We did get our stick save yesterday – only it came at 7:45 pm!

That's right, on pretty much no news at all and without any global markets open, the US futures all took off in synch at 7:45 last night and went up and up and up into Asia's open. There was no particular news and Jim Cramer had just finished telling his viewers that the markets may be overbought. Cramer also is now targeting a "3-5% decline," which is amazingly the exact decline I predicted last week and he also swiped my BBT pick as his "find of the day." So good morning Jim, nice to have you back! We don't mind Cramer stealing our buy picks because we have a full day advantage over his flock so welcome aboard suckers – er, fellow Cramer fans…

Anyway, so the after-hours markets were flat but the ubiquitous futures market took off as soon as all the retail traders had their trading accounts turned off for the night and you would have thought something huge was happening to watch the relentless, non-stop, 3-hour climb in the Dow, the Nasdaq, the S&P and even the Russell futures that led into the Asian open. Did this blatant manipulation of the indexes fool Asian investors? Of course it did! The Nikkei opened at 8pm EST and had gapped down to 10,200, exactly 4% off the high of 10,620 on Friday. As I said to members in yesterday's chat, that 4% line is critical in the follow-through day on the 5% rule as it represents our expected bounce off 5%, so holding that line is still bullish.

Well, never let it be said that Mr. Stick doesn't know how to paint a bullish picture and the Nikkei was rescued from failing that 4% line by the relentless futures buying between 8pm and 10:30, which coincided with 9pm to 11:30 on the Nikkei, which just so happens to be when they close for lunch. What happened at 11:30 Tokyo time? Well, suddenly everyone lost interest in the US futures and they fell ALL THE WAY BACK to where they started in just 60 minutes. Please Congress, whatever you do, don't look into this nonsense – better to just sit there in your little offices and say "the market forces are too complicated for me to understand" and let 12 people control the world, that's what America's all about right?

Well, never let it be said that Mr. Stick doesn't know how to paint a bullish picture and the Nikkei was rescued from failing that 4% line by the relentless futures buying between 8pm and 10:30, which coincided with 9pm to 11:30 on the Nikkei, which just so happens to be when they close for lunch. What happened at 11:30 Tokyo time? Well, suddenly everyone lost interest in the US futures and they fell ALL THE WAY BACK to where they started in just 60 minutes. Please Congress, whatever you do, don't look into this nonsense – better to just sit there in your little offices and say "the market forces are too complicated for me to understand" and let 12 people control the world, that's what America's all about right?

So, where was I? Oh yes, manipulative BS! Of course, coming back from lunch and seeing that the US futures had nose-dived sent the Nikkei right back to 10,200 but there was another way to prop up the Nikkei and that would be a dollar rally against the Yen. The dollar had already been jacked up from 94.37 Yen at the Nikkei's open to 94.75 at lunch but, at 12:31, the minute the Nikkei reopened, the Dollar began flying up all the way to 95.30, which rallied exporters and lifted the Nikkei 100 points into the close. After the Nikkei closed, the Dollar fell back to 94.9 Yen – mission accomplished, time to rest…

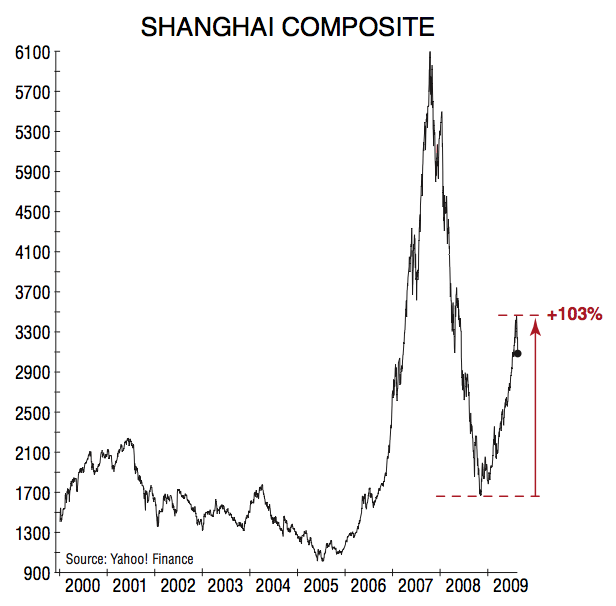

The Hang Seng also had an exciting session. Having already blown the 4% mark on Monday, the 5% test was inevitable and we got it out of the gate with a dip just below 20,000 at lunch (down 100) but that was all reversed in a 500-point up move from 11:45 to 3pm that even a sell-off into the close couldn't prevent from printing as a net up 169-point day (0.8%), which is EXACTLY the 4% line (20,400) so not bullish again until they cross it. The Shanghai Compsite posted a 1.4% gain on the day (less than a 10% retrace of the drop – so not significant yet) with a huge run back into metal stocks by "bargain hunters." "The rally in equity prices has disguised what are still large imbalances in the real economy. And, as equity prices fall, these imbalances will find themselves under more scrutiny, especially after July's economic data disappointed," Royal Bank of Scotland economist Ben Simpfendorfer wrote in a report.

