Resistance is, unfortunately, not futile for our indices.

Resistance is, unfortunately, not futile for our indices.

On Monday we discussed our expectations for a 2% weak bounce for the week, which would be a 20% retrace of the 10% drop I had predicted we'd have way back (and a bit early) in March. That constitutes a WEAK bounce and not a rally and they almost fooled us on Monday by taking back most of that 2% on day one but, since then – it's been pathetic and we've essentially done nothing the rest of the week.

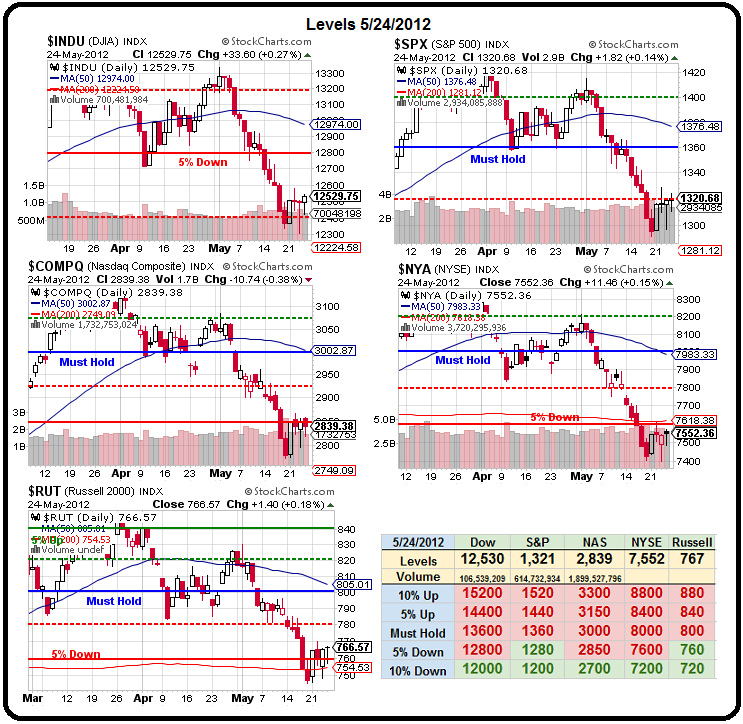

The levels we were looking for were laid out in Monday's Member Chat and in Tuesday morning's post and were:

- Dow – 12,750 (12,540 is 20% retrace/weak bounce), now 12,529 – off by 11

- S&P – 1,343 (1,319), now 1,320 – off by 1

- Nas – 2,900 (2,840) , now 2,839 – off by 1

- NYSE – 7,720 (7,560), now 7,552 – off by 8

- RUT – 780, (765), now 766 – off by 1

So, out of 25,024 points worth of predictions, our system is off by 22 for the week – less than 0.1% – not too shabby! This is our 5% Rule in action and it works very well in a Bot-driven market.

So, out of 25,024 points worth of predictions, our system is off by 22 for the week – less than 0.1% – not too shabby! This is our 5% Rule in action and it works very well in a Bot-driven market.

As you can see from our Big Chart above, 2 of our indices (S&P &, Nasdaq) are right on their lines and the Russell is just over it's -5% line on yesterday's super-stick while the NYSE is just under and the Dow is a very silly index anyway and we don't really care what it does as long as it's in the ballpark but notice it's 2.5% WEAKER than the other indices (5% weaker than the S&P, which has held up best).

The strong Dollar is not good for Dow components, who make much of their income overseas and some of the components, like AXP, CAT, CVX, HPQ, IBM, JPM, MSFT, PG, UTX and XOM have been tremendous drags for various reasons but they are all looking a bit more attractive at these prices so I think it's time to play the Dow bullish – in case we do get good news over the weekend.

