Falling, falling, falling.

Falling, falling, falling.

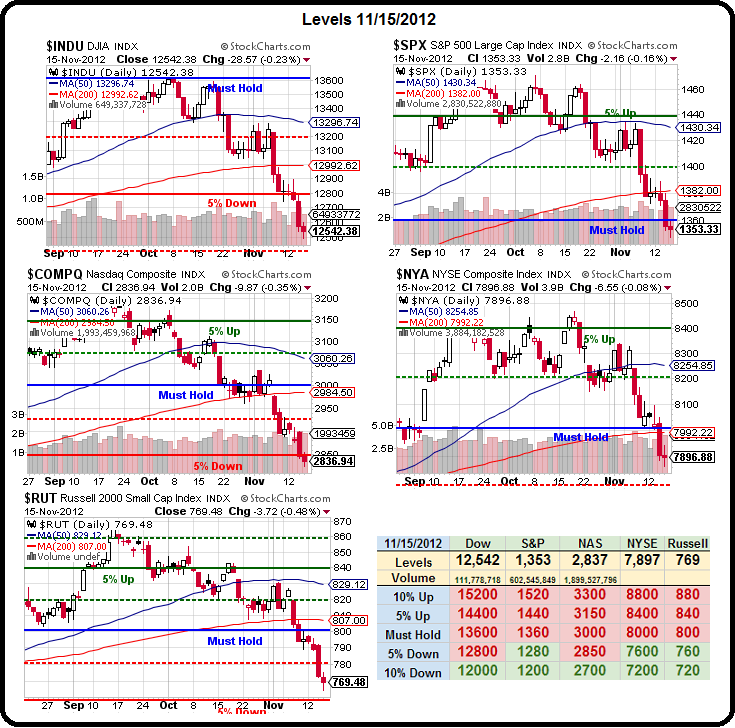

That's all the markets have been doing lately. As you can see from our Big Chart – it's been a pretty orderly sell-off according to our 5% rule with roughly a 4-5% drop during October with some consolidation, followed by a much steeper 4-5% drop after the election.

We're back to the point where we expect resistance at an 8% total drop as well as some bounce action where once again we'll be measuring for strong or weak bounces to determine whether or not we can get a turn again (our indicators kept us bearish last time). Regarding the current action, I said to our Members yesterday in Chat:

I think there is a lot of selling as people take capital gains while they can. I think that it's very possible that it's going to be very difficult to get a proper rally into the end of the year because there are plenty of people waiting for a rally to take their gains, whether through timing or position. The problem with this state of not knowing is it becomes prudent for people to hedge for the worst and, if someone had a 20% gain for the year and now it's 15% and they can take it off now and keep 12.75% (after 15% tax) vs possibly hitting another 5% drop and running down to 8.5% this year or possibly 7% (at 30%) if they wait until next year and there's no recovery (and the more the cliff looms the less likely recovery seems) then it almost doesn't make sense not to take the 12.75% and run. So that's very possibly the selling pressure we see and it may continue to be relentless into the end of the year unless there is some sort of resolution or delay to the cliff.

While we don't think the Fiscal Cliff will end up being a big deal – that doesn't stop others from panicking. This week we've been scooping up positions they have been running away from but, if we're going to have another leg down – we'll be needing those disaster hedges (see Wednesday's post) to keep us out of trouble. It doesn't take much to profit from a downturn, fortunately, when we use good hedges. On Wednesday I suggested the TZA April $17/24 bull call spread for $1.40, selling the $14 puts for $1.05 for net .35 on the $7 spread that was .40 in the money at TZA $17.40. We got a great open and TZA fell to $17.11, giving us easy entries and yesterday TZA finished at $18.62 and the $17.24 bull spread is now $1.62 in the money at net $1.83 and the short $14 puts have fallen to .75 for net $1.08 on the trade so that's up 208% in two days and it still has the potential to go up to a full 1,900% at $24 – which is what makes it such a nice hedge.

While we don't think the Fiscal Cliff will end up being a big deal – that doesn't stop others from panicking. This week we've been scooping up positions they have been running away from but, if we're going to have another leg down – we'll be needing those disaster hedges (see Wednesday's post) to keep us out of trouble. It doesn't take much to profit from a downturn, fortunately, when we use good hedges. On Wednesday I suggested the TZA April $17/24 bull call spread for $1.40, selling the $14 puts for $1.05 for net .35 on the $7 spread that was .40 in the money at TZA $17.40. We got a great open and TZA fell to $17.11, giving us easy entries and yesterday TZA finished at $18.62 and the $17.24 bull spread is now $1.62 in the money at net $1.83 and the short $14 puts have fallen to .75 for net $1.08 on the trade so that's up 208% in two days and it still has the potential to go up to a full 1,900% at $24 – which is what makes it such a nice hedge.

