PSW features the most important and most interesting news from around the web every day, all day. If you missed it, it's probably in our Market News section. And if you are looking for non-mainstream, provocatively narrated news, we feature Zero Hedge on PSW right here. For in-depth market, economic and political commentary, visit our Favorites section. And, of course, for Phil's daily commentary and stock option ideas, visit our home page.

Financial Markets and Economy

This is what will happen when the Fed raises rates (Business Insider)

St. Louis Fed President James Bullard stopped by Business Insider to talk about the potential economic consequences of higher interest rates.

.png) The largest takeover of the year could be about avoiding US taxes (Business Insider)

The largest takeover of the year could be about avoiding US taxes (Business Insider)

Drug giants Pfizer and Allergan are in talks to merge.

If succesful, the deal could be the largest this year. Allergan has a market value of about $113 bilion.

It could also offer Pfizer something the US drugmaker has been after for a while – a way to move overseas and slash its tax bill.

BofAML: Markets Are Once Again Mispricing Tail Risk in the Credit Market (Bloomberg)

Bond bulls seeking a scare just two days before Halloween need look no further than Bank of America Merrill Lynch, which offers up some financial crisis-era parallels for investors in junk-rated U.S. corporate debt.

Mario Draghi is demonstrating hubris, and he's leading the ECB down the road to financial catastrophe (Business Insider)

Albert Edwards is going after European Central Bank president Mario Draghi.

The super-bearish Societe Generale strategist is not certain that Draghi can deliver on his promise to do "whatever it takes", like he said in 2012, to lift demand and stimulate spending in the euro area.

Nigeria Risks Investment It Can't Afford to Lose With MTN Fine (Bloomberg)

Nigeria’s government is at risk of scaring off investors it can’t afford to lose after imposing a $5.2 billion fine on MTN Group Ltd., the nation’s biggest mobile-phone company, that analysts say is excessive.

MasterCard reports a fall in profit due to higher costs (Business Insider)

MasterCard reports a fall in profit due to higher costs (Business Insider)

Payments network operator MasterCard Inc <MA.N> reported a 3.8 percent drop in quarterly profit, as operating expenses rose 8.5 percent.

Net income fell to $977 million, or 86 cents per share for the third quarter ended Sept. 30, from $1.02 billion, or 87 cents per share, a year earlier.

U.K. Bonds Drop for 2nd Day as Fed Revives BOE Rate Speculation (Bloomberg)

U.K. government bonds fell for a second day, pushing two-year gilt yields up the most in almost three months, after Federal Reserve officials resurrected speculation they will raise U.S. interest rates in December, a move many investors view as a precursor to a liftoff by the Bank of England.

Ally Financial third-quarter profit falls 37 percent (Business Insider)

Ally Financial third-quarter profit falls 37 percent (Business Insider)

Ally Financial Inc <ALLY.N>, the largest U.S. auto lender, reported a 37 percent fall in quarterly profit as it made less money from its automotive and dealer financing business.

Of Four Traded Central Banks, Greece's Is Beating Them All (Bloomberg)

Here is a little-known fact: Greece’s central bank is traded, and it’s beating its peers.

Shell profits slump after huge write-offs (Business Insider)

Shell profits slump after huge write-offs (Business Insider)

Royal Dutch Shell <RDSa.L> on Thursday reported a sharp drop in third-quarter profits on the back of low oil prices and a hefty $8.2 billion charge which included write-offs in Alaska and Canada.

Shell's current cost of supplies (CCS) earnings excluding identified items, the company's definition of net income, fell to $1.8 billion from $5.85 billion a year earlier and from $3.835 billion in the previous quarter.

Charting the Markets: A More Hawkish Fed Rattles Investors (Bloomberg)

Two-year treasury yields rise for a second day, the New Zealand dollar falls and Nokia shares jump the most in two years.

London and Hong Kong Facing Housing Bubble Risk, UBS Says (Bloomberg)

London and Hong Kong are the cities most at risk of a housing bubble as real estate begins to look overvalued, according to UBS Group AG.

Glencore to Invest $950 Million Upgrading Zambia Copper Mine (Bloomberg)

Glencore to Invest $950 Million Upgrading Zambia Copper Mine (Bloomberg)

Glencore Plc plans to invest $950 million over three years to expand operations at its Mopani Copper Mines as part of a plan to refurbish assets and lower production costs in Zambia.

The Swiss mining company last month announced it’s halting production for 18 months in Zambia, Africa’s second-largest copper producer, in response to a drop in prices for the red metal.

PetroChina Third-Quarter Profit Drops 81% Amid Oil's Plunge (Bloomberg)

PetroChina Co., the countrys biggest oil and gas producer, posted an 81 percent slump in third-quarter profits, missing estimates, as a plunge in crude prices punished revenues.

German Bonds Fall First Time in 4 Days as Fed Hints at 2015 Move (Bloomberg)

Euro-area government bonds fell, following a selloff in U.S. Treasuries Wednesday, after the Federal Reserve revived speculation it will raise interest rates in December.

