Is this a joke?

Is this a joke?

As we thought, yesterday's volume was very low – it was actually the 2nd lowest day of the year, that didn't stop the Nikkei and the Hang Seng from following us up half a point but Shanghai was flat at 2,008, dropping 10 points from its pumped up open and I'm sorry but you are NUTS to be too bullish in this market when that index is in danger of failing 2,000.

I don't mean not bullish at all – our LTP is still 100% bullish but it's hedged by the STP, which is mostly bearish. Just – BE CAREFUL!!!

Did you catch that news item above? "Shinzo Abe turned to Nobel laureate Robert Shiller to try to

restore a vital ingredient of his economic revolution: optimism." That's the World we're living in now – Central Bankers aren't even ashamed to admit that they manipulate the news and take actions aimed at making you THINK the economy is recovering.

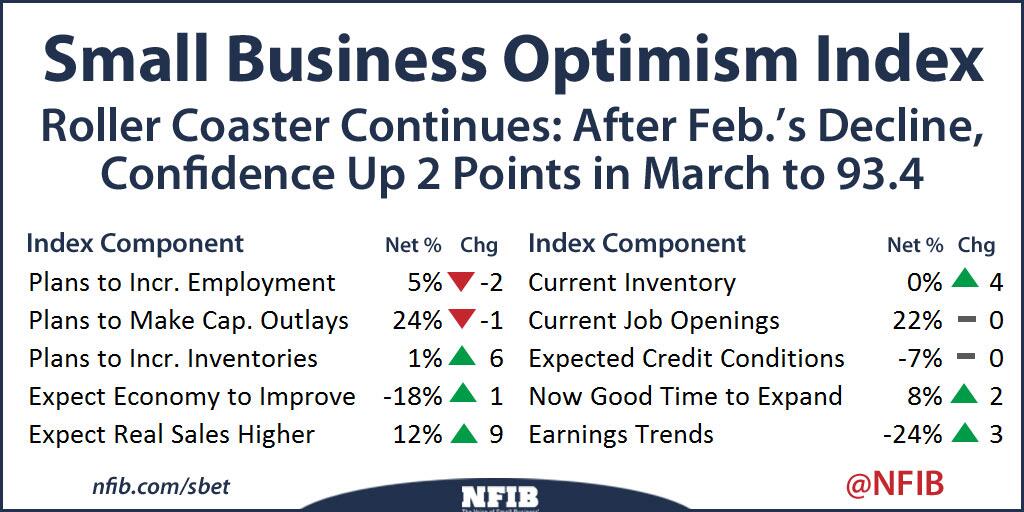

That's based on the old "truism" that, if people are optimistic, the economy will improve but it's FLAWED because consumers no longer have any discretionary income to spend and they don't have any savings and small businesses, who still employ 80% of the workers, don't have any money to spend either.

That's based on the old "truism" that, if people are optimistic, the economy will improve but it's FLAWED because consumers no longer have any discretionary income to spend and they don't have any savings and small businesses, who still employ 80% of the workers, don't have any money to spend either.

They have shifted the bulk of the discretionary GDP to the top 0.01% who don't spend it at all but use it to consolidate their empires. All these old economic rules don't apply to an oligarchy – every act of stimulus only serves to make the rich richer and push the rest of the country further into debt. Sure, the rich are in debt too but a guy with $1Bn owes the same $164,000 per family as the guy with $100,000 does.

Not only that, but when you tax the top 0.01% 15-20% but tax the bottom 99.99% 35%, the money just keeps funneling to the top. This madness has to end but, like Global Warming, it happens too slowly for most people to be aware of it until it's far too late. Maybe it is already too late – look at the way Occupy Wall Street was crushed out of existence by coordinated thuggery by our Corporate-sponsored Governments.

It was more sophisticated than we had imagined: new documents show that the violent crackdown on Occupy last fall – so mystifying at the time – was not just coordinated at the level of the FBI, the Department of Homeland Security, and local police. The crackdown, which involved, as you may recall, violent arrests, group disruption, canister missiles to the skulls of protesters, people held in handcuffs so tight they were injured, people held in bondage till they were forced to wet or soil themselves –was coordinated with the big banks themselves.

The Partnership for Civil Justice Fund, in a groundbreaking scoop that should once more shame major US media outlets (why are nonprofits now some of the only entities in America left breaking major civil liberties news?), filed this request. The document – reproduced here in an easily searchable format – shows a terrifying network of coordinated DHS, FBI, police, regional fusion center, and private-sector activity so completely merged into one another that the monstrous whole is, in fact, one entity: in some cases, bearing a single name, the Domestic Security Alliance Council. And it reveals this merged entity to have one centrally planned, locally executed mission. The documents, in short, show the cops and DHS working for and with banks to target, arrest, and politically disable peaceful American citizens.