Just 20 contracts like that are $700, now $2,160 and have the potential to go as high as $13,300 in an extreme drop in the Russell. You don't need to buy a lot of insurance to get a big pay-off if you use these hedges. The original set of Disaster hedges from October 20th had the other TZA spread that we were layering and that was the April $14/22 bull call spread with the short $13 puts at net .65 (we were more aggressive as we were more sure of a drop) and 20 of those purchased for $1,300 are now worth $5,240 (at net $2.62) for a 303% gain. Doing the layered protection on Wednesday allows us to stop out the original spread at our bounce lines and take that $3,940 off the table and now we have cash we can use to re-position our bullish trades or do a little more bottom fishing.

And, of course, when we bottom fish, we fish well below the bottom. HOV, for example, fell to $4.30 yesterday and it was a nice opportunity for us to re-enter our favorite home-builder after we took $5.50 and ran earlier in the month. Now, just like AAPL, we've had our 20% pullback and it's time to BUYBUYBUY but, like AAPL, there's no need for us to pay $4.30 when we can construct a much better spread. In HOV's case, we sold the 2014 $4 puts for $1.40 and buy the $4/7 bull call spread for .75 so we have a net .65 credit and our WORST CASE is that we end up having HOV put to us at net $3.35 – an additional 25% discount to the current price.

And, of course, when we bottom fish, we fish well below the bottom. HOV, for example, fell to $4.30 yesterday and it was a nice opportunity for us to re-enter our favorite home-builder after we took $5.50 and ran earlier in the month. Now, just like AAPL, we've had our 20% pullback and it's time to BUYBUYBUY but, like AAPL, there's no need for us to pay $4.30 when we can construct a much better spread. In HOV's case, we sold the 2014 $4 puts for $1.40 and buy the $4/7 bull call spread for .75 so we have a net .65 credit and our WORST CASE is that we end up having HOV put to us at net $3.35 – an additional 25% discount to the current price.

A trade like that "limits" us to a $3 gain at $7 on the bull spread but it also gives us 25% free downside protection and, frankly, making $3 at $7 on a .65 credit nets a total of $3.65 back and HOV was $4.30 when we took it so buying the stock, we'd have to hit $7.95 to make the same $3.65 and the best part is, our gain on cash in this trade can be as much as 561% in just a year. THAT's what we mean when we say we're bottom fishing. Combining sensible entries like that with a little bit of disaster hedging and, as long as the S&P holds 1,100 – we should be fine – so why NOT start buying now? We don't need to make perfect bottom calls when we hedge properly.

If we get some resolution, or even a can-kicking, of the Fiscal Cliff, we will rally very quickly and miss these opportunities for great entries. If the uncertainty continues, we will likely grind lower. At the moment, our most recent Long Put List is performing ridiculously well in it's first month – as with our Disaster Hedges, we caught them just ahead of the fall on 10/24 but, unlike the disaster hedges, you don't need margin for the Long Put List so it's easy protection anyone can use. I do not advocate chasing these positions and, like the Disaster Hedges – it's time to take some profits ahead of the expected bounce. We'll be watching our levels closely next week and are very likely to add a similar set if we fail to get a good bounce. Our 10/24 set was:

- DIA March $120 puts for $2.45, now $3.40 – up 39.5%

- DIS April $48 puts at $2.15, now $3.50 – up 63%

- HD Feb $57.50 puts at $1.40, now $1.40 – even

- JNJ Mar $67.50 puts for $1.35, now $1.88 – up 39%

- MA April $355 puts at $5, now $4.25 – down 15%

- MON April $75 puts at $2.30, now $2.58 – up 12%

- MRK Jan $44 puts at .93, now $2.27 – up 144%

- SPY Jan $132 puts at $1.97, now $2.78 – up 41%

- V March $120 puts at $1.15, now $2.12 – up 84%

- WMT Mar $70 puts at $1.52, now $3.85 – up 153%

- XRT Mar $58 puts at $2.10, now $2.42 – up 15%

Even a simple hedge like DIA or SPY on your whole portfolio returned 40% on an 8% drop in the index due to options leverage. That means hedging with just 10% of your portfolio and risking a 5% loss on the insurance (with a 50% stop) would have paid you back 4% against the 8% that was lost in this dip. THAT's the money you are free to spend re-positioning and bottom-fishing – it's a strategy that practically forces you to buy low and sell high!

Even a simple hedge like DIA or SPY on your whole portfolio returned 40% on an 8% drop in the index due to options leverage. That means hedging with just 10% of your portfolio and risking a 5% loss on the insurance (with a 50% stop) would have paid you back 4% against the 8% that was lost in this dip. THAT's the money you are free to spend re-positioning and bottom-fishing – it's a strategy that practically forces you to buy low and sell high!

As you can see from the performance of HD, MA, MON and XRT – we are still very far from a full-blown crisis. The recent market drop barely touched them. Our premise is blown on housing (HD) as it's been the real strength in the economy recently while MON still makes an interesting short if the World is going to hell in a hand basket. Like our disaster hedges – the length of the dates on these puts means they have plenty of room to run but, as I said, next week, if we don't make our strong bounces – it's going to be time to layer in a new batch.

Have a nice weekend,

– Phil