First, the big news:

EBAY has finally agreed to spin off PayPal and that's going to give us a nice boost in our Income Portfolio (which we fortunately just adjusted more aggressive yesterday) and EBAY has been on our Buy List (Members Only) since 5/20, when they were testing $50 and, as I said to our Members when I predicted an earnings beat in July:

Paypal, Paypal and Paypal. They should beat the .68 expectations (.63 last year) and all of last year they traded in the $50s, so why should they be below it now when they are making $3 a year (p/e 16.7)? Compared to the rest of the market, this thing is a real bargain!

They beat by a penny and, as you can see from the chart, that was enough to kick them up 10% and we recently got a nice re-entry at $50, when we took advantage of the spike down to sell more 2016 $50 puts for $5.50 which were up 15% at $4.80 at yesterday's close – not bad for a month's work and they should be up 30% by the end of today!

Today we will see an all-out effort to keep the markets afloat so the books on Q3 can be spun positive by the Banksters, who have Trillions of Dollars riding on the outcome.

Today we will see an all-out effort to keep the markets afloat so the books on Q3 can be spun positive by the Banksters, who have Trillions of Dollars riding on the outcome.

Of course, we KNOW that no Bankster would ever attempt to manipulate the Market, or LIBOR, or Currencies, or Ratings… Well, not if they knew for a fact they would get caught AND the punishment was more than a slap on the wrist, anyway. Thank goodness, that never happens.

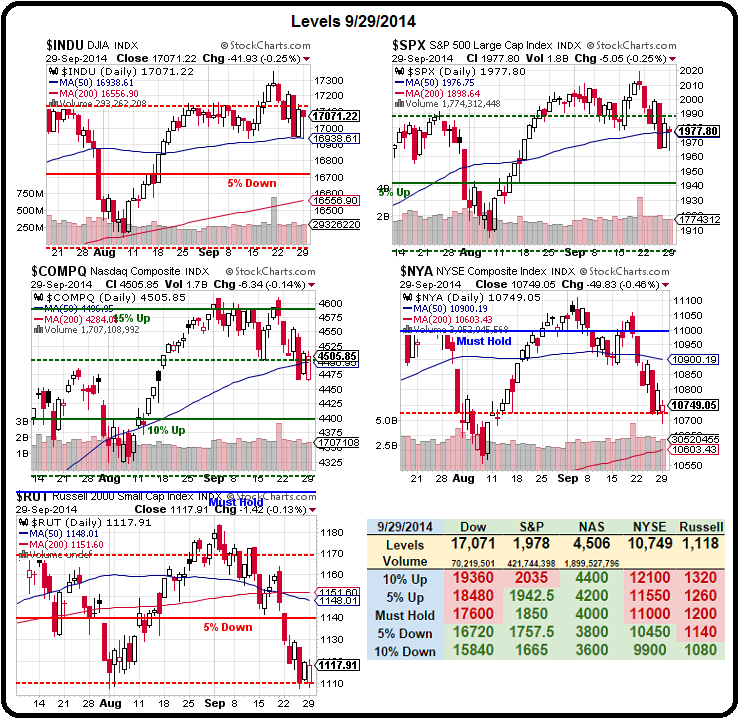

As you can see from our Big Chart, the S&P came to a rest right on the 50 dma at 1,977 so that's the do or die line for the day while it's 4,495 on the Nasdaq. On the Dow we want to see 17,100 taken back and the NYSE needs to hold 10,750 while the poor, beleagured Russell just needs to hold that 1,110 line. Officially, our bounce lines remain:

- Dow – 17,000 (weak) and 17,100 (strong)

- S&P 1,975 (weak) and 1,985 (strong)

- Nasdaq 4,475 (weak) and 4,500 (strong)

- NYSE 10,760 (weak) and 10,820 (strong)

- Russell 1,125 (weak) and 1,140 (strong)

Since we lost ground from yesterday (S&P & NYSE were green, now on the line) those weak bounce lines are no longer good enough today and we must start seeing some strong bounce lines re-taken or we'll have to get more bearish. Even based on yesterday's performance, we added additional hedges to our Short-Term Portfolio as well as the Income Portfolio.

Ahead of the open, the Euro went into free-fall this morning with a plunge to $1.257 and that sent the Dollar flying to 86.30 and the Yen to 109.85. If you like currency trading, you can play for a retrace at 110, which means the Dollar will pause below 86.50 and that run was from 83 so 3.5 in September means we expect a retrace of 0.75 (weak) to 85.75 and, possibly, a strong retrace back to the 85 line.

The Yen, meanwhile, should drop back to 109 (weak) and 108 (strong) and that means it's game on for the /NKD shorts (16,250) and EWJ can be played short at $12 with Oct $12 puts at 0.20.

The Yen, meanwhile, should drop back to 109 (weak) and 108 (strong) and that means it's game on for the /NKD shorts (16,250) and EWJ can be played short at $12 with Oct $12 puts at 0.20.

Gold, as you can see, was also crushed back to $1,200 on the Dollar strength and we called a long on /YG in our Live Member Chat Room earlier this morning and we discussed our ABX play with our $1,200 gold entry target in yesterday morning's post, so you are just in time to catch up. ![]()

Today we have a Live Trading Webinar at 1pm (Members Only) and we'll see what kind of opportunities are available to us this afternoon and there should be plenty of opportunities to cherry-pick some gold miners as GDX (miners ETF) is looking very oversold in general (thanks ChartFreak):

There's an initial reaction to weakening Global currencies that sends the Dollar up and gold down but then the reality of weak Global currencies begins to set in and people in those devaluing markets begin to put more of their wealth into gold to hedge against the loss of buying power they are experiencing in their own currencies.

Also, it's very possible that this entire move up in the Dollar is nothing but leverage for window-dressers, who can tank the Dollar again later today – when they need something to goose the indexes into the close. That makes both gold ($1,205 on /YG) and silver ($17.15 on /SI) both excellent long plays this morning (with tight stops below).

See you at the Webinar!