Thursday's close was very exciting, wasn't it?

Thursday's close was very exciting, wasn't it?

Well it sure was for us as my 10:01 Alert to Members was a play on the DIA Jan $103 puts at .56. Thanks to the late afternoon dip, they finished the day at .90 (up 60%) after peaking out at .95, a very nice win to close off the year. That was the only Alert trade all week as this market has been too tough to call and we don't make trades just for the hell of it. I had been sniping at DIA puts all week expecting a pay-off but Thursday it finally came together.

Of course, I also strongly advocated hedging on Thursday morning and listed 4 trade ideas in the morning post to hedge ourselves against the possibility of just such a drop so don't say you haven't been warned. Whether there will be follow-through on Monday or a full reversal remains to be seen and, even if I knew, I wouldn't tell you here because this is a review – predictions are another article entirely.

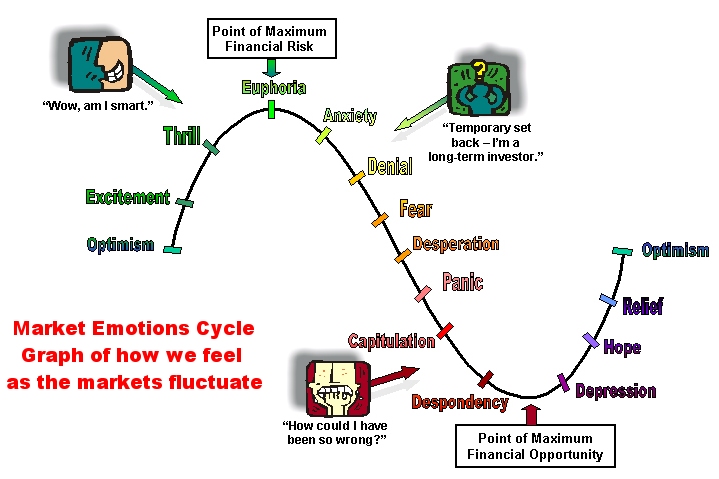

We treaded very cautiously into last year because our PSW Holiday Retail Survey was not looking very pretty so it was no surprise to us, on Dec 26th, when we got some horrific retail reports. These are, of course, the same reports that we "beat" this year – but not by much. Dec 29th was Monday and Israeli jets attacked Hamas targets in the Gaza sending oil flying up to $48 a barrel. That gave us a nice commodity rally into the close of the year but January 2nd was a Friday and we decided (fortunately) to take the money and run on our long plays, holding open our main cover of SKF Jan $120s at $4.35, which hit $80 later in the month (up 1,732%) and USO Feb $32 puts at $3.40, which hit $10.50 in the Feb dip (up 208%) so, on the whole, not too differently positioned than we are now, coming into the new year. Visually 2009 looked a little like this:

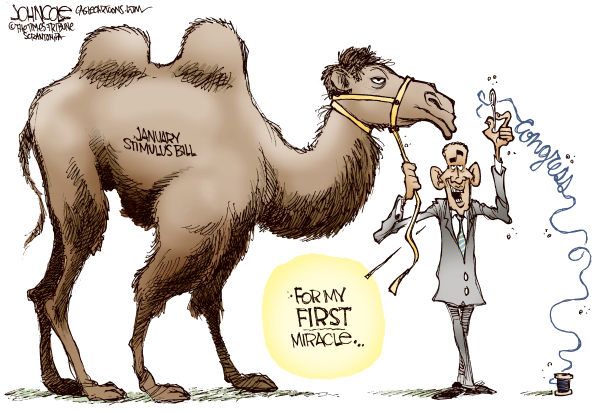

January – Waiting for Obama, or Something, to Change

We began January much the same way we ended December with my Wed Jan 7th comment being: "We call it "Testy Tuesday" for a reason and our 5% rule was tested twice during the day but the market failed to break out despite what seemed to be a contrarian rally to Fed minutes that I summarized to members at 2:02 as "BAD!!!!" I set a target of 8,200 the next morning and we did bang along that area through early February.

