOT investing. Investing is what we should be doing with the vast bulk of our equity assets – gambling is not! See our series on Smart Portfolio Management, which has examples for $10,000, $100,000 and $1M+ portfolios. We demonstrate a lot of these trades for our Members during the year using 4 virtual portfolios with various sizes and trading styles.

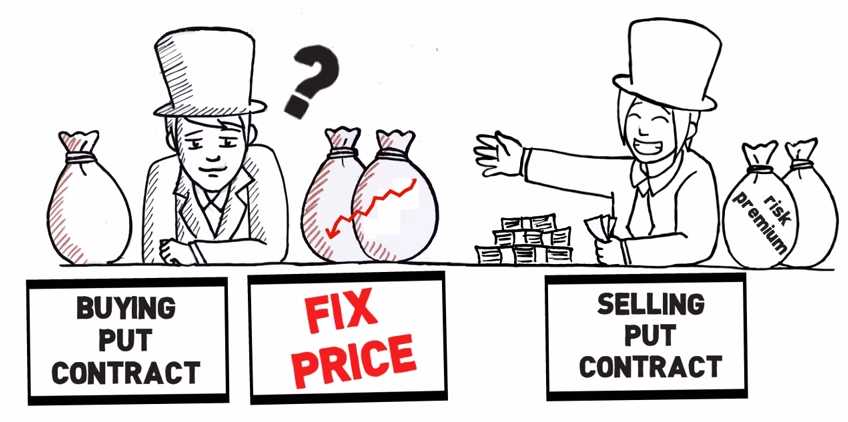

BUT, as I said above, sometimes we just forget the basics – the reason we love options in the first place. We can sell a put to give ourselves a discounted entry on a stock and we can sell a call to pay ourselves a dividend. Year after year we demonstrate how these techniques can give you those consistent 20-40% annual returns WITHOUT taking huge risks and this coming year, our concentration is going to be on having our Members EMBRACE those long-term wealth building strategies.

BUT, as I said above, sometimes we just forget the basics – the reason we love options in the first place. We can sell a put to give ourselves a discounted entry on a stock and we can sell a call to pay ourselves a dividend. Year after year we demonstrate how these techniques can give you those consistent 20-40% annual returns WITHOUT taking huge risks and this coming year, our concentration is going to be on having our Members EMBRACE those long-term wealth building strategies.

If you believe investing is gambling, then you are doing it wrong and, if you believe investing is gambling – you are more likely to take the kind of risks that ARE gambling, which will then reinforce your misguided view that investing is gambling – get it?

There is no gambling in buying ABX TODAY, for $18.40 and selling the June $18 calls for $1.40. Your net entry is $17 and, on June 17th (34 days), you will either be called away at $18 with a $1 profit (5.8%) if the stock is above $18 or, if ABX is below $18, you will own the stock for net $17 (a 7.6% discount) – at which point you will wash, rinse and repeat the trade by selling the July $17s for $1.40 or so, dropping your basis to $15.60, 15% below the current price.

This is not an options class so I won't get into all the what-ifs down the road. Suffice to say you can repeat the performance that gave us eventual profits on ABX in the past with very little risk. Now, our Members know there are fancier ways to go, so let's pick another example and see if we can make it more interesting than 5.8% in 34 days.

Remember, we want to find stocks that are likely to stay in a channel. Stocks that have decent volatility day to day (to boost the price of the options we sell) but are not too likely to stray from a trading range of maybe 20% up or down. WMT comes to mind, MCD, VZ, T, F… Blue chips are good when you are beginning, as they are less likely to go to zero.

We'll start with F, because F is only $13.22 a share so anyone can play with it. Option contracts trade in 100-share blocks so SELLING the 2018 $12 put for $1.50 obligates you to buy 100 shares of F for $12 ($1,200) and puts $150 in your pocket right away. That nets you into the stock for $10.50, which is giving yourself a quick 20.5% discount (see "How to Buy a Stock for a 15-20% Discount").

We'll start with F, because F is only $13.22 a share so anyone can play with it. Option contracts trade in 100-share blocks so SELLING the 2018 $12 put for $1.50 obligates you to buy 100 shares of F for $12 ($1,200) and puts $150 in your pocket right away. That nets you into the stock for $10.50, which is giving yourself a quick 20.5% discount (see "How to Buy a Stock for a 15-20% Discount").

You can then conservatively buy 100 shares the stock for $13.22 ($1,322) as well and that would put you in at a net of $11.72 a share and, if F goes below $12 and the 100 shares are assigned to you, then you end up with 200 shares at an average of $11.86 ($2,372) – that's your maximum risk on the trade (and F is not likely to go to zero, of course). Now you can sell the June $12.75 calls for 0.70, putting another $70 in your pocket, so the total cash outlay drops to $1,102.

If you are called away in June $12.75, you get paid $1,275 in cash, keep the $70 from selling the calls and the $150 from selling the puts and you are left with just the obligation to buy 100 shares again at $12 (if the stock goes below that price by Jan 2018). That turns you initial net $1,102 into $1,275 (+$173 or 15.6%) in 34 days. If you do end up having to buy 100 shares of F in 2018 for $1,200, the $173 you made reduces your net cost to just $1,027 or $10.27 per share – 22.3% off the current price!

So clearly there is no reason to fear the upside and the downside is F goes lower and you keep the $220 you've collected and, in July, you sell another call for another 0.70 and now you have $290 in your pocket for August and $360 in Sept and $430 in Oct and $500 in Nov and $570 by December. A year from now – if you are NOT called away with more than a 20% profit, you will have $850 in cash and the F stock you bought for $1,102 and that's net $252 on your first 100 shares + $12 for the next 100 (since, clearly, we'd be under $12 by then) would be $1,452 for 2,000 shares or $7.26 per share (45% off the current price).

