Courtesy of Declan.

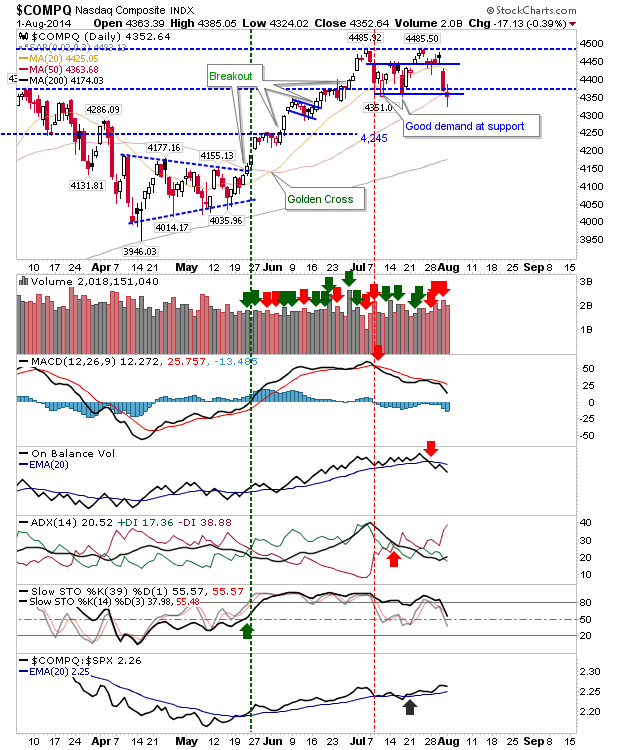

In previous sell offs, buyers have quickly come to the fore to buy-the-dip. They weren’t so encouraged on Friday with buyers struggling to meet the supply created by sellers. Buyers still have a chance to strike with available support, although the amount of risk required to take such a position has widened.

The indices closest to support, like the Nasdaq, finished with an opportunity at converged July swing lows and 50-day MA. A loss of the Friday low is the place for stops, although there is a good chance this low could be taken out on (probable) Monday (morning) weakness.

The Nasdaq 100 hasn’t yet made it to the 50-day MA, but the shorter ‘shadow’ of Friday’s candle suggests there is more demand here than in other indices.

The Dow didn’t stop at former resistance of the March-May trading range, although it now has the 200-day MA to lean on for support.

The S&P has some room to run before it gets to nearest support. Of the indices it’s the one most lacking a natural area for buyers to step in.

The Russell 2000 has the widest intraday range, and is some distance from support. However, May support should be good enough to offer a trade-worthy bounce.

Watch for bearish follow through Monday morning, but for indices with nearby support any early sell off may offer an opportunity – particularly if buyers step-in after the first hour.

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.