Just two weeks ago, on October 17th, I warned in the Weekly Wrap-Up that it was "Dow 10,000 or Bust" for the next week and we failed that one and last Wednesday we were looking to hold NYSE 6,900 and THAT failed too. Now we enter into the second phase of our limbo game where the deep-voiced guy asks the question "how low can you go?" and we’ll be setting our next bar at our long-standing 9,650 target for the Dow, which we are already hitting in pre-market trading. If that fails, we’ll have to look down to S&P 1,000. As you can see from Jesse’s Chart, we took a nice bounce off serious resistance yesterday but we’re just not feeling it yet, even though the market is now as technically oversold as it was in March.

Yesterday was like a roller coaster and my first Alert to Members of the morning targeted 9,775 as the on/off line for our bullish/bearish posture on our DIA covers. We whipped past that line right about 10 am as we got good reports from ISM, Pending Home Sales and Construction Spending but by 12:45 we had broken back down so I sent out an Alert calling to refocus back to 55% bearish by adding the DIA Jan $100 ($5) and Jan $102 puts ($6.20), already covered by the Nov $99 puts ($2.50).

The reason we mess around with our covers is we don’t want to flip in and out of our option positions, which are generally either straight bearish or well-hedged long positions, is because options carry a relatively large bid/ask spread and cost you money every time you get in and out. So, on the whole, we’d rather let our over-riding cover plays, like our DIA spread, adjust our stance as conditions change, making a single adjustment that keeps us balanced as we ride out the market waves.

The reason we mess around with our covers is we don’t want to flip in and out of our option positions, which are generally either straight bearish or well-hedged long positions, is because options carry a relatively large bid/ask spread and cost you money every time you get in and out. So, on the whole, we’d rather let our over-riding cover plays, like our DIA spread, adjust our stance as conditions change, making a single adjustment that keeps us balanced as we ride out the market waves.

It’s been a couple of weeks since we had a good, old-fashioned stick save but we got a mother of one yesterday (as seen in Dave Fry’s chart) which was right on schedule as Kustomz bought it up in Member Chat at 3:09 and I agreed at 3:19 that "It does feel like a pre-stick move" and we grabbed VIX $25 puts at .85 to protect ourselves from a sudden surge in complacency.

By 3:33, my next comment to Members was: "The stick lives!" but we gave a little too much credit to the move and grabbed some DDM $39 cals for $1.25 for those of us who were worried we were too bearish. Again, the idea is not to shift our existing bearish positions but to cover against something catastrophic, like a 200-point gap up at the open over some stimulus nonsense.

We also have a Fed meeting tomorrow and lots of jobs numbers – with the markets this oversold, it pays to be cautious. If we are really going to break down, we have a LONG way to go. Note that the oversold condition of late February was actually improving into March 9th WHILE the Dow plunged from 7,500 to 6,500 (13%) in 3 weeks.

We also have a Fed meeting tomorrow and lots of jobs numbers – with the markets this oversold, it pays to be cautious. If we are really going to break down, we have a LONG way to go. Note that the oversold condition of late February was actually improving into March 9th WHILE the Dow plunged from 7,500 to 6,500 (13%) in 3 weeks.

So we will be rolling our upside protection even as we enjoy the ride down, just as we rolled our downside protection all the way to DIA Jan $103 puts (which we sold on the spike down) after starting with Dec $96 puts back in early October. We did a tiny bit of bottom fishing yesterday with option plays on AIB, ARNA, VLO and YRCW but, other than that, we were not very enthusiastic about the buy side and AIG, ARNA and YRCW are all speculative plays while VLO is the only one we are really looking at as a long-term investment (we always do if we can net a $16.50 or less entry).

VLO is our value investing play but a bigger value investor than me was on the prowl yesterday as our man Warren Buffett just announced a $34Bn buyout ($100/share) of the 76% of BNI he doesn’t already own. That’s roughly 33% over yesterday’s close and Buffett also has a good portion of UNP (one I would buy on this news) so someone is believing in a recovery down here (or at least a massive pending chunk of government funding for rails next year). That should save the Transports from breaking below the 200 dma at 1,725, a level they were testing in pre-market trading as we’ve been selling off sharply since 2am.

I’m also excited that Berkshire’s B-shares are being split 50 to 1 to smooth out this cash and stock deal ($40 cash + 1 BRK.B share at $60 for each BNI share) as this will finally stimulate option trading in the very thinly traded Berkshire stock. At $3,265 a share, there are only 19 open March $3,300 contacts at $160 – that’s no fun at all! At 40% off the 2007 highs, Berkshire is one of my favorite stocks but, due to lack of options, we haven’t bought it since it was $2,750 in the spring as it’s simply too dull to hold. This stock split, more so than anything else that’s happened lately, may be one of the single best investing opportunities of the decade. Stay tuned as we will be all over this one as the options are issued – there is nothing I’d rather put in a solid long-term buy/write virtual portfolio than Berkshire Hathaway stock!

I’m also excited that Berkshire’s B-shares are being split 50 to 1 to smooth out this cash and stock deal ($40 cash + 1 BRK.B share at $60 for each BNI share) as this will finally stimulate option trading in the very thinly traded Berkshire stock. At $3,265 a share, there are only 19 open March $3,300 contacts at $160 – that’s no fun at all! At 40% off the 2007 highs, Berkshire is one of my favorite stocks but, due to lack of options, we haven’t bought it since it was $2,750 in the spring as it’s simply too dull to hold. This stock split, more so than anything else that’s happened lately, may be one of the single best investing opportunities of the decade. Stay tuned as we will be all over this one as the options are issued – there is nothing I’d rather put in a solid long-term buy/write virtual portfolio than Berkshire Hathaway stock!

