It's the plot of "A Mad, Mad, World" and also the chart pattern we're getting as the S&P 500 makes yet another MIRACULOUS recovery off our Must Hold Line at 1,850. The 2,000 line is where the rubber hits the road and it's 8% over 1,850 and halfway back to our highs but, as you can see from our chart – there are A LOT of resistance lines bunched up in that area.

Our expected strong bounce line for the S&P was 1,950 (see yesterday's post), so that's no surprise and the Dollar is down 1% so add 19 more points and that's 1,970 without even overshooting the mark so no shocker at all to see us testing 2,000 but going over 2,000 is going to be another matter entirely.

For one thing, for the S&P to get over 2,000, the DAX has to get over 10,000 and, as you can see, we're right on that line now with a 1% gain on the day – capping off a 6.4% run from last week's low at 9,400. So, if the DAX is having trouble at 6.4%, why do we think the S&P will breeze over significant resistance at 8%?

If you are going to be a TA person – those are the kind of questions you should be asking yourself. As a Fundamentalist, however, I would ask you how any of this is happening when we just got TERRIBLE Industrial Output reports from Germany (-1.2%) and Spain (-1.4%). It is especially troubling for Germany, where leading Economorons predicted a gain of 0.2% because – well because they are clueless practitioners of a voodoo profession.

When are Economists (and Investors) going to wake up to the concept that the Global Economy is WEAK and still essentially in a recession – the one that never ended but has been papered over by TRILLIONS of Dollars in stimulus that has faked growth for 6 years. Like the proverbial dead parrot, this economy wouldn't go "voom" if you put $4Tn into it – and the Fed has proven that point – as has the BOJ, the PBOC, the ECB, RBI, SNB, ETC… This is an EX-ECONOMY!!

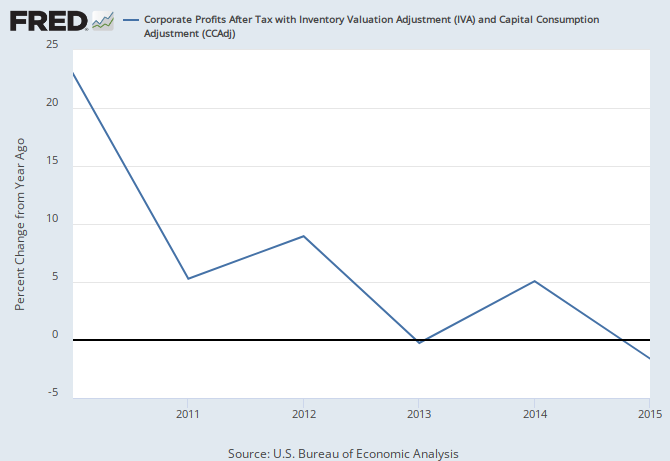

Nowhere is this more evident than in this chart of Corporate Profits (thanks Naybob) from the St Louis Federal Reserve. This is the no-BS way to look at the problem and, as you can see – it's a pretty major F'ing problem!

Nowhere is this more evident than in this chart of Corporate Profits (thanks Naybob) from the St Louis Federal Reserve. This is the no-BS way to look at the problem and, as you can see – it's a pretty major F'ing problem!

Those profits are trending to NEGATIVE growth in 2015 and we'll see what kind of shock and awe we get in Q3 but how, How, HOW can you reconcile this chart with a 100% increase in stock prices over the same period? At some point – something has to give so either Corporate Profits start catching up to the runaway Market Valuations or the Market Valuations may begin to come down to match the Corporate Profits.

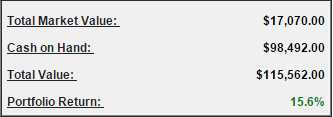

When will this happen, you may wonder? Well we've been layering on our shorts into this rally as our Option Opportunities Portfolio gained another $1,200 (1.2%) yesterday, finishing the day up 15.6% and we're not even done with our second month yet! We have similar silly gains in our other three Member Portfolios and, in our much larger STP/LTP paired portfolios, we added the following aggressive hedge using the ultra-short Russell ETF (TZA):

When will this happen, you may wonder? Well we've been layering on our shorts into this rally as our Option Opportunities Portfolio gained another $1,200 (1.2%) yesterday, finishing the day up 15.6% and we're not even done with our second month yet! We have similar silly gains in our other three Member Portfolios and, in our much larger STP/LTP paired portfolios, we added the following aggressive hedge using the ultra-short Russell ETF (TZA):

- Buying 20 TZA April $46 calls for $10 ($20,000)

- Selling 20 TZA Jan $55 calls for $4.85 ($9,700)

We did that one at 3pm yesterday – as the Russell was around 1,135 – so it should be good this morning if the Futures hold up. That's net $10,300 for $18,000 of protection but, of course we have a time advantage with our longs so this is more like a trade in progress where we're selling a lot of premium in step one to help pay off our longer position. Note that the April $70s are $5, so our protection is really way more than $9 because, if TZA does head higher – we'll roll to a much higher strike and widen our spread.

We also took a short play on oil Futures (/CL) as well as the ETF (USO) as oil ran up to test $49.50 and this morning I sent an Alert to our Members outlining some good spots to short the Futures. I felt certain enough about that one to Tweet it out as well – so you can check the link here (and follow me if you want to be on top of these things).

We also took a short play on oil Futures (/CL) as well as the ETF (USO) as oil ran up to test $49.50 and this morning I sent an Alert to our Members outlining some good spots to short the Futures. I felt certain enough about that one to Tweet it out as well – so you can check the link here (and follow me if you want to be on top of these things).

If you want to know how to hedge against this drop, I can only refer you to the same "Hedging for Disaster" article we recently reviewed. Our last round of Futures shorts gained over $25,000 in fairly short order and, as long as you keep tight stops above – then the risk/reward of catching a move down is, as the Donald likes to say – HUGE!!

I'm not trying to be all doom and gloomy – just realistic. The IMF just cut their Global Growth Forecast for the 4th time in 12 months yet the market is at record highs again? Come on – that's simply not realistic! The only reason we're still up here is that things are so bad that investors think there will be yet another round of free money showered down upon us – particularly from China, which re-opens for business this evening after a week-long holiday.

I'm not trying to be all doom and gloomy – just realistic. The IMF just cut their Global Growth Forecast for the 4th time in 12 months yet the market is at record highs again? Come on – that's simply not realistic! The only reason we're still up here is that things are so bad that investors think there will be yet another round of free money showered down upon us – particularly from China, which re-opens for business this evening after a week-long holiday.

We'll probably get a nice pop when the Shanghai opens as global markets are up 5-8% since they closed just a week ago – so they have a lot of catching up to do but that is exactly the kind of excitement we'll be looking to short into (FXI).

We also have the Fed minutes tomorrow and people will read into that what they will but, FUNDAMENTALLY, it's still a very good time to be in CASH!!!, or at least well-hedged.

Be careful out there.

"

"