And up we go again!

And up we go again!

Fortunately, as PSW, we are able to calmly view the action with bemused detachment because we are in CASH!!! and don't give a damn what the market does from day to day.

Meanwhile, there are plenty of opportunities to make money off the up and down action, like the call I made yesterday, right in the morning post, to short the S&P Futures at 2,105, which paid $1,150 per contract at 2,082 by 3:30 – not bad for a day's work.

For the non-Futures players, we also mentioned the FXI June $50 puts, which opened at $1.45 and finished the day at $1.82 – up 25% for the day!

For the non-Futures players, we also mentioned the FXI June $50 puts, which opened at $1.45 and finished the day at $1.82 – up 25% for the day!

Oil only fell from $60.45 to $60.20 at first ($250 per contract) but, in our Live Trading Webinar, we caught a great move down from $61 all the way back to $60.45 for a $550 per contract improvement and this morning, we jumped in short again on /CL (Oil Futures) at $62 and already caught our first $500 gain, down to $61.50 – looking for a reload as we head into the inventory report at 10:30. Hopefully, we'll get another nice intra-day spike to short into (we can also go long at $61.50 while we wait).

This kind of flexibility comes from being in a CASH!!! position. We still have plenty of opportunities to add positions (a Top Trade Alert was issued just this morning on Coffee) and, even as I'm writing this (8:15 am, EST), the Dollar is once again being pushed down in order to engineer the LOOK of a rally in the indexes and commodities – once again looking to steer the sheeple back into the market so Cramer's buddies can dump their shares on them.

This kind of flexibility comes from being in a CASH!!! position. We still have plenty of opportunities to add positions (a Top Trade Alert was issued just this morning on Coffee) and, even as I'm writing this (8:15 am, EST), the Dollar is once again being pushed down in order to engineer the LOOK of a rally in the indexes and commodities – once again looking to steer the sheeple back into the market so Cramer's buddies can dump their shares on them.

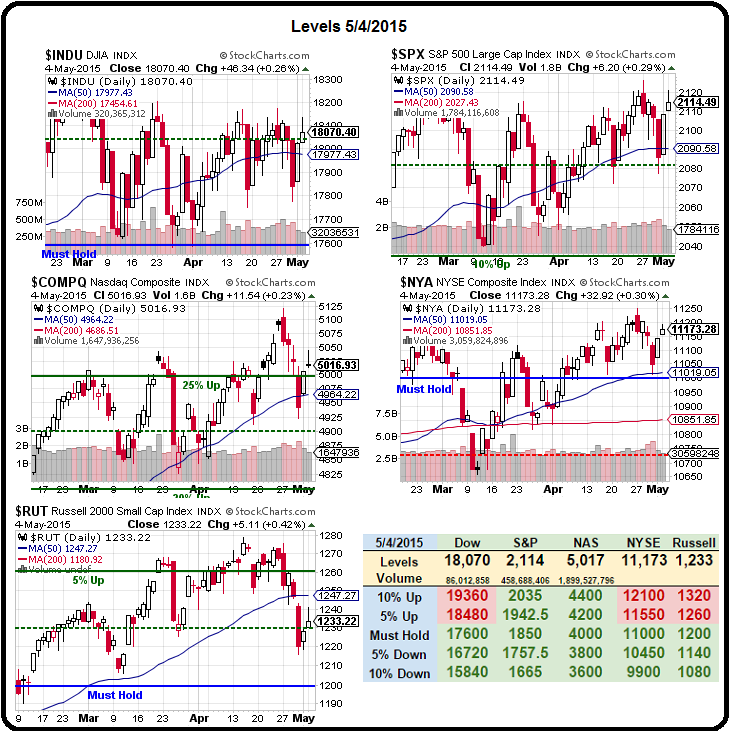

Today, we're not going to be the least bit impressed by anything less than the strong bounces predicted by our 5% Rule™, which are:

- Dow 17,950 (weak) and 18,000 (strong)

- S&P 2,096 (weak) and 2,102 (strong)

- Nasdaq 4,975 (weak) and 5,000 (strong)

- NYSE 11,080 (weak) and 11,110 (strong)

- Russell 1,220 (weak) and 1,225 (strong)

As you can see from the Big Chart, the 50-day moving averages have held up so far, except on the Russell – which failed and now won't really impress anyone until it climbs back over. Usually, we need 3 of 5 indexes to confirm a move but I'd say that, if ANY of the other indexes fail their 50 dma before the Russell retakes 1,247 – that's going to be a clear signal of a very bearish turn in the indexes.

We went over our hedges in yesterday's live webinar, so I won't bore you with them here. The S&P and the Dow are, so far, our lagging indexes to the downside, both 2.5% higher than the Russell so, if you think you need more hedges – those are the indexes I'd concentrate on.

