The Fed has become "Wall Street's Bitch." – Barry Ritholtz

Now that's funny (and, sadly, true).

"We have, in this country, one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board. This evil institution has impoverished the people of the United States and has practically bankrupted our government. It has done this through the corrupt practices of the moneyed vultures who control it". — Congressman Louis T. McFadden in 1932 (Rep. Pa)

"The [Federal Reserve Act] as it stands seems to me to open the way to a vast inflation of the currency… I do not like to think that any law can be passed that will make it possible to submerge the gold standard in a flood of irredeemable paper currency." — Henry Cabot Lodge Sr., 1913

"A great industrial nation is controlled by it's system of credit. Our system of credit is concentrated in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the world–no longer a government of free opinion, no longer a government by conviction and vote of the majority, but a government by the opinion and duress of small groups of dominant men." — Woodrow Wilson

"I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a monied aristocracy that has set the government at defiance. The issuing power (of money) should be taken away from the banks and restored to the people to whom it properly belongs." — Thomas Jefferson

There was another drawdown in crude today, 3.2M barrels, that makes 15M barrels this month and the country is now has 48M barrels less oil (out of 1.71Bn) than it had last August. That is to be expected because all but 28M barrels of the 420M barrels that were originally contracted for delivery to Cushing, OK on the September crude contract were cancelled before the contracts settled in August. Cushing can usually handle about 40Mb of crude per month and this is the 3rd consecutive month it has been underutilized.

So stocks went up, oil prices went up, gold went up and tomorrow we hang our hats on how Goldman Sachs is doing. With the country very obviously in shambles we are going to buy WMT and GM and, dare I say, XOM because Wilson's "small group of dominant men" are making money. And how does GS make money? By moving money around! When there's more money to move, they make more money. Perhaps that's why Goldman's stock is up 50% since their CEO became the US Treasury Secretary in May '06 (gee, who could have seen that coming?).

Despite my attempt to be bullish I am just too taken aback by a different kind of bull I'm seeing and I made a call to cash out on longer positions with stops yesterday. Having just been very wrong about the Fed that was a difficult call to make but I really think we're due for a pullback and the danger of a poor report from 2 of 3 out of GS, BSC and FDX tomorrow outweighed the additional gains I felt we could make pre-expiration.

We did have a positive day and we did touch the levels I set in the morning (13,850 for the Dow, 2,675 for the Nas and 1,535 at the S&P) but we generally pulled back from 11:30 onwards, triggering many stops.

The good news is we figured out how to break the scam at the NYMEX. Since they tend to leave as much as 100M barrels on order just days before settlement (that's today, by the way) and since 40M barrels is "a lot" for actual settlement. All we need to do is buy 50M barrels AND ACTUALLY ACCEPT DELIVERY and we lock in a glut of oil for the following month. Sure it will cost $4Bn to take the oil and sure you are killing the price (but if you're clever you will have already contracted them out for $5 under market so you "only" lose $200M) but imagine how much you can make shorting the energy sector! Would that be wrong?

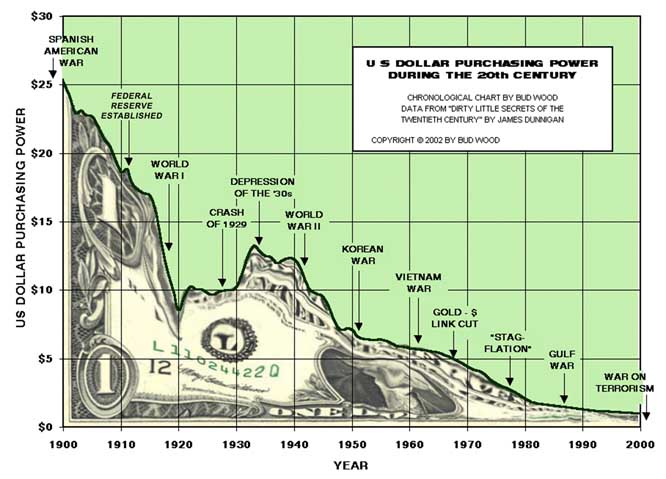

Gold gapped up and paused at $730 but looks well on it's way to testing it's non-inflation adjusted high of $800 while the dollar bounced off 79.5, pausing on it's way to 75, testing it's non-inflation adjusted low of ZERO (see chart above)!

