How low can we go?

How low can we go?

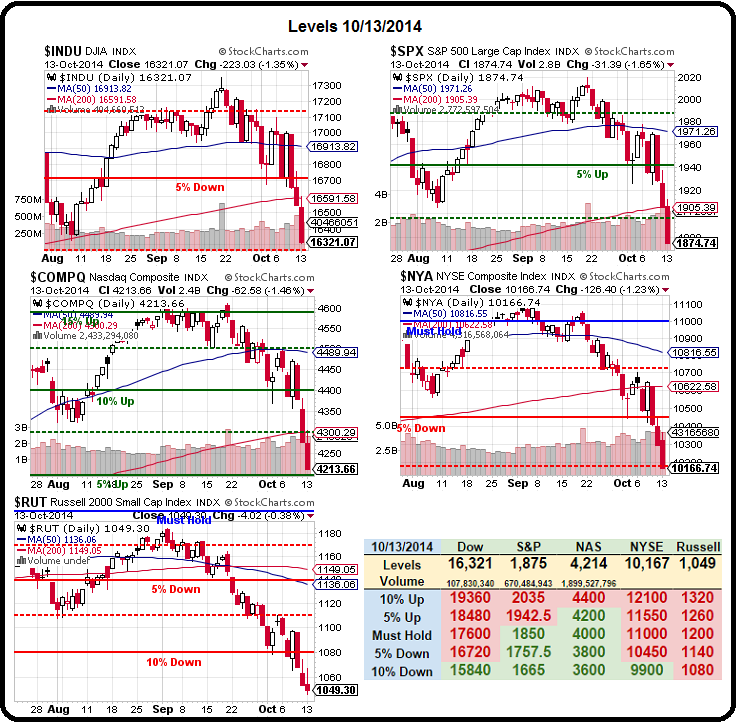

So far, the Russell is the only index that's gone through a full 10% correction – falling from 1,180 in early September to 1,050 yesterday – actually 11% – so far. According to our 5% Rule™, if the 10% line is going to hold over the long term, we should hold -12.5% on any additional move down – that would be 1,050 from the 1,200 line. Let's call that our line in the sand for now.

Meanwhile, as I noted in our Live Member Chat room – we're comfortable going long on the Russell Futures (/TF) over the 1,150 line, looking for a nice run back to 1,080 but THRILLED with 1,060 – as that's already +$1,000 per contract! Failing to get back over 1,060, however, will be a sign that there's likely more downside to come.

Of course, thanks to the 5% Rule™ and our Big Chart, we knew to get bearish as soon as 1,200 failed on the Russell, way back in July. In fact, on June 30th, I titled our morning post: "Monday Misgivings – CASH!!! Is King as we Begin Q3" saying:

I'm NOT going to depress you.

If you want to be depressed about the market, check out my Twitter Account, where I posted our Morning Alert to Philstockworld Members (and you can become one of those HERE) in which I aired my concerns with the Global Macros.

Last week we discussed the various forms of market manipulation that are keeping us at record highs and, on Friday, I asked "How Many Countries are Faking Economic Data?"

…While we can keep dream-walking for quite some time (especially with all the drugs the Fed is giving us), there's always the danger that people will eventually wake up so keep one hand firmly on the exit door at all times. On Friday we discussed a DXD hedge in the morning post and, for our Members, we had TZA (now $14.19) hedges as well and, as I've mentioned, we are VERY LIGHTLY INVESTED in our major portfolios.

If the crash never comes, then we have plenty of cash to buy things with but, if it does – then we have plenty of cash to buy things with. That's a win-win!

TZA is now at $19.23, up 35% from that post and the TZA spreads we identified using options are up 300-400% (they had October targets, in fact), as did our DXD spreads. So let's keep in perspective that this is the sell-off we've been expecting based on the exact same Big Chart and the exact same 5% lines we've been tracking all year. So far, this is just a CORRECTION – as in the market is coming back to the CORRECT levels (as opposed to overbought).

