$2,000!

$2,000!

That's how much money yesterday's Alert to Members made as of this morning as the Russell Futures crossed our goal line at 1,150. The alert went out at 9:52 am and we had all day to enter as the Russell drifted along that line until, finally, we got our big drop this morning.

My call in the morning was:

I still like the /TF play below the 1,170 line – that's got $2,000 written all over it (down to 1,150).

We actually oveshot that mark with the bottom coming at 1,140, which is our -5% line on the Big Chart, which uses our 5% Rule™ to make these amazingly profitable predictions. Those extra 10 points were ANOTHER $1,000 per contract for those who hung on past our goaaaaalllllll!!!

We actually oveshot that mark with the bottom coming at 1,140, which is our -5% line on the Big Chart, which uses our 5% Rule™ to make these amazingly profitable predictions. Those extra 10 points were ANOTHER $1,000 per contract for those who hung on past our goaaaaalllllll!!!

Even if you are a free reader, you got your money's worth – as we gave away, FOR FREE, our TZA Aug $14 calls at .91 on Tuesday's post. Sure it was 50% after our Members got the trade at .66 on July 3rd, but beggers can't be choosers, right? Still, even if you only began following our hedge at .91, those calls are now $1.50 in the money, so up another 50% this morning for a $1,180 profit on the 20 we suggested in just two days!

That's just one of the many ways we teach our Members to make money by hedging at PSW (you can subcribe here) we expected this sell-off (see last two week's worth of posts) and positioned for it with trades like:

- DXD Aug $25/27 bull call spread (6/27 in main post) at net 0.60, now $1.15 – up 91%

- TZA Aug $15s calls (6/27 at 11:26) at .70, selling Jan $12 puts for $1 for net .30 credit, now 0.45 – up .75 (250%)

- 40 SQQQ Aug $40/44 bull call spreads (1/3 at 11:29) at $1.15 ($4,600), now $2.15 – up $4,000 (86%)

- 20 QQQ July $97 puts (1/7 at 9:35) at $1.59 ($3,180), now $3 ($6,000) – up $2,820 (88%)

So our average hedge (ignoring the out-performing TZA) is up 85% on a 5% dip. That's exactly what hedges are supposed to do! That way, we can put a little bit of our profits into protective play and they help to lock in our gains when the market does finally reverse on us.

So our average hedge (ignoring the out-performing TZA) is up 85% on a 5% dip. That's exactly what hedges are supposed to do! That way, we can put a little bit of our profits into protective play and they help to lock in our gains when the market does finally reverse on us.

Of course we also have tons of fun with Futures trades too, but these options trades are great hedges for any portfolio. We discuss these trades live in our weekly webcasts each Tuesday at 1pm (last replay available here), if you'd like to get an idea of what we do in our Live Member Chat Room every day (but without the video, of course).

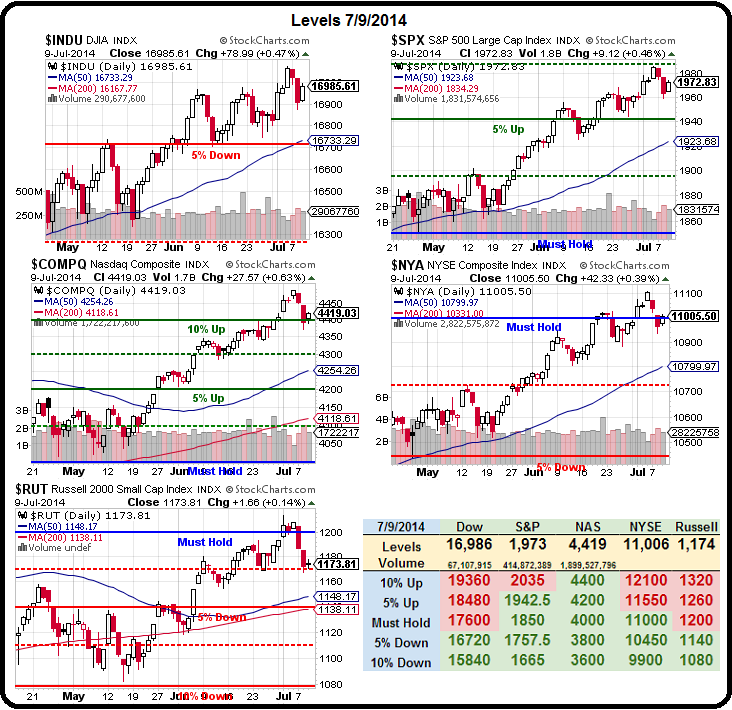

Meanwhile, as we can see from our Big Chart, we have a classic Spitting Cobra pattern on all of our indexes so we expect a 5-10% pullback from the highs.

Meanwhile, as we can see from our Big Chart, we have a classic Spitting Cobra pattern on all of our indexes so we expect a 5-10% pullback from the highs.

The Russell already made a perfect move from 1,200 to 1,140 and, keep in mind, these are levels we predict not months but YEARS in advance!

If this is going to be a shallow correction (indicating we can buy the dips), then 1,140 should hold on the Russell and we'll look for a weak bounce to 1,150 and a strong bounce back to 1,160 while the S&P holds their 5% up line at 1,942.50 (good so far).

The Dow is testing their 5% down line at 16,720 this morning (funny how so many of our predictions get hit on the nose, right?) and we'll certainly need to see the Nasdaq take back 4,400 before we even consider a bullish play – even on our beloved AAPL, which is also taking the dip we bet on in our Income Portfolio, which has 35 short Jan $87.14 calls at $9.25 half-covering our long position.

We already used the Nasdaq Futures (/NQ) as a short this morning in Member Chat, below the 3,850 line and that's been good for a 5-point, $100 per contract gain already. We switched to them when the Russell hit 1,140 as we expected a bounce there.

That's a strategy we call "getting fresh horses."