More bad news today.

More bad news today.

China's Industrial Output is at its lowest level since the 2008 crash and Hong Kong stocks dropped 1%, the 7th consecutive down day over there and the Royal Economists at the Bank of Scotland slashed their forecast for China as worries rise that the world's second-largest economy is headed for another slowdown. Too bad for them, they are just catching up to what we told you a month ago, on 8/18, when I said in the morning post:

Chinese Banks' Loan-Loss Reserves have fallen to the the lowest levels in 3 years — We shorted India last week (EPI) and now FXI has got my mouth watering as a potentially good short. I'd feel better about taking up a short on FXI at $45, not $42 but the Jan $42/38 bear put spread is just $1.80 on the $4 spread and that makes it very interesting as it pays 122% on a less than 10% decline in the Chinese markets – a nice way to hedge your bullish China bets!

As we expected, there was a little more gas in the tank but now we're right back on track as the magical China story begins to show its age. The benchmark index for the Asian region, the MSCI All Countries Asia Ex-Japan in U.S. dollar terms, is down 2.2% since reaching the year's high earlier this month. Saturday's weak economic data—including news that August electricity output fell 2.2%—suggest that earlier government stimulus measures lack staying power.

"The economy is losing steam very quickly in August," said Macquarie Group economist Larry Hu. "Previously when they stimulated the economy, private companies followed, leading to a restocking cycle. But this time, the private sector is so cautious." "The IP number is a surprise because Premier Li talked in Tianjin about a quite stable situation," said Mizuho economist Shen Jianguang. "I think, very soon, they're reaching a moment of truth. If they don't ease, the economic deceleration will come much faster."

"The economy is losing steam very quickly in August," said Macquarie Group economist Larry Hu. "Previously when they stimulated the economy, private companies followed, leading to a restocking cycle. But this time, the private sector is so cautious." "The IP number is a surprise because Premier Li talked in Tianjin about a quite stable situation," said Mizuho economist Shen Jianguang. "I think, very soon, they're reaching a moment of truth. If they don't ease, the economic deceleration will come much faster."

As you know, we got a lot more bearish last week and those DXD hedges I mentioned in Thursday's post (and Friday again, actually) popped 25% as the market threw its little temper tantrum on Friday. We're not expecting a huge correction but certainly 5-10% wouldn't be out of line and Friday was interesting as the volume (117M on SPY – see Dave Fry's chart) was the most we had since Aug 15th – also a Friday (and options expiration day).

We have options expiration this Friday for the August contracts but, between now and then we'll get our own Industrial Production Report along with Empire State Manufacturing (which should be very good) this morning and tomorrow we have our PPI, UKs PPI and CPI and Germany's Economic Sentiment (not good, we're betting) and Koroda will weigh in early in the morning.

We have options expiration this Friday for the August contracts but, between now and then we'll get our own Industrial Production Report along with Empire State Manufacturing (which should be very good) this morning and tomorrow we have our PPI, UKs PPI and CPI and Germany's Economic Sentiment (not good, we're betting) and Koroda will weigh in early in the morning.

Wednesday is Fed day along with Euro-Zone CPI, our CPI and some Housing data but all eyes will be on Janet, who will "tell us about" it at 2:30 pm. Thursday we'll get the Philly Fed, Housing Starts and a look at the Fed's Balance Sheet and Friday we get Japan's Industrial Data along with our own Leading Indicators.

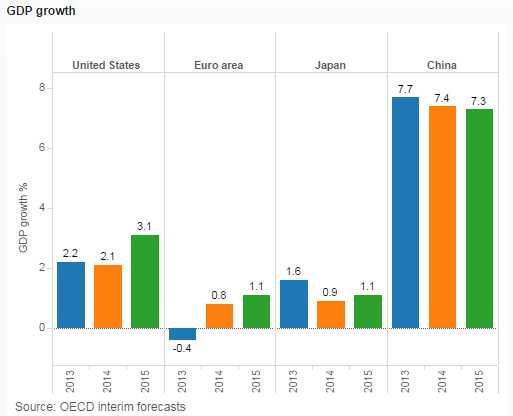

We're still in "bad news is good news" mode, as evidenced by today's pop in the Futures on the terrible China news as well as the OECD cutting growth forecasts by about 20%, with the US outlook dropping from 2.6% to 2.1% and the EuroZone shaved from 1.2% down to 0.8% growth with Italy now forecast to end 2014 DOWN 0.4% for the year – that's revised down from 0.5% growth in May!

We're still in "bad news is good news" mode, as evidenced by today's pop in the Futures on the terrible China news as well as the OECD cutting growth forecasts by about 20%, with the US outlook dropping from 2.6% to 2.1% and the EuroZone shaved from 1.2% down to 0.8% growth with Italy now forecast to end 2014 DOWN 0.4% for the year – that's revised down from 0.5% growth in May!

"The global recovery from the crisis has been inadequate in several ways," the OECD said. "Economic slack has persisted, potential growth has slowed, and inequality has risen. Meanwhile, external imbalances and threats to financial stability have remained."

"Recent ECB action is welcome but further measures, including quantitative easing, are warranted," said Rintaro Tamaki, the OECD's acting chief economist. And that's the key, isn't it? The economy doesn't have to do well for our Corporate Masters to do well.

"Recent ECB action is welcome but further measures, including quantitative easing, are warranted," said Rintaro Tamaki, the OECD's acting chief economist. And that's the key, isn't it? The economy doesn't have to do well for our Corporate Masters to do well.

In fact, in this new economy, where they are given FREE MONEY the worse the economy looks – bad news is indeed good news for the markets. But, at some point, won't the party end?

Ending the party is usually the Fed's job – but no action is expected this week but the next meeting (October) is when some sort of a rate increase is potentially expected. This week, we'll be looking for clues from the statement on Wednesday as well as from Yellen's press conference after that.

Meanwhile, let's be careful out there!