Will it be enough to save our futures this morning, which, as I mentioned, fell off a cliff at 2am? Hopefully not, as we need a proper test of 9,650. What killed us this morning was YET ANOTHER 1.8% drop in the Hang Seng, which finished back at the low of the day AGAIN in one of the most manipulated, BS market moves I’ve ever witnessed. It is very clear at this point that China simply will not allow more than a 1.8% daily loss (and the more controlled Shanghai Composite was up 1.2%), which means it will take 13 down days to level test 16,000 and if we assume a normal distribution of positive days, we’re probably not going to be getting lower than 18,000 this month, regardless of the actual selling pressure that will mount if they blow the 50 dma at 21,000.

This was a very poor showing for a low-volume trading day (Japan was closed for a holiday) as the Dollar sank below 90-Yen again once the BOJ took their eye off the ball. “We’re tending towards the view that we will see some relapse next year as people basically lose faith in governments’ ability to continue to come to the rescue,” said Peter Elston, a Singapore-based strategist at Aberdeen Asset Management. Investor concern about the withdrawal of stimulus policies has helped drag the MSCI Asia Pacific Index, which includes Japan, down by 5.8 percent from this year’s high on Oct. 20. The U.S. must increase stimulus spending or risk “many years of high unemployment,” Paul Krugman wrote in the New York Times yesterday.

Europe is down 1.5% this morning, led down by the continuing bank panic (which is why we gambled on AIB) as RBS and LYG get ANOTHER $51Bn of bailout money. We’ll be picking up more LYG as they near $5 but not RBS, who are kind of scary. Both banks are now controlled by the British government but LYG is getting relatively minor aid as the bailout funding in this round is the government buying about 1/4 of their $35Bn fund-raising that will, if successful, take them OUT of government control. “There is now a very fine line between RBS being nationalized,” said Danny Gabay, director of Fathom Consulting in London and a former Bank of England economist. “This contrasts with Lloyds willing to fight harder for its independence.”

Europe is down 1.5% this morning, led down by the continuing bank panic (which is why we gambled on AIB) as RBS and LYG get ANOTHER $51Bn of bailout money. We’ll be picking up more LYG as they near $5 but not RBS, who are kind of scary. Both banks are now controlled by the British government but LYG is getting relatively minor aid as the bailout funding in this round is the government buying about 1/4 of their $35Bn fund-raising that will, if successful, take them OUT of government control. “There is now a very fine line between RBS being nationalized,” said Danny Gabay, director of Fathom Consulting in London and a former Bank of England economist. “This contrasts with Lloyds willing to fight harder for its independence.”

Also on the International front (sort of) the IMF is selling 200 metric tons of gold to the Reserve Bank of India for $6.7Bn, which works out to $1,042 an ounce. That should knock gold off the $1,060 mark and give us a good test of $1,050 and, failing that, could send gold lower which would push the dollar higher which would push oil lower ($78 at yesterday’s close), which will damage the markets so let’s keep a close eye on this little drama as it plays out. Gold bugs are actually very fortunate that the IMF found a large buyer for 0.125% of the world’s total supply of gold or things could have gotten nasty on the open market. Is the IMF calling a good top? Maybe but they still have another 200 tons to sell based on their September announcement.

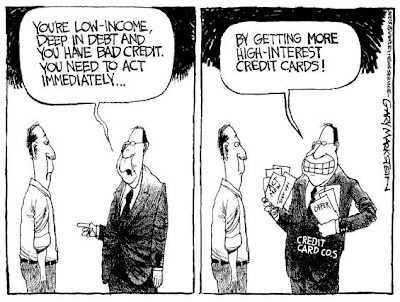

Overall, I’m still very worried about consumer spending. JNJ just announced they are cutting 7% of their work-force and if people are cutting back on Band-Aids, then we really are in trouble! We already knew people were cutting back 5% on their food spending (which is 15% of all consumer spending) and ADM just announced still-soft earnings, down 53% from last year on significantly lower margins (6.5% vs 8.8%). There are only 50 shopping days until Christmas and ICSC Same-Store Sales plunged from an annualized 2.8% improvement last week back to a more realistic 1.9% level. Redbook Retail Sales (which are not spun by Goldman Sachs like ICSC are) show just a 0.9% improvement over last year’s horrific crash.

Overall, I’m still very worried about consumer spending. JNJ just announced they are cutting 7% of their work-force and if people are cutting back on Band-Aids, then we really are in trouble! We already knew people were cutting back 5% on their food spending (which is 15% of all consumer spending) and ADM just announced still-soft earnings, down 53% from last year on significantly lower margins (6.5% vs 8.8%). There are only 50 shopping days until Christmas and ICSC Same-Store Sales plunged from an annualized 2.8% improvement last week back to a more realistic 1.9% level. Redbook Retail Sales (which are not spun by Goldman Sachs like ICSC are) show just a 0.9% improvement over last year’s horrific crash.

We get Factory Orders for September and they should be up 1.2% because retailers, who use CIT to factor, would have lined up to max out their lines of credit ahead of that bankruptcy, which will make it impossible for tens of thousands of retailers to factor their receivables until they get new financing (good luck!). We also get our first full month of post-Clunker Auto Sales during the day and tomorrow is going to be wild with Challenger Job Cuts, ADP Employment, ISM Services, Crude Inventories and the Fed so we’ll be holding onto/rolling our DDMs, looking for a good bounce off 9,650 if the Dow would be so kind as to give us a test today, once again betting on a nice 200-point Dow move in either direction to pay off our spreads.

Buffett’s big bet makes me think a second round of stimulus is right around the corner so we will be very mindful of our levels and the possible snap-back from oversold as we now look to see if our downside levles hold up.