The Hang Seng also had an exciting session. Having already blown the 4% mark on Monday, the 5% test was inevitable and we got it out of the gate with a dip just below 20,000 at lunch (down 100) but that was all reversed in a 500-point up move from 11:45 to 3pm that even a sell-off into the close couldn't prevent from printing as a net up 169-point day (0.8%), which is EXACTLY the 4% line (20,400) so not bullish again until they cross it. The Shanghai Compsite posted a 1.4% gain on the day (less than a 10% retrace of the drop – so not significant yet) with a huge run back into metal stocks by "bargain hunters." "The rally in equity prices has disguised what are still large imbalances in the real economy. And, as equity prices fall, these imbalances will find themselves under more scrutiny, especially after July's economic data disappointed," Royal Bank of Scotland economist Ben Simpfendorfer wrote in a report.

What was the big news that rallied China's metal markets? No news at all, just speculaion on behalf of big-three manipulator JPM's Jing Ulrich, the head of China equities and commodities, who said "In the event of further correction, the Chinese authorities will be prepared to put a floor under the stock prices." Beijing may do that through measures such as slowing measures to absorb excess liquidity and eliminating stamp duty on equity transactions, she added. So the promise of more government stimulus in China from one of the 12 guys who control the markets in America keeps things going in Asia – very neat!

We've already discussed the fine art of global plate spinning by our beloved I-Banks so I won't get into it here but this is one fine example of the way that a small buy here and a little rumor there can move the entire world's markets as money never sleeps (and neither do, effectively, tens of thousands of global employees of the Big 12, who coordinate announcements in Asia, Europe and the US to craft the headlines in the cooperative media). The media never stops looking for quotes and investors never stop jumping on news. Archimedes said "Give me a place to stand and, with a lever, I will move the whole world…" Leverage is what it's all about as the analysts get to stand on a global soap box and tout the party line while the bosses run the buy programs to make their analysts look even smarter which reinforces their influence in the eyes of the retail investor, making them easier to control the next time the bosses want something bought. Simple enough, right?

We've already discussed the fine art of global plate spinning by our beloved I-Banks so I won't get into it here but this is one fine example of the way that a small buy here and a little rumor there can move the entire world's markets as money never sleeps (and neither do, effectively, tens of thousands of global employees of the Big 12, who coordinate announcements in Asia, Europe and the US to craft the headlines in the cooperative media). The media never stops looking for quotes and investors never stop jumping on news. Archimedes said "Give me a place to stand and, with a lever, I will move the whole world…" Leverage is what it's all about as the analysts get to stand on a global soap box and tout the party line while the bosses run the buy programs to make their analysts look even smarter which reinforces their influence in the eyes of the retail investor, making them easier to control the next time the bosses want something bought. Simple enough, right?

If you look in your favorite media outlet this morning, you are unlikely to see this Bloomberg story that Corporate Credit is deteriorating rapidly and yields relative to benchmark rates on U.S. corporate bonds jumped the most since March, while credit-default swaps tied to investment-grade debt rose to an almost-four-week peak. Investors are concerned the recovery in Japan’s economy, which emerged from its deepest postwar recession in the second quarter, will falter once governments worldwide complete $2 trillion in stimulus spending. Speculation the U.S. consumer will help revive global growth was dented last week when a confidence index fell to the lowest since March. “While there is a rebound in economic activity, consumption is still impacted,” Philip Gisdakis, a Munich-based strategist at UniCredit SpA, wrote in a note to investors today. “This problem will not disappear in the short term and indicates that the current recovery might not be sustainable.”

You'll have to excuse, Gisdakis as UniCredit is not one of the 12. Of course it is coincidence, not self interest that contracts on JPMorgan, the biggest U.S. credit-card lender, rose about 5 basis points to 81.6 basis points, the highest level since July 16, according to CMA. Credit derivatives tied to debt of Goldman Sachs gained 10 basis points to 150 basis points, the highest since July 13, CMA prices show. Credit swaps on Citigroup Inc. jumped 21 basis points to 298 basis points, the highest since July 29, according to CMA. All three banks are based in New York and all 3 banks have analysts talking up the economy, which will lower their borrowing costs by Billions if effective. Motive, means and opportunity – case closed!

