Courtesy of John at Bronte Capital

Note:

Note:

About ten minutes after I posted this blog Valeant terminated its relationship with Philidor.

The liability questions at the end of this post now have greater importance.

I have left the post unchanged for that announcement. Enjoy.

Original post:

Forgive a long post. The Valeant/Philidor/US Attorney situation is complicated. The pattern of this post will be to state both what we know and how we know it – and to explore theories around the edge of that knowledge. Because the underlying situation is complicated the post will unfortunately be detailed and at some points non-committal.

Almost anyone who has been following Wall Street will know that Valeant Pharmaceuticals, a large-cap and previously acquisitive pharmaceutical company, has been under pressure. They held a special conference call to answer concerns raised by Citron Research (a prominent individual short-seller), The Southern Investigative Research Foundation [SIRF] (see here and here), the Wall Street Journal (notably this article) and this blog. [If you haven't read Citron's article, Valeant — Could this be the Pharmaceutical Enron?, click here.]

These articles focuss on a specialty pharmacy (Philidor) which distribute almost entirely Valeant products, have close interchange with Valeant staff, and is quite large (targeting 1000 staff by the end of this year). This was never disclosed by Valeant prior to the SIRF article. The main sources for these articles were two court cases in California where a Philidor associate, another specialty company called Isolani was suing R&O – a small specialty pharmacy company in California.

The complete prior lack of disclosure about Philidor (which is clearly important to Valeant) allowed several wild theories to develop. Some of these theories (including theories I had) were wrong. Others are almost certainly correct. Some of these theories allege criminal activity by Philidor. Valeant has disclosed criminal investigations by two US Attorneys. If any of the criminal theories are correct it will be very bad for Philidor. Whether it is similarly bad for Valeant was one of the topics of the conference call and hence of this blog post.

The most prominent allegation in the various articles came from Citron Research. That allegation – that the tied specialty pharmaceutical companies are being used for channel stuffing is almost certainly false. Valeant spent a disproportionate amount of time on this allegation – perhaps at the expense of ignoring the problems identified by SIFR, the WSJ and me. [From Bronte Capital, see: Simple proof that Philidor has shipped drugs where it is not licensed, Valeant and its captive pharmacies: some questions, Some comments on the Valeant conference call].

Whatever: let's take the conference call seriously.

The more pertinent allegation is that Philidor is an artifice for defrauding insurance companies. This was inadequately addressed in the conference call. However it is the elephant in the room.

Valeant's defence was three-fold:

- Specialty pharmacies like Philidor are legal and several drug companies have them.

- Even if what Philidor did was illegal we are not responsible for them. Valeant argued they don't own them, don't appoint the CEO and are not in control. Besides Valeant are indemnified by them for any losses anyway.

- Even if there is a problem here Philidor is a low-single digit percentage share of our sales and hence it won't cause us much grief.

I am going to lay out the evidence in this post as we currently know it. Some of this comes from the work of Bronte and some is poached from other sources, including Roddy Boyd and SIRF, the WSJ, Propublica.

In Part 1, I detail what is a specialty pharmacy and why both drug companies and customers and doctors might like them and insurance companies hate them. I also discuss the sort of infractions they might commit and the lines that separate criminal activity from merely aggressive business practice.

In Part 2, I go through the evidence that Philidor might be on the wrong side of that line.

In Part 3, I discuss the separation between Philidor and Valeant – a separation I believe is questionable. Some of the evidence comes from our own research, some from the call and some from some excellent work done by the WSJ.

In Part 4, I detail the size of Valeant's non-traditional distribution models and how we might scale them. This produces data contrary to the data in the conference call. The scope of non traditional distribution at Valeant is much larger than bulls believe.

In Part 5, I detail how Philidor may be used to fake Valeant's accounts. I don't think this is Philidor's main purpose but it clearly is an issue and Mike Pearson (Valeant's CEO) did not answer a very precise question on this in the conference call.

After that there will be a brief summary.

Part 1: Describing the specialty pharmacy business – the good, the bad, the legal and the illegal

A specialty pharmacy is a pharmacy (usually but not necessarily) tied to a manufacturer which specialised in distributing classes of branded drugs. They are usually mail-order operations and operate over State lines. To operate they usually require a license in every State which they service.

There are several features of these pharmacies which are are common to most but not all of these.

- They specialise in branded drugs – and they offer the customer as smooth as possible a way to get reimbursed on those drugs. They generally offer excellent customer service. The customer normally discloses all their insurance details and pays a copayment. The refund claim is administered by the speciality pharmacy. In this case the specialty pharmacy or more likely the drug company bear the risk that the product will not get reimbursed. Customers do not need to deal with their insurance companies – a great advantage for some particularly if you are sick. Sometimes the copayment is waived or copay cards are administered. [If you unaware as to what copay card is look at this example from Jublia.]