This is over a year old but, of course, it was never even allowed on the US News.

As Mara Verheyden-Hilliard, executive director of the PCJF, put it, the documents show that from the start, the FBI – though it acknowledgesOccupy movement as being, in fact, a peaceful organization – nonetheless designated OWS repeatedly as a "terrorist threat":

"FBI documents just obtained by the Partnership for Civil Justice Fund (PCJF) … reveal that from its inception, the FBI treated the Occupy movement as a potential criminal and terrorist threat … The PCJF has obtained heavily redacted documents showing that FBI offices and agents around the country were in high gear conducting surveillance against the movement even as early as August 2011, a month prior to the establishment of the OWS encampment in Zuccotti Park and other Occupy actions around the country."

You would think the Tea Party would be outraged by this clearly outrageous Government behavior but the Tea Party is a Koch-sponsored farce, not an actual organization that actually cares about individual rights. The GOP wants smaller Government – except for the ones that crack the heads and the Dems are no better as I haven't heard a single one stand up for these people, other than Elizabeth Warren, of course.

These documents also show these federal agencies functioning as a de facto intelligence arm of Wall Street and Corporate America."

There is a new twist: the merger of the private sector, DHS and the FBI means that any of us can become WikiLeaks, a point that Julian Assange was trying to make in explaining the argument behind his recent book. The fusion of the tracking of money and the suppression of dissent means that a huge area of vulnerability in civil society – people's income streams and financial records – is now firmly in the hands of the banks, which are, in turn, now in the business of tracking your dissent.

Oh wait, I take it back, the Washington Post did publish something about this in their blog section – on Dec 31st, 2012 – just in time for no one to notice it.

Am I crazy to care about this stuff?

Sometimes I feel like I am, but I guess that's the point of the top 0.01% taking control of the media – the idea is to make us feel like there's something wrong with us when we question the status quo. As Orwell said and as Goebbels put into practice, history can be rewritten until people can't even remember the way things were before. I see that all the time in my kids' "history" books.

Sometimes I feel like I am, but I guess that's the point of the top 0.01% taking control of the media – the idea is to make us feel like there's something wrong with us when we question the status quo. As Orwell said and as Goebbels put into practice, history can be rewritten until people can't even remember the way things were before. I see that all the time in my kids' "history" books.

Now that we are, effectively, "burning" the last of the paper books in the world (2 more generations, at most), all of history will be electronic and then, when they change it, no one will ever know.

Same goes with Financial Info – if you listen to CNBC or Bloomberg, oil is heading to $110 over the summer but, if you dig enough (and this one is even on Bloomberg.com), you find out this truth:

WTI slid for a second month in April as U.S. crude inventories expanded to a record 399.4 million barrels, the highest level since the Energy Information Administration began publishing weekly data in 1982. Supplies were probably at 398.5 million barrels in the week ended May 16, according to the median estimate in a Bloomberg survey of seven analysts.

Stockpiles at Cushing, Oklahoma, declined to 23.4 million barrels in the seven days through May 9, said the EIA, the Energy Department’s statistical arm. That’s the least since December 2008. Supplies have decreased as the southern leg of the Keystone XL pipeline began moving oil to Gulf Coast refineries from storage in January. The U.S. is the world’s largest oil consumer.

So it's not that there's been any real draw on oil at all – new record highs means new record highs – they've just moved the oil from Cushing (where it's measured) to other places where it isn't.

So it's not that there's been any real draw on oil at all – new record highs means new record highs – they've just moved the oil from Cushing (where it's measured) to other places where it isn't.

Oil (/CLN4 = July) is $102.32 today (we're short from $102.50 already), the boost is being caused by the rolling of /CLM4 ($102.76), which expires tomorrow, into the next month contracts. That means, once the rolling is done – if Russia does back down in the Ukraine, the only real boost left for oil is Libya – and Libya only produces 1Mbd total. So, still hope for a sell-off but a very tough call with the holiday weekend coming up – maybe not until next week.

Silver, meanwhile, tapped our long line at $19.30 again (/SI) – I still like that over the line. Copper fell back to $3.145, nat gas is $4.46 and gasoline dove back to $2.96 and now that's a nice long (/RB) into the weekend as I'm sure they'll go for $3 again.