$188Bn!

$188Bn!

That's how much money yesterday's rally cost. Spain got the green-light on $123Bn from the ECB, most of which goes to just ONE bank (Bankia Group). This news sent Bankia shares up 15% and did wonders for their creditors' stocks as well because, as we know, the best way to get money from a Central Banks is to owe a lot of money to other banks so – borrow, borrow, borrow if you want to survive the Financial Crisis. Spain led Europe higher with a 4% gain on the day and hit another 1.75% early this morning before pulling back.

Also in the Free Money train yesterday was Brazil, who initiated a $65.6Bn stimulus package aimed at much-needed infrastructure ahead of the 2016 Olympics. This is a "just in time" thing for Brazil as 32 of 58 reporting companies in the Bovespa Index missed sales projections this quarter – the worst performance since Q1 2009.

The Olympics have also greatly aided the UK's economy and July Retail Sales were the stars of Europe at +0.3% and August should be good too – it's September, October and November we're worried about. The entire Euro Zone is clearly in a Recession, but it could be argued that it's the same one that started 4 years ago, which some would call a Depression – but not if they want the MSM to listen to them or to keep their Government positions.

Even China is seeing declining exports, with August projected to come in at less than 1% according to ForexLive, who says "China's Government has underestimated the impact of the European debt crisis on trade flows." As you can see from the chart on the right for California, China's export woes are hitting us on this side of the Pacific as well as total state revenues are 10% below projections with HUGE misses in Sales Tax – indicating an extremely beaten-down West Coast consumer.

Even China is seeing declining exports, with August projected to come in at less than 1% according to ForexLive, who says "China's Government has underestimated the impact of the European debt crisis on trade flows." As you can see from the chart on the right for California, China's export woes are hitting us on this side of the Pacific as well as total state revenues are 10% below projections with HUGE misses in Sales Tax – indicating an extremely beaten-down West Coast consumer.

The state has avoided default by temporarily borrowing from state trust funds, but those accounts will soon need their cash back to continue operating. Today California quickly began trying to sell $10 billion in municipal bonds to fund the record $28 billion they need to keep the lights on. With tax revenue plummeting and the state already the second lowest rated credit in the country, if the independent credit rating agencies downgrade the state to “junk bond”, California will be short up to $18 billion and default.

California is roughly 10% of the US economy and about as big as Spain's $1.5Tn economy. $28Bn may not seem like much as we are so used to such massive bail-out numbers these days but keep in in context of what they collect (about $50Bn, which is already $18Bn short (40%)) and you can see where the problem is. Obviously California isn't going to be able to raise taxes by 40% to get even as the people who make the most money and pay the most taxes would leave the state. Unfortunately, like Europe, California has been trying to cut their way out of a deficit and that is failing miserably as they have murdered the consumers. Only the record incomes of top 1% people and corporations (who take advantage of cheap local labor and sell to other states and countries) are keeping them from total failure at the moment.

None of this, of course matters to the markets, which today are being kept afloat by a misinterpretation of Angela Merkel's comments in Canada. While she did, in fact, say: "Euro-area policy makers feel committed to do everything we can to maintain the common currency.” – she also said: recent ECB decisions “have made it clear that the European Central Bank is counting on political action in the form of conditionality as the precondition for a positive development of the Euro."

Conditional is pretty much saying no, or at least, not yet. What she's saying is yes, we're all for helping out, if Spain and Italy SUBMIT to German authority. Who wants to be the PM that finally hands control of their nation to Germany? By September? Not likely…. And, from the same article:

Even so, Greece, on its second rescue program after triggering the crisis in late 2009, may run out of road at the end of the year. Samaras’s government probably can’t come up with enough austerity measures even if creditors extend the time line as his coalition wants, according to the Citigroup note. That means an end to international funding “looks very likely” after the next audit set for December, it said.

