That's 2 closes over 1,920.

That's 2 closes over 1,920.

It's almost enough to make us regret cashing out our Long-Term Portfolio last week. We didn't expect to call a perfect top, when you have a large portfolio it can take days to unwind your positions and, despite the very low volume – we'd like to thank all the retail bagholders who bought our shares at top dollar in the last few days.

Thanks Dave and Bill and Jack and Joe and – well, that's about it as volume is so low, there can't be more then 3 or 4 guys trading in this market!

Last June started off with low volume too – as well as record highs – and then we dropped 5% into July. We're simply taking our 119% cash and waiting for the dip – is that so bad?

Yesterday was only the 3rd lowest volume day of the year and the action was wonderfully fake around a PMI report that was released, revised and then revised again – all in the same morning!

Yesterday was only the 3rd lowest volume day of the year and the action was wonderfully fake around a PMI report that was released, revised and then revised again – all in the same morning!

In the end, they decided on 56.4, which was in-line with consensus but not before giving us a glimpse on how quickly this market can fail on bad news.

In our Live Member Chat Room, we took full advantage of the over-reaction on the bad news to go against the panicking sheeple and buy TNA (3x bullish ETF on the Russell) in a 9:57 Alert I sent out to our Members.

That trade was so obvious I tweeted it out as well (you can follow me here) saying:

Those calls came in cheaper (because our timing was perfect) at $1.50-$1.40 and they topped out at $1.70 and finished the day at $1.61 but should be cheap again this morning, which is why I'm mentioning them now as they make an excellent upside hedge – in case the market does better than we think.

Those calls came in cheaper (because our timing was perfect) at $1.50-$1.40 and they topped out at $1.70 and finished the day at $1.61 but should be cheap again this morning, which is why I'm mentioning them now as they make an excellent upside hedge – in case the market does better than we think.

Since we sidelined $598,000 last week ($98,000 in profits in less than 6 months), we decided to spend $3,000 on 20 of the above contracts – that way we won't cry if the market flies back up on us.

If the market goes lower, like we think it will, we won't cry either as we will get to take our CASH!!! and go shopping!

Meanwhile, since we have a $3,000 upside bet on the Russell it was an easy call this morning to short the Russell Futures at 1,125 and already (8:10) we have a dip to 1,120 for a quick $500 per contract win this morning. In addition to topping off our Buy List in today's live Webinar (1pm EST – sign in here), we'll probably have some time for a Futures Trading Workshop.

A single contract in a single day (out of 45 days remaining on the contract) allows us to make 16% of the contract cost back and the Futures play is, of course, PROTECTED by the long contracts – just in case we were wrong.

A single contract in a single day (out of 45 days remaining on the contract) allows us to make 16% of the contract cost back and the Futures play is, of course, PROTECTED by the long contracts – just in case we were wrong.

We weren't, fortunately, and we also weren't wrong on our other calls this morning which were (all shorts):

- Dow (/YM) at 16,700, now 16,675 – up $125 per contract

- S&P (/ES) at 1,920, now 1,916 – up $200 per contract

- Nasdaq (/NQ) at 3,725, now 3,715 – up $200 per contract

Futures are a wonderful tool, which is why we have our workshops at least once a month. We trade futures a lot more often than that (see our recent trade reviews) and it's something every serious trader should consider putting the effort into learning – as it's a skill that can get you out of a lot of market scrapes, when you are lined up on the wrong end of a trade after hours – as well as providing a fun platform to grab a little extra cash before, during or after regular market hours.

At the moment, the markets are sustaining themselves on Draghi fever, with the ECB making a rate decision on Thursday morning that traders are "sure" will be a move to more easing. Since it's already baked in, we prefer to short it for the disappointment but, as I said, we cashed out or main portfolio – so we're not taking things too seriously in either direction this week.

At the moment, the markets are sustaining themselves on Draghi fever, with the ECB making a rate decision on Thursday morning that traders are "sure" will be a move to more easing. Since it's already baked in, we prefer to short it for the disappointment but, as I said, we cashed out or main portfolio – so we're not taking things too seriously in either direction this week.

Yesterday we discussed the currently hidden inflation that is building up inside our poorly-measured economy and, ironically, the ECB is moving to BOOST inflation in the Euro-zone, as it's been coming in at an anemic 0.5%. DEflation is worse then INflation to Banksters and top 0.01%'ers, who own a lot of stuff and want it to maintain it's value since they levered their cash 10:1 to buy it.

With the Central Banksters looking to sustain inflation at all costs, why are gold ($1,245) and silver ($18.80) so out of favor? Well, one major reason is Goldman Sachs and their Bankster buddies have been bashing gold for most of the year. You might say "well, that's their opinion" but why then is GS, AT THE SAME TIME, making deals with countries like Ecuador, who are giving GS 466,000 ounces ($580M) in a 3-year commitment?

Drive the price of gold to rock-bottom and then make deals to get control of all the gold before driving the prices back up – now where have I heard that plan before?

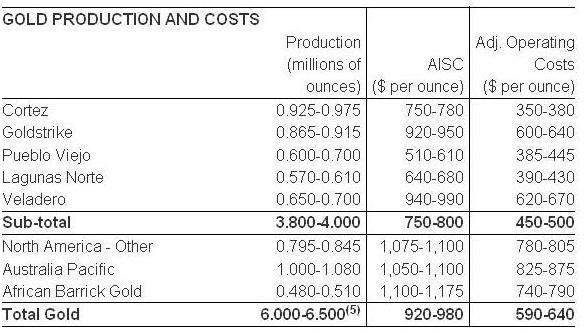

You can conduct your own "Operation Grand Slam" by taking a position in ABX, the World's largest gold miner who have 140M ounces of proven reserves ($174Bn) yet are trading at just $18Bn at $15.90, about 1/10th the value of their gold holdings.

Of course, it doesn't matter how much gold you have in the ground if you can't extract it profitably but gold is so cheap at the moment that ABX is holding $2.7Bn of it in their inventory – waiting for prices to improve.

Of course, it doesn't matter how much gold you have in the ground if you can't extract it profitably but gold is so cheap at the moment that ABX is holding $2.7Bn of it in their inventory – waiting for prices to improve.

Meanwhile, they are still generating positive cash-flow ($327M last year) while paying another $500M in dividends and servicing their debts. They've taken $10Bn in write-offs so it will be many years before they owe any taxes, which will be a huge boost to future earnings if there ever are any.

If you don't want to buy the stock for $15.90 (and we NEVER pay retail at PSW!), then you can sell the 2016 $15 puts for $2.05, which obligates you buy the stock for net $12.95, which is 19% below the current price. If ABX stays over $15 through Jan 2016, the short puts expire worthless and you simply keep the $2.05 ($205 per 100-unit contract) in exchange for the promise you made – if ABX goes below $15, you may be assigned and own the stock at net $13.

Since the net margin on the short puts is just $2.28, the trade returns 90% on margin in 18 months – not a bad inflation hedge, is it?

If you want to get more aggressive, you can add the 2016 $15/22 bull call spread for $2 and you still have a nickel credit but now you have an upside of every penny over $15 up to $22 with a potential return of $7.05 on your 0.05 cash outlay (+14,100%) if ABX gets back to $22 by Jan 2016.

We'll go over this trade in today's Live Webinar, I think it may be the first play we add back to our Long-Term Portfolio as it's really too good to pass up when net $50 on 10 contracts can make a $7,050 profit in 18 months and our worst case is owning ABX and their $170Bn worth of gold for $18Bn (one net $14.95 share at a time!).