That gave us time to look into other matters like Conde Naste Exposing GS's attempts to take over the financial universe but we won't get into that again. I was disturbed on the 8th that we needed 20 Trillion Dimes to fund our deficit but all those Treasury sales went off well this year – thanks to the Fed buying them. Speaking of the Fed – Big Ben Bernanke went to London on Jan 13th to push for massive global stimulus – a wish that was granted by his fellow Central Bankers in '09.

That gave us time to look into other matters like Conde Naste Exposing GS's attempts to take over the financial universe but we won't get into that again. I was disturbed on the 8th that we needed 20 Trillion Dimes to fund our deficit but all those Treasury sales went off well this year – thanks to the Fed buying them. Speaking of the Fed – Big Ben Bernanke went to London on Jan 13th to push for massive global stimulus – a wish that was granted by his fellow Central Bankers in '09.

On Wed Jan 14th, Osama Bin Laden called for (surprise) a Jihad and Saudi Arabia chipped in the same day by calling for deeper production cuts while Nigerian Rebels attacked a pipeline and TBoone Pickens came on CNBC to tell us oil would head back to $140 in 2009. None of that stopped us from making 200% on our USO puts but it was a hell of a good try, wasn't it?

Peter D wrote an excellent article on Profiting from Short Strangles, which is a must-read for new members and Sage and I wrote a general article on Strategies to Hedge Your Virtual Portfolio – also making a good read. We still weren't convinced that it was safe to go back in the water so we tempered our buying with plenty of downside hedges and disaster protection.

We got our new Government on January 20th, on the same day Spain's debt was downgraded so we added Feb bear plays with SDS $85s at $6.35, DXD $61s at $5.05 and QID $61s at $4.85, all of which made scads of money when the market fell. The dollar was on the way up, as was gold AND oil and we were betting both ways during chat, as summarized that weekend. We got a nice pop into Wed Jan 28th on all the exciting low interest and toxic asset buying being done by our Fed but my comment that morning was:

We got our new Government on January 20th, on the same day Spain's debt was downgraded so we added Feb bear plays with SDS $85s at $6.35, DXD $61s at $5.05 and QID $61s at $4.85, all of which made scads of money when the market fell. The dollar was on the way up, as was gold AND oil and we were betting both ways during chat, as summarized that weekend. We got a nice pop into Wed Jan 28th on all the exciting low interest and toxic asset buying being done by our Fed but my comment that morning was:

"Had I known the government was willing to spend $100,000 times 80M households over just a 4 month period, I would have been more generous in my proposed program last April that solved the housing crisis by merely lending $100,000 to the then 4M homeowners at risk of foreclosure (a mere $400Bn stimulus) who could be saved by cutting their mortgage down with a principal reduction. In September, as the situation got worse, I pointed out that it would be much cheaper to just guarantee the mortgage payments on all 5M homes that faced foreclosure – a cost of "just" $5.8Bn a month that would effectively clean up all the balance sheets without necessitating taking possession of a Trillion dollars worth of properties and dislocating their owners."

I had been saying all the final week of January that I was dreading the GDP report and XOM's earnings "which could create a nasty 1-2 punch to the gut of the Dow" and that's pretty much what happened to end the month as we fell 350 points in the last two days. The GDP wasn't that bad really, down "just" 3.8% in Q4 '08 so I put up a Buy List that was looking to hedge into a 20% drop using buy/writes, which turned out to be 38 stocks that gained an average of over 60% for the year but January was indeed, the worst one EVER and I used that Weekly Wrap-Up to delve into the bear case.

February – Weighed Down by Concerns

January was such a wild month that my first post of February was an Economic Overview for 2009. I was very concerned that the sentiment was way too bullish and, I summarized my economic outlook with the following example:

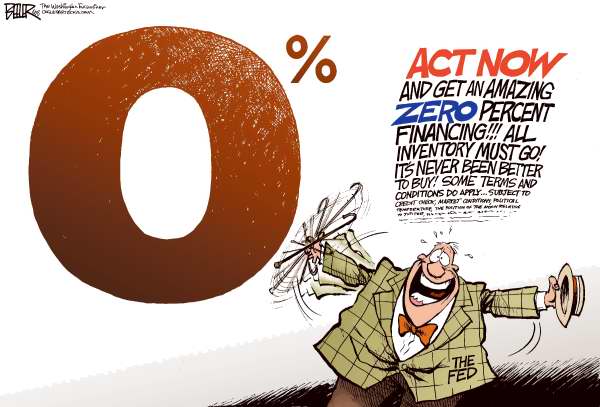

The Fed is going for it big time as they prepare to spend 1,200 times $500M to purchase long-term Treasury Notes in a scheme that sounds like it came from "The Honeymooners" in which Ralph writes a check to Norton who uses the check to lend Ralph the money to cover the check so he can write Norton another check which will be covered by another loan from Norton, who only has the money from the bad checks Ralph keeps writing – at least Madoff had the decency to PRETEND there was a third party involved! Fortunately, Zimbabwe has just started printing $1Tn bills and will be able to lend the Fed as much as they need (have I mentioned I like gold lately?).

Despite my short-term concerns (the Dow was at 8,000 at the time) I concluded my oulook with: "For good or inflationary ill, the Fed has a virtually infinite supply of ammunition to fight this downturn and they are determined to use it. It was Archimedes who said of using leverage "give me a place to stand and I shall move the earth." Well I think if we give the new administration more than a week to get their footing and apply some economic leverage, we will be able to move the markets. Even Whitney and Roubini are down to forecasting the last $2.5Tn in losses for the banks… Only $2.5Tn?!? That’s what the kid in Zimbabwe is holding (there was a picture) to go buy some milk at the grocery store!"

Feb 2nd was a Monday and I posted this picture of a maelstrom to emphasize what I thought was going on with the markets circling the edge of vortex saying:

Feb 2nd was a Monday and I posted this picture of a maelstrom to emphasize what I thought was going on with the markets circling the edge of vortex saying:

"Yesterday I posted our Economic Overview 2009 and I did come to the conclusion that we are priced about right for a bottom at 8,000 but that Keynes (who is very popular these days) warned us that "the market can remain irrational longer than you can remain solvent." So we will not be betting counter to this trend, stocks are cheap enough down here that we can wait until they are on the way up before jumping in – there is no need to catch the falling knives, we already have a full set!"

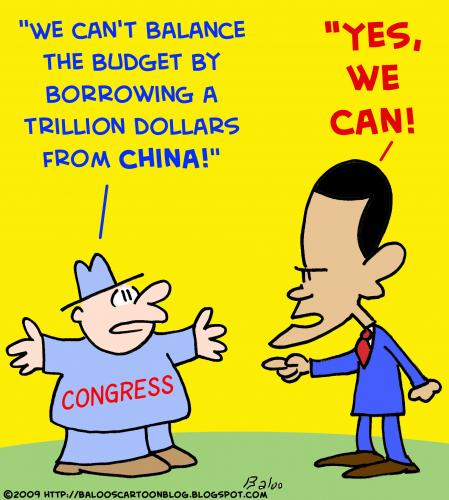

By Friday, Feb 6th, Obama had already managed to unite Congress – which is to say he united the Republicans as 100% of them voted against the stimulus package and I noted that the possibility of no stimulus was likely to spook the markets. Nonetheless we went long on the Dow for the day and short on XOM at $80. On Monday, Feb 9th, I posted another solution to the mortgage/foreclosure crisis, offering 3% mortgages to homeowners instead of giving 0% money to the banks who refused to lend to them.

Things were going well for a moment but Monday night Obama warned: "This is not your ordinary run of the mill recession" causing me to ask on Tuesday "Can We Handle the Truth?" It was, of course, a rhetorical question because we all know this country is like a 5-year old and it immediately threw a temper tantrum and the Dow dropped 400 points in one of the year's single worst sessions.

