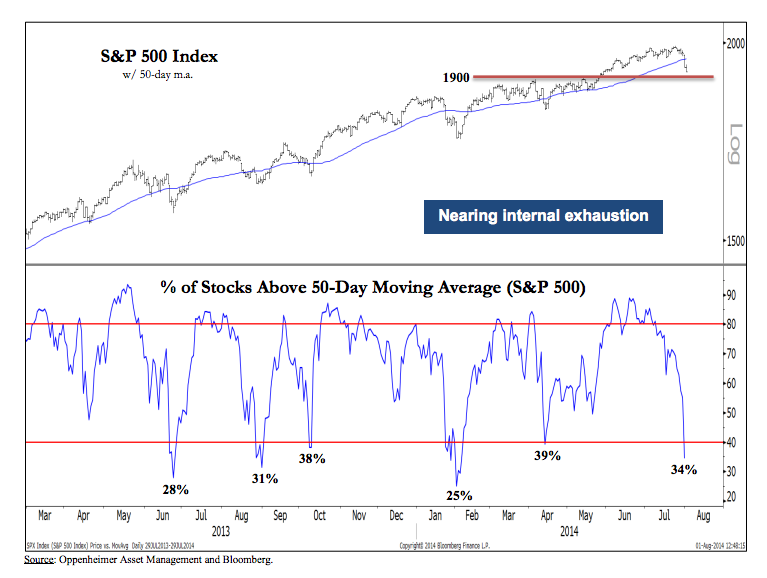

Actually it's a rule of thumb at PSW that dip buyers need to get burned 3 times before they wise up to a proper correction, so they still have at least another try in them before they finally walk away from this crazy market. As you can see from Oppenheimer's S&P chart, 56% of the S&P has plunged back below their 50 dma in the past 30 days.

This is EXACTLY what I've been warning you about. At the same time the indexes LOOKED like they were rallying, MOST stocks were actually being dumped while a few (AAPL, for expample) were kept aloft to maintain the ILLUSION that the market was still strong. That's how they keep the retail buyers moving in while the institutional investors head for the hills. Yesterday's action was nothing but another low-volume bounce – the kind we teach our Members to ignore:

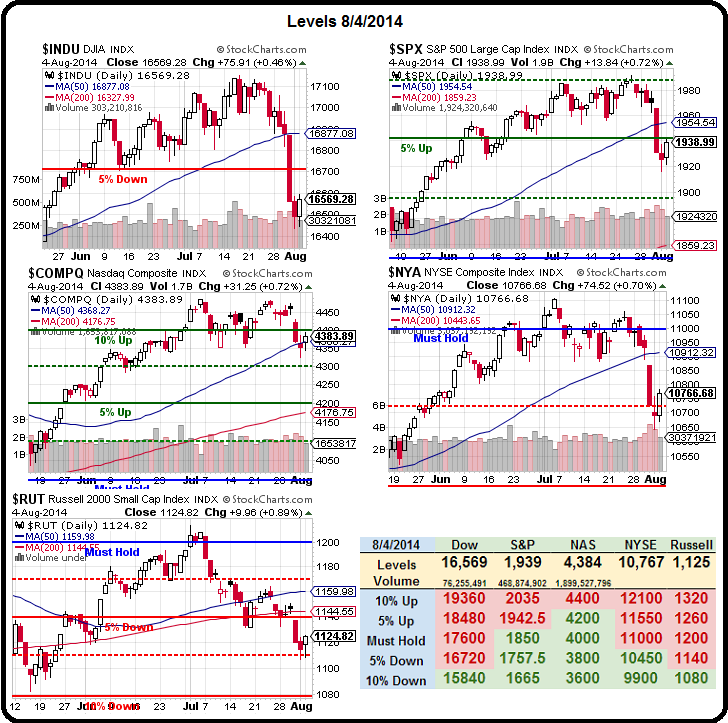

Short-term, we're certainly oversold but we'll be very critical of a low-volume recovery until we see those 50 dmas retaken on the indexes. Those are way up at 16,877 on the Dow, 1,954 on the S&P, 4,368 on the Nasdaq, 10,912 on the NYSE and 1,160 on the Russell. Anything less than that and there's nothing to be particularly bullish about.

