Smoking Swap Guns in EuroLand: Sovereign Debt Buyer Beware

Courtesy of Reggie Middleton’s BoomBustBlog.com

There are broad indications hinting that Italy and Greece are not the only countries that have used swap agreements to manipulate its budget and deficit figures. France and Portugal may be two other European economies which have resorted to similar manipulations in the past in order to qualify as part of single currency member nations (Euro Zone). Below is a small subset of the research that I have been gathering as I construct a global sovereign default model. This model is very comprehensive and thus far has indicated that quite a few (as in more than two or three) nations of significance have a 90% probability of defaulting on their debt in the near to medium term.

More on this later. Now let’s dig into what we have found that looks like gross manipulation of the numbers in order to hide debt in several European countries. I think I’ll call it the Pan-European Ponzi. Conspiracy theorists are going to love this post.

Like Italy (see below), Portugal has also been known for years to take advantage of derivatives contracts to dress up its budget numbers in the late 1990s. In a recent press article (Debt Deals Haunt Europe) Deutsche Bank’s spokesman Roland Weichert commented that the bank executed currency swaps on behalf of Portugal between 1998 and 2003. He also said that Deutsche Bank’s (DB) business with Portugal included "completely normal currency swaps" and other business activity, which he declined to discuss in detail. He also added that the currency swaps on behalf of Portugal were within the "framework of sovereign-debt management," and the trades weren’t intended to hide Portugal’s national debt position (yeah okay!).

Though the Portuguese finance ministry declined to comment on whether Portugal has used currency swaps such as those used by Greece, it said Portugal only uses financial instruments that comply with European Union rules. Thus, if the use of these instruments complied with European Union rules, then there is nothing wrong with them, right??!! The word "if" is probably one of the most abused words in the English language. As my lawyer used to tell me as I once abused the word, "If Grandma had balls, she’d be Grandpa, wouldn’t she?"

The French

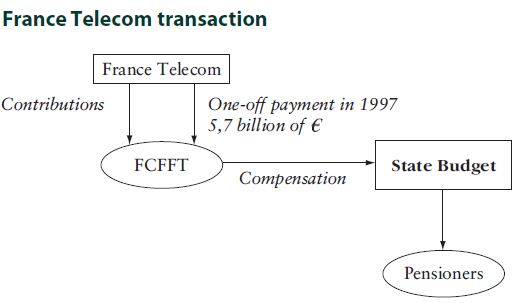

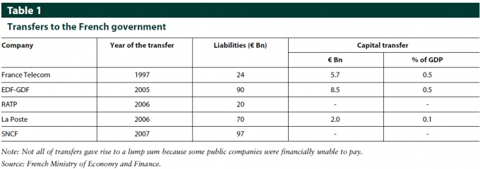

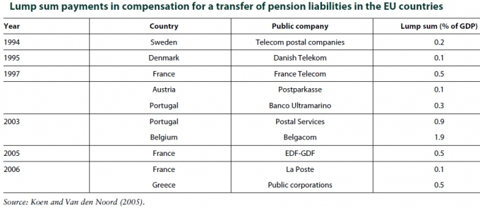

In 1997, the French government received an upfront payment of £4.7 billion ($7.1 billion) for assuming the pension liabilities for France Telecom (FTE) workers in return. This quick cash injection helped bring down France’s deficit, helping the country to meet the pre-condition to join the Euro zone. You may reference the Laurent_Paul_and Christophe_Schalck_study for a background on the deal. I don’t necessarily concur with their conclusions, but it does provide some info.

For the record and according to the document referenced above, according to the state balance sheet for 2006, total pension liabilities of civil servants have been estimated at €941 billion, i.e. 53% of annual GDP in France. An attempt to reform all special schemes in 1995 collapsed because of severe strikes on the railways. Sounds awfully Hellenic in nature, doesn’t it??? I, for one, believe that Greece is getting a bad rap, and not becaue it is being falsely accused but because it is just a lot sloppier at covering up its shenanigans than its European neighbors.

Now, back to France. A transaction similar to the France Telecom deal took place in 2006 with La Poste which still employs 200,000 civil servants, but is now facing the same evolution as France Telecom in 1997.

Yet an important difference with France Telecom is the obvious insufficiency of the lump sum paid by the postal company (€2 billion) compared to the amount of pension liabilities transferred (€70 billion at the end of 2006). This low amount is explained by the weak financial position of the company. Thus, the balance of the transaction is guaranteed by 1) additional contributions by the postal company which will be paid until 2010, the scheduled year of the complete liberalization of the postal services; and 2) the annual contribution by the state budget the amount of which should progressively increase, from €0.5 billion in 2006 to €2 billion in 2020.

Click to enlarge

As you can see, the French government has accepted €301 billion of pension liabilities for $16.2 billion of upfont payments. Who wants to bet if these liabilities are drastically underfunded? Either cut Greece some slack or jump into France’s finances. We shouldn’t have it both ways!

As public entities replace the public company for the payment of pensions and the collection of contributions, the tax burden can be increased significantly: around 0.1% of GDP each for the EDF-GDF, France Telecom and La Poste transactions. Overall, transfers of pension liabilities implemented since 1997 have supposedly increased the French tax burden by 0.3% of GDP.

Is France the only one doing this? You know the answer to that question.

The Greeks (again)…

According to people familiar with the matter interviewed by China Securities Journal, Goldman Sachs Group Inc. (GS) did as many as 12 swaps for Greece from 1998 to 2001, while Credit Suisse (CS) was also involved with Athens, crafting a currency swap for Greece in the same time frame.

