Up and up the markets go, where they stop – only Ben knows!

Up and up the markets go, where they stop – only Ben knows!

We actually initiated the October 8 picks on Thurs, Sept 30th, when we had that crazy Dow spike to 10,950. As it was the last day of the month we got an instant winner on the NFLX play and some other good ones as we plunged to 10,700 that Monday. In between, when I wrote the post on Sunday, Oct 3rd, I said "I hate to go short."

We were still very bullish in our virtual portfolios (see September's Dozen, Turning $10K to $50K, Defending with Dividends, 9 Fabulous Dow Plays and the June 26th Buy List) since the June bottom (and we were early on that call too) but we felt is was time to start covering with some bearish plays as we completed our projected 12.5% run back 11,000. These 8 trade ideas were to get the ball rolling in October. Since then we have flown up to 11,062 on the Dow, slightly over our projected top, much the way 9,650 was slightly below our projected bottom in July. The rally still has not retraced enough to cause us to give up on our long-term longs so this is a BALANCING move on an expected pullback, not an overall long-term bearish posture – always be clear about that! We've been bullish since the beginning of July as this point it pays to diversify.

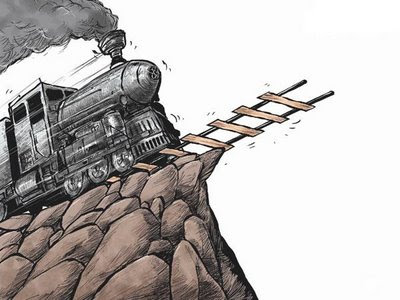

Like July, we can take advantage of the the spike out of our range to scale into positions and to roll and adjust the trades and, like July, we looked at some bullish covers along the way – just in case we are even earlier than we thought. I'm not going to get into the whole macro thing here – I did that all week but everything old is new again, as you can see from this chart:

I don't know how well you can see this but I copied the current rally and lined up the bottom with the Feb rally. It's hard to see because the movement is VIRTUALLY IDENTICAL. That's right, Lloyd is either too lazy or too cheap to even bother to change the Bots he uses to gooses the markets. As you can see in the area with the extra lines – day after day, tick after tick, there is virtually no variation to the market's moves up. Last year, we joked about the Omega 3 pattern that we watched repeat itself for months. We'll call this one the Beta 5 but this may be bad news for the bears as, like the groundhog's warning, we may have 6 more weeks of this nonsense before we get a proper pullback.

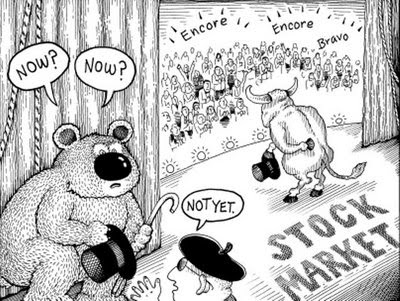

Special Update: Thanks to the Elliot and the News Team at Stock World Weekly (our new Newsletter in Beta) we have a more professional version of the chart where Elliot used red to illustrate the copied section (this chart kind of reminds me of the song, "The Bear Climbed Over the Mountain."

So bears BEWARE! We do not short stocks just because they are high, we short them because they are not worth what people are paying AND because we believe that earnings (or some other event) will make that obvious at some point. That is our premise – Yet a rising tide does lift all ships (for a while) and, if we are wrong, then we need to admit it and that looks like about 11,500 if we keep following this pattern. 6 weeks from now is Thanksgiving – it would really suck to come back from the holidays right into another flash crash, wouldn't it. But, let's assume the flash crash was an accident. Then we'd be looking for a steady, downward grind with no Santa Rally and a bottom, once again, in early February.

I hope we don't get such an exact match-up or who needs guys like me to predict the markets? Well, as Field Marshal Moltke said: "No battle plan survives first contact with the enemy" and, as I said in the "October 8" post: "My major bear premise is that the dollar makes a comeback and knocks down oil, copper and gold and that sends the energy and mining sectors down which drags down the broader market and gives us a good, healthy pullback where hopefully we can go long again." So far, so wrong, I guess as we simply can't fight the Fed but, like we saw at the end of 2009 – they do get to the point of diminishing returns…

Despite the relentless rise in the market, we have still been able to take advantage of the spikes up to take quick shorts. We discussed the value of having a good stop discipline in yesterday's Member Chat and our first three trade ideas from the 9:40 morning Alert were a great example of that as I suggested craps roll plays (the amount of money you would be willing to lose on a roll of the dice in a casino) on DIA ($111 puts at .22), QQQQ ($51 puts at .16) and GOOG ($590 puts at $1.65).