In the Fed's Quarterly Survey of Banks it was found that: "With delinquency rates rising to a record high, banks were still clamping down on lending to businesses and consumers over the past three months, and they said they planned to keep their credit standards tight for at least a year." In its quarterly survey of banks' senior loan officers, the Fed said lending standards got even tighter for almost every type of loan, from prime residential mortgages to commercial and industrial loans. The survey covered May, June and July. "The degree of caution exhibited in the survey of senior loan officers over coming quarters will act as a drag on the coming recovery," wrote Richard Moody, chief economist for Forward Capital. "This is one factor that has been, and remains, behind our forecast of a tepid recovery from the Great Recession."

Doesn't this sound like something the MSM SHOULD be talking about? Isn't a credit crunch what crashed the markets last Fall? Isn't it almost Fall? Didn't we give these banks TRILLIONS of dollars so they COULD lend money to keep businesses going and isn't this the OPPOSITE of what was supposed to happen? SHOULDN'T we be concerned??? Outstanding loan balances FELL by 2% at 22 banks receiving federal assistance from the Troubled Asset Relief Program. WHERE IS THE OUTRAGE?

In a separate report released Monday, the Fed said the delinquency rate for all loans and leases rose to 6.49% in the second quarter from 5.58% in the first quarter. That's the highest delinquency rate since 1985, when the Fed began collecting the data. The charge-off rate rose from a record 2.03% to a record 2.65%. Before this recession, the highest charge-off rate had been 1.70%. Delinquency rates for real estate loans rose from 7.10% to 8.27%, the highest since the data begin in 1987. Delinquency rates for commercial and industrial loans rose from 3.12% to 3.73%, while delinquencies for consumer loans rose to from 4.69% to 4.92%, also a 22-year high.

Not surprisingly to members of PSW but apparently a shock to "expert" analysts is today's PPI report, which came in -0.9%, 350% worse than the -0.2% expected by the usual idiots they ask, even though we JUST got a CPI report that flat out told us we were going to be down more than 0.2% unless Corporations bought a lot of apparel and visited the doctor, which were the only two parts of the CPI that had increases. I mean REALLY, are economists actually so dumb that they can't pick up a CPI report on Friday and adjust their outlook for the PPI report the next week? Well, it seems they can't so the MSM is "taken by surprise" this morning as the PPI disappoints (and that JPM analyst in China must feel very silly).

Also from the land of Duh, Housing Construction and Building Permits fell 1% in July. Could it possibly be due to the almost total lack of lending? As I pointed out last month when the markets rallied on a 1.7% gain in starts, we're talking about 581,000 homes a year – it's still down 75% from the highs so who really cares if the number is 581,000 or 586,810 (+1%) or 575,190 (-1%)? The margin of error is 4% as this is a survey, not a full count. Housing starts for July are off 37.7% from last July, when they were down 50% from the previous July – now THOSE are numbers that dwarf the margin of error!

Also from the land of Duh, Housing Construction and Building Permits fell 1% in July. Could it possibly be due to the almost total lack of lending? As I pointed out last month when the markets rallied on a 1.7% gain in starts, we're talking about 581,000 homes a year – it's still down 75% from the highs so who really cares if the number is 581,000 or 586,810 (+1%) or 575,190 (-1%)? The margin of error is 4% as this is a survey, not a full count. Housing starts for July are off 37.7% from last July, when they were down 50% from the previous July – now THOSE are numbers that dwarf the margin of error!

The bottom line is that just 55,600 homes are being built in 50 states for the month of July. Just how many people can that really employ? How much material can be consumed? How many realtor and broker fees can be paid? How many new appliances will be placed? How much carpet? Housing has a massive effect on the economy, second only to consumer spending in it's effect on the GDP and housing remains dead, dead, DEAD and you can try to ignore the unemployment, credit debt and bankruptcies that are killing the consumer and you can try to ignore falling prices, tighter lending requirements and excess inventory that plague the housing market but, sooner or later – these things WILL matter. You can fantasize about a recovery all day long but one day, something needs to actually recover besides expectations.

So forgive me for today's rant but this ridiculous pre-market pumping has really ticked me off. I do hope we hold our levels today – only the Dow held the levels we predicted in yesterday's morning post and the others hovered just below it. Tuesdays are often test days and certainly all the stops are being pulled out to prevent the markets from failing but we're going to remain cautious with our cash on the sidelines, waiting for some REAL bargains to present themselves.