Barclays Investment Bank Profit Climbs 12% on Equities Income (Bloomberg)

Barclays Investment Bank Profit Climbs 12% on Equities Income (Bloomberg)

Barclays Plc, the second-biggest U.K. lender, said third-quarter profit at its investment bank rose 12 percent as income from advising companies on deals and managing bond sales increased.

Pretax profit rose to 317 million pounds ($483.7 million) from 284 million pounds a year ago, the London-based bank said in a statement Thursday. Investment-banking fees climbed 22 percent and equities income gained 12 percent, while operating expenses were little changed at about 1.3 billion pounds.

U.S. Economy Grew at 1.5% Rate in Third Quarter (Market Watch)

U.S. Economy Grew at 1.5% Rate in Third Quarter (Market Watch)

Despite still-healthy spending by consumers, the American economy slowed significantly last quarter, the government said Thursday.

At an annualized rate of 1.5 percent, which was in line with analysts’ expectations, the tempo of growth in July, August and September represents a marked drop from the 3.9 percent pace of expansion in the spring.

Danske Says Profit Rose 12% Last Quarter After Cost Cutting (Bloomberg)

Danske Bank said profit rose 12 percent in the third quarter as Scandinavias second-biggest lender cut costs and reversed some impairments.

Barclays Third-Quarter Drops 10% as McFarlane Squeezes Out Costs (Bloomberg)

Barclays Third-Quarter Drops 10% as McFarlane Squeezes Out Costs (Bloomberg)

Barclays Plc said it doesn’t expect conduct charges to drop anytime soon after rising costs prompted Britain’s second-largest lender to cut its profitability target for 2016. The shares slumped.

The ‘extreme’ risk in chasing this rally higher (Market Watch)

The ‘extreme’ risk in chasing this rally higher (Market Watch)

The bears haven’t flipped bullish, even after Wednesday’s Fed-fueled rally, which has thrust the Dow industrials nearly back into the green for the year.

“Those who are chasing Goldilocks on declining earnings, decelerating economic data and high valuations in the 7th year of zero interest rate policy are exposing themselves to extreme levels of risk,” warns JonesTrading’s Mike O’Rourke, who’s been bearish for a while, in his latest note. “Goldilocks” generally refers to a not-so-hot economy with a rising stock market — what we’ve had for years.

BT Earnings Fall on Higher Investment in TV Sports Content (Bloomberg)

BT Earnings Fall on Higher Investment in TV Sports Content (Bloomberg)

BT Group Plc’s earnings fell last quarter after the U.K.’s biggest broadband provider boosted spending on exclusive rights to broadcast high-profile soccer games to attract pay-TV customers.

Adjusted earnings before interest, taxes, depreciation and amortization fell about 1 percent 1.44 billion pounds ($2.2 billion) in the three months ended September, the London-based company said in a statement Thursday. That compares with the 1.42 billion-average of estimates compiled by Bloomberg. BT added 106,000 TV customers in the period, compared with 60,000 in the preceding quarter.

Gold takes a hit as investors increasingly look for Fed hike in Dec. (Market Watch)

Gold takes a hit as investors increasingly look for Fed hike in Dec. (Market Watch)

Gold prices fell sharply on Thursday, a day after the Federal Open Market Committee left the door open to hiking interest rates at its December meeting.

“An absolutely enormous intraday turnaround has scuppered what looked to be a burgeoning rally once more. This is the second time in 4 sessions this has happened (the first being on Friday in the wake of the PBOC rate cut),” Richard Perry, analyst at Hantec Markets, in a note.

The traditional auto industry could beat Google on driverless cars (Bloomberg)

The traditional auto industry could beat Google on driverless cars (Bloomberg)

Keith Naughton has a Bloomberg Businessweek cover story about driverless cars and Detroit's efforts to keep up with Silicon Valley.

It's a fascinating read for one key reason: it vividly highlights the huge conceptual gap that exists between the traditional auto industry and the tech-centric disruptors, chiefly Google, with its self-driving vehicle.

Dollar declines after lackluster GDP report (Market Watch)

The dollar weakened against the euro Thursday, trimming gains from a day ago, after official data showed economic growth in the U.S. was lackluster during the third quarter.

The shared currency EURUSD, +0.3112% traded at $1.0948, up 0.2% from $1.0905 late Wednesday in New York.

Politics

Sanders says he'd remove marijuana from federal drug list (AP, Yahoo)

FAIRFAX, Va. (AP) — Vermont Sen. Bernie Sanders said Wednesday if elected president he would seek to remove marijuana from a list of drugs deemed illegal by the federal government, freeing up states to regulate pot like alcohol or tobacco

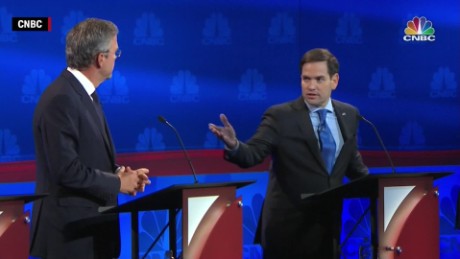

GOP debate: Marco Rubio, Jeb Bush brawl (CNN)

GOP debate: Marco Rubio, Jeb Bush brawl (CNN)

Marco Rubio shined on the debate stage Wednesday night — and the timing couldn't have been better.