- Because they are captured by the branded drug distributors they are very loathe to suggest cheaper generics. A typical example is a Valeant product called Onexton – an acne cream. Onexton is a mix of two well known treatments for acne – clindamycin phosphate and benzoyl peroxide. Both these products are available as generics at low cost. However the combination has a price of $478 per tube. If you went to your local pharmacy they would (if they were competent and unbiased) suggest you buy the two generics. However if you go to the captive specialty pharmacy you will be sold the expensive drug (and the cost will largely be borne by your insurance company).

- Specialty pharmacies are often very willing to waive copays and other charges to sell the drug. To put it mildly Valeant would be more interested receiving hundreds of dollars a tube for Onexton than actually collecting the copay. This is not limited to Valeant.

Valeant made a big deal of the quality of the service at the speciality pharmacies in their call. This is consistent with most (but not all) of the discussion on consumer chat boards.

Alas specialty pharmacies are also the easiest way to get someone to pay $400 for your branded skin cream containing only generic ingredients. That someone is an insurance company and the product is a rip-off.

Valeant spent considerable time in the conference call listing specialty pharmacies tied to other large pharmaceutical firms. They are legal.

The government tends to be more forgiving of one-off instances of waiving copayments for Medicare. [Big fines but not prison.] Systematically defrauding the US Government is however unwise. One-off instances can happen accidentally: sometimes patients will misrepresent their own insurance position and sometimes processes to ensure no copayment waiver happens are slightly sloppy.

That said – even waiving copayments for private insurance have sometimes been held to be breach of contract. There is a reasonable legal summary here. To quote:

Private insurers and the courts are not generally alarmed by occasional accommodations for individual patients with documented financial limitations. However, insurance carriers have successfully challenged the routine waiver of copayment obligations in the courts on numerous occasions.

Courts dealing with challenges to discounts of copayment obligations have been concerned with two basic issues. First, a provider who discounts established fees for some patients but not others, without a valid distinction for the differing treatment, can be subject to claims of false billing by a party not receiving the discount or consideration, including claims by insurance carriers. Second, the routine waiver of patient copayment amounts can be viewed as breach of contract. Almost without exception, insurers impose a contractual duty on providers to make a reasonable effort to collect applicable copayment amounts from patients, and benefits are only available when the charge for the service submitted by the provider is the actual, and the usual, reasonable and customary charge (URC). The reasoning in these cases is that the uniform discounting or waiver of patients’ copayment portion of a provider’s fee evidences that the provider really only intends to collect that portion of the fee which is not discounted, making it improper to claim that the fee is the full undiscounted fee.

Other things that a speciality pharmacy can do that are illegal is altering prescriptions so that cheaper generics can't be prescribed. If a doctor writes "dispense as written" on a script in most States it is illegal to dispense a medically identical generic. However if they do not write this the insurance company may insist on the generic. Given sales incentives (presumably with staff remunerated for getting payment from insurance companies) the incentive to write dispense as written onto scripts or to otherwise falsify doctor instructions is high. Warner Chilcott (a division of Allergan) was criminally convicted for (amongst other things) manipulating prior authorizations to induce insurance companies to pay for prescriptions of Atelvia. The fine however was not large ($125 million).

Fines for infractions at specialty pharmacies are not uncommon. Generally you reward specialty pharmacies for getting the product out the door and reimbursed by insurance companies. To the extent that you use cash incentives for the speciality pharmacy for getting reimbursement the staff of the specialty pharmacy have an incentive to cheat.

Whilst fines are common they are not usually ruinous. After all these are rarely systematic attempts at cheating insurance companies. A systematic attempt at cheating insurance companies will probably result in an enormous fine, criminal charges and executives in handcuffs. There were huge infractions at Arthrocare and the CEO went to prison – however they got the conviction on easier to prove channel stuffing allegations.

One recent case that is probably close to settling is against Novartis. The Government sought $3.3 billion in fines (and criminal sanctions) in a kick-back case involving Medicare and specialty pharmacies. To quote the Wall Street Journal:

The U.S. is seeking as much as $3.3 billion from Novartis AG in a suit claiming the company paid kickbacks to increase sales of two prescription drugs.

The government claims a group of specialty pharmacies submitted thousands of fraud-tainted reimbursement claims to Medicare and Medicaid for the two drugs, Exjade and Myfortic. It’s seeking damages and civil fines against the drugmaker in a case set to be tried in New York in November. The U.S. disclosed the amount of its demand in a court filing Monday.