Under its "off-market" swap in 2001, Goldman agreed to convert yen and dollars into euros at an artificially favorable rate in the future. This helped Greece to use that "low favorable rate" when it recorded its debt in the European accounts-pushing down the country’s reported debt load.

Moreover, in exchange for the good deal on rates, Greece had to pay Goldman (the amount wasn’t revealed). And since the payment would count against Greece’s deficit, Goldman and Greece came up with another twist: Goldman effectively loaned Greece the money for the payment, and Greece repaid that loan over time. And the two sides structured the loan as another kind of swap. So, the deal didn’t add to Greece’s debt under EU rules. Consequently, Greece’s total debt as a percentage of GDP fell from 105.3% to 103.7%, and its 2001 deficit was reduced by a tenth of a percentage point in GDP terms, according to people close to Goldman.

Another action that smacks of Hellenic manipulation, at least to the staff of BoomBustBlog: For years it apparently and simply omitted large portions of its military-equipment spending from its deficit calculations. Though European regulators eventually prevailed on Greece to count everything and as a result, in 2004, there was a massive revision of Greek deficit figures from 2000 (a budget deficit of 2.0% of GDP in 2000 to beyond the 3% deficit limit in 2004), by then Greece had already gained entrance to the euro. As in my trying to prepare for the coming sovereign debt crisis, timing is everything, isn’t it???

The Italians

As discussed in a recent ZeroHedge article, a 1996 Italian currency swap, arranged by J.P. Morgan, allowed Italy to receive large payments upfront that helped keep its deficit in line, with the downside of greater payments later.

In addition to curbing their current deficits, countries are now using these swap agreements to push off their loan liabilities (related to swap agreements) to a later date through securitization, and Greece is one such example.

Under the 2001 deal brokered by Goldman, Greece swapped dollar- and yen-denominated debt for Euros at below-market exchange rates. The result was that the country got paid €1 billion ($1.35 billion) upfront on the swap in exchange for an obligation to buy the swaps back later. In 2005, this obligation was in turn securitized as part of a 20-year debt issue, further pushing off the day of reckoning.

Moreover, one of the key reasons why such manipulations continued is the apparent ignorance of the EU’s Eurostat, which knew enough about these deals to tighten the rules governing their accounting-albeit only after they had served their purpose – the Ponzi! When Italy’s then-Prime Minister Romano Prodi miraculously achieved a four-percentage-point improvement in Italy’s budget deficit in time to usher the country into the common currency, Italy’s use of accounting gimmicks was widely discussed, and then promptly ignored. As at that time, everyone was only too eager to look the other way in the drive to get the single currency up and running.

It wasn’t until 2008- a decade after the deals became popular- that Eurostat was able to revise its rules to push countries to include swaps in their debt and deficit calculations. Still, till date too little is known about countries’ continued exposure to the deals that are already out there.

There is less evidence to support that there are more such swap deals that happened during the late 90’s till the early part of this decade. But the data below, which shows a sharp decline in interest payments as a percentage of GDP particularly for Belgium (apart from Greece and Italy), hints that there are considerably more of these deals to be discovered. The questions is, will they be discovered before or after the respective sovereign issues record debt to the sovereign fixed income investors (suckers).

Notice the extremely supercalifragilisticexpealidocious reductions Belgium, Greece and Italy have made in their interest payments from 1993 to 2000 in this graphic made pre-2000. If one didn’t know better, one would have thought theses countries actually used magic to make such reductions. Hell, Italy practicaly cut its debt service (projected, of course) in half. It really makes one wonder. I’m just saying…

According to Derivatives and Public Debt Management" by Gustavo Piga,

The political stakes of the 1997 budget package were enormous. Therefore, it was no surprise that many countries were accused of ‘creative window-dressing’ in their budget through the use of accounting tricks to reach the desired goal. One contentious item was interest expenditure, which is the interest expense that governments sustain to finance their deficit and roll over their debt. Interest expenditure represents a high percentage of public spending and GDP in the European Union. It is highly variable over time, especially when compared to other components of the budget. Because of its relevance and because it is subject only to minimal scrutiny during budget law discussions (and many times even after its realization during the fiscal year), interest expenditure is an ideal target for reaching fiscal stabilization goals without incurring excessive political protest or opposition.

Oh, do you mean like this???

For those who have not been following me, I have published a signficant amount of research on what I call the Pan-European Sovereign Debt Crisis. I fully suspect quite a few countries to default on their debt, and my next installment will include a full write-up, supporting data and model for my subscribers, as well as an anecdotal list that I will release publicly. In the meantime, here is the crisis series to date:

- Can China Control the "Side-Effects" of its Stimulus-Led Growth? Let’s Look at the Facts – Explains the potential fallout of the excessive fiscal stimulus in China. While not European, it is quite likely to kick off the daisy chain effect.

- The Coming Pan-European Sovereign Debt Crisis – introduces the crisis and identified it as a pan-European problem, not a localized one.

- What Country is Next in the Coming Pan-European Sovereign Debt Crisis? – illustrates the potential for the domino effect

- The Pan-European Sovereign Debt Crisis: If I Were to Short Any Country, What Country Would That Be.. – attempts to illustrate the highly interdependent weaknesses in Europe’s sovereign nations can effect even the perceived "stronger" nations.

- The Coming Pan-European Soverign Debt Crisis, Pt 4: The Spread to Western European Countries

-

The Depression is Already Here for Some Members of Europe, and It Just Might Be Contagious!

-

I Think It’s Confirmed, Greece Will Be the First Domino to Fall

Disclosure: Short European Banks