The Shanghai Composite fell 3% this morning.

The Shanghai Composite fell 3% this morning.

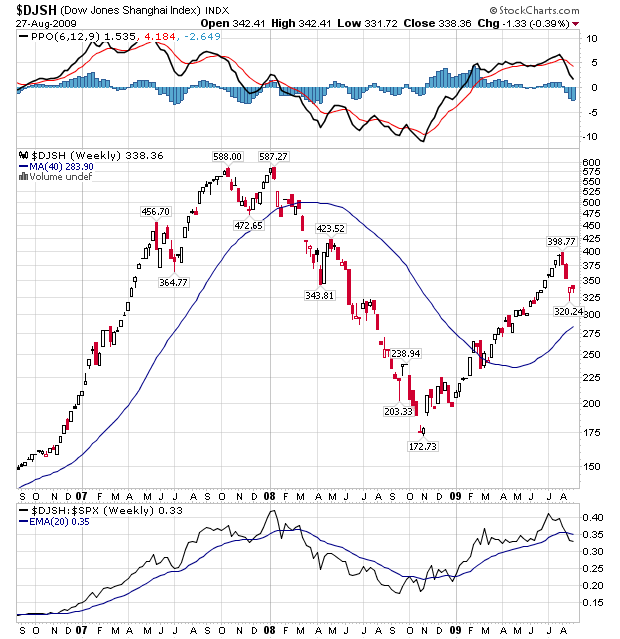

That drops them to 328, down from 398 on August first (-17.5%), which is almost a perfect 20% retrace off the run from the last consolidation at 250 in March. As you can see from the chart, we are about midway between the high for the year and a 50% retrace of the entire run from the bottom at about 280, which happens to be the 40-week moving average. This is significant in many ways as the Chinese market has been the driver of the global recovery and our global markets (and our local stocks and indexes) are all flying high above their 200 dmas, just about where China was 30 days ago.

I am sorry to be the annoying voice of caution the past two weeks but, when I was a kid, "Spinning Wheel" was a hit song and "what goes up must come down" is etched into some very deep neural pathways in my brain. We've been using the FXP (ultra-short China) as a cover for almost exactly a month as I had put my foot down when the Shanghai hit 400 and the Hang Seng hit 21,200, up exactly 100% from their November lows.

As David Fry points out in his daily S&P chart, the volume for the days is DOWN volume and, once the sellers get their fill, the auto-bots come out to play and run the markets back up. I pointed out on Wednesday, close to 40% of the entire volume of the markets is centered around 4 stocks (C, FNM, BAC and FRE). Throw in AIG's 150M shares and we're getting close to ONE HALF of the total market volume in 5 stocks.

As David Fry points out in his daily S&P chart, the volume for the days is DOWN volume and, once the sellers get their fill, the auto-bots come out to play and run the markets back up. I pointed out on Wednesday, close to 40% of the entire volume of the markets is centered around 4 stocks (C, FNM, BAC and FRE). Throw in AIG's 150M shares and we're getting close to ONE HALF of the total market volume in 5 stocks.

While that may be shocking and ridiculous and has now been pointed out by several analysts, what I'm not seeing discussed is the implication that holds for the rest of the market. If those 5 stocks are 50% then the market, which is already trading at historically low volumes, is actually trading 50% LOWER than that! Then we have the well documented indications that GS, CS and a handful of other firms account for 40% of all trading volume. That means, if GS and other manipulators aren't trading those 5 stocks, then they are accounting for 80% of all remaining transactions!

More likely the real number is somewhere in-between. Perhaps half their trades are in the Big 5 so that would be 40% of 50% of the market volume allocated to C, BAC, FRE, FNM and AIG (which should REALLY disturb you if you are trading those) and half their trades are in the other 99.99% of the stocks. That would be 40% of 100% which is, of course 40% plust 40% of 50% (20%) so we can very reasonably assume that 60% of all stock transactions are controlled by GS, CS, JPM et al. Isn't that a little disturbing? Imagine playing poker where 6 out of 10 people at the table were on the same "team" against you.