We went over our hedges in yesterday's live webinar, so I won't bore you with them here. The S&P and the Dow are, so far, our lagging indexes to the downside, both 2.5% higher than the Russell so, if you think you need more hedges – those are the indexes I'd concentrate on.

Our Short-Term Portfolio is probably not bearish enough as we only finished the day yesterday up 123.6%, which was flat to the weekend's review. Ideally, we should have made some money but we were too short on oil, which is having a good week. Fortunately, we're bullish on the oil sector in the Long-Term Portfolio, and that's posted a nice $5,200 gain in two trading days – so the week isn't a total waste.

Of course we're not going to have dramatic gains since we're 90% in CASH!!! (have I mentioned how much I love cash lately?) but thank God we're not dealing with the drama of the German Bond Market, where rates have jumped 438% in less than 30 days.

Sure rates started off at 0.1%, which was idiotically low – but that didn't stop idiots from buying those bonds and those idiots are getting badly burned on that massive spike higher. German inflation numbers are coming in hotter than expected (by Economorons, not by us!) and now there's talk of forgiving some of Greece's debt, which effectively takes German money out of circulation – because they will NEVER get it back!

That's caused BUNT, the 3x German Bond ETF, to fall 13% (so far) in two weeks, shocking complacent investors who thought these things only go up.

Meanwhile, Germany's Manufacturing PMI hit a 2-month low this morning, falling back to 54.1 but that's still expanding. France, on the other hand, was only 50.6 – barely holding it's ground despite gargantuan EU stimulus. In fact, when you consider that this is the first month of Draghi's $70Bn monthly stimulus package – it's very scary that the Composite PMI for the Eurozone FELL from 54 in March to 53.9 in April. Not much of a fall, but why should there be a fall at all?

“Growth in Germany remained reasonably robust, but the weakening also highlights how firms need to remain focused on competitiveness, especially in manufacturing, where export growth remains worryingly meager despite the weaker euro.”

“France, however, saw growth slow to near stagnation, suggesting the government needs to worker harder to boost competitiveness and lift confidence among both business and consumers if France is not to be left behind in the euro area’s recovery."

China's PMI was already pathetic and the rest of Asia was not picking up the slack so where exactly is this supposed demand for oil coming from? Well, to sum it up in a nutshell – it's nothing but fake, Fake, FAKE orders at the NYMEX where there are currently 383,780 1,000-barrel contracts ordered for delivery to Cushing, OK in June.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Jun'15 | 60.72 | 62.08 | 60.62 | 62.00 |

08:52 May 06 |

– |

1.60 | 64886 | 60.40 | 383780 | Call Put |

| Jul'15 | 61.74 | 63.12 | 61.71 | 63.06 |

08:52 May 06 |

– |

1.56 | 12777 | 61.50 | 264041 | Call Put |

| Aug'15 | 62.40 | 63.68 | 62.28 | 63.61 |

08:52 May 06 |

– |

1.50 | 5190 | 62.11 | 84134 | Call Put |

| Sep'15 | 62.89 | 64.06 | 62.80 | 63.95 |

08:52 May 06 |

– |

1.41 | 6207 | 62.54 | 154877 | Call Put |

| Oct'15 | 63.08 | 64.36 | 63.04 | 64.26 |

08:52 May 06 |

– |

1.32 | 4233 | 62.94 | 83990 | Call Put |

| Nov'15 | 63.49 | 64.73 | 63.44 | 64.63 |

08:52 May 06 |

– |

1.27 | 3101 | 63.36 | 58697 | Call Put |

| Dec'15 | 63.95 | 65.09 | 63.81 | 64.97 |

08:52 May 06 |

– |

1.22 | 11031 | 63.75 | 211814 | Call Put |

| Jan'16 | 64.48 | 65.27 | 64.48 | 65.20 |

08:52 May 06 |

– |

1.16 | 1328 | 64.04 | 56042 | Call Put |

The problem with ordering almost 400M barrels of oil for delivery to Cushing in June is that Cushing only has capacity for 50M barrels and, by the way, it's full. Adding 400M barrels to Cushing's stockpile would give us 100M weekly builds on the inventory reports – where just 5M extra barrels can send oil crashing down.

So, of course, all of those FAKE orders need to be cancelled but the contracts expire on May 20th, which means the Fakers trading at the NYMEX have just 10 days to cancel 383,000 contracts or pay to roll them to longer months. That can, and will, lead to some exciting volatility over the next couple of weeks and, at the moment, we're accepting those fake orders to buy oil at $62 by pretending we have oil to sell and shorting those contracts – we'll see who breaks first!