The U.S. claims Novartis referred patients to the specialty pharmacies and paid kickbacks in the form of rebates to get the pharmacies to recommend the drugs to patients and to increase sales. The scheme violated the False Claims Act and Anti-Kickback Statute, according to the government.

In this case it was a fully external speciality pharmacy owned by Express Scripts which did Novartis' dirty work. Express Scripts settled (for $60 million) and the fact that the false claims were submitted by a third party did not save Novartis. Novartis is almost certainly cooperating in this investigation and they recently raised reserves on the eventual fine (but to a number considerably lower than $3.3 billion).

Insurance rejection as a more likely end-game for specialty pharmacies

Specialty pharmacy (especially in dermatology) is often a device for getting overpriced drugs reimbursed by insurance companies. It may be legal or it may not be, depending on the practices of the pharmacy.

But insurance companies fight back – especially if the pharmacy is particularly egregious. They either (a) stop paying or (b) pay an amount considerably lower than the list price of the drug.

There is good reason. After all in some cases (such as Onexton) the cheaper combination is medically equivalent. And besides from the insurers point of view this is barely a customer service issue. Usually the insured has received their (overpriced) drugs from the specialty pharmacy already. There is some evidence (below) that insurers were rejecting claims from Philidor prior to the exposure by Roddy Boyd. After the Philidor scandal this will become more common and at the time of writing the wholesale rejection of claims processed by Philidor had begun.

Part II – The nature of the problems at Philidor – have they committed crimes and are insurance companies withholding payment

Anyway the various California lawsuits mentioned the use of the network of specialty pharmacies (including R&O) was to deal with insurance companies rejecting claims. The idea is that if the insurance company is wary of paying Philidor claims (say insisting on an audit of each claim) Philidor staff just use another pharmacists identification number. The insurance company may be much less likely to audit a claim made on say a retail pharmacy in California.

This solution to insurance companies that were slow to pay claims was also discussed in a a recent (and fabulous) WSJ article. This relates to the period prior to the exposure of Philidor by Roddy Boyd and SIRF.

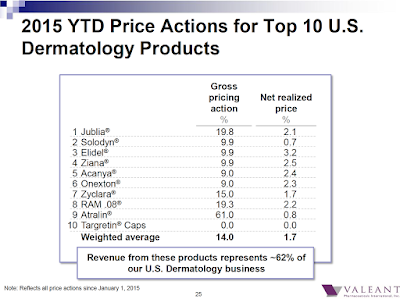

But we also have evidence to existing rejection problems given to us in the 3Q conference call. Here is a table of gross pricing action and net realised price for the dermatology business. [Remember the dermatology business is the business most dependent on specialty pharmacies.]

How is possible on average to get no increase in price having raised prices 61 percent? The answer I think is that insurance companies won't pay.

And why is Atralin so extreme? Well it is a branded $604.81 small tube of Vitamin A cream. And that is it.

Nobody in their right mind would buy it. It gets sold only because insurers pay – and having Philidor, a tied specialty pharmacy company – rather helps in getting this done.

But Atralin is just an extreme version of the need for specialty pharmacy.

- Jublia is a marginally effective treatment for toenail fungus. Paint it on daily for 48 weeks and and your chance of having toenail fungus cured rises from 5 percent to 18 percent with some chance of an adverse reaction and a cost to insurance companies of more than $8000.

- Solodyn is a slow release minocycline for treating acne. There are generics available.

- Ziana is another combination of two generics.

I could go on. This is not the collection of drugs a company gets from fantastic R&D. Indeed R&D has never been a major attraction of owning Valeant. Its a collection of drugs you get from fantastic – or maybe sneaky – marketing.

And it is the list of products that absolutely require insurers to pay because well informed consumers generally would not.

After the exposure of Philidor by SIRF, the WSJ, Propublica and this blog it was only a matter of time before insurers started rejecting claims more generally. As of writing both CVS and Express Scripts (amongst the biggest pharmaceutical benefits managers) have cut off Philidor.

Evidence for systematic problems at Philidor

I have no evidence that Philidor systematically waives copays for Medicare or other government funded insurance.

There is strong evidence Valeant waives copays systematically over the whole private-pay business. In the 3Q conference call Mike Pearson (Valeant's CEO) said this:

Looking at history, our commitment to patient assistant programs has grown at an annual compound rate of 128% from $53 million in 2012 to approximately $1 billion we expect to spend in 2016.

This is appoximately 8% of all revenue. Copay waiving must be near ubiquitous.