I went off on Cramer that Wednesday (2/11) as he was on a crusade to talk people OUT of the ultra-short funds just when I was advocating using them for protection. Cramer even claimed the SEC was listening to him and was considering shutting the ultras down – a ridiculous statement but one that kept many, many investors out of using these sensible hedges even as Jim's hedge fund buddies were maxing out their own leverage to take advantage of a downturn. I will restate part of my comments from that day as they are relevant today as well:

Never trust a man who shows you charts when it suits him but then tells you something else and says "you can look it up" because that man is counting on you to be too stupid or lazy to actually do it! The reason we short the ultras when they spike up (as we did yesterday) is because we understand how they work because we do not invest based on what someone on TV tells us to do. Once the XLF drops below $10, then a $1 recovery sends the SKF DOWN 20%. Understanding this relationship helps you play these ETFs very effectively. In fact, right at the end of last Thursday’s post I had said "we expect Monday’s lows to hold but look out if they don’t and have some downside bets ready – maybe those SKFs!" What would having SKF plays ready have done for you yesterday? Jim does not want ordinary people to be able to do what any hedge fund can do through leverage that is not available to the average investor. While Cramer says many, many, stupid and misleading things – his campaign against the very useful ultra ETFs is really pissing me off.

Friday was, fittingly, the 13th as the market was having it's own Valentine's Massacre. With President's day coming up, I took the time that morning to talk politics and about how I came to hold my own political beliefs so it's a good reference for people who want to know where I stand and why. As I mentioned that day, people do let their politics color their investing decisions an, while I may get criticized often for my political opinions – at least you know what they are. It's the pundits who pretend not to have any that are truly dangerous! My closing comments that Friday saved our Members from a World of hurt the next two weeks:

"For us, it’s all about the levels as we try to remain unbiased as investors, no matter how voraciously we defend our political views. Dow 7,800, S&P 820, Nas 1,460, NYSE 5,100, Russell 437 and SOX 203 all better continue to hold today but, even if they do, we’re nowhere near where we want to be and we’re going to take some bearish covers into the weekend – just in case. So whether you are a witch celebrating the horrors of the 13th or waiting for a rose from your true love the next day, remember to be careful out there – we are certainly still deep, deep in the woods!"

That weekend I published my own Report to Tim Geithner entitled "How to Solve the Housing Crisis TOMORROW" – I'm still waiting for him to get back to me. On what I called "Terrible Tuesday Morning" I set the downside target for the Dow at 6,920 using the very accurate 5% rule, which nailed it 2 weeks later. For some time I had told members that there were 3 things that would take us to 6,920: The failure of a major bank, a medium country or GM. GM was the culprit and my Wednesday post warned "Stop GM Before They Kill the Economy Again!"

Friday, February 20th, was Rick Santelli's famous "Tea Party" ouburst and we commented: "In the annals of CNBC cluelessness, this morning’s outburst by the channel’s Rick Santelli is up there with the worst. This is an example of what’s wrong with a certain kind of financial journalism, the kind where people of like backgrounds spend all day staring at tickers and interviewing each other. The segment couldn’t more clearly illustrate the disconnect between the financial-services sector, certain financial journalists, and, you know, “reality.”

My concluding comment for the week ending that Friday (2/20) was: "They say any crash you can walk away from is a good one but this sure doesn’t feel like it." We had a great video explaining the Crisis of Credit that weekend – it's good to watch as we're making all those mistakes again this year – especially in China.

Nonetheless, as you can see in the 2/22 Weekly Wrap-Up, we got close enough to 7,000 for us to start taking some bullish bets, including our flip on SKF, where we started shorting them with the March $200 puts at $1.45 and we also began to go long on China with FXI longs and C Sept $3s at .52 among other, slightly too early longs.

I wrote about 6 pages of comments that weekend, doing an overview of the economic situation at the end of Friday’s post (we decided we liked F at $1.58) and in the comments of the Weekend Wrap-Up, where there is a book's worth of strategy advice as we looked at Edro’s virtual portfolio and set up some long plays on OSX and DRYS. I would have to call this mandatory reading for members – the discussion centered around our "buy/write" strategy outlined in "How to Buy Stocks for a 15-20% Discount."

We set up to go bullish at the bottom in the Monday Post (2/23) and I wrote a special evening post where I said:

"I wish I had something optimistic to say here but I don’t. I do think it’s ridiculous that the government has committed $9Tn worth of assistance to the markets since those November lows and investors are just as scared today as they were when BSC and LEH were failing. The global GDP is down 5%, not 60% and perhaps we need some rotation into sectors that work but this is not the Great Depression Part II – yet!"