Of course you have to allocate at least $165 for the GOOG trade, so it's not for everybody. Those topped out at $2.45 right about 10:19 which was the same time I called for tight stops on the DIA $111 puts as they topped out at .90 (up 300%) the QQQQ $51 puts only made it to a double at .38 before they too fell off and this is why we say, over and over again: DON'T BE GREEDY! Even if you are "only" playing $100 on each, that's $300 and $100 in profits – in an HOUR! You have to keep perspective on what you can expect to gain on short-term positions and that goes for the bigger ones too….

Our first trade idea for the October Overbought Eight was NFLX, who we had been watching for some time as going too far. Our first NFLX play was selling Oct 8th WEEKLY $170 calls for $3.50 and those were .25 (up 92%) at the end of that day. NFLX had the nerve to spike back up and we then looked at the Oct $170 calls for $8 and those, of course expired worthless (up 100%) as NFLX finished the period at $155.72 – still too high but not as much fun to short.

#2 on the O8 list was BIDU and the Nov $95 puts were the pick at $5.30. After reaching $7.30 (up 37%) on Monday, the 4th as well as Friday the 8th, they are back to $5.05 – yet another great example of why stops are important (see Strategy Section) – with stops, you could have made $2 twice. With greed, you are right back where you started with 2 weeks less to play! Of course I had discussed taking the money and running on BIDU in the Oct 3rd post as we had already hit our 20% goals (20% is ALWAYS our goal) that Friday (1st). I was also very specific about stops in our 3rd BIDU short:

Anyway, our new trade on Thursday was the fairly aggressive Oct $95 puts at $1.35. Those popped nicely to $2.15 (up 60%). If we continue to follow Mr. Buffet’s advice, it is best to "Be fearful when others are greedy" and note that taking 1/2 off the table with a 60% gain leaves us in 1/2x at net .55 so a stop at $1.10, still leaves us with a 25% overall profit on the trade, which means we can certainly ride out the gyrations for a day or two to see if BIDU makes a proper drop or not.

Remember, the shorter your time-frame, the more conservative your stops need to be! We simply don’t have time to be wrong on October spreads, which expire in just two weeks, especially when we are committing the cardinal sin of buying premium, rather than selling it. It doesn’t matter that the BIDU Oct $95 puts jumped to $2.15 – you must keep in mind that they are STILL $3.80 out of the money with 10 days left to trade – that’s the kind of nonsense we usually sell to other suckers – not hold onto ourselves!

I could say this stuff 100 times and still people don't listen so I'll say it for the 101st and apologize to those who are bored hearing it – Set Stops, Don't Be GREEDY! As you can see from the chart, we caught a huge break that Monday as BIDU did fall further and the $95 puts jumped to $3.25, almost a 50% gain from my Sunday comment and up just shy of 200% from our entry. Now, where do we stop out with a 200% gain? At 160% ($2.85) – ALWAYS have a 20% of the profits trailing stop!!!

Notice that having $2.85 cashed out on Monday, the 4th, gives you an excellent opportunity to get back in on Tuesday at .90 and take it back to, guess where – $2.25! It is not coincidental that option prices retrace back to our original goals like that – we pick those numbers for solid reasons and that's why we get the hell out when we hit them. Just because things are going your way, does not mean they are going the right way.

#3 with a bullet to our brains was the dreaded TLT. We picked them for a short at $105 when they first popped it on Sept 23rd and what a long, strange trip it's been to Friday's close at $100.27. As I keep saying, with straight stock picks, our goal is just to make more than the 2.5% per month that our cash is devaluing at. Our option idea was selling the Nov $105 calls for $2.20 (now .45 – up 80%) and buying the Dec $102 puts for $2.45 (now $4.10 – up 67%) which proves, as usuals, that it is better to sell premium than to buy it but doing both doesn't suck either as a net .25 entry can now be cashed for $3.65, which is a 1,460% gain on cash committed in 10 market days. If that sort of thing doesn't satisfy you – I really can't help you!

PCLN was our #4 selection and we found selling the Jan $380 calls for $23.25 (now $18.80 – up 19%) to be a comfortable way to set ups a short on the stock at net $403.25. However, those calls dropped to $11.99 on the 7th and that's 50%(ish) in a week. Back to $18.80 now is yet another example of how GREED KILLS. As I had commented in the original O8 post on this trade: "Those have already dropped to $17.50 (up 25%), which isn’t bad for 2-day’s work!" Take profits, Take Profits, TAKE PROFITS and, have I mentioned, TAKE PROFITS! The other half of that pair was the Apr $190 puts at $5, which hit our $7.50 exit target (up 50%) on the 7th as well but are now down to $4 (down 20%). Imagine if every Friday they handed you a paycheck and you said "Nah, I'm going to let it ride" – would you be richer or poorer???

