.jpg) This whole week did not feel right to me.

This whole week did not feel right to me.

We were too bearish as I had expected a bogus commodity rally in last weekend's wrap-up but I didn't expect it to persist for a week, even as the dollar held it's ground above 80, a 10% pullback off the top, when oil was $40, copper was $1.50 and gold was $850. Now oil is $80 (up 100%), copper is $3.35 (up 123%) and gold is $1,135 (up 33%). Let's say gold is a true indicator of dollar weakness – that means that only 33% of oil and copper's move up can be attributed to the 10% drop in the dollar (not that even that makes sense but we'll give it to them). Can the rest be attributed to demand?

Certainly not with copper. Global copper consumption was down 1.9% in 2009 and Q1 2010 is lower than any quarter since Q1 2009 and even Barclays' very aggressive targets for China growth only bring global demand up 2.5% this year – whch would just about bring us back to 2007 levels of consumption. That, of course, also assumes a rebound in housing construction – something we are not seeing at the moment. Also, China spent $700Bn last year stimulating their economy and one of the ways they did this was to stockpile copper. As you can see from the chart – that too appears to be winding down and even Goldman Sachs has abandoned the bullish side of copper at this point.

Oil is just as silly. According to the EIA, global oil consumption is not expected to return to 2007 levels until late 2011 – and that is with some very rosey estimates of a global econonomic recovery – exactly the type of thing that can be derailed by high oil prices! Mighty China's consumption is projected to go from 8.66Mbd this year to 9.13Mbd in 2011, a 500,000 barrel increase. Last week, the US had a build in inventories of 4Mb – we just send those over to China and everyone is happy! I've already had my say on oil demand this this weekend, so let's just move on…

Let's just say I'm a little skeptical about any market moves that are lead by commodity pushers at this very early stage in a recovery. Prices are not going up based on demand but on expectations of demand in the future and that's a very dangerous game to play because it depends on drawing an ever-increasing number of speculators into the tent as they play hot potato with front-month contracts, like the 250 Million barrels that are on order at the NYMEX for April delivery to Cushing, OK – a facility that can only handle 40M barrels a month!

If I order 2 dozen Boeing 787s to be delivered to my house because I think there will be demand and I can sell the planes to others for a higher price – am I an investor or a speculator? Clearly I can't possibly take delivery of even a single 787 as I only have a 3-car garage and I'll never get the kids to clear out their bikes and sleds from the 3rd bay. So that makes me a speculator. I am not an airline and I am unable to take delivery. Why then, is it so hard for our Congress to understand that those extra 210M barrels of undeliverable NYMEX contracts (84%) are PURE SPECULATION.

You would think the fact that those 250,000 contracts were traded 278,000 times on Friday would be a tip-off as well yet our government sits silently as oil prices are ramped up 100% in 12 months, costing US consumers an extra $24Bn a month in the middle of a recession and hitting the planet up for an extra $1.2Tn – and that's without the refining mark-ups or flow-through inflation.

We know our Government is bought and paid for by energy interests but et tu Europe? China? Bueller??? Anyway, so when I see a "rally" (it was only 150 points for the week) that is led by the commodity pushers in the Materials sector, which is now up 15% in the last 7 sessions, Energy, which is up 5% in 7 trading days, and the IBank speculators (up 12% in a month) then I begin to have late 2007 flashbacks, especailly as we have several countries on the verge of collapse while the markets party like it's 1999. Forgive me for being skeptical but a low-volume rally led by commodity pushers moving up on a false premise is not a train I'm looking to jump on board of. But what a week it was:

Monday Market Mayhem

The Earthquake in Chile was the excuse to jam oil and copper up in pre-markets and I noted that copper production in Chile had been unaffected, sending out a 5am Alert to Members with a short play on the copper futures, which topped out at $3.48 and fell all the way back to $3.27, which is huge for a futures move! We also had a long-standing play to short FCX at $77.50 and they hit our target as well – that's a play I re-stated in the morning post as it was still available at 9:30.

