Courtesy of John Nyaradi

Helicopter Ben” went on the attack again in defense of quantitative easing during his appearance on February 9th before the House Budget Committee and the “Bernanke Put” remains in play as dips are bought with vigor and enthusiasm and the major indexes continue their seemingly unstoppable climb.

Additionally, the week brought good news from around the world as Egypt deposed President Mubarak and earnings reports at home continued to be largely positive.

On My Radar

Too much bullishness is usually a danger signal but in this distorted world of ours, the only reliable indicators in my opinion are those that center on momentum and market breadth.

Chart courtesy of Stockcharts.com

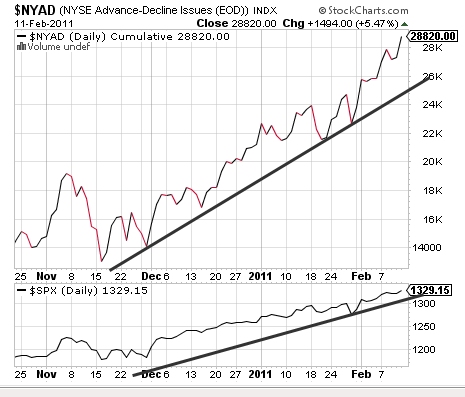

One chart I keep a careful eye on is the NYSE Advance/Decline line which basically is a pictorial view of net advances of all stocks on the New York Stock Exchange. When advancing stocks exceed decliners, the line goes up and it goes down when there are more declining stocks than advancing.

This is an important and widely watched indicator because obviously a rising line indicates positive breadth and a market that is in a confirmed uptrend.

Looking at this chart, we can see a solid uptrend in place since early December in the NYAD which confirms the price action of the S&P 500 in the lower panel.

No one has a crystal ball and so can say when this trend might reverse, but it will be obvious when it does and then will be a good time to reassess our current portfolio positioning.

As always, one must trade with a set of reliable indicators and not listen to your emotions or all the noise around us.

The View From 35,000 Feet

The big news of the week, of course, was the change of power in Egypt and what that might mean for the Middle East going forward.

For now the market thinks this will be positive based on the stiff decline in the price of oil after Mubarak went down.

However, this weekend, protests flared in Algeria as this rolling drive for independence hop scotches across the North coast of Africa.

In market action we saw the major indexes hit 32 month highs in their relentless march upwards and as earnings season continues, approximately 3/4 of companies are beating expectations.

However, perhaps ominously, the news coming out of Europe hasn’t been so good with more than 50% of their companies missing earnings expectations so far for Q1.

Also the decline in emerging markets exchange traded funds continues as money seems to be rotating out of those previously high flying sectors and towards the United States and its free money Federal Reserve.

Bullish sentiment remains at extreme levels which usually are a warning of trouble ahead but with Helicopter Ben in full attack mode, this so far hasn’t seemed to matter.

Money also continues fleeing the municipal bond market and 44 states are projecting budget deficits for next year. Since the states don’t have helicopters of their own, either they will have to significantly tighten their belts or the Feds will have to come to their rescue, as well, in some sort of bailout in addition to all of the other bailouts we’ve seen to date.

The questions of the day remain, “When do the helicopters get grounded or run out of gas and what happens then?”

We may get our answers sooner than we think as President Obama presents his budget on Tuesday. Facing a record $1.4 Trillion in red ink, this will be a monumental challenge for our duly elected officials, and looming just ahead somewhere between mid March and late May is “D-Day,” the day the United States hits the deficit ceiling and we either stop paying our bills or raise the ceiling yet again.

What It All Means

For today, all looks rosy; however, there are many potential obstacles just ahead that could derail this fast moving freight train.

The budget talks and deficit ceiling could be game changers just ahead since everyone knows this rally has largely been driven by more debt and excessive liquidity and any serious attempt by Congress to turn off or even slow the flow from this fire hose could have eye-catching and speedy consequences.

At Wall Street Sector Selector we will stick to our knitting and do what our indicators tell us to do, however, I plan on leaving the party well before the lights go out.

The Week Ahead

Lots of important economic news this week which promises to be mostly positive, along with earnings reports from the likes of MGM, Marriott and Tesla Motors.

Economic Reports

Tuesday: January Retail Sales, February Empire Manufacturing Index

Wednesday: NAHB Housing Market Index, January Housing Starts, January Building Permits, January PPI, January Industrial Production, January Capacity Utilization, Fed Meeting Minutes

Thursday: Initial Unemployment Claims, Continuing Unemployment Claims, June CPI, June Leading Indicators, Fed Philly Index

Sector Spotlight

Winners: (NYSEArca: ITB) Homebuilders (NYSEArca: IYT) Transportation

Losers: (NYSEArca: EWH) Hong Kong (NYSEArca: THD) Thailand

This weekend was my young son’s District High School Swimming Championships. He won his two events, the 200 and 500 yard freestyles, and so moves on to Portland next week for the Oregon Class 5A State High School Championships.

The eight kids in the championship finals parade out to the starting blocks to music picked by the top qualifier in preliminaries, and his choice was an old family favorite, “Smoke On the Water.”

All the best,

He left some smoke and I’m looking forward to next weekend.

Click here to learn more about John’s book and for a free membership to Wall Street Sector Selector