PCLN was our #4 selection and we found selling the Jan $380 calls for $23.25 (now $18.80 – up 19%) to be a comfortable way to set ups a short on the stock at net $403.25. However, those calls dropped to $11.99 on the 7th and that's 50%(ish) in a week. Back to $18.80 now is yet another example of how GREED KILLS. As I had commented in the original O8 post on this trade: "Those have already dropped to $17.50 (up 25%), which isn’t bad for 2-day’s work!" Take profits, Take Profits, TAKE PROFITS and, have I mentioned, TAKE PROFITS! The other half of that pair was the Apr $190 puts at $5, which hit our $7.50 exit target (up 50%) on the 7th as well but are now down to $4 (down 20%). Imagine if every Friday they handed you a paycheck and you said "Nah, I'm going to let it ride" – would you be richer or poorer???

#5, MOS is our first Oct short play that's still in play and it's a total disaster! The Nov $52.50 puts were $1.10 and plunged to .55 the next day. We thought it would be clever to spend another $1 to roll to the Nov $57.50 puts and $1.75 more to roll to the Jan $57.50s, which are now $2.15, so down 44% from the $3.85 worth of net adjustments for those who rode it out. Gosh I hate to say it but, if you are still in them, you probably want to DD at $2.15, which would be net $3 and down .85 on the Jan puts that have a delta of .23 so you need a $4 drop to get even. I do like the Jan $57.50 puts as a new entry and this is another great example of the benefits of stopping out. Even if you killed the original MOS trade at .55 (down 50%) then it would cost just $1.60 more to reposition at the Jan $57.50 puts now and just a $2 drop would bring you back to even. Net entry on the Jan $57.50 puts (now $2.15) at $3.85 (before the DD) vs $2.70 – that's the difference between stopping out and repositioning and rolling!

Rolling is fine as long as it's combined with scaling in (Once again, see Strategy Section) as the Double Down to 2x nets $3 vs $2.70 if you would have stopped out. That's the power of scaling in, even on a position that goes horribly against you like MOS did on us, by keeping conservative entries you have plenty of spare firepower to "fix" it – if you should decide to keep at it and, of course, losing 40% on 1x is far less damaging than losing 20% on a full 4x or 5x allocation, isn't it?

AMZN was our 6th short trade idea and, as I said at the time, it's a very scary stock to short. I should have made a more directional play but we liked the short buy/write of the Jan $190/165 bear put spread at $18, now $16 (down 11%) paired with the sale of the Jan $170 calls at $9 (now $10.75 – down 19%). Similar to our normal buy/write trades, these longer plays are not ones we tend to adjust unless we have to. While AMZN is making an impressive show of strength at $165, we still have a hard time believing they will justify $160 on Thursday's earnings report. That coupled with our general feeling that the market will correct by January means we still like this one.

FSLR came in at #6 but it's always in the top 10 of my short list. This particular round of idiocy was based on them hitting $151 on the Thursday we picked our 8 and the play on them was a ratio backspread on the put side, buying 3 Jan $130 puts for $7 ($2,100) and selling 2 Nov $130 puts for $4 ($800) as we didn't think they would fall that fast. I was wrong as they dropped like a rock to $136 on the 12th but they've recovered back to $145 and our net $1,300 spread is now net $1,375 so boring but progressing. Yes the straight put would have been more exciting and a huge winner but that's what we thought with MOS – sometimes they work, sometimes they do not!

Our last of the October Overbought Eight was CMG as we were looking for a longer-term short position. Part of the reason for this is the first 4 picks were made into that Thursday morning pop so the short-term, directional plays made more sense. By the afternoon, the market had already fallen back so we moved to more hedged positions, in case we popped again – which we did. The backspread on CMG was selling 5 Nov $175 calls for $8.75 ($4,375, now $12.75 for $6,375) and buying 4 March $190 calls for $10.75 ($4,300, now $14 for $5,600) so a net $700 loss so far. This is a long play and the Nov $175 calls can be rolled even to the Jan $185 calls and still carry $6 of premium and our premise hasn't changed so nothing to do here but wait.

