Lee Adler of the Wall Street Examiner has provided another glimpse into the insightful Wall Street Examiner Professional Edition Treasury Market Update.

Snapshots from Lee Adler’s

Conditions As Good As They Get, What Comes After for Treasuries and Stocks?

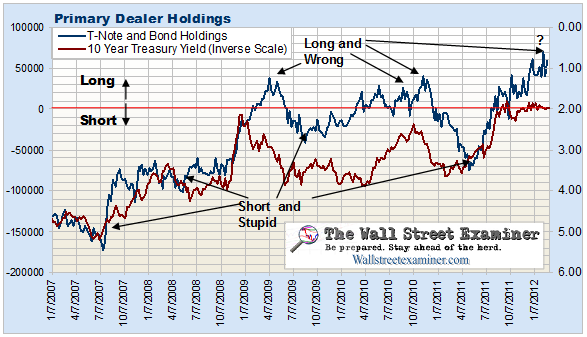

This is as good as it gets for the Treasury market. Primary dealer purchases of Treasuries are running at record levels. So are bank purchases. So are fund purchases. And foreign central bank purchases have been running at the highest levels in 14 months. Finally, this week the ECB flooded the European banking system with over €300 billion in net new money. Much of that went to US Primary Dealers and other banks who invest in US Treasuries. Yet, in spite of that, the Treasury market did not reach record lows in yields. Instead, the 10 year yield bobbed its head above 2% on a couple of occasions. When conditions slip from less than “as good as it gets,” what do you suppose will happen to Treasury yields?

The markets faced an enormous slug of Treasury supply that settled Wednesday and Thursday but those who would absorb it had the good fortune of having the ECB’s El Toro Grande, or Long Term Refinancing Operation (LTRO) at the same time. What could have been a very rough week turned into the non event I had postulated as a result. The banks got hundreds of billions in nearly free money from the ECB, so what better way to invest it than in the “safest of safe” paper, US Treasuries?

But what about afterwards? It’s now afterwards.

I doubt that the equivalent of $425 billion hitting the market in one fell swoop would be fully invested quickly. The reserves have been created, they’re sitting at the ECB and can be leveraged, but given the insolvency and inadequate capital of the banking system, not much of it is likely to be deployed anywhere but central bank depositories. The markets did plenty of front running in advance of the event. Seeing how wild the buying has been from virtually every market segment, the after-effects of the ECBs money bomb may turn into a non event.

Meanwhile, withholding tax receipts ended February on a modestly positive note, although they were extremely volatile during the month. That makes it hard to get an accurate read on the trend. In real terms the numbers are holding minimally positive. The economy appears to be limping along at a rate that is barely growing, but isn’t contracting.

Stabilizers seem to be at work with a big increase in government outlays, including a big jump in tax refunds, meaning that the deficit has expanded and there’s more money walking around in the economy. Bigger deficits mean more Treasury supply, but they also mean that there is and will be more spending, which boosts the economic data.

However, the pundits upped their estimates based on the January “strength” and February’s numbers have come in a little light of expectations. Going forward, some moderation in expectations should be written in to the consensus estimates, and the economic numbers are likely to be mixed with few big surprises either way.

Treasury supply will be pretty light until the next big settlement at mid month, and the Fed should fund much of that with a big, well timed, MBS purchase settlement with the Primary Dealers. So even if liquidity does begin to dry up, there’s little reason to expect much of a market hiccup in March for either bonds or stocks. It could be a pretty boring month.

Finally, the dollar looks like it’s poised to rally again. The Fed has fallen behind its central bank brethren in the money printing race to the bottom. The Fed will have no basis to act as long as stock prices hold up, inflation threatens, and the economic data limps along in a mildly positive fashion. Because politicians like to get reelected and both parties fear a voter backlash if the economy weakens, we’re likely to see a deficit spending bubble between now and November to keep the façade of growth in place. So the Fed will be forced to continue to sit on its hands.

Note: This section is part of the Wall Street Examiner Professional Edition Treasury Market Update, available to WSE subscribers and being made available to us this week.

Lee reports on Treasury auctions, federal revenues, the outlook for Treasury supply, Treasury yields, the Dollar, and more. He follows “money flows” – the "blood" flowing through the veins of our economy. We've devoted a section to Lee at Stock World Weekly (click here for trial to SWW and here for a new sample issue). ~Ilene