Tuesday, Feb 24th, I drew a line in the sand and dared the markets to cross below it, vowing to BUYBUYBUY at the bottom. Wednesday, the 25th, I mentioned we had bottom-fished JPM, X, IP, VNO, HMY, M and IYR, which may strike Members as fully as we are very short on VNO and IYR now. Thursday was the passage of our Budget with a record $1.7Tn deficit yet we kept buying but Friday I got distracted as Jim Cramer blatantly ripped off my Feb 9th housing solution – even going so far as to lift elements directly out of my 2/16 article to make "his" point.

Tuesday, Feb 24th, I drew a line in the sand and dared the markets to cross below it, vowing to BUYBUYBUY at the bottom. Wednesday, the 25th, I mentioned we had bottom-fished JPM, X, IP, VNO, HMY, M and IYR, which may strike Members as fully as we are very short on VNO and IYR now. Thursday was the passage of our Budget with a record $1.7Tn deficit yet we kept buying but Friday I got distracted as Jim Cramer blatantly ripped off my Feb 9th housing solution – even going so far as to lift elements directly out of my 2/16 article to make "his" point.

That weekend we got Buffet's Berkshire Annual Report and I was, overall pleased and picked BRKA's stock as a safe bet for the year. We had gone into the weekend very bearish on our short-term bets but we were also adding tons of longs – mostly well-protected buy-write plays from our Buy List.

March Madness

We began the month on the 2nd with a Monday Market Melt-Down as the International stocks failed to hold our levels and I was generally looking for 60% off the top to hold – which is a nice intersection of Fibonacci and our 5% rule. My comments that morning were: "Keep in mind that 630 is the 60% off line for the S&P and 5,608 is that level for the Dow, with 1,144 being the death line on the Nasdaq (which we are looking to for leadership on the turn)." Tuesday we got a small ($200Bn) TALF boost but not enough to really stop the downward momentum that we had already built up.

We began the month on the 2nd with a Monday Market Melt-Down as the International stocks failed to hold our levels and I was generally looking for 60% off the top to hold – which is a nice intersection of Fibonacci and our 5% rule. My comments that morning were: "Keep in mind that 630 is the 60% off line for the S&P and 5,608 is that level for the Dow, with 1,144 being the death line on the Nasdaq (which we are looking to for leadership on the turn)." Tuesday we got a small ($200Bn) TALF boost but not enough to really stop the downward momentum that we had already built up.

Wednesday was "When Wen Chips In" as I predicted early that China would come though with a 4Tn Yuan ($585Bn) stimulus. This was the global move on stimulus we'd been waiting for since Big Ben went to London to ask for it on Jan 13th so, on Thursday, March 5th, Warren Buffett and I were BUYBUYBUYing and Friday I was in full bull market mode, despite the continuing collapse, as I got ready for my 3 hour LiveStock appearance that afternoon where my 13 trade ideas presented on TV that day returned 469% over the next 6 months. These were, of course, just the same old plays we'd been making in Member chat that month so no big deal really – just a coincidence that the Weekly Wrap-Up was effectively televised that week live, during market hours so even non-members could participat. For information on becoming a Member – CLICK HERE.

![[Shrinking Predictions]](http://s.wsj.net/public/resources/images/MI-AV441_ABREAS_NS_20090308214708.gif) My weekend post was titled "Weekly Whipping – How to Profit from Chaos!" as we were all quite pleased with ourselves and cashing out our bearish positions into the panic drop. While I had been on TV on Friday, telling people to BUYBUYBUY, our friend Cramer was telling his sheeple to SELLSELLSELL and actually had the nerve to come up with the outrageous figure of Dow 5,320 – a position I made fun of that Monday, pointing out that the wave of negativity was reaching it's peak as EPS estimates from GS, BAC and C (see chart, left) had all led to a ridiculous panic that allowed fear mongers like Cramer to have a field day at the expense of the American investor.

My weekend post was titled "Weekly Whipping – How to Profit from Chaos!" as we were all quite pleased with ourselves and cashing out our bearish positions into the panic drop. While I had been on TV on Friday, telling people to BUYBUYBUY, our friend Cramer was telling his sheeple to SELLSELLSELL and actually had the nerve to come up with the outrageous figure of Dow 5,320 – a position I made fun of that Monday, pointing out that the wave of negativity was reaching it's peak as EPS estimates from GS, BAC and C (see chart, left) had all led to a ridiculous panic that allowed fear mongers like Cramer to have a field day at the expense of the American investor.