Yes, spreads are boring but boring can be nice in a choppy market. Again, we are generally bullish and using plays like these to hedge what had been very, very bullish picks that we've been making for months. As we hit new highs and get closer to our 11,500 line, we get a little more bearish each day but now we are hedging our bearish picks with some high-reward upside plays. We already cleared last Thursday's SSO spread off the table at 800% (which turned out to be way too early) and decided to ride out the XLFs, which are looking a bit shaky. I have called for getting to more cash as I think the dollar is too far down and the market is too high so, when you cash out and the dollar bounces, your cash dollars are able to (hopefully) gain in value, giving you cheaper opportunities to pick up stocks and commodities later.

This week we added Disaster hedges on QID and FAZ (to offset the XLFs) on Monday and the QID entries are now cheaper but the FAZ is already doing great. WYNN was a new short trade idea on Monday and what a bad one it's been so far. RICK and AAPL, on the other hand, are doing just fine as upside plays. Tuesday I said (how many times?) "DON'T BE GREEDY" on the short side in our Morning Alert to Members and the Dow kissed our 10,900 target and that was it for that.

Tuesday we looked at long plays on INT, C, SVU, VZ, rolled MOS to Jan and then the Fed had us puzzled going into the close. In the Wednesday morning Member Alert, we decided there was too much free money floating around and after adding a new TZA Disaster Hedge, we added 3 bullish trade ideas for UNG, XLF and DDM as laggards that could really take off if this rally gets legs. Obviously, DDM is up huge already but the other two are still playable if you need more bull for this BS rally…

USD was also added to the bull side before the bell on Wednesday and the PCLN $350 calls were a sell at $1.80 into the afternoon excitement and dropped to .50 the next morning but severely punished the greedy with a $4 finish on Friday! That's why Rule #1 is: ALWAYS sell into the initial excitement.

DRYS came up as our last trade idea of the day on Wednesday, that is a 2012 buy/write that's still a good way to play a rally. C was Thursday's pre-market selection and I joked in the morning Alert that things were getting very 1999ish again and maybe it was time to buy YHOO but that was a joke, based on the merger rumor, not a pick! I did call a buy on the Nat Gas futures (/NG at $3.60 and those jammed up over $4 at the day's end but now back to $3.52 in overnight trading so maybe we get another whack at them next week!

XLF seemed like it was giving us a good entry at 11:04 and we looked at a 2012 artificial buy/write. They have fallen .30 since then so not really a panic (and that's what the FAZ's are for) but it will be for the markets if they fail to hold $13.50 next on a downturn. UUP may have seemed crazy at 12:13 on Thursday but I still liked them at $22.20 and maybe, just maybe, we found a bottom. DBC was my idea for an inflation hedge in the afternoon but, unfortunately, PCLN tempted me to make another short pick and I liked those October $350s short at $2.40 again, which did not work this time (down 67% at close -same chart) as well as the short Nov $380 calls at $8.90, which are now $10.70 and down 20%. While ugly, net $388.90 on PCLN still does not seem very likely.

ENTG is working out great so far as a bullish play and the .10 QID Oct $14 calls were a total loss by Friday's close. Finally we got bearish again for real with an EDZ April atificial buy/write and our tricky GOOG spread idea was a loser as GOOG popped out of our range (we were going for something more neutral) but, of course, I prefaced that one by saying "If I had an inkling of a clue as to what they will do, I’d play them but I have no idea at all!" Still, my bad for putting it in a featured trade idea box…

Yesterday we hit the jackpot on our two index shorts and the GOOG trade took some of that back. We added QQQQ puts for next week (too tempting not to with the Nas 2,470 as well as the SQQQs and QIDs on the same premise so we'll be watching tech earnings with great interest next week. We also looked at an upside trade idea on AAPL to offset (hedged of course with earnings) and I also liked HOV (as usual) as they dipped back to $3.75 while HMY was our selection for playing continuing metal madness.

Yesterday we hit the jackpot on our two index shorts and the GOOG trade took some of that back. We added QQQQ puts for next week (too tempting not to with the Nas 2,470 as well as the SQQQs and QIDs on the same premise so we'll be watching tech earnings with great interest next week. We also looked at an upside trade idea on AAPL to offset (hedged of course with earnings) and I also liked HOV (as usual) as they dipped back to $3.75 while HMY was our selection for playing continuing metal madness.

Surprising isn't it? I'm surprised as I thought I had been much more bearish but I guess, after reviewing the week's comments, I just FELT bearish while making mainly (2:1) bullish picks – holding, as I have said, our noses while we try to go with the flow. We'll see what happens next week but balance and cash are the way to go in this crazy market. As I keep repeating, it is all about the dollar – if the Dollar goes up, the market falls and if the Dollar goes down – God help us all but it will, at least, be "good" for the APPARENT value of stocks.

And remember my darlings, it is better to look good than to feel good!