The Earthquake in Chile was the excuse to jam oil and copper up in pre-markets and I noted that copper production in Chile had been unaffected, sending out a 5am Alert to Members with a short play on the copper futures, which topped out at $3.48 and fell all the way back to $3.27, which is huge for a futures move! We also had a long-standing play to short FCX at $77.50 and they hit our target as well – that's a play I re-stated in the morning post as it was still available at 9:30.

We got mixed signals out of China but it was Goldman Sachs upgrading China’s automobile, health-care, personal computer and Internet stocks that got me bearish as I KNOW that is BS so the whole thing smacks of market manipulation. As I said that morning: "Gee, a Gang of 12 member dropping the upgrade bomb on foreign markets and goosing our futures – IT MUST BE MONDAY!" 21,000 was the 5% line on the HSI and I predicted resistance there and we got a nice pullback during the week. That will make 21,000 a critical global indicator for next week's action!

I was wrong in thinking that the BOE and the ECB would raise rates to fight inflation on Thursday. That gave commodities another boost to end the week but it doesn't change my fundamental outlook that they are overbought here. A huge move in the Dax was the surprise of the week and we are pretty much over all the red lines I laid out in Monday's multi-chart so we will have to prepare to switch off our brains and go with the technical flow if we don't get a quick reversal next week.

- FCX short at $77.50, out at $76.50 – up 1%

- FCX March $75 calls sold for $3.75, out at $3 – up 20%

- FCX March $70 puts at .75, out at .90 – up 20%

- TZA Apr $7.50s average $1.05, now .70 – down 36%

- FCX ratio back spread – on target

- ERY March $11 puts sold for .50, now .85 – down 70%

- TBT complex spread – on target

- TASR Jan $50 puts sold for .55, now .50 – up 10%

- SPWRA Apr $19 puts sold for $1.60, now $1.10 – up 31%

The smartest thing I said all week was at Monday's close when I was asked if we should flip bullish based on the day's action and I said: " If we hold it tomorrow we’ll have to be until we have a 3/5 breakdown (of our bounce levels)." I sure would have had a better week if I'd followed the technicals instead of my gut! Of course, we were trading to balance last week's extremely bullish collection and ALL of our losing plays from last week (ACI, TBT (6x), AMED) except for PALM were bullish plays that have now turned around – bumping us up to 55 winners out of 56 trades for the prior week so it's little wonder we strive to protect ourselves from a drop until we cash out our bull side.

Tuesday – Bill Gross Gives Us 90 Seconds

Tuesday – Bill Gross Gives Us 90 Seconds

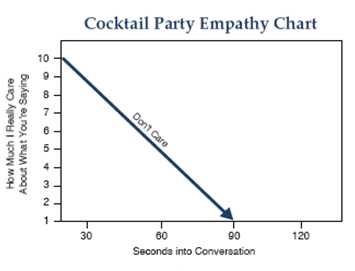

Here's how powerful Bill Gross is: In my post, I called him "a pompous jackass" (lovingly, of course), which I don't feel is unfair for the guy who comes up with this chart to explain why "no one gives a damn about you and your problems – maybe those shoes and that dreadful eye shadow you’re wearing, but not anything audible coming out of your mouth." Bill Gross is so far up the ladder in the top 0.1% that we are all literally ants that annoy him as he tries to make his way around a buffet table.

When this article was published in Forbes, though, Bill Gross becomes "a pompous dude." Great, 100,000 people think I use the word "dude" to describe people – now my Pulitzer is right out the window! At least we've spared Bill Gross the awkward shame of being called a jackass just because he thinks its amusing to tell us little people how insignificant their petty lives are to him to the point where 1/1,000th of his day quickly becomes unbearable when someone like you attempts to monopolize it by having the nerve to actually speak to him at a party. In fact, when you think about it, the kind of people at a cocktail party with Bill Gross are already in the top 1% – when he's forced to go out in public I'm sure he has snipers making sure none of the real riff-raff waste any of the precious time of the man who said: "Medical problems? Unless you’re dying from cancer – don’t care."