Monday, March 9th was yet another Market Maelstrom but this time I pointed out that, while the people on one side of the ship looked down and saw nothing but oblivion, the people on the other side of the ship could look out and see calm seas – if only we could stop spinning around in circles! I quoted Edgar Allen Poe as advice for our bottom fishers, who wrote: "It may appear strange, but now, when we were in the very jaws of the gulf, I felt more composed than when we were only approaching it. Having made up my mind to hope no more, I got rid of a great deal of that terror which unmanned me at first. I suppose it was despair that strung my nerves."

That day our buys included COF at $9, MAT at $145, V at $50, IWM Aug $38 calls for $3, GOOG at $300, GS at $75, XLF at $6, C at $1, BAC at $3.50, JPM at $16.50, CCJ at $14.35 and QLD Apr $14s at $6.10 – another group of very strong performers off the bottom. This was all in addition to the Weekend Wrap-Up (see above), where I had laid out 5 different trade ideas that were designed to return 500-2,500% on a rebound (and they did!). My comment in the "Turnaround Tuesday" post of March 10th was:

"In my special report yesterday, I laid out my case for why I think the media was driving a fear-induced bottom and, lo and behold, yesterday there was a great article in Gawker.com that pointed out that FEAR SELLS. CNBC is keeping their ratings up by keeping you terrified – isn’t that nice to know? After being lambasted for being catastrophically wrong about everything its anchors and reporters are paid to understand, the business network is actually enjoying its notoriety. It’s the reality-TV theory of publicity; as long as people are talking about you, it doesn’t matter what they are saying. "If I get gushy, then I’m not going to be relevant," Cramer said."

No, I'm not fixated on Cramer, he's just the front-man – but I do like to warn people of the dangers in the market and there is nothing more dangerous than listening to this bozo. The WORST thing you can do in a downturn is panic and it's our own media, who we support simply by paying attention, who deprive people of a chance to get even by telling them idiotic things like to liquidate their 401K AFTER they drop 50% and telling people to stay out of ultra-shorts at the top and out of ultra-longs at the bottom – all things Jim and his Hedge Fund buddies made millions by betting against exactly the sort of bull and bear panics that they now foment for a living. If I don't remind you how poisonous their advice was when they told you to SELLSELLSELL in March, how will expect you to understand how dangerous they are in December when they are telling you to BUYBUYBUY?

On Wednesday I reflected that Tuesday was easy, what Cap likes to call a "Free Money Day" as the Dow climbed over 400 points on a single day. Thursday I analyzed the impact of individual components on the Dow and I added RIMM in the morning post along with AA, C, GM, GE, PFE, MSFT, KFT, JPM, INTC, HD, DIS and DD who I said could all double without even pushing the Dow back over 9,000. Friday was the 13th again but this time we felt very lucky as I had made a bullish call for Members at 9:53 on Thursday, ahead of another 250-point gain that took us up to our target break-out levels. I set new levels that morning, targeting Dow 8,000, S&P 850, Nas 1,600, NYSE 5,250 and Russell 450 and we nailed all of them at the top of the next 30-day run.

On Wednesday I reflected that Tuesday was easy, what Cap likes to call a "Free Money Day" as the Dow climbed over 400 points on a single day. Thursday I analyzed the impact of individual components on the Dow and I added RIMM in the morning post along with AA, C, GM, GE, PFE, MSFT, KFT, JPM, INTC, HD, DIS and DD who I said could all double without even pushing the Dow back over 9,000. Friday was the 13th again but this time we felt very lucky as I had made a bullish call for Members at 9:53 on Thursday, ahead of another 250-point gain that took us up to our target break-out levels. I set new levels that morning, targeting Dow 8,000, S&P 850, Nas 1,600, NYSE 5,250 and Russell 450 and we nailed all of them at the top of the next 30-day run.

