In 1964, Justice Potter Stewart tried to explain "hard-core" pornography, or what is obscene, by saying, "I shall not today attempt further to define the kinds of material I understand to be embraced . . . but I know it when I see it . . ."

In 1964, Justice Potter Stewart tried to explain "hard-core" pornography, or what is obscene, by saying, "I shall not today attempt further to define the kinds of material I understand to be embraced . . . but I know it when I see it . . ."

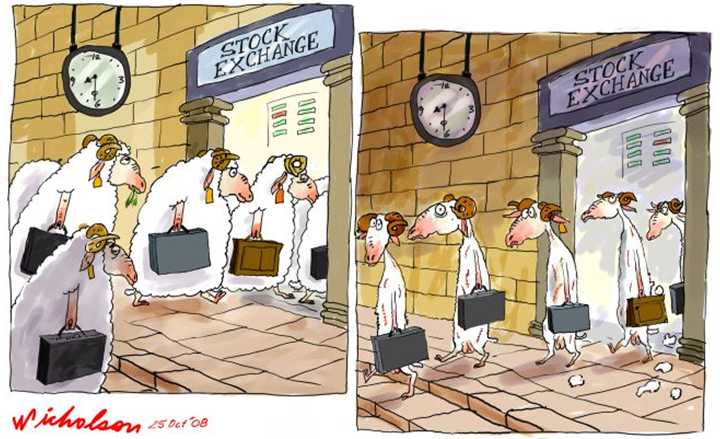

David Fry knows it when he sees it and points out the offending material in yesterday’s intra-day chart of the SPY. I often sum up action like this for members as simply fake, Fake, FAKE – using one of my favorite Seinfeld clips where Elaine plays the part of Goldman Sachs, who admits to Jerry (the unsuspecting public) that she faked it "all the time." As Elaine explains to Jerry – "It wasn’t you, I just couldn’t have them back then." 2009 was like that – we just couldn’t have any real rallies so our government and their pet IBanks (or is it our IBanks and their pet government – it’s hard to tell these days) simply got tired of waiting for investors to get in a groove and decided to fake the rallies.

Once the faked a few rallies early in the year, it just got too easy. Also, with practice, they got better and better at faking the rallies – so good, that they began to get paid for it with record profits as the High-Frequency Trading Platforms (ie. front-running) they employed using the free money they borrowed from the Fed turned into little money machines to the point where (as you can see in the above chart) they now run them more than once a day.

Notice the pattern of high volume sell-offs or flat activity followed by low-volume run-ups. The game is to run the markets up to levels that trip retail investor interests as the charts signal a "break-out" or, even better, trip buy signals at funds and ETFs where retail investors are forced to "go with the flow" as their committed capital chases every rally and then, once the trap is sprung, the big boys start to sell into it, leaving the retailers holding the multi-Billion Dollar bag.

Right now, you can say it’s a win-win as the market has gone up for 6 consecutive months, with the entire US market gaining $7Tn in value in the second half of 2009. Isn’t that fantastic? Truly Lloyd Blankfein is doing God’s work here so what could be wrong with that? The problem with playing God is that Lloyd Blankfein and the rest of the Gang of 12 CAN’T make the markets gain $7Tn in value – they can only make it LOOK like they have. If you have 100 shares of POT, which was trading at $50 in March, and GS buys 1 share from you in April for $60 and sells it to Bob for $65 and then GS buys a share from you in May for $70 and sells it to Tom for $75 and so on and so on until, 6 months later, GS is buying a share from you for $115 and selling it to Mary for $120 (because it just so happens their analyst upgraded it that day).

In this example, GS makes $30 selling POT for a $5 profit 6 times. Bob, Tom and 6 other guys make money as POT goes from $65 to $115 – as long as they find Mary’s of their own along the way to buy it from them and you have sold 6 shares of POT for an $85 average so everyone’s a winner right? Wait a minute though, even though you, yourself sold just 6 shares of POT, 18 shares were transacted in our low-volume market. Your virtual portfolio of POT went from $5,000 to $10,810 on your 94 remaining shares plus the $510 you collected selling 6 shares. Is your POT really worth $10,810 or are you high?

In this example, GS makes $30 selling POT for a $5 profit 6 times. Bob, Tom and 6 other guys make money as POT goes from $65 to $115 – as long as they find Mary’s of their own along the way to buy it from them and you have sold 6 shares of POT for an $85 average so everyone’s a winner right? Wait a minute though, even though you, yourself sold just 6 shares of POT, 18 shares were transacted in our low-volume market. Your virtual portfolio of POT went from $5,000 to $10,810 on your 94 remaining shares plus the $510 you collected selling 6 shares. Is your POT really worth $10,810 or are you high?

While you may feel rich, the fact of the matter is that an average of just 3 shares per month were sold. There is not a lot of demand for POT outside of these occasional surges and if you find a need to liquidate your holdings you will find there is no real demand for your stocks. We got a peek at how quickly a very small surge in selling can tank this market as the Dow dropped 100 points in 30 minutes on Thursday as someone tried to raise a little cash and quickly found out how fake, Fake, FAKE those buyers really were.

