"Thruppence and sixpence every day

Just to drive to my babyI don't care how much I pay (Too much, Magic Bus)

I wanna drive my bus to my baby each day (Too much, Magic Bus)I don't want to cause no fuss (Too much, Magic Bus)

But can I buy your Magic Bus? (Too much, Magic Bus) " – The Who

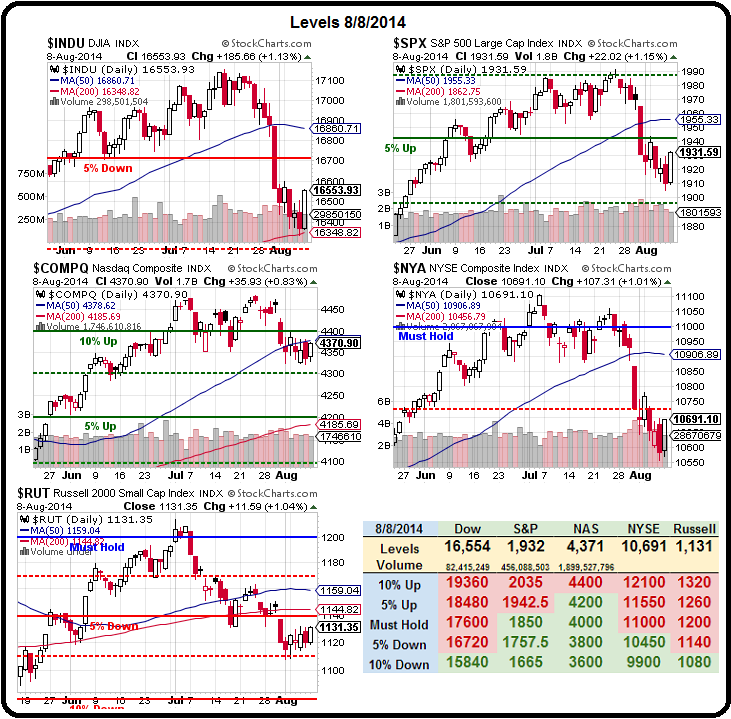

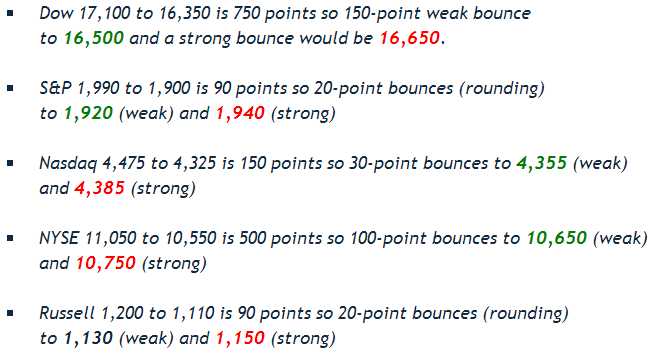

This is certainly one Magic Bus of a market, flipping on a dime or, more accurately, bouncing off the Dow's 200 day moving average at 16,350 back towards our predicted strong bounce line at 16,650. The Transports are also bouncing right off the 100 dma at 142, down from 152 and. per our 5% Rule™, we expect 146 to be tested this morning. This is not "surprising", this is what we said would happen on Friday morning.

As we discussed all of last week, BALANCE is the key in a choppy market and our Long-Term Portfolio finished Friday at $590K, up exactly 18% for the year, while our Short-Term Portfolio jumped to $136,000, up 36% for the year and together they are $726,000, up over 20% for the year on our two primary virtual portfolios.

Having well-balanced portfolios allowed us to ride out the dip and, in fact, buy more longs while the market was pulling back, rather than panicking out of positions that, for the most part, only went down with the market – rather than because there was any actual weakness in the stock.

Having well-balanced portfolios allowed us to ride out the dip and, in fact, buy more longs while the market was pulling back, rather than panicking out of positions that, for the most part, only went down with the market – rather than because there was any actual weakness in the stock.

Our general strategy of Being the House – Not the Gambler is also a great help in consistently making progress in our portfolios, even when the market has such a choppy week.

For most traders, it's "thruppence and sixpence every day" just to hold on to their positions as they gyrate up and down. As sellers of premium, we own the Magic Bus and we collect those daily pennies instead of selling them and that acts as a tremendous buffer to our long-term investing, where simply hanging on to a position allows us to collect another day's rent!

Meanwhile, we can play with short-term positions, like the SCTY trade I put up in Friday morning's post (and you'll never miss a post or a trade if you subscribe to our newsletter RIGHT HERE), which has already jumped from a $975 credit to net $325 for a nice +$1,300 return (133%) on the day.

That trade is a microcosm of our system, we sold a lot of premium (the Sept $77.50 calls for $6.50) and bough less premium (the Jan $80/95 bull call spread at $4.55) to cover it. That gave us a huge advantage whether we were right or wrong and, in this case, we turned out to be right and made us some very quick money.

Our other trade ideas from Thursday's Live Member Chat Room (all noted in Friday's post as well) were 5 for 5:

Our other trade ideas from Thursday's Live Member Chat Room (all noted in Friday's post as well) were 5 for 5:

During Live Member Chat yesterday, we also found a bullish trade on WAG ($60), bearish on GMCR at $120, bearish on TLSA at $255(above), bullish on NLY at $11.40, bearish on SCTY (above) and our last trade of the day was bullish on SSO ($110 – ultra-long S&P).

Having our portfolios well-balanced gives us the flexibility to make adjustments like these CALMLY and professionally – even when the markets are falling hard, as they were on Thursday. Our 5% Rule™ allowed us to correctly predict the likely turning point and adjust our trades accordingly. Having time to think when market conditions change is the most underrated aspect of a balanced portfolio strategy!

Now we begin a new week and we have the same old bounce lines we were watching last week and we expect our strong bounce levels to all be in play today. Nothing short of 5 greens is going to satisfy us at the end of the day – otherwise we will likely be tilting back a bit more bearish in our Short-Term Portfolio but our primary goal, with 7 months gone this year, is to lock in those 20% gains.

Now we begin a new week and we have the same old bounce lines we were watching last week and we expect our strong bounce levels to all be in play today. Nothing short of 5 greens is going to satisfy us at the end of the day – otherwise we will likely be tilting back a bit more bearish in our Short-Term Portfolio but our primary goal, with 7 months gone this year, is to lock in those 20% gains.

If the market continues to go up or stays flat, those premiums we sold will pay us our daily pennies and our portfolios will continue to grow. If the market remains weak, we will have to consider getting to more cash as we're not too far away from a serious breakdown if this downtrend doesn't reverse itself this week (over the strong bounce lines to stay).

Japan's GDP tomorrow night WILL be a disaster, the real question is – how will the markets take it? Euro-Zone GDP is also not likely to be a big winner on Thursday morning and Chinese Retail Sales will also be a market-mover on Wednesday so it's going to be a wild week – today is more of a "watch and wait" event for us – but we'll still take our pennies, thank you!

.png)