Tomorrow is a very big day, this is the end of Q3, options expire, brokers report, oil is at an all-time high and we get the holiday retail sales report – I'm sure it will all be fine!

|

Description |

Basis |

Open |

Sale Price |

Sold |

Gain/Loss |

% |

| 10 SEP 30.00 $VIX CALL (VIXIF) | 110 | 9/10 | $ 1,440 | 9/18 | $ 1,330 | 1209% |

| 10 NOV 13.00 $VIX CALL (VIXKO) | 1,410.00 | 2/8 | $ 7,690 | 9/18 | $ 6,280 | 445% |

| 20 OCT 140.00 AAPL CALL (APVJH) | 4,010.00 | 7/2 | $ 13,990 | 9/19 | $ 9,980 | 249% |

| 10 JAN 150.00 AAPL CALL (WAAAJ) | 33,360.00 | 9/6 | $ 42,090 | 9/19 | $ 8,730 | 26% |

| 20 OCT 32.50 ABX CALL (ABXJZ) | 4,510.00 | 8/3 | $ 14,030 | 9/19 | $ 9,520 | 211% |

| 20 SEP 95.00 BA CALL (BAIS) | 5,010.00 | 9/5 | $ 6,990 | 9/18 | $ 1,980 | 40% |

| 10 SEP 260.00 BIDU PUT (BDUUV) | 1,510.00 | 9/18 | $ 990 | 9/19 | $ (520) | -34% |

| 10 SEP 250.00 BIDU PUT (BDUUJ) | 2,760.00 | 9/18 | $ 3,290 | 9/18 | $ 530 | 19% |

| 150 OCT 133.00 DIA PUT (DAWVC) | 64,520.00 | 9/7 | $ 17,990 | 9/19 | $ (46,530) | -72% |

| 50 OCT 133.00 DIA CALL (DAWJC) | 20,260.00 | 9/12 | $ 32,490 | 9/19 | $ 12,230 | 60% |

| 100 OCT 135.00 DIA PUT (DAWVE) | 31,010.00 | 9/18 | $ 15,990 | 9/19 | $ (15,020) | -48% |

| 100 SEP 134.00 DIA PUT (DAWUD) | 510 | 9/18 | $ 9,990 | 9/19 | $ 9,480 | 1859% |

| 100 SEP 134.00 DIA PUT (DAWUD) | 510 | 9/18 | $ 12,990 | 9/19 | $ 12,480 | 2447% |

| 150 OCT 134.00 DIA CALL (DAWJD) | 57,030.00 | 9/14 | $ 86,210 | 9/19 | $ 29,180 | 51% |

| 150 SEP 135.00 DIA PUT (DAWUE) | 1,510.00 | 9/14 | $ 26,980 | 9/19 | $ 25,470 | 1687% |

| 100 SEP 135.00 DIA PUT (DAWUE) | 1,010.00 | 9/14 | $ 17,490 | 9/19 | $ 16,480 | 1632% |

| 100 OCT 135.00 DIA PUT (DAWVE) | 36,010.00 | 9/14 | $ 15,990 | 9/19 | $ (20,020) | -56% |

| 400 SEP 134.00 DIA PUT (DAWUD) | 2,010.00 | 9/18 | $ 51,990 | 9/19 | $ 49,980 | 2487% |

| 100 OCT 131.00 DIA PUT (DAWVA) | 36,010.00 | 9/7 | $ 19,490 | 9/18 | $ (16,520) | -46% |

| 10 SEP 156.00 FXI CALL (FFPIZ) | 3,510.00 | 9/14 | $ 3,790 | 9/18 | $ 280 | 8% |

| 20 SEP 155.00 FXI CALL (FFPIY) | 9,710.00 | 8/31 | $ 11,390 | 9/18 | $ 1,680 | 17% |

| 40 JAN 37.50 GE CALL (GEAS) | 5,410.00 | 2/27 | $ 20,590 | 9/19 | $ 15,180 | 281% |

| 20 OCT 22.50 GG CALL (GGJX) | 3,310.00 | 8/22 | $ 13,590 | 9/19 | $ 10,280 | 311% |

