Banks are Still at the Derivatives Casino

Courtesy of John Lounsbury

The TBTF (too big to fail) banks have learned their lesson about over leveraging, right? They are working hard to separate themselves from the gambling that got them into trouble in 2008, right?

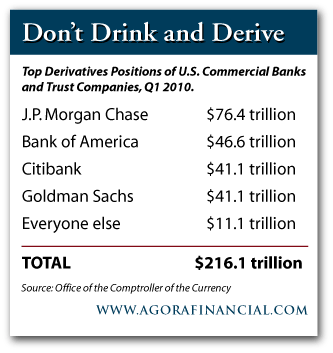

Well, think again. The 5 Min. Forecast has the following table:

According the folks at www.agorafinancial.com, this $205 trillion total for the four big banks is 1/3 the total nominal value of derivative contracts in the world. The four super banks have derivative contracts of total nominal value about 16 times the GDP of the U.S.

The $205 trillion total is 445 times the current market cap of the four banks and 488 times the net tangible assets on their balance sheets.

Admittedly, these derivative contracts have a net value much less than the nominal value because many individual contracts are offset by other contracts. None the less, as we have seen in 2008, counter party risks, selective debt security defaults and loss of confidence can start a cascade effect of calls for capital which can prove disastrous.

It is argued that such a web of financial entanglement creates risk diversification among many parties. But, because of this risk diversification with very high leverage across all large firms, trouble in any one firm can bring down the entire group.

In effect, the risk is diversified away from the banks and onto the backs of the tax payers because the TBTF financial institutions are allowed to continue in existence and expose the world to the fallout when one of their highly leveraged ventures goes south. This was the problem that led up to the 2008 crisis. Proposed financial reform legislation does not eliminate the exposure.

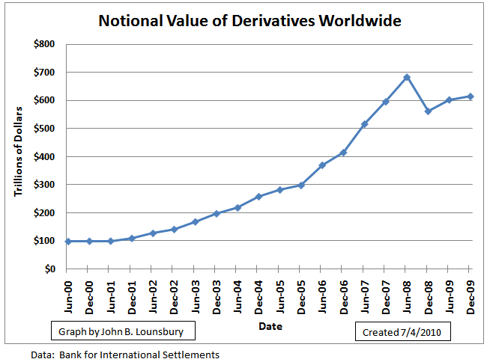

According to the BIS (Bank for International Settlements), the notional value of all derivatives held by banks was $596 trillion at the end of 2007. So the notional value has actually increased by the end of 2009. The history of derivative notional values from BIS records is shown in the following graph:

The appetite of the world’s banks for derivatives has not diminished. The notional value of derivatives held by banks remains 6-fold higher than it was a decade ago. The financial crisis appears to be no more than a hick-up on this graph.

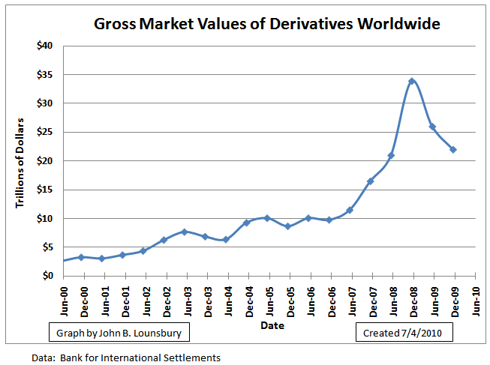

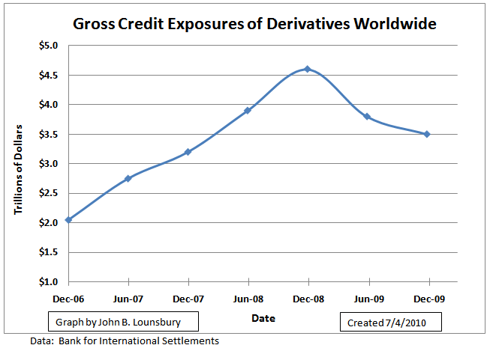

Other data reported by the BIS includes their estimates of gross market value of derivatives and gross credit exposures. At the risk of oversimplifying, consider the gross market values the BIS estimate of the cost of replacement of all derivatives and the gross credit exposure the estimated potential loss risk for the banks.

The following two graphs show the history of these other two metrics reported by the BIS.

The two graphs above show a potential for gradual improvement in the risks associated with derivatives over the past two years. I am not feeling very secure in that observation, though, because both factors are subject to "accounting rules" applied by the BIS. The notional value, although much too large to describe the risk, is a simple "bean counting" result. As a first approximation, I would take percentage change in notional value as an estimate of how risk changes, rather than the results obtained by "accounting processes". All that said, the "accounting values" may have merit and should not be dismissed.

The changes over the past year (as of year end 2009) are as follows:

Notional Value – Up 8%

Gross Market Value – Down 24%

Gross Credit Exposure – Down 35%

The changes over the past two years (as of year end 2009) are as follows:

Notional Value – Up 3%

Gross Market Value – Up 9%

Gross Credit Exposure – Up 33%

By any estimate the numbers indicate risk is elevated from year end 2007. By notional value only, risk is elevated from the end of 2008.

The biggest percentage changes have occurred in CDSs (credit default swaps, the type of derivative that brought down AIG). See recent article about AIG. According to data in the latest BIS report containing data as of year end 2009, the notional values of CDS declined by 55% since the first half of 2008. The same report also makes the statement that gross market value of CDS has declined by 35% since the end of 2008. These declines have been offset by increases in derivatives in other areas, most notably interest rate swaps and currency swaps.

Interest rate and currency swaps are not innocuous vehicles. These are the gems that have been implicated in the Greek financial crisis, in municipal financial crises in the U.S. and possibly in problems in other countries besides Greece.