That doesn't stop us, of course, from picking individual short-term longs. On Wednesday, for example, I was on TV on Money Talk and we featured this play on GTAT as my "Options Play of the Month." Last night, GTAT knocked it out of the park on earnings and the stock shot up over 10% to $15+ already in pre-market trading. That will put us well on track to the full $14,000 return on this spread and a 1,650% gain on cash ($13,200 profit on the $800 we invested)! Not bad for a few day's work, right?

That doesn't stop us, of course, from picking individual short-term longs. On Wednesday, for example, I was on TV on Money Talk and we featured this play on GTAT as my "Options Play of the Month." Last night, GTAT knocked it out of the park on earnings and the stock shot up over 10% to $15+ already in pre-market trading. That will put us well on track to the full $14,000 return on this spread and a 1,650% gain on cash ($13,200 profit on the $800 we invested)! Not bad for a few day's work, right?

By the way, if you never want to miss trade ideas like GTAT again – sign up right here for Membership and you will be among the first to hear about our new trade ideas every day!

We're still running our SQQQ hedge as we didn't think yesterday's little bounce warranted a change of plans. Our Member Portfolios remain very well-balanced with our Short-Term Portfolio holding a 31.6% gain at yesterday's close while our Long-Term Portfolio is hanging on to 17.7% at the moment. The LTP is $500K (now $588K) and the STP is $100K (now $131K) and, as long as they net out around $710,000 (now $719K), we're comfortable enough riding out this market chop.

We have a Live Trading Webinar today at 1pm (EST), where we'll be looking over our Short-Term Portfolio and determining whether or not we should change course for the week.

Looking at our Big Chart (thanks StJ!), we see 4 Spitting Cobra patterns that have already resolved to the downside with only the Nasdaq holding onto it's 50 dma at 4,368. That's why we're shorting the Nasdaq with SQQQ – it's the "laggard" with the farthest left to fall if they all go to Hell.

Looking at our Big Chart (thanks StJ!), we see 4 Spitting Cobra patterns that have already resolved to the downside with only the Nasdaq holding onto it's 50 dma at 4,368. That's why we're shorting the Nasdaq with SQQQ – it's the "laggard" with the farthest left to fall if they all go to Hell.

If not, we'll be looking for strong bounces and the Russell as noted yesterday, has very neatly made a 7.5% drop so we'll be watching that 1,110 line with great interest and a weak bounce off there is 20 points (rounding 18) to 1,130 and a strong bounce would neet to take back 1,150 and that STILL would not get them to the 50 dma at 1,160 – so a lot of work for the Russell to do if we're going to recover.

That's why we picked up a small TNA hedge yesterday in our Live Member Chat Room, an adjustment of the play that failed to trigger on 7/22 (because the RUT couldn't hold 1,150) and our new trade needs the Russell to hold that 1,110 line – boy have we lowered our expectations quickly! Meanwhile, we're looking for bounce lines on our indexes at:

- Dow 17,100 to 16,500 is 600 points so 120-point weak bounce to 16,620 and a strong bounce would be 16,740.

- S&P 1,990 to 1,920 is 70 points so 15-point bounces (rounding) to 1,925 (weak) and 1,940 (strong)

- Nasdaq 4,475 to 4,350 is 125 points so 25-point bounces to 4,375 (weak) and 4,400 (strong)

- NYSE 11,050 to 10,650 is 400 points so 80-point bounces to 10,730 (weak) and 10,810 (strong)

- Russell 1,200 to 1,110 is 90 points so 20-point bounces (rounding) to 1,130 (weak) and 1,150 (strong)

Those are the levels we'll be watching this week and the longer it takes to get there – the less impressed we'll be. We're also keeping our eye on oil at $98.50 but, as I said to our Members early this morning – I'm far more inclined to short it at this level (/CL Futures).