| 10 SEP 25.00 GLW CALL (GLWIE) | 60 | 9/12 | $ 740 | 9/19 | $ 680 | 1133% |

| 20 SEP 35.00 GM PUT (GMUG) | 1,010.00 | 9/17 | $ 2,790 | 9/19 | $ 1,780 | 176% |

| 5 SEP 520.00 GOOG CALL (GOPIV) | 13,510.00 | 9/4 | $ 6,125 | 9/19 | $ (7,385) | -55% |

| 5 OCT 520.00 GOOG CALL (GOPJV) | 8,225.00 | 6/20 | $ 18,990 | 9/19 | $ 10,765 | 131% |

| 10 SEP 570.00 GOOG CALL (GOPIQ) | 1,010.00 | 7/13 | $ 190 | 9/19 | $ (820) | -81% |

| 10 SEP 530.00 GOOG CALL (GOPIW) | 12,510.00 | 9/4 | $ 9,490 | 9/19 | $ (3,020) | -24% |

| 10 SEP 540.00 GOOG CALL (GOPIX) | 16,610.00 | 7/12 | $ 8,990 | 9/19 | $ (7,620) | -46% |

| 10 SEP 530.00 GOOG CALL (GOPIW) | 7,510.00 | 9/5 | $ 9,490 | 9/19 | $ 1,980 | 26% |

| 10 SEP 520.00 GOOG CALL (GOPIV) | 9,010.00 | 9/12 | $ 9,390 | 9/17 | $ 380 | 4% |

| 10 SEP 520.00 GOOG CALL (GOPIV) | 9,010.00 | 9/7 | $ 9,390 | 9/17 | $ 380 | 4% |

| 10 OCT 195.00 GS CALL (GPYJS) | 6,010.00 | 9/14 | $ 14,990 | 9/19 | $ 8,980 | 149% |

| 20 OCT 195.00 GS CALL (GPYJS) | 12,710.00 | 9/17 | $ 29,990 | 9/19 | $ 17,280 | 136% |

| 40 OCT 195.00 GS CALL (GPYJS) | 25,410.00 | 9/17 | $ 28,790 | 9/18 | $ 3,380 | 13% |

| 10 SEP 77.00 IWM PUT (IOWUY) | 80 | 9/14 | $ 120 | 9/19 | $ 40 | 50% |

| 20 DEC 50.00 KWK CALL (KWKLJ) | 210 | 7/31 | $ 4,890 | 9/19 | $ 4,680 | 2229% |

| 20 SEP 120.00 LVS PUT (LVSUU) | 510 | 9/14 | $ 1,590 | 9/19 | $ 1,080 | 212% |

| 50 OCT 55.00 MCD CALL (MCDJK) | 7,260.00 | 9/17 | $ 9,340 | 9/19 | $ 2,080 | 29% |

| 10 SEP 130.00 NMX CALL (NMXIF) | 510 | 9/12 | $ 4,990 | 9/17 | $ 4,480 | 878% |

| 30 SEP 185.00 OIH CALL (ODLIQ) | 5,110.00 | 9/13 | $ 11,240 | 9/18 | $ 6,130 | 120% |

| 40 SEP 86.63 RIMM CALL (RFYIW) | 7,420.00 | 9/13 | $ 11,990 | 9/17 | $ 4,570 | 62% |

| 30 SEP 95.00 SU PUT (SUUS) | 3,010.00 | 9/12 | $ 9,890 | 9/19 | $ 6,880 | 229% |

| 20 SEP 40.00 T CALL (TIH) | 2,210.00 | 8/28 | $ 1,790 | 9/19 | $ (420) | -19% |

| 60 SEP 30.00 TIE CALL (TIEIF) | 9,910.00 | 6/28 | $ 16,790 | 9/19 | $ 6,880 | 69% |

| 15 SEP 140.00 WYNN PUT (UWYUX) | 760 | 9/14 | $ 1,415 | 9/19 | $ 655 | 86% |

| 10 JAN 100.00 X CALL (XAT) | 5,510.00 | 9/14 | $ 11,740 | 9/19 | $ 6,230 | 113% |

| 10 SEP 95.00 X CALL (XIS) | 2,460.00 | 9/6 | $ 4,090 | 9/18 | $ 1,630 | 66% |

| 30 SEP 90.00 XOM PUT (XOMUR) | 310 | 9/12 | $ 2,390 | 9/19 | $ 2,080 | 671% |