Anyway, Bill did make other, good points in his letter that were similar to my points in "The Wonderland Market" and we talked about how the current market is being governed by "The SEP Effect" and can continue to rise indefinately, now matter what Bill and I think about the fundamentals. I predicted that Greece would not actually get bailed out on Friday and, not only is Greece not resolved but now Iceland is poised to boil back over into a crisis. There's clearly a housing bubble in China along with the usual CDS, MBS, unemployment, inflation, deflation, foreclosures and credit-card defaults but, as the markets have clearly indicated this week – they must be somebody else's problems.

Anyway, Bill did make other, good points in his letter that were similar to my points in "The Wonderland Market" and we talked about how the current market is being governed by "The SEP Effect" and can continue to rise indefinately, now matter what Bill and I think about the fundamentals. I predicted that Greece would not actually get bailed out on Friday and, not only is Greece not resolved but now Iceland is poised to boil back over into a crisis. There's clearly a housing bubble in China along with the usual CDS, MBS, unemployment, inflation, deflation, foreclosures and credit-card defaults but, as the markets have clearly indicated this week – they must be somebody else's problems.

- DIA March $103 puts at .80, out at $1, up 25%

- USO Apr $38 puts at $1.05 (roll) now .88 – down 16%

- EDZ Apr $4/5 bull call spread at .60, now .45 – down 25%

- EDZ Apr $5 puts, sold for .50, now .65 – down 30% (pair trade)

- SDS June $29/32 bull call spread at $1.90, now $1.60 – down 16%

- SDS June $32 puts sold for $1.90, now $2.05 – down 8% (pair trade)

The EDZ and SDS are our newest "disaster hedges," both with 10/1 payoffs if the market heads south. Both are even cheaper now than the were on Tuesday and can be used to protect uside gains by committing 10% of the profits into the protection – that allows us to ride out our winners past the point where we'd usually want to take profits off the table.

Something that bothered me on Tuesday was this chart from Bespoke, which listed the S&P 500 companies with the highest percentage of sell ratings. What's crazy about this chart is there are just 21 out of 500 stocks in which even 1/4 of the analysts following rate it as a sell. This level of unbridled optimism can be a LITTLE dangerous:

Which Way Wednesday – The Beige Book Boogie

I posted up our 5% rule chart and our 2.5% upside line was 10,420, we topped out almost exactly 1.25% above that at 10,550 on Friday. We considered this a possibility and my plan in that case was to cash out the longs at 10,700 and go "CRAZY SHORT" on the retest of our tops. Tracking the last BBook day, we know we had a false rally into the next week but if we get over 10,550, then crazy will be the operative word for going short until things settle down. We did, in fact get a nice sell-off into the afternoon but then – what a comeback!

- GLL Apr $9 calls at .65, now .75 – up 15%

- FCX March $80 calls sold for $2.50, out at $1.50 – up 40%

- FCX Apr $75 puts at $2.50, out at $3 – up 20%

- DBA 2012 artificial buy/write – on target

- USO Apr $38 puts (roll) at $1.24, now .88 – down 27%

- RUT complex put spread – on target

- RUT complex call spread – on target

- EDZ Apr $5 puts sold for .60, now .65 – down 8%

- EDZ Apr $4/5 bull call spread at .60, now .45 – down 25% (pair trade)

- EWJ March $10 puts at .08, still .08 – even

- TZA March $8 puts sold for .29, now .52 – down 79%

- FTR Aug $7.50 puts sold for .70, now .75 – down 7%

- BRK.B artificial buy/write – on target

We got the Beige Book at 2pm and I had the summary with my comments up for Members that afternoon. The report was far from encouraging – possibly worse than the one we had on January 13th, the week before the market began an 800-point decline but that was spurred on by the catalyst of Greece. This week we had nothing but happy talk and more stimulus that took us quickly off the bottom – a little to quickly for our comfort.