The Weekend Wrap-Up of March 14th is a great look at how we added more and more bullish plays (adding 2 more 500-2,500% plays during Member Chat – LVS and CBS) and I was already having to apologize for sounding like a broken record with "buy FAS" as my standard answer to every question that week as well as the aggressive, but ultimately worth it, SKF July $175 puts at $37.50 (which were a 4x return by April). I summed up the turning point in the markets at the time saying:

We begain the week talking about "The Law of Unintended Consequences" and how mark to market rules were being used to push the banks lower than logic would dictate. In the "Weekly Wrap-Up" we talked about how it wasn’t so much that 6,500 was a bottom but that the recent batch of buy-outs suggest that stoks are finally well and truly oversold. I made the value case for C, then $1 and it was indeed C that sparked the rally this week when they said they were, indeed making some money.

There is no great trick to what we were doing here at PSW. We were simply taking advantage of the point of maximum financial opportunity. Warren Buffett tell us: "Be fearful when others are greedy and be greedy when others are fearful" – as fundamantal investors we sometimes move in and out a little ahead of the curve (we turned bearish a little early this November) but there is plenty of money to be made in the middle! We're certainly not certain of what the market will do every day but we do discuss it and develop our investing premise so we are READY to take advantage of situations like this. You can join us for the next opportunity by becoming a Member HERE.

By Monday, March 16th, we were much more sure of the market's direction. As we had anticipated, OPEC did not cut production and oil fell back to $44 per barrel and the G20 came through and backed Big Ben's Jan 13th request and pledged "a sustained effort" to end global recession and to "cleanse banks of toxic assets." This was the fruition of my Dec 2006 prediction that the appointment of Hank Paulson to Treasury was part of a plan to "Burn Dollars to Fight Gravity." Since we knew where this strategy was going to lead, it was a running joke at PSW, because I said it so often, that I would simply say: "Have I mentioned I like gold lately?"

Tuesday we looked for breakouts and Wednesday, also as expected by us, the Fed went beyond and below 0% interest as they began their policy of quantitative easing. We expected a pullback but we also took it as another buying opportunity so we reviewed "How To Buy A Stock For A 15-20% Discount" as I set us a new Buy List for Members that I pushed out the evening of March 18th as the pullback opportunity was clearly forming. Looking back now, we can almost cry that we didn't liquidate our silly homes, sell the children and the silverware and put it all on these picks, which included: AAPL at $89, AXP at $19.64, BA at $39.88, BBY at $19, BTU at $19.55, CAT at $28.41, CBS at $5.83, CI at $11.16, FAS at $5, GCI at $8.18, GLW at $8.45, GNW at $1.10, GOOG at $315, HAR at $13.25, HOG at $14.71, INTC at $12.50, ISRG at $97.92, M at $6.41, MSFT at $18..65, TEX at $11.71, TIE at $7.28, TXN at $14.15, TXT at $13.90, XLF at $10.55 and X at $25.50. As I said to Members at the time:

"Think about what we are buying here, Boeing, American Express, Intel, Microsoft, Texas Instruments, Macys, US Steel, Corning, John Deere, Pfizer, GE, Coke, Pepsi, Nike, Avon, CBS, Gannett, Harley Davidson, Apple, Best Buy, Wal-Mart… Even in a depression, can you imagine life without those things? That’s the idea of bottom fishing in a tragic market – take advantage of the opportunity to buy the top brands at bottom prices. You can always gamble on the up and comers but this is a very rare opportunity to get the best companies on sale."

Thursday we were quite pleased with the little dip we got and on Friday, March 20th, there was a bad market reaction to the House passing a tax on Wall Street Bonuses, which later died a quiet but expensive (lobbying-wise) death in the Senate. Nonetheless at 2:17 I called a bottom into the new week saying to Members: "Good place to pick up FAS again if you have the guts! How many times will you watch in disbelief as it hits $7.50 before you buy some at $5? You can sell naked Apr $5 puts for $1.20, which should leave you with about $1.10 in margin used for a double and hell yes, we’d be happy to own them at $3.80."

I ended up calling it a "Wobbly Weekly Wrap-Up," where I said: "What happens next can be very ugly if we can’t turn it back up right away next week." In a special "Weekend Reading" post, I listed the various factors that led the market to panic that week, the main of which was Geithner's very poorly understood plan for the banks but I concluded after reading the actual plan (as opposed to the sound bites that were kicked around like a political football): "On the whole, it's really pretty clever!"