Since writing my first cryptic post I have received numerous stories of auto-ship refills with copayments waived.

As explained above almost without exception, insurers impose a contractual duty on providers to make a reasonable effort to collect applicable copayment amounts from patients, and benefits are only available when the charge for the service submitted by the provider is the actual, and the usual, reasonable and customary charge.

Philidor clearly does not do that.

The lack of a California license

There is one place where we can unequivocally say that Philidor skates very close to the letter of the law. Philidor was denied a license to be a pharmacist in California. I rang Philidor, they answered Philidor and they stated explicitly on the phone that they service the whole USA.

In addition, they are exploring partnerships with independent pharmacies on a contractual basis. Under these arrangements Philidor would provide the back-end services while the partners would run the front of the store. In the future we would anticipate that Philidor's growth plans will rely much more on expanding its network via partnerships. This strategy should allow Philidor to grow faster with fewer regulatory hurdles. This model is also much less capital intensive than acquiring pharmacies…

We understand that Philidor holds nonresident licenses in 45 states, the District of Columbia and its resident license in Pennsylvania. In the few states where it is not directly licensed, such as California, Philidor does not dispense products to patients. Philidor has agreements with affiliated pharmacies that have California licenses and those pharmacies have dispensed products to patients in California.

Gay Dodson, executive director of the Texas State Board of Pharmacy, said her agency would need to look into whether there was a connection between Philidor and Orbit Pharmacy, whose top official, James Fleming, is Philidor’s controller. Texas law allows people to set up corporations “as you wish,” she said, and if Philidor and Back Rank are fully separate entities, “I think we would have problems tying the two together and being able to take action with a different corporation, an entirely different corporation. We would have to really look at it.”

The latest WSJ article really is a stunner. Jonathan Rockoff (the journalist) has one of those wonderful definitive documents: he claims to have a Philidor training manual. I have not seen this manual and cannot judge first-hand what it contains. However – the evidence provided by the WSJ – and on the say-so of the WSJ – would be very useful in determining whether there was systematic fraud at Philidor.

If this manual tells staff how to deceive insurance companies then its a slam-dunk for systematic fraud.

Moreover this is all done across state lines using mail and wires. That would be a text book wire and mail fraud against a financial institution the penalty for which is up to $1 million per instance with no limit to the number of instances.

So here is what Rockoff says (and they are his sources and I have not seen the said manual).

If a health insurer wouldn’t work with Philidor Rx Services LLC, the pharmacy instructed staff to try again using the identification number of a partner pharmacy to secure payment. “We have a couple of different ‘back door’ approaches to receive payment from the insurance company,” a Philidor training manual said.

This is a scorcher of an allegation. Philidor has acquired a network of pharmacies (mostly former mum-and-pop operations). The allegation here is that if the insurance company rejects the claim originally you should just "borrow" the identification number of a "partner pharmacy" and resubmit the claim. The money quote is "we have a couple of different ‘back door’ approaches to receive payment from the insurance company". Does "back door" mean deception? If so there is a very big problem for Philidor.

Moreover the article from Jonathan Rockoff confirms work done by Bronte and The Skeptic. The Skeptic's take is better than mine. We know the UPS delivery details of 21,000 prescriptions administered by Philidor but marked using R&O's pharmacy identification number. These were not just shipped to California (as asserted by Mike Pearson in the conference call) but were shipped all over the USA and to states where neither Philidor nor R&O were licensed. The Skeptic has an analysis of all 21,000 prescriptions stripping data from UPS's website.

Using R&O's number to ship to states where Philidor was licensed but R&O was not looks like Philidor was shopping for a Pharmacist's number that did not prompt rejection from the insurance companies This is the allegation in the WSJ.

Deceiving an insurance company as to who filled the prescription also looks like it matches the definition of mail fraud. It is an artifice to obtain money from a financial institution using mail over State lines. Philidor pretended the script came from R&O whereas it really came from Philidor.

The fine in this instance – and this is just one specialty pharmacy "partner" amongst an undisclosed many would be greater than $10 billion. [It is against a financial institution and the penalty for mail fraud is a million dollars per instance and there are no limits to the number of instances. And there are more than 10,000 instances outside California where the administration was done by Philidor and the product was supposedly distributed by R&O.]

Whatever: if the prosecutors wish to take this seriously (and I suspect they will) this is enough to kill Philidor. Whether it is enough to bankrupt Valeant will depend on whether Valeant can successfully defend the notion from the conference call that it is not liable for Philidor misdeeds. I don't think they can – but that is discussed below.

Other possible misdeeds by Philidor

The Wall Street Journal hints at other misdeeds by Philidor.