I'll put up a specific play in the Morning Alert but the simple idea is the Dow is 2.5% behind 3 of our majors and 5% behind the S&P and, since it's the rest of the World that's dragging us down – if we're going to go short, it's EDZ (now $18.54) – and we already discussed various hedges using EDZ in yesterday's Member Chat and it's been our primary hedge for quite a while (see last Thursday's post for two we recently closed).

I'll put up a specific play in the Morning Alert but the simple idea is the Dow is 2.5% behind 3 of our majors and 5% behind the S&P and, since it's the rest of the World that's dragging us down – if we're going to go short, it's EDZ (now $18.54) – and we already discussed various hedges using EDZ in yesterday's Member Chat and it's been our primary hedge for quite a while (see last Thursday's post for two we recently closed).

While we HOPE (not a valid investing strategy) that we're at least going to get an oversold move up – let's keep in mind looking at Dave Fry's NYSE Summation Index, that we may have said the same thin last Summer in mid July – when the S&P was at (drum-roll please) 1,300 – on it's way to 1,100 over the next 3 weeks!

So it's not that the market hasn't gone anywhere in the past 4 days – it hasn't actually gone anywhere for a year…

The Dow was 12,550, S&P 1,300, Nasdaq 2,850, NYSE 8,450 and Russell 840 – hmm, the RUT and the NYSE aren't doing so good and they are our broadest indexes and down about 10% from last July. Where's that bull market they've been talking about? So now we see that the Dow isn't really that far off base – only per it's more recent performance but, over the long haul – it's the S&P that's over-achieving and perhaps that means a nice SDS trade (ultra-short S&P) would do us well for the weekend.

The Dow was 12,550, S&P 1,300, Nasdaq 2,850, NYSE 8,450 and Russell 840 – hmm, the RUT and the NYSE aren't doing so good and they are our broadest indexes and down about 10% from last July. Where's that bull market they've been talking about? So now we see that the Dow isn't really that far off base – only per it's more recent performance but, over the long haul – it's the S&P that's over-achieving and perhaps that means a nice SDS trade (ultra-short S&P) would do us well for the weekend.

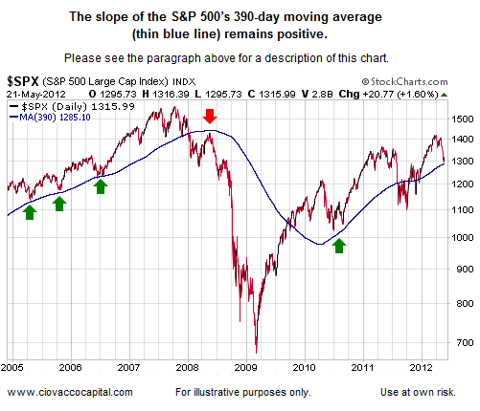

The key to a good short-term hedge is to have an attainable goal and manage your losses (as it is insurance) and we can see from the S&P chart that 1,290 is a solid floor and they're at 1,320 so that's 30 points down, which is 2.25%, which is 4.5% on the 2x SDS which is $16.88 x 1.045 = $17.63. So, not a very sexy move expected BUT the SDS June $16 call is only $1.08 – just .19 of premium. The June $17 calls, on the other hand, are .58 and 100% premium so, if we set up a bull call spread of the SDS June $16/17 calls, our net entry is .50 and we can offset that by selling CHK June $13 puts for .40 (or any other stock you'd REALLY like to own if it drops 15% in 3 weeks) and now we're in the whole spread for just net .10 in cash with a 900% upside potential if SPY drops on us.

That's a nice hedge! You can also be more aggressive with CHK long-term, selling the 2014 $13 puts for $4.20. You net into CHK at the same price and let's say we sell 10 of those and collect $4,200, which obligates us to buy 1,000 shares of CHK for $13. TOS says the net margin on that sale is just $1,350 and we can take that $4,200 and use $3,000 of it to buy 60 of the bull call spreads and now we have a potential $6,000 hedge for the weekend (through June expirations) and we still have $1,200 left from the put sale so our net entry on 1,000 CHK would be reduced by $1.20 to $11.80, which is 25% BELOW the current price.