In the Wrap-Up we went for the easy money with DBC but on March 22nd, despite feeling short-term bearish on it, I decided it was time to start positioning seriously for the gold rally and I wrote a special post called "Spinning Straw Trades Into Gold." This led to many of our Members enjoying the ride gold went on this year.

Monday, March 23rd, was manic to say the least as we added 500 points on the day (best of the year) and by Tuesday we were testing our upside target levels. Wednesday we had a little trouble with the Czech Republic, who's PM said: "Widening budget deficit and protectionist trade measures — such as the "Buy America" — all of these steps, these combinations and permanency is the way to hell." Ordinarily, we wouldn't care what the PM of the Czech Republic has to say but it was his turn to be President of the EU this year so we decided to go a little bearish on Thursday, March 26th, after deciding the GDP results weren't all that thrilling.

That Friday, March 27th, marked the first time I complained about market manipulation being used to prop up the markets as I went over my logic for suddenly turning bearish on Thursday, saying:

That Friday, March 27th, marked the first time I complained about market manipulation being used to prop up the markets as I went over my logic for suddenly turning bearish on Thursday, saying:

"They have literally thrown everything but the kitchen sink at the markets this week to get a 10% gain into the end of quarter (IF they can hold it together that long) but, what next? For the first time in a very long time I’ve called for raising cash as we’re heading into some very volatile earnings and I’m really not expecting us to break our upper levels, now just 2% away, without considerable effort. Balance is usually fine but sometimes the flexibility of cash is a big help!

I’m not bearish per se – I still think the market should settle down back around our old 8,650 range after earnings but it will probably be a wild ride getting there. While the economy is better than you may think (see very cool chart) – charts do still rule. If we can’t break our top levels by next Wednesday, we’re much more likely to see AT LEAST a 50% retrace of our gains off the bottom. That’s why I like a little more cash here, huge drops can blow our your hedges so better to have cash on the side to take advantage…"

It was a good prediction but I was off by a day – we took out our levels on Wednesday, not Thursday. I had stuck to my bearish guns on Friday as we had a minor pullback and I said to members in the Weekend Reading post: "There are several new trade ideas in comments below but we’re kind of in wait and see mode for next week. There’s an excellent wrap-up of the week by Tyler Durden of Zero Hedge, which very neatly summarizes why we went bearish on Thursday and remained so over the weekend. Don’t forget I was looking for something like a 5% pullback and "all" we got was 2.5% so far."

It was a good prediction but I was off by a day – we took out our levels on Wednesday, not Thursday. I had stuck to my bearish guns on Friday as we had a minor pullback and I said to members in the Weekend Reading post: "There are several new trade ideas in comments below but we’re kind of in wait and see mode for next week. There’s an excellent wrap-up of the week by Tyler Durden of Zero Hedge, which very neatly summarizes why we went bearish on Thursday and remained so over the weekend. Don’t forget I was looking for something like a 5% pullback and "all" we got was 2.5% so far."

By Monday morning we were already in freefall and my comment that morning was: "So let’s not be all "shocked" that there’s a pullback today. It’s the same pullback as we had on Friday, following through to where it belongs. Timing-wise, it was to be expected as we run-up to the G20 and my catch-phrase prediction for this week was: "While Obama’s away, the bears may play" and it looks like the bears are bringing their "A" game this week, pressing hard before Obama is even airborne for his European tour."

The very exciting month of March ended on Tuesday, the 31st. We had already gone bullish on Monday afternoon with a slew of bullish positions I went over in the Tuesday post but I was a bit worried about how the day would be going. We did manage to hold our levels for the last day of the month with the Dow right around 7,500, still down 16.67% from Jan 1st (9,000) and up 15.4% from the bottom at 6,500.

Tune in next weekend for Q2, maybe even Q3 if things go well. For more on my 2009 Market Review, see also:

- Stock Market Crash – Year One in Review – The Gathering Storm

- Stock Market Crash – Year One in Review – The Next 30% Down

- Stock Market Crash – Year One in Review – March Madness