The Florida senator brought his A-game to the third Republican presidential debate of the campaign season, sharply attacking his rivals and the media, swatting away criticisms about his candidacy, and bringing a personal narrative to the prime-time event sponsored by CNBC.

Technology

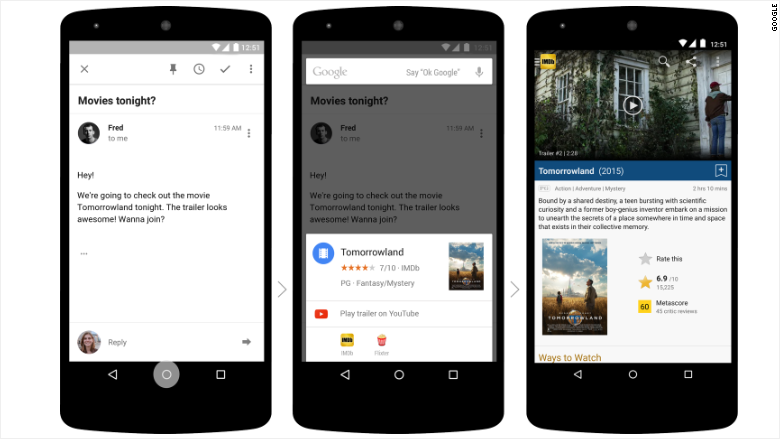

This could be Google's greatest invention (CNN)

This could be Google's greatest invention (CNN)

It does a whole lot of tasks — but you still have to work harder than you should to get stuff done.

Think about it: When your friend texts you to meet at 8 at a particular restaurant, it will probably take you three minutes to set up a calendar event for yourself.

Robots will replace our labor 'like the sun comes up in the morning' (Business Insider)

Robots will replace our labor 'like the sun comes up in the morning' (Business Insider)

From "Terminator" to "The Matrix," the idea of a robot revolution has established a place in the cultural lexicon for decades.

According to Ron Shaich, Founder and CEO of Panera Bread, there is a tech revolution coming, and it's going to be bad news for many workers.

Health and Life Sciences

More Evidence That Drinking May Raise Breast Cancer Risk (Medicine Net)

More Evidence That Drinking May Raise Breast Cancer Risk (Medicine Net)

A new study out of Europe supports the notion that drinking raises women's risk of breast cancer.

Researchers from five Spanish universities looked at data on more than 334,000 women aged 35 to 70, across 10 European countries. Nearly 12,000 of the women developed breast cancer over the study period.

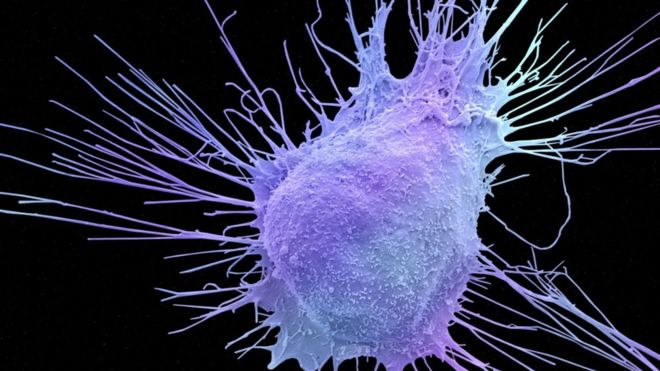

'Milestone' prostate cancer drug (BBC)

'Milestone' prostate cancer drug (BBC)

The first drug that targets precise genetic mutations in prostate cancer has been shown to be effective in a "milestone" trial by UK scientists.

The study, at the Institute of Cancer Research in London, took place on 49 men with untreatable cancer.

The drug, olaparib, had low overall success, but slowed tumour growth in 88% of patients with specific DNA mutations.

Our ancient ancestors may have slept better than you (CNN)

Our ancient ancestors may have slept better than you (CNN)

Our hunter-gatherer ancestors must have gotten more sleep than you. Before modern stresses and schedules and binge watching "House of Cards," humans were certainly getting at least eight hours of solid deep cave sleep, right? A group of scientists studying the history of human sleep patterns says dream on.

Life on the Home Planet

Buddhists push for Paris climate deal (BBC)

Buddhists push for Paris climate deal (BBC)

Senior Buddhists have called on world leaders to agree a new climate change agreement at a conference in Paris next month.

The 15 signatories, including the Dalai Lama, are urging politicians to completely phase out fossil fuels.