The danger with building a "rally" on false premises is you have effectively built a house of cards and, while you never know when, the slightest thing can topple the whole mess very quickly. Only volume confirms a market move and the volume we’ve had in this markets since March has been less than 1/2 of what it was in the previous 6 months and even that is misleading as we have pointed out in previous posts that the HFT programs have worked the Financial sector into over 75% of the market volume (used to be 12%) as bank shares are traded back and forth between computers all day long. THAT is bothering me a great deal…

The danger with building a "rally" on false premises is you have effectively built a house of cards and, while you never know when, the slightest thing can topple the whole mess very quickly. Only volume confirms a market move and the volume we’ve had in this markets since March has been less than 1/2 of what it was in the previous 6 months and even that is misleading as we have pointed out in previous posts that the HFT programs have worked the Financial sector into over 75% of the market volume (used to be 12%) as bank shares are traded back and forth between computers all day long. THAT is bothering me a great deal…

Mortgage Applications don’t seem to be bothering anybody this morning, which I find amazing as it confirms the horrific Pending Home Sales Report we got yesterday (down 16%). Mortgage Applications for the week ending 12/25 were down 22.8% and that’s the "adjusted" number – the raw number (that would be the ACTUAL physical number of applications) was down 46.9% from last year. We bounced back in the week ending Jan 1st with a 0.5% gain with refinances making up 69% of the activity as rates creeped up to 5.08%.

We do have "good" news on the jobs front as the Challenger Job-Cut Report shows "just" 45,094 planned lay-offs in December and that makes the quarter’s 151,121 reductions the lowest since early 2000 (which wasn’t exactly a stellar time for the markets but Yay, I guess).

Challenger noted that layoffs slowed in the second half for most of the hardest-hit sectors, including retail (down 85% from the first half to the second), industrial goods (down 62%), autos (down 54%) and government and nonprofits (down 33%). Challenger’s monthly tally covers only a small fraction of those who lose their jobs each month. Most layoffs are not announced in press releases. According to the government’s most recent report, 2.1 million people lost their jobs by layoff or termination in October. Through the first 10 months of the year, the government counted 23.5 million actual layoffs.

We also have good news from the ADP Report, which showed "just" 84,000 jobs lost and that should give investors hope that Friday’s Non-Farm Payroll report will be close to flat as ADP had generally trended about 85,000 jobs below the official government statistics. A positive revision was also made to November losses, moving from 169,000 to 145,000. The service sector actually added 12,000 jobs as retailers staffed up for the holidays but that was offset by another 96,000 jobs lost in the Goods-Producing sector, including another 43,000 lost manufacturing jobs:

.jpg)

Speaking of weed sellers (or week sellers of weed killer, anyway) – MON missed expectations as sales fell 36% in Q4 and the company reported a net loss of $19M or 3 cents a share, compared with last year’s profit of $556M or $1 per share. Revenues of $1.7Bn missed analyst expectations of $1.98Bn by a pretty wide margin (more than 10%) but: "We’ve delivered on our targets for the quarter," President and Chief Executive Hugh Grant said in a prepared statement." – maybe he prepared that statement before he saw the actual numbers…

![[RETAIL]](http://s.wsj.net/public/resources/images/MK-BA441_RETAIL_NS_20100105185228.gif) We were waiting for MON’s results to short POT, hoping that the IBank upgrades would jam them to $120 and we’ll be executing those plays this morning as these valuations are truly stupid in the Ag sector. Thank goodness for rich folks though – they may not eat enough to save the agriculture industry from overall demand weakness but they sure do know how to buy the bling bling and othe luxury items including all the newest electronics, saving overall retail sales from a repeat of last year’s disaster (but just barely).

We were waiting for MON’s results to short POT, hoping that the IBank upgrades would jam them to $120 and we’ll be executing those plays this morning as these valuations are truly stupid in the Ag sector. Thank goodness for rich folks though – they may not eat enough to save the agriculture industry from overall demand weakness but they sure do know how to buy the bling bling and othe luxury items including all the newest electronics, saving overall retail sales from a repeat of last year’s disaster (but just barely).

This is exactly the action I predicted way back on December 27th in my "2010 Outlook – A Tale of Two Economies" where there are plenty of picks for a bullish market as a companion to the Members Only Watch List. So we have our bullish plays ready and all set to go if we can finally top our levels but so far, no good this week and we’ve been holding onto our bearish bets, expecting a repeat of last January’s massacre. We’ll be pleasantly surprised if it doesn’t happen but there hasn’t really been any strong data to convince us it won’t so far and that makes the exuberance we’re seeing in the first few days of 2010 seem somewhat irrational.

Asian markets were up about half a point with the Shanghai Composite the big exception with a half-point drop. Europe is down slightly ahead of the US open but our futures have staged a fantastic recovery since 7:30 and we’re looking to open flat. Will we continue to hold our breakdown levels (see Monday’s post) and can we finally do more than bounce off our breakout levels (also Monday’s post). So far, we’re getting exactly the action we expected in our first three days (crazy pump, flat, flat) and we’ll see if the next step is dip or if we break the pattern.

Menwhile, let’s be careful out there. Oil inventories at 10:30 will be very critical (we’re short USO already).