If you are playing Texas Hold-Em, you are dealt 2 cards and make the best hand with the 5 cards the dealer lays down. In theory you have an even chance of winning against every other player but if 6 of the other players team up and combine their cards, then they have 12 and you have 2 – suddenly the odds are not so good for the poor individual investor. Even if they don't combine their cards into one pile, just being able to see each others hands lets them know where to place their bets while you are flying blind. This is not some 3rd world banana republic market we're discussing here – this is what's happening in the United States of America right now…

If you are playing Texas Hold-Em, you are dealt 2 cards and make the best hand with the 5 cards the dealer lays down. In theory you have an even chance of winning against every other player but if 6 of the other players team up and combine their cards, then they have 12 and you have 2 – suddenly the odds are not so good for the poor individual investor. Even if they don't combine their cards into one pile, just being able to see each others hands lets them know where to place their bets while you are flying blind. This is not some 3rd world banana republic market we're discussing here – this is what's happening in the United States of America right now…

Speaking of China, AAPL is off to the races this morning as China Unicom announces a deal to sell IPhones in China with a launch in the 4th quarter that will give Apple a nice revenue boost even if they sell just 1M phones (0.06% market penetration). AAPL has low expectations next quarter considering they have beat the last 4 Qs by an average of 20% and had 17% sales growth last quarter and each 1M IPones sold in China drops about $100M on their bottom line of (projected) $1.5Bn in profits. Not only that but think about the inroads that the IPhone will lay for other Apple computer products and, of course, the upcoming IPad, which is effectively an inexpensive wireless notebook computer.

AAPL was $200 last year on 20% lower sales and, IF the global economy is really bouncing – how the heck are they trading for $170 now? I like selling the AAPL Jan $150 puts naked for $7.50, which is a net $143.50 entry if put to you. I also like the Jan $150 calls for $27.25, selling the Jan $170 calls for $15.50, which is a net $11.75 on a $20 spread with a break-even at $161.75. You can do that same net spread with the April $150/170 calls and that takes you past Jan earnings and MacWorld – these are all nice ways to make great profits with limited risk.

A nice way to hedge AAPL (as it's now a China play) and the global markets in general is EDZ, which can be added to Monday's list of good market hedges. EDZ is an ultra-short emerging market ETF and has dropped from $95 in March all the way to $8.96 as the global markets have exploded. More notably though, EDZ has "only" fallen from $20 to $9 since May and has held $9 all of August so it's "getting worse more slowly." This hedge can be played as a buy/write, taking the stock for $8.98 and selling the Oct $8 puts and calls for $2.60. That is a net entry of $6.38 with a 25% profit if called away at $8 and, if put to you below $8, you will be in the stock at an average of $7.19, which is 20% less than the current price – NOW THAT'S A HEDGE! A more aggressive way to go is buying the Jan $6 calls for $3.75 and selling the Jan $8 calls for $2.75 which is in for $1 on the $2 spread – a 100% profit on the hedge should the emerging markets have the nerve to sell off from here.

If we hold our breakout levels today (the week's highs) then we will be dumping our FXP short puts in anticipation of China bouncing on Monday. We already exited our FXP calls at yesterday as they topped out. As I said to yesterday in the morning Alert to Members: "Dow 9,400, S&P 1,010, Nasdaq 2,000, NYSE 6,600 and Russell 575 – anything over those and we are still in a bullish trend but below those and we should get our move down to 9,100 et al." We came nowhere near our breakdowns but the rally looked so fake that we ended up too bearish, a position I am unlikely to change into the weekend but one which will be very painful to hold.

Japan is likely to vote out their government this weekend as unemployment there reaches new highs ahead of Sunday's election. We're not sure how that will affect Asian markets but it's all about whether the Shanghai pulls out of its tailspin or begins to drage the Hang Seng down with it.

Europe is up a full point ahead of the US open despite weak UK Retail Sales, terrible earnings from Lukoil and a big loss from Iberia on much lower than expected travel demand. None of that matters because consumers read Mr. Murdoch's papers and decided to be confident and all the happy, happy economic news is driving retail investors into the thinnest volume market in modern history, sending the EU up to new highs for the year.

We had 0% growth in personal income in July but a combination of cash for clunkers and rocketing gasoline prices pushed personal spending up 0.2%, which was a miss on the 0.2% expected and a huge drop from last month's 0.6% but those are just facts and we don't like to discuss facts in our happy, happy markets as Mr. Murdoch's Wall Street Journal proudly headlines "Clunkers Plan Boosts Spending." Oh yes, more spending on less income – that will fix everything! With such good news headlining Rupert's US papers too, we can only imagine that Michigan Sentiment at 10am will be better than the 64.8 expected. Ironically Michigan has the nation's highest rate of unemployment (18%) and you can buy homes there at auction for under $1,000 and they STILL can't find buyers but it's a national poll that just happens to be called the Michigan poll but it will be interesting to see how excited Americans are about the economy this month.

So I hate to be a stick in the mud but I will remain bearish into this weekend and next weekend for that matter as it's a holiday. After that, I guess I'll have to start running with the bulls if they can hold it together that long but, keep in mind, those bulls are actually being herded into an arena where they will be slaughtered!

Have a good weekend,

– Phil