That's a nice hedge! You can also be more aggressive with CHK long-term, selling the 2014 $13 puts for $4.20. You net into CHK at the same price and let's say we sell 10 of those and collect $4,200, which obligates us to buy 1,000 shares of CHK for $13. TOS says the net margin on that sale is just $1,350 and we can take that $4,200 and use $3,000 of it to buy 60 of the bull call spreads and now we have a potential $6,000 hedge for the weekend (through June expirations) and we still have $1,200 left from the put sale so our net entry on 1,000 CHK would be reduced by $1.20 to $11.80, which is 25% BELOW the current price.

That means we are getting $6,000 of upside protection for free in exchange for promising to buy CHK for $11.80 and, if CHK is higher than $13 in Jan 2014, we keep the $1,200, which is an 88% return on margin. Won't you sleep better over the weekend with protection like that?

Cash is still king as we now (since we only got a weak bounce and failed to break over) are back to leaning bearish. From the news chatter, it's very, VERY doubtful the EU comes up with a concrete solution over the weekend and it is slightly possible the EU melts down over the next 3 days and we wake up Tuesday down 300 points or more. Setting the tone into the weekend (from SA Market Currents):

The slow-motion train wreck continues in Greece, with police urging citizens to keep their money in the banks rather than sowing the seeds for a wave of home thefts. Greek banks have seen almost 25% of their deposits drained out over the last two years, and are likely to be shored up today or Monday with €18B of bailout funds that are weeks overdue.

"Greece is a failed state," says incoming Deutsche Bank co-CEO Jurgen Fitschen, speaking at a conference. Moving on to Spain, he says the numbers needed to revive the country's banks are "staggering."

The real nightmare scenario for the EU power elite is what if Greece exits EMU and thrives, says BNY's Simon Derrick. If Greece leaves, devalues, collapses, and then quickly rebounds (a la Iceland, though it was never part of the eurozone), the other struggling states (and their electorates) are sure to take notice.

The euro hit a 22-month low against the dollar yesterday, and has lost 5% in the last 3 weeks after barely moving against the dollar for most of the year. There's no end of reasons, though a notable downward driver is confirmation from some of Europe's biggest fund managers that they've been dumping euro assets on Grexit concerns.

Bankia shares are suspended in Madrid amid reports the Spanish lender plans to ask for a government bailout of over €15B following a board meeting later today.

Catalan President Artur Mas appeals to Madrid for a rescue, saying his region (home to Barcelona) is running out of debt financing options. "We don't care how (Madrid helps), but we need to make payments at the end of the month." The euro falls to session lows at $1.2510.

Mario Monti's insistence he can bring Germany around to acting in the EU's "common good" may rest on support from Merkel's domestic opposition parties, which are far more disposed to liability sharing. They believe they have the blueprint for such with a so-called European redemption fund floated back in November.

"Monti couldn't reform (his) own country, now he will deliver substantial changes in (the) EU treaty that requires loss of sovereignty for 17 nations," asks Uldis Zelminis, responding to the Italian PM's confidence he can persuade the EU to go for common eurobonds.

With the focus so strongly on Europe, it has been easy to miss the data pointing to economic trouble in China, India, South Africa, Brazil and elsewhere. The specter of renewed crisis looms large if activity is slowing in sync around the globe and not just in isolated regions.

As I said the other day on BNN, US equities may be the best place to park your money but that's more of a commentary on how absolutely TERRIBLE the rest of the World looks – certainly not a ringing endorsement of US equities. You can't seriously read this news and conclude that it's time to buy commodities and the last crash should have taught you that gold drops along with everything else, which is why CASH IS KING – we can always find something to buy later if we have our cash – now if only there were a bank we trusted to put it in….

Have a great holiday weekend,

– Phil