Thrilling Thursday – Consumers Still Unemployed, but Shopping!

469,000 people were fired in the week ending February 26th. According to Friday's NFP report though, 459,000 people must have replaced them because our total job losses for the month were 40,000. We didn't know that was going to happen on Thursday but I was expecting a better-than-expected NFP report on Friday due to census hiring. The real upside story on Thursday was retail sales, which were much better than last year – which sucked. Not sucking is rally fuel to good news-starved investors and we should have had more faith in the stick this week as end of day and pre-market moves were responsible for 400 out of 150 points the Dow gained for the week:

Even more impressive, the up volume for the entire week was less than the volume of the 450-point drop from Jan 21 & 22. So, in theory, a person who ran a program selling into that drop at an average of Dow 10,400 could have run another program to buy back the same stocks between 9,900 and 10,400 (averaging 10,150). Once they do that, all they would have to do is run a program to jam the market back to 10,700, at which point they could dump everything again for an average of 10,400 and PRESTO – another 2.5% profit!

Thank goodness there are no firms we can think of who would do something like that, which would virtually guarantee they make money on every single trade and thank goodness such a trading program couldn't possibly exist or I'd be worried by this kind of chart action… Speaking of market manipulation (not that there is any, of course), Barry Ritholtz has some great advice for traders who are fed up by the games they see being played that I heartily agree with:

Yes, there is an insanity to the markets that can make you mad if you let it. Instead, learn to see the delightful absurdity of it all. Revel in the stupidity, learn to read when the ‘wisdom of the crowd’ turns into an angry mob. Find some Zen in the foolishness of others… You need to be able to comment on the madhouse — and you can do so acerbically, mockingly, derisively at times — while recognizing, acknowledging, and waiting for the technical set up to bet against the crowd.

You must learn patience, young grasshopper. You must have faith that EVENTUALLY, the sorta kinda, almost efficient market will figure it out. That is when money returns to its rightful owners. There will be long periods of time when the blowhards, the jackasses, the arrogant, the ignorant will be eating better than you. During the dot com bubble, the dumber you were, the more money you made. Many of those who understood how silly things were missed out on the boom.

But this state of affairs is temporary. Eventually, the knaves starve to death under the oppressive force of their own ignorance. Be patient. The day of reckoning is often surprisingly late in its arrival, but it will not be denied. The beast must be fed… Trust me when I tell you, its worth the wait . . .

It was with the same attitude that I gave this closing advice to readers in Thursday's post: "Greece is still the word and even a rumor of a move regarding a possible resolution to the Greek tragedy send the Euro and the Pound flying up and down. So let’s enjoy this morning’s "good" news and we’ll see if we can get another nice entry on the USO puts and possibly a re-load on the DIA (same plan as yesterday) but we DO NOT want to be too short into the close as we may get an upside surprise on tomorrow’s Non-Farm Payroll number thanks to the census hiring."

- Oil futures short at $80.50, out at $80 – up $10 per penny per contract

- USO Apr $37 puts at avg $1.01 now .88 – down 15%

- OIH Apr $120 puts at $2.65, now $2.30 – down 13%

- OIH March $125 calls sold for $3.60, out at $2.45 – up 32%

- SRS complex spread – on target

- PNC ratio backspread – on target

Notice we were not sure what was going to happen the next day so we had very little trading. The quick money from the OIH call sale allowed us to hang tough on the USO and OIH April bearish plays. This is a good way to look at balance in a microcasm – we take profits off the table to keep ourselves more neutral and, if necessary, we have cash to go long on oil or other commodities (like Wednesday's DBA trade, which is a serious long-term play, not like the smaller, short-term trades) to balance things out.