A separate department at Philidor would seek insurance coverage. If the insurer asked a doctor to explain why the patient needed a costlier Valeant drug rather than a less-expensive alternative, Philidor employees would sometimes fill out the paperwork for the doctor, two of the employees said.

The WSJ leaves it as ambiguous as to whether this has been done with or without approval from the doctor. With approval from the doctor is legal. Without about approval from the doctor it is criminal and that behaviour has been prosecuted in the past.

Dispense as written fraud

Caroline Chen at Bloomberg News is stating she has acquired written instructions from Philidor to their staff to falsify "dispense as written" and other doctor instructions on the prescription. This is an allegation of criminal behavior:

A specialty pharmacy that fills prescriptions for Valeant Pharmaceuticals International Inc. has altered doctors’ orders to wring more reimbursements out of insurers, according to former employees and an internal document.

Workers at the mail-order pharmacy, Philidor RX Services LLC, were given written instructions to change codes on prescriptions in some cases so it would appear that physicians required or patients desired Valeant’s brand-name drugs — not less expensive generic versions — be dispensed, the former employees said. Typically, pharmacists will sell a generic version if not precisely told to do otherwise by a “dispense as written” indication on a script. The more "dispense as written" orders, the more sales for the brand-name drugmaker.

An undated Philidor document obtained by Bloomberg provides a step-by-step guide on how to proceed when a prescription for Valeant dermatological creams and gels including Retin-A Micro and Vanos is rejected. Similar instructions for changing the DAW indication are supplied for patients who are paying in cash.

I have not seen the training manual but if this training manual exists it is evidence of systematic fraud against insurance companies.

Part III – the separation of Valeant from Philidor

Valeant went to an unusual extent to hide their relationship with Philidor.

Philidor was first exposed publicly by the Southern Investigative Reporting Foundation. At this point Philidor was growing enormously fast (rising to about 1000 staff by this year end). Philidor however had a website registered to domains by proxy and no information as to ownership on Valeant's website or in any SEC filing. Moreover the California government went as far as alleging that Philidor had given false statements under penalty of perjury – seemingly to hide their ownership.

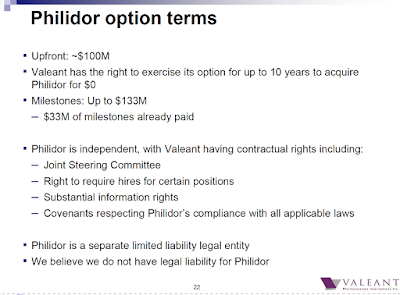

The headline from the call was that terms of the options involved and whether they do or don't "own" Philidor.

If you want a quirky take on it Matt Levine is clever as usual.

But in the presentation we discovered deniability had been built into the Philidor arrangements from inception.

Valeant says that they paid $100 million up front for an option to acquire Philidor at no consideration any time in the next ten years. They also are liable for milestone payments of up to $133 million.

This is a strange asset. Valeant can acquire Philidor for no consideration – but they seem not to own it. This is a sort of limbo: ownership but not ownership. This left Valeant with a very difficult line to thread which was to argue that they gave $100 million to something they did not control but they were not financially reckless. [We don’t control them but look at all these controls we have over them.]

Remarkably many accepted this rhetorical stunt.

The line of the conference call came from Valeant CEO Mike Pearson:

In terms of the zero dollar option value, I think it is legal and maybe it's unusual.

Mike Pearson thinks it is legal and knows it is unusual.

There were some prior indication of Philidor's existence. This is- from the 2015Q2 conference call is probably the strongest:

David Steinberg – Jefferies LLC – Analyst

Just wanted to follow-up on the Jublia question. You mentioned the change in the gross to nets, but did the — especially, did the number of scrips going through the specialty pharmacy improve? I think it was about 50% last time. Secondly, given the strength in some of your other derm products, Onexton and Luzu, what percent of those scrips are through your specialty pharmacy channels?

Ari Kellen – Valeant Pharmaceuticals International Inc – Company Group Chairman

Yes, the adoption through multiple specialty pharmacies continues. I think last time we said Jublia was around 50%. That trend continues. For derm overall, it varies by product, but it's around 40%.

And here we discovered that that for dermatology products specialty pharmacies were very important and the analyst thought that it was likely to be particularly important for Onexton and Luzu. We saw above why it would be particularly important with Onexton. Luzu like Onexton also has generic alternatives and would require insurance to get people to pay the high sticker price.

Even when asked directly Valeant did not reveal it "owned" its main specialty pharmacy.