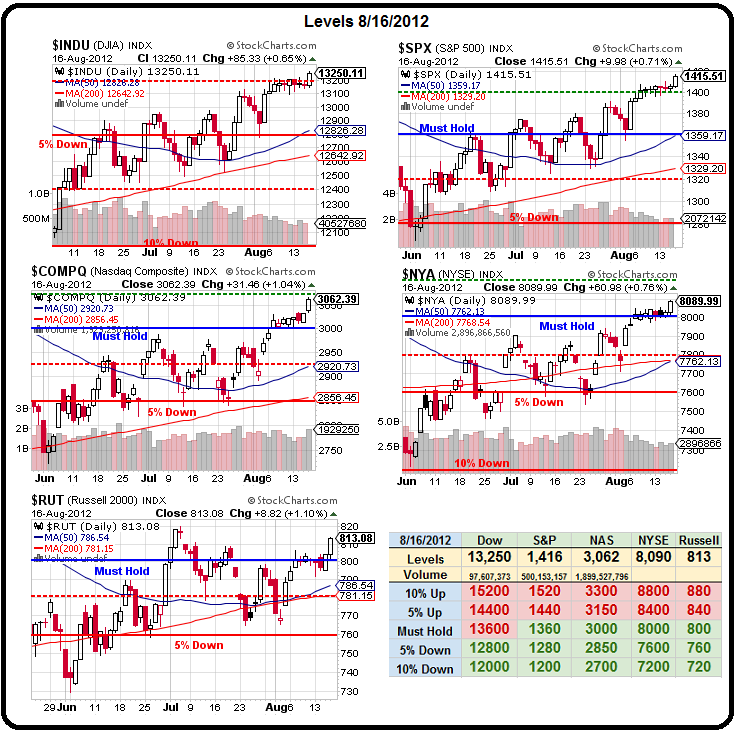

Nonetheless, we are very close to our breakout levels on the Big Chart so it may be that next week we will have to switch off our brains and flip bullish – for as long as our new levels hold up. While our $25,000 Portfolios have been holding up this week – despite their generally bearish stance, we will have to capitulate and flip more bullish if our breakout levels hold up after the weekend.

Nonetheless, we are very close to our breakout levels on the Big Chart so it may be that next week we will have to switch off our brains and flip bullish – for as long as our new levels hold up. While our $25,000 Portfolios have been holding up this week – despite their generally bearish stance, we will have to capitulate and flip more bullish if our breakout levels hold up after the weekend.

On Tuesday, I mentioned that we had to adjust our levels to account for the fall in the Dollar to 82.50 and we're right there this morning and yesterday the Nasdaq took our 3,060 line. It remains to be seen if we can take Dow 13,464, S&P 1,428, NYSE 8,160 and Russell 816 and we have continued to add bearish bets as we test the top of our range but once we top 3 out of 5 of our levels – we just need to join the herd and cut back on the shorts.

AMZN sure didn't work yesterday but we still love them short and, of course, our defensive longs from Tuesday are off to a great start with the FAS Oct $105/115 bull call spread (our favorite long) already $2.40 (up 20%) while the offsetting short BBY 2014 $18 puts have already fallen to $3 (up 7.7%) so the suggested combo of buying 2 FAS spreads for $4 and selling one BBY for $3.25 for net .75 is now worth $1.80 for a very nice 140% gain in 3 days – that really takes the sting out of this little move up for the bears!

The 2014 SHLD $32.50 puts we had wanted to sell for $8 came in at $7.50 but those have already dropped to $6.50 for a quick $1,000 gain on 10 in our virtual Income Portfolio – also not bad for 3 day's work but we're in that one for the long haul. The EWJ Jan $9 calls already gained over 10% (now .59) did the Sept $9 calls (now .37) and the combo of buying portions of 10 of the Jans for $530 and selling 1 BBY 2014 $18 put for $325 for net $205 is already net $290 for a very quick 41% gain – also a nice long-term bullish hedge as there's no upper limit to the gains.

The 2014 SHLD $32.50 puts we had wanted to sell for $8 came in at $7.50 but those have already dropped to $6.50 for a quick $1,000 gain on 10 in our virtual Income Portfolio – also not bad for 3 day's work but we're in that one for the long haul. The EWJ Jan $9 calls already gained over 10% (now .59) did the Sept $9 calls (now .37) and the combo of buying portions of 10 of the Jans for $530 and selling 1 BBY 2014 $18 put for $325 for net $205 is already net $290 for a very quick 41% gain – also a nice long-term bullish hedge as there's no upper limit to the gains.

Obviously our trade idea on the Russell also did well as it popped 2% since Tuesday and that sent TNA up 6% and the Oct $55/61 bull call spread is now $1.32 in the money at $3, up a quick 20%. Our idea on that one was to offset the then $2.50 bull call spread with the short Oct $42 puts at $1.90 for net .60. The Oct $42 puts have fallen to $1.55 already so the net is now $1.45, up .85 from .60 or 141% – much like our FAS trade.

As I said on Tuesday, it only takes 5 or 10% committed to aggressive upside positions like this to offset fairly sharp losses on the bear side. We're about 2/3 bearish at the moment but, if we cross those lines – we'll quickly be 60/40 bearish by simply switching a couple of positions but, over the weekend, we'll risk a loss into today's follow-through and move to 70/30 bearish – our last stab before capitulating. As you can see from David Fry's SPY chart – all the technicals already scream BUY!, but the MACD and RSI are very toppy and we still haven't seen this market hold up on any kind of volume so I remain – unsurprisingly – skeptical.

Have a great weekend,

– Phil