TIVO – At $9.89 you can buy the 2012 $7.50s for $4.75 and sell Feb $10 puts and calls for $3 so that’s $1.75 on the $2.50 spread with lots of time to roll. The 2011 $7.50 puts are an even roll from the Feb $10s but you’d better be willing to own TIVO at net $8.50ish to make this trade. To avoid the put issue entirely, the 2011 $10/15 bull call spread is $1.40 and you can cover that with the 2012 $15/12.50 bear call spread at $1.60 so you get $2.50 back if TIVO goes belly up and we can assume you won’t lose more than .80 on the bear side if TIVO does well and then you collect $5 in Jan 2011 less whatever you lose on the long bear play.

In play #1, we could not have been more thrilled as TIVO hit our target on expiration day, closing at $9.99 on 2/19 and wiped out our caller and putter! That left us with a very comfortable net of $1.75 on the 2012 $7.50 calls, now $10.50, up 500% in 3 months. In the second play the 2011 $10/15 bull call spread is now $3.20 (up 128%) and the $15/12.50 bear call spread is still $1 (down 38%). As a pair, $3 was put in play and the two positions are now $4.20 for a 40% total gain on a very well-hedged position in just 3 months! Of course, we now feel fairly secure in the bull call spread so we cash out the protective put play, take the .60 loss these and hopefully we'll end up with $1.80 more as the $10/15 spread matures, which would bring us up to a total return of $6 – up 100% but with just $2 of $3 original dollars left on the table for the longer term.

If 75% of your virtual portfolio is made up of nice, safe plays that make a nice return and require virtually no attention from month to month – THEN you can afford to mess around with the fast money of front-month options but, without building that solid long-term foundation, the pressure to "perform" day in and day out can be overwhelming and even lead you to make poor trading decisions. I see a lot of people chasing the fast money, possibly because so much of what you see on TV and what many sites advertise is based on that because everyone wants to hit the lottery but the real money in this World is NOT made by the lottery players – it is made by the House! Please take the time to learn to BE THE HOUSE and not the gambler!

If 75% of your virtual portfolio is made up of nice, safe plays that make a nice return and require virtually no attention from month to month – THEN you can afford to mess around with the fast money of front-month options but, without building that solid long-term foundation, the pressure to "perform" day in and day out can be overwhelming and even lead you to make poor trading decisions. I see a lot of people chasing the fast money, possibly because so much of what you see on TV and what many sites advertise is based on that because everyone wants to hit the lottery but the real money in this World is NOT made by the lottery players – it is made by the House! Please take the time to learn to BE THE HOUSE and not the gambler!

Jobless Friday – US, Japan and Europe Add More Stimulus

We lost a net of 36,000 Jobs in January. The country needs to produce 100,000 jobs a month to stay even with population growth and we lost 36,000 for a total of 8.4M jobs lost (and none gained) since December of 2007. 9.7% of the population is officially unemployed with 16.8% in the government's U6 statistic – counted as "underemployed." 40% of the unemployed people (3.3M) have been so for more than 27 weeks and are on extended benefits, the kind that barely got extended in last weeks idiocy in the Senate. The average workweek for those who are "employed" has dropped to just 33.8 hours and over 250,000 of our job additions in the past 4 months have been Temp jobs, including census workers who WILL be let go later this year.

High-paying Construction and Goods Producing jobs dropped 124,000 in January and were replaced by 42,000 Service Jobs (do you want fries with that?) and 47,000 Temp workers so forgive me if I don't do backflips over these numbers.

High-paying Construction and Goods Producing jobs dropped 124,000 in January and were replaced by 42,000 Service Jobs (do you want fries with that?) and 47,000 Temp workers so forgive me if I don't do backflips over these numbers.