Did Valeant need to disclose the ownership of Philidor and why did they hide it so thoroughly?

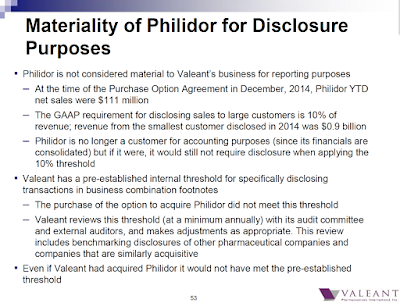

The short answer is Valeant probably didn't need to disclose Philidor but that hiding it was unusual. Here is the critical slide.

The observation was that Philidor – a $100 million option with cumulative net-sales was not material and therefore did not need to be disclosed.

I am not going to argue with their legal advice with respect to this. Mike Pearson "thinks" it is legal (as quoted above). However I will observe that Valeant does not always hide their acquisitions. During the same quarter (the fourth quarter of 2014) Valeant disclosed acquisitions down to $20 million in value. [Size of deal here, and one of many disclosures as to the acquisition here. This was one of many similarly small disclosed acquisitions.]

Moreover the list of subsidiaries Valeant has goes to subsidiaries much smaller than Philidor. For instance the attached list from the 10-K has tiny little subsidiaries – multiple subsidiaries – each with one corporate jet. But it does not mention Philidor. Philidor also met the definition of a subsidiary within Valeant's bank covenants – but I am not sure whether this obliged them to disclose them in SEC filings or only to the banks.

Hiding Philidor made me think prima-facie the company is doing something wrong at Philidor.

The company has an alternative explanation: they hid it because it was a competitive advantage.

Notwithstanding this Valeant has gone to lengths to legally distance itself from Philidor suggesting that they were aware there was a possibility that they were doing something wrong.

In the conference call they said they were

- indemnified by Philidor and

- able to walk away entirely.

Both those assertions are questionable. But these suggestions make it clear they were aware of the possibility of legal problems.

Agency fraud

Whilst Valeant has made a great deal of effort to legally separate itself from Philidor there are plenty of circumstances where such a separation will not stick.

Above I mentioned a case where Novartis is facing criminal charges (and a $3.3 billion fine) because of actions by its specialty pharmacy. In this case the specialty pharmacy is owned by Express Scripts. It is clearly legally separate.

The reason that Novartis is (potentially) liable for the actions of Express Scripts is that the incentives that Novartis gave Express Script induced the fraud and they were either reckless or knowing as to this inducement.

The issue is simple: was Valeant or senior members of staff complicit in crimes at Philidor? If so then nothing much will save Valeant.

Again the WSJ offers some fantastic colour. They indicate that senior staff at Philidor were in fact staff of Valeant acting under (mostly silly) false names. To quote:

Around the Phoenix-area offices of mail-order pharmacy Philidor Rx Services LLC, employees said they often ran into a friendly colleague named Bijal Patel who tracked prescriptions. But when the employees got an email from the colleague, they say he used a different name: Peter Parker, the alter ego of Spider-Man.

He was among a few workers at Philidor offices who went by one name in person and another in emails during the past two years, according to three former employees. Mr. Patel and the other people weren’t employed by Philidor, though the emails used a Philidor address, these people said. They were employees of drug company Valeant Pharmaceuticals International Inc.

As late as Sunday afternoon, the LinkedIn page for a man named Bijal Patel identified him as manager of access solutions at Valeant in Scottsdale, Ariz. Mr. Patel didn’t respond to requests for comment.

The Valeant employees were placed at Philidor while the pharmacy was in its infancy, to provide help on “structures and processes,” said a Philidor spokeswoman. She said in a statement that the Valeant employees set up separate Philidor email accounts, under “clearly distinguishable names,” to keep “their internal Philidor communications separate from the Valeant communications, primarily to reduce the risk of incorrectly sharing either company’s proprietary information.”

Bluntly senior employees of Philidor were in fact Valeant employees but were obscuring that tie by using the names of Peter Parker and other super-heroes. The Valeant employees (plural) set up "structures and processes".

This is going to be impossible to keep separate.

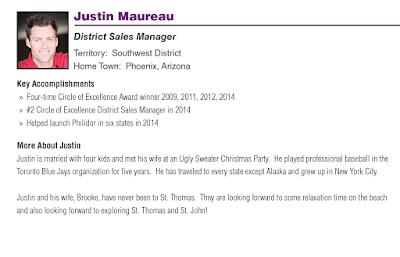

Further we know that Valeant rewarded its own staff for helping Philidor. Here is a corporate award to a Valeant sales staff member who "helped set up Philidor in six States".

