Click here to sign up for a free subscription to the PSW Report. It’s easy! – Ilene

Schwarzenegger declares ‘day of reckoning’; Wells Fargo CEO says California in ‘financial ruin’

Courtesy of Mish

Courtesy of MishDeclaring that "California’s day of reckoning is here," Gov. Arnold Schwarzenegger said today the state should turn its dire budget straits into an opportunity to make government more efficient.

Speaking to a relatively unusual joint session of the Legislature and other constitutional officers, Schwarzenegger acknowledged the billions of dollars in spending cuts he has proposed to close a $24.3 billion hole in the budget will be devastating to millions of Californians.

"People come up to me all the time, pleading ‘governor, please don’t cut my program,’" he said. "They tell me how the cuts will affect them and their loved ones. I see the pain in their eyes and hear the fear in their voice. It’s an awful feeling. But we have no choice.

"Our wallet is empty. Our bank is closed. Our credit is dried up."

The short-term problem faced by lawmakers is closing the budget gap in time for state officials to go the private investment markets and borrow billions of dollars to get the state through the first months of the fiscal year that starts July 1.

State Controller John Chiang has warned that without such loans, the state’s coffers will run dry by the end of July. Chiang said last week that as a practical matter, the budget must be patched up by mid-June in order to give officials time to borrow the money.

To do that, Schwarzenegger has proposed a plan that relies partially on accounting maneuvers and borrowing funds from coming fiscal years, but mainly on deep cuts in nearly every program funded by state government.

Those range from cutting spending on K-12 schools, community colleges, the University of California; releasing some non-violent prisoners a year early; closing 80 percent of the state’s parks, and wiping out or paring back on health and social service programs for California’s neediest residents.

I see very little new in what Schwarzenegger is saying. I would like to see a list of items, what each is going to save and whether or not the total comes up to $24 billion. Short term borrowing or accounting shenanigans are not going to do it. My fear is Obama throws taxpayer money at the problem like he is everything else.

Unions, local governments split on bankruptcy bill

Meanwhile, a battle is brewing in the California state legislature with Unions, local governments split on bankruptcy bill.

What started as a municipal bankruptcy in the city of Vallejo has morphed into an all-out fight between California’s local governments and unions over the sanctity of labor contracts vs. the autonomy of cities and counties.

Next battle zone: the floor of the state Assembly, where legislation requiring local governments to get state approval to file for bankruptcy protection is headed for a vote later this week.

The bill by Assemblyman Tony Mendoza, D-Artesia, is sponsored by the California Professional Firefighters and supported by nearly three dozen labor organizations in the state and AARP – groups worried about labor contracts or pensions potentially being affected by bankruptcy filings.

The legislation, AB 155, would require local governments to get approval from the California Debt and Investment Advisory Commission before filing. If it passes in the Assembly, it goes to the Senate.

The law is intended to help protect the state’s credit rating on Wall Street, said Richard Garcia, Mendoza’s spokesman.

My Comment: The law is intended to get Mendoza re-elected by sponsoring legislation favorable to the unions, and extremely unfavorable to taxpayers who have to foot the bill for ridiculous pension promises.

"Every city is in trouble," said Marc A. Levinson, the lead insolvency lawyer on the Orrick Herrington & Sutcliffe team handling Vallejo’s bankruptcy filing.

"Nobody wants to go through bankruptcy. I counseled Vallejo to stay out of bankruptcy. But if you can’t pay your bills, what do you do?"

Strongly opposing the bill are the League of California Cities and the California State Association of Counties.

If you live in California it would behoove you to write your state representatives and tell them to vote down this monstrosity and that you are sick to death of your taxes funding ridiculous pensions for state employees.

Hopefully Schwarzenegger will have the common sense to veto this ridiculous bill if it passes.

Wells Fargo CEO says California in ‘financial ruin’

The Sacramento Business Journal is reporting Wells Fargo CEO says California in ‘financial ruin’

“The state of California is in financial ruin,” Stumpf told those attending a statewide microfinance lenders’ conference at Stanford University. “The budget deficit in California is staggering.”

Stumpf said the recession is taking a toll on some of the loans made to creditworthy borrowers who lost their jobs and fell behind on payments.

“Today we’re charging off loans to people we should have made loans to,” said Stumpf, reiterating that the bank avoided many of the exotic mortgages offered by rivals.

Stumpf’s comments were not intended as guidance on how the San Francisco bank is faring in the second quarter, a bank spokesman said.

Regardless of what Stumpf intended to imply, his statements are a reflection on Wells Fargo.

But the idea that the bank avoided many of the exotic mortgages offered by rivals is extremely disingenuous. Wells Fargo (by acquisition of Wachovia) is veritable hotbed of foreclosures to come via its Pay Option ARM and Alt-A portfolios.

Let’s revisit Mortgage Meltdown, More Pain To Come.

Here’s the good news:

The Wave of Resets from Subprime Loans Is Mostly Behind Us.

Alt-A Mortgage Resets

Here’s the bad news:

There Are $2.4 Trillion of Alt-A Mortgages and Their Resets Are Mostly Ahead of Us.

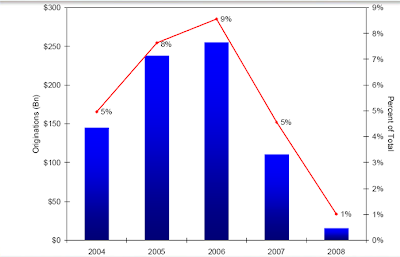

Option Arm Oiginations

About $750 Billion of Option ARMs Were Written, Nearly All at the Peak of the Bubble.

Option ARMs by State

California accounts for 58% of all Option ARMs. Think Wells Fargo, a big option ARM player is going to come out of this glowing? Warren Buffett does. I don’t. Place your bets.