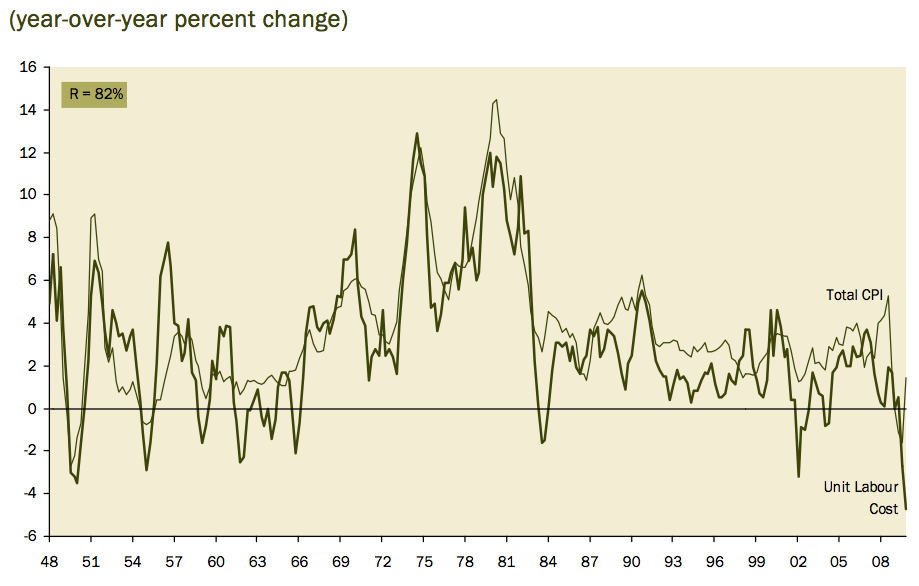

BUT, as you can see from this chart that Barry dug up, this is GREAT news for us top 10%'ers because look how much cheaper it is to pay the little people! Good news for US plantations corporations, who are able to drive profits ever-higher despite the declining ability of US consumers to spend, as they are free to pursue both profits and even lower-cost labor overseas. This slash and burn-style policy is nothing new – here's a 1994 article from Business Net advising corporate pirates to make sure the don't JUST lay off the employees because "they come back like weeds" – the trick is to make sure you ERADICATE the structural position entirely so that cost never again darkens your bottom line! Ah Capitalism…

- FCX short at $80, now $80.71 – down 1%

- DIA $106 calls at .61, out at .75 – up 23%

- USO Apr $38 puts at .88, still .88 – even

- TZA Apr $7.50 calls at .80 avg., now .72 – down 10%

- Oil Futures short at $82, out at $81.50 – up $10 per penny per contract

- EDZ July $40/48 bull call spread at $4, still $4

- EDZ July $35 puts sold for $2.50, still $2.50 (pair trade, not trading yet).

- TZA March $9 calls at .11, now .09 – down 18%

- DIA $104 puts at .68, now .58 – down 15%

- AAPL Apr $220 calls sold for $8, out at $7.50 – up 6%

- GOOG complex spread – on target

- VIX May $18/March $18 calendar spread for .15 credit, still .15 credit – even (note this is a dangerous play as VIX months do not have a direct correlation to each other!)

At 3pm Consumer Credit came in at +$5Bn vs. -$5Bn expected. That helped give the markets and added boost to end the day but we just strapped in and endured (not enjoyed) the ride as our short plays were being crushed. The last play of the day was a tough decision to take out the FAZ $17 calls we sold in the $100KP at .95, up 70% from our original sale but it leaves us exposed on our $15 calls and we'll have to deal with that next week if the markets don't turn down. We'll do a $100K Virtual Portfolio Review on Sunday.

So, all in all, it was a rotten week with 17 of 46 trade ideas missing the mark. We are pretty bearish on our short-term plays and we'll need to get aggressively long if we head higher next week to balance back out but we had to go bearish to protect last week's gains as the prudent thing to do would have been to cash them out at 10,400 but now we are glad we waited as we may hit that 10,700 mark before turning back down after all.