Valeant made a big show in the conference call how they have an indemnity from Philidor. There is of course a likelihood that Philidor can't pay. After all it is only a mail order pharmacy (and it is hard to identify huge quantities of assets that can be turned into hard cash in a crisis). However as Philidor is consolidated into Valeant recovering from Philidor would have a limited effect on the GAAP accounts. [Contra: I guess Valeant could abandon Philidor, take the charge and then sue Philidor. However Philidor would have little business without Valeant so this is moot.]

Part IV – the size of Philidor and the specialty pharmacy channel

The specialty pharmacy channel is very important in dermatology in America. Above I quoted the second quarter conference call where they put the specialty pharmacy channel (including but not limited to Philidor) at 40 percent of sales and 50 percent of Jublia sales.

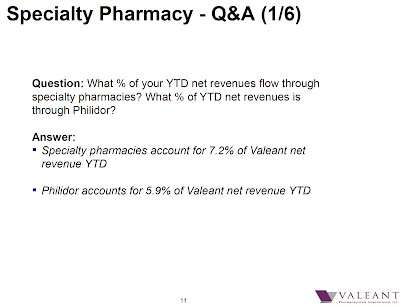

In the conference call however they downplayed this. They did not give the numbers versus dermatology – but rather against the whole business. Here is a typical slide:

To regular Valeant watchers this slide came as a shock. It downplayed the importance of Valeant's alternative distribution channels.

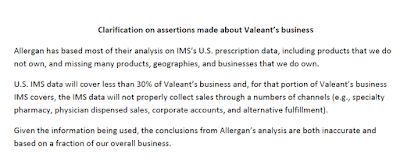

Only a year ago Valeant was telling us how big and important their alternative distribution was. If you remember Valeant was having the huge spat with Allergan. Allergan were saying Valeant's sales were falling and Valeant was saying that they were growing.

Allergan was using IMS data which is a standard data source in pharmaceuticals. Valeant stated outright that their sales were not falling and that the IMS data did not cover the bulk of their sales due to reliance on channels such as specialty pharmacy.

This critical text is here (and the source is here).

Now these slides were made when Philidor was much smaller than its current size and even then more than 100 percent of the growth of many of the business lines of Valeant came from specialty pharmacy and other non-traditional distribution channels. Net of non-traditional channels Valeant's sales were falling (Allergan was not misrepresenting the IMS data). Inclusive of non-traditional channels Valeant claimed their sales were rising.

Moreover we now know that Valeant has relationships with other specialty pharmacies. It also has a network of pharmacies that it may or may not be including in the Philidor numbers. [Honestly I don’t know – the disclosure here is very poor.]

The changing scope of Philidor

One observation that had me wondering was the changing scope of Philidor between the 3Q conference call and the special conference call.

In the 3Q conference call this is what Mike Pearson (Valeant's CEO) said:

Philidor, one of our specialty pharmacy partners, provides prescription services to patients across the country, and provides administrative services for our copay cards and is a dispensary that fills prescriptions. We have a contractual relationship with Philidor, and late last year we purchased an option to acquire Philidor if we so choose.

Specifically Philidor is one of several specialty pharmacy partners [which fits with observations above], dispensed scripts across the country [for which we know it is not licensed] and "provides administrative services for our copay cards".

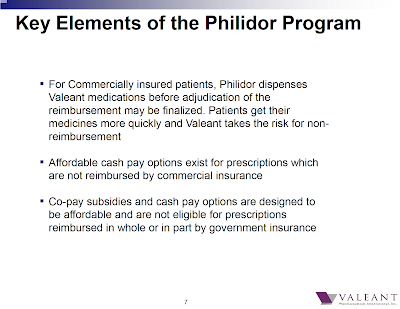

The administrative services for copay cards function had entirely disappeared by the special conference call. This is the key slide:

At no point does it say that Philidor administers Valeant's copay cards. Maybe the first conference call misspoke – but administration of the copay card is a core function.

Moreover the copay card program is critical to Valeant's relationship with other specialty pharmacies. If Philidor acts abusively then the entire non-traditional channel for Valeant is probably tainted.

I would really like to understand whether Philidor really does administer Valeant's copay system generally (and how that is run) or whether Mike Pearson misspoke in the 3Q conference call.

Part V: How Philidor could be used to fake Valeant's accounts

Since Philidor is consolidated into Valeant it cannot be used to fake Valeant's accounts by channel stuffing. Citron's core allegation is incorrect.

However there are other things that can be done.