Of course, if F is lower than $7.26 (down 45%) in a year, you do lose money. As I often say to our Members, these are not magic beans – there is some risk, BUT – by intelligently managing our risk, we have a much more likely upside than downside and MOST of the time, we can make some very nice returns.

Of course, if F is lower than $7.26 (down 45%) in a year, you do lose money. As I often say to our Members, these are not magic beans – there is some risk, BUT – by intelligently managing our risk, we have a much more likely upside than downside and MOST of the time, we can make some very nice returns.

Now, there's a fancier way to play F and that's what we call an ARTIFICIAL buy/write where, instead of owning the stock (which pays a nice 4.5%, 0.60 dividend, according to Dividend.com), we instead buy the 2018 $11.75/16.75 bull call spread for $1.75, selling the same $12 puts for $1.50. That drops our net cash outlay to just 0.25 and we're only obligated to buy 100 shares for net $12 ($1,200) but we can STILL sell those calls.

Since our cash outlay is now 0.25 though (and margin required is $1.44 per contract) and since we don't have any stock to call away, our goal should be just to collect 10% per month of the $1.69 cash+margin we've committed to the trade – otherwise we are engaging in the great sins of greed and over-leveraging.

Looking to make 0.17 per month is easy. We can, for example, sell the June $13.75 calls for 0.17 and see how that goes before selling more. That's a very easy way to quickly generate 10% monthly returns while your upside risk doesn't kick in until F is over $16.75 – the top of your spread (otherwise you just roll your short calls along on months you don't collect the cash).

Again, not magic beans – some months you will win and some you will lose but, on the whole, when the potential is to make 120% per year if you have 12 winners – there's a HELL of a lot of ways you can end up making 20-40% returns with little trouble.

As a rule of thumb, if a stock isn't paying 3.5% or better dividend, there's no point in tying up the cash required to own it – so we'll prefer the artificial buy/write to the traditional but both are valid and both are very powerful long-term wealth creation tools that form the basis of our Long-Term Portfolio.

Here's a great list of Top Dividend Stocks by Sector and T is one we often play as they are very steady, year after year and also pay a $1.92 (5%) dividend which, of course, we can enhance using our system. PFE is ranked #4 on the Dow with a $1.20 annual dividend (3.62%) and we can enhance that nicely – as I noted in our Live Member Chat Room two weeks ago:

Dividend stocks: So Pat asked me what I think are good dividend stocks but first we need to define what a good dividend stock is. There are lots of stocks that pay high dividends but they also often carry a high risk of ownership. We can turn any stock into a dividend stock through options sales and, per example, the other day I mentioned PFE as my favorite because they pay a $1.20 dividend 3% AND I can construct a very conservative play around them:

PFE, for example, at $32.61, pays a $1.20 dividend so he can just buy 500 shares for $16,305 and sell 5 2018 $30 calls for $4.20 ($2,100) and sell 5 2018 $28 puts for $2.20 ($1,100) and that's net $26.21/27.105 (worst case if assigned 500 more, which is 17% off) = $13,105 and, if called away at $30 (10% lower than it is now), he'll collect $15,000, which is + $1,895 (14.4%) PLUS $1.80 in dividends ($900) for another 7% so 29% that way. Since you are only shooting for 9% – he can do that with 1/3 of what he wants to make the money on and keep the rest on the side – in case the market collapses and other opportunities come up.

So, to me, If I'm trying to make 5% in a $100,000 portfolio, 1,000 shares of PFE in this spread is $26,210 and you get called away (presumably) at $30,000 (+3,790) plus $1,800 in dividends over 18 months is $4,590 and you're only committing 1/3 of your buying power even in an IRA.

A trade like that is as low-risk as you get. It's one of the best dividend stocks. I also love T, which pays 5%, MO at 3.7%, WM at 3%, WMT at 3%, RRD at 6%, FTR at 7.5%, WIN at 7%, TOT at 5.5%, F at 4.25%, CAT at 4%, CSCO at 3.6%, INTC at 3.25%, KO at 3%, WFC at 3%, GE at 3% and, of course, our LTP REITs: ARR (15.2%), CIM (13.4%), CM (4.5%), NRF (12.3%) and STWD (10%). Some of these are monthly dividend stocks, which is also nice to have.

So any of those, when they are low in the channel and you can construct a nice, conservative spread around them, will do the trick towards building a dividend portfolio but use the REITs sparingly because they are a lot of risk for those 10% dividends – in the LTP they represent about a 10% allocation because it's nice money when it works – until it doesn't. Also in the LTP, we almost never enter the REITs unless they have dropped about 40% and we think they have bottomed – because they often do (and will again).

These are not "sexy" trades, these are the slow, reliable trades that we put the bulk of our capital into while we allocate a smaller portion (generally around 20%) to more aggressive short-term trading BUT, even then, we use a lot of our short-term firepower to BALANCE out our long-term trades. While the trades themselves are not sexy – our portfolio returns are VERY SEXY across the board – BECAUSE we use these techniques to Be the House – NOT the gambler and all those small wins add up over time with GREAT consistency.

This year (2016), our Long-Term Portfolio has been 100% bullish and our Short-Term Portfolio has leaned bearish to protect it. At the moment, we're playing for a correction over the summer, so we're not leaping into a lot of long-term positions, but that's a topic for another post…

For more content on Trading Education, check out our Archives at: http://www.philstockworld.com/education/