The bad news is, if you foolishly bought overbought positions in the "rally" and are now HOPING (not a valid investing strategy) that they will "come back" – you may not be getting that wish. Based on what's real in the Global Economy, these are probably the right prices for equities. In fact, Members have been asking about a lot of "bargain" stocks in the past week and, more often than not – they are still not cheap enough – yet.

The bad news is, if you foolishly bought overbought positions in the "rally" and are now HOPING (not a valid investing strategy) that they will "come back" – you may not be getting that wish. Based on what's real in the Global Economy, these are probably the right prices for equities. In fact, Members have been asking about a lot of "bargain" stocks in the past week and, more often than not – they are still not cheap enough – yet.

Our current drop, from mild consolidation on the way down for our indexes is generally around 4% in the last 3 market sessions. What we need to see is weak bounces (1%) off of these lines which will be (try to follow) a strong bounce (2%) off the -5% drop we never hit as well as being a weak bounce (2% total) off the larger 10%(ish) drop. Or to put the whole thing in numbers:

- Dow 17,200 (long-term levels ignore spikes) less 10% is 15,480. The weak bounce line is a 20% retrace of that 1,720-point drop (which hasn't happened yet), so +344 to 15,824 and a strong bounce is another 344 unit up to 16,168. So, if the market is to be stabilizing, 16,168 should hold.

- S&P 2,000 is the general top so easy math says 1,800 is the -10% line and the 200-point drop means 40-point bounces to 1,840 (weak) and 1,880 (strong). At the moment, the S&P is just over that strong bounce line and holding it will be a bullish sign.

- Nasdaq topped out at 4,600 and 4,140 is the -10% line which makes for 92-point bounces to 4,232 (weak) and 4,324 (strong). Yesterday, we finished just below weak and need to take it back quickly or we'll have to lower our expectations.

- NYSE 11,000 is a fat enough line to round off to and it was also our Must Hold (it didn't), whose failure kept us skeptical of the narrow market rally all along. That makes 9,900 the -10% line – just as it is on our Big Chart, so that's easy! Bounces off the 1,100-point drop would be 220 points each to 10,120 (weak) and 10,340 (strong), we finished last night at 10,166 – barely hanging on.

- Russell topped out at 1,200 and then it dropped to 1,107 (-7.75%) and then recovered to 1,183 (-1.5%) and now down to 1,050 (12.5%). This is, at the moment, our most critical index because, IF WE ARE DONE GOING DOWN – then 1,050 MUST HOLD. With the 150-pont drop from the top, we're looking for AT LEAST a weak bounce to the 10% line at 1,080 and then a stronger bounce to 1,110. If we don't accomplish them this week – look out below!

Sorry I don't have better news than that for you but, if we assume that our Must Hold levels were, in fact, the correct Fundamental levels for the indexes, then we can expect to see a consolidation pattern as much as 10% below those lines and that means that any stock that is still trading over its 200 dma is probably still not a good buying opportunity.

Sorry I don't have better news than that for you but, if we assume that our Must Hold levels were, in fact, the correct Fundamental levels for the indexes, then we can expect to see a consolidation pattern as much as 10% below those lines and that means that any stock that is still trading over its 200 dma is probably still not a good buying opportunity.

As you can see from Dave Fry's McClellen Chart, we are HOPEFULLY hitting an oversold condition although, as you can see in July, we can get more oversold than this. Either way, those -12.5% lines MUST HOLD and then we MUST get quick bounces back to at least our weak bounce levels by the end of the week (options expiration on Friday). If not, we'll start looking for the lower end of our trading range and will place our bets accordingly (see yesterday's post for some great hedging ideas).

We'll see how the day goes and we'll hold a LIVE Trading Webinar at 1pm today, where we'll review our levels and look for some new opportunities on both sides of the market. Our expectations for this morning were to end the dump with a blow-off bottom but we already had nice volume yesterday and a big dump – so hopefully not too much more damage before we turn up.

Be careful out there.