As stated above Valeant is liable for up to $133 million of "milestone" payments (presumably if Philidor meets sales targets". These milestone payments would of course be capitalised into the cost of buying Philidor – but you could alternatively describe them as "sales support expense" in which case they should be deducted in the P&L statement.

There was an explicit question about this in the conference call and Mike Pearson did not provide a real answer. Here is the exchange:

David Common – JPMorgan – Analyst

Yes. Thank you very much for taking a fixed income question.

I wondered if you could tell us who got the $100 million and the potential $133 million in milestone payments. Is that basically money that is used by Philidor to stand the Company up? I wonder if the consideration really needs to be zero dollars for the purchase option. I normally think of some consideration to make that transaction legal…

J. Michael Pearson – Valeant Pharmaceuticals International, Inc. – Chairman and CEO

In terms of who received the money for the $100 million up front plus the first milestone payment, my understanding is that there are a number of equity owners. I think it's between 10 and 20, maybe more. And they would be whoever owns the equity of Philidor would've received the money.

And whether those individuals decided to contribute money into the operation I have no clue. I just know that we have not contributed any money into the operation. In terms of the zero dollar option value, I think it is legal and maybe it's unusual.

The answer to the question was "I don't have a clue".

We know however that Philidor was linked to Valeant from inception. The WSJ reported:

The Valeant employees were placed at Philidor while the pharmacy was in its infancy, to provide help on “structures and processes,” said a Philidor spokeswoman. She said in a statement that the Valeant employees set up separate Philidor email accounts, under “clearly distinguishable names,” to keep “their internal Philidor communications separate from the Valeant communications, primarily to reduce the risk of incorrectly sharing either company’s proprietary information.”

Now we know (from above) that Valeant provided support for establishing Philidor and that several Valeant staff work at Philidor (using names borrowed from comic books).

But Valeant paid $100 million for what was essentially a startup they founded. And they pay progress payments too.

If that is a capital expenditure it is a bizarre one. Valeant provided critical support for setting it up and after doing that they buy it.

The alternative in part is the $100 million was used to run Philidor and the $133 million of milestone payments also cover Philidor expense.

But in that case they should be expensed.

I guess this is something for the Ad Hoc Committee of the board to work out.

Effect of the consolidation of Philidor

Philidor can't be used for channel stuffing now but it could be used for channel stuffing before acquisition.

If it had been used for channel stuffing before acquisition then pre-acquisition Philidor would have owed a great deal of money (for inventory) to Valeant.

When it was acquired that internal loan would be cancelled and the consideration would have been added to goodwill.

That is a wonderful fraud and is in fact how Lernout & Hauspie (a very famous fraud) faked its accounts. Essentially fake earnings from stuffing Philidor would be turned into fake receivables – and then the receivables will be cancelled and turned into (unauditable) goodwill. I hope the accountants have covered base for this possibility.

The tell in the accounts would be a strange drop in receivables at the end of the 4Q of 2014. Alas Philidor was small relative to Valeant (then) and so it is not certain that this change would happen.

The evidence is against Valeant having committed this fraud. The trade receivables rose between 3Q and 4Q 2014.

In general I agree with the proposition in the conference call that Philidor has not been used to fake Valeant's accounts – although Michael Pearson's answer to a pretty direct question was disconcerting. He doesn't have a clue…

Summary

Citron's report into Valeant was easy to dismiss. Citron argued that Valeant used the undisclosed relationship with Philidor to goose the accounts through channel stuffing.

Valeant did a good job dismissing that though in the conclusion we learn there are some minor accounting issues with Philidor.

The more pertinent question though is whether

(a). Philidor is a device to systematically defraud insurance companies

(b). Whether the legal separation from Philidor is sufficient to immunise Valeant from liabilities and

(c). Whether this is big enough in Valeant to cause very adverse impacts on Valeant equity and debt holders.

The evidence is very strong for (a) and most the evidence has been provided by the Wall Street Journal. Insurance companies are taking no chances: several big companies are now no longer reimbursing claims submitted by Philidor.

It is very unlikely that the separation between Philidor and Valeant (as per question (b)) is sufficient to protect Valeant from liability. They appear to be joined at the hip with Valeant providing senior staff (who work under false names) and Valeant providing much advice when establishing Philidor.

Whether the Philidor problems are sufficient to cause major pain to shareholders (even bankruptcy) is unclear. Philidor itself is a high single-digit percentage of Valeant's sales (but it critical to the dermatology franchise). However Phildor also may administer the copay cards and they are critical to quite a lot of Valeant's business. Non traditional distribution is the difference between a shrinking Valeant (as per the IMS data) and Valeants assertion that it is growing.

I am intrigued as to how this plays out.

John