PSW features the most important and interesting news from around the web every day, all day. If you missed it, it's probably in the Market News section. And if you are looking for non-mainstream, provocatively narrated news and commentary, we feature Zero Hedge on PSW here. For in-depth market, economic and political commentary, visit the Favorites. And, of course, for Phil's daily commentary and stock option ideas, visit our home page.

Financial Markets and Economy

Oil Market Needs Another Month to Decide If the Rebound Is for Real (Bloomberg)

Even with oil prices possibly past the low point, and production falling from outside of OPEC, there aren’t enough signs to say a full recovery is in the works, Kuwait’s oil minister said.

Fox's adjusted revenue falls 6.3 percent (Business Insider)

Fox's adjusted revenue falls 6.3 percent (Business Insider)

Twenty-First Century Fox Inc reported a 6.3 percent fall in quarterly adjusted revenue as a lack of major movie releases weighed on its studio business.

Net income attributable to shareholders fell to $675 million, or 34 cents per share, in the first quarter ended Sept. 30, from $1.04 billion, or 47 cents per share, a year earlier.

Why retailers like customers who shop using layaway (Market Watch)

Why retailers like customers who shop using layaway (Market Watch)

While some people wait for Black Friday deals to start their holiday shopping, many customers started using layaway programs weeks ago. Those shoppers, experts say, have likely been to the store more than once to make payments since, creating a valuable form of customer loyalty.

Seventeen percent of shoppers will take advantage of a layaway program this holiday season, according to Deloitte.

UBS: Emerging Markets Are Entering 'A New and Dangerous Phase' in 2016 (Bloomberg)

Just like Christmas music, the year-ahead previews from Wall Street seem to come a little earlier each year.

Exclusive: Renault-Nissan boardroom fight masks French merger push (Business Insider)

Exclusive: Renault-Nissan boardroom fight masks French merger push (Business Insider)

French Economy Minister Emmanuel Macron is pressuring Renault

boss Carlos Ghosn to undertake a full merger with alliance partner Nissan on the government's terms, people with knowledge of the matter told Reuters. Macron's push sheds more light on a power struggle that burst into public view when the government, the French carmaker's biggest shareholder, raised its Renault stake in April to secure double voting rights.

Buying into the FANG stocks hype? Don’t invest in acronyms (Market Watch)

They are the rising powers in the world, set to dictate the terms of trade for the rest of the century. They can grow at incredible rates, churning out new fortunes in the process. They have unstoppable momentum, and any investor smart enough to back them can reliably expect to make a fortune. Certainly no portfolio should be without them.

Michael Kors Profit Tops Estimates as New Stores Boost Sales (Bloomberg)

Michael Kors Profit Tops Estimates as New Stores Boost Sales (Bloomberg)

Michael Kors Holdings Ltd., the seller of luxury handbags and clothing, posted second-quarter profit that topped analysts’ estimates as new retail locations boosted sales.

Earnings in the quarter through Sept. 26 were $1.01 a share, the company said in a statement on Wednesday. Analysts estimated 89 cents, on average.

Chesapeake Energy posts third quarter loss on $5.42 billion charge (Business Insider)

Chesapeake Energy posts third quarter loss on $5.42 billion charge (Business Insider)

U.S. natural gas producer Chesapeake Energy Corp <CHK.N> reported a quarterly loss, compared with a year-ago profit, as it wrote down the value of some oil and gas assets by $5.42 billion.

The company said net loss attributable to shareholders was $4.69 billion, or $7.08 per share, in the third quarter ended Sept. 30, compared with a profit of $169 million, or 26 cents per share, a year earlier.

Takata's Survival in Doubt as Top Customer Deserts Air-Bag Maker (Bloomberg)

Takata's Survival in Doubt as Top Customer Deserts Air-Bag Maker (Bloomberg)

For Takata Corp., reaching a deal with U.S. regulators was supposed to draw a line in the sand and begin the end of its years-long air bag crisis. Instead, its stock plunged by the most in a year and analysts covering the company are now openly questioning its chances of survival.

Wednesday began with Takata agreeing to a $70 million fine — equivalent to less than five days’ worth of sales…

What did we learn from the 2000 tech crash? Three investors share lessons (Market Watch)

What did we learn from the 2000 tech crash? Three investors share lessons (Market Watch)

The Nasdaq Composite Index hit an important milestone on April 23, when it finally rose above the all-time closing high set way back on March 10, 2000.

There is little question that, 15 years later, the landscape for tech stocks and investors is much better than it was then it was on March 10, 2000, just before the drop. Innovative tech companies tend to be in much better financial shape now than during the Internet boom of the late 1990s.

Time Warner Inc's quarterly revenue rises 5.1 percent (Business Insider)

Time Warner Inc's quarterly revenue rises 5.1 percent (Business Insider)

Time Warner Inc <TWX.N> reported an 5.1 percent rise in quarterly revenue, boosted by higher subscription fees at its premium TV service, HBO.

Net income attributable to Time Warner shareholders rose to $1.04 billion, or $1.26 per share, in the third quarter ended Sept. 30, from $967 million, or $1.11 per share, a year earlier.

Brazil's September Industry Output Falls Less Than Forecast (Bloomberg)

Brazil’s industrial output in September fell less than forecast by analysts, as the central bank maintains rates at a nine-year high in the face of recession.

U.S. stock futures edge higher after ADP, trade data (Market Watch)

U.S. stock futures edge higher after ADP, trade data (Market Watch)

U.S. stock futures inched modestly higher Wednesday after a pair of economic reports pointed to a slight slowdown in the labor market but a pickup in exports.

A report on private-sector employment showed 182,000 jobs were created last month, while September gains were revised down, according to the Automatic Data Processing Inc. Economists look at the ADP report to get a feeling of the official job gains data due on Friday.

This is how a central bank could kill off cash and bring in negative interest rates on your savings (Business Insider)

This is how a central bank could kill off cash and bring in negative interest rates on your savings (Business Insider)

Since the financial crisis, the world's understanding of economics has been undergoing a lot of rapid change.

Ideas that would have been considered crazy just a decade ago are now seen as much more likely.

One of those ideas is that central banks could bring in negative interest rates.

Standard Chartered Cash Call Making It a Target, Bernstein Says (Bloomberg)

Standard Chartered Plc’s planned $5.1 billion capital increase will make it a target for potential takeovers with losses on bad loans expected to decline next year, according to analysts at Sanford C. Bernstein Ltd.

Energy stocks, after rebounding from the mini-crash, are still poised for big gains (Market Watch)

Energy stocks have gone from worst to first — and may even extend gains in the months ahead.

Volkswagen shares are plunging (Business Insider)

Share traders are in for a busy day, there's lots of action as markets open on Wedensday.

Charting the Markets: Global Stocks Rise for Third Day (Bloomberg)

Global stocks are rising for a third day before Federal Reserve Chair Janet Yellen addresses Congress, in her first speech since the U.S. central bank signaled last week interest rates may rise in 2015. Investors are still digesting comments made by European Central Bank President Mario Draghi, who spoke at a cultural event in Frankfurt Tuesday evening. He said policy "will need to be re-examined" in December, leaving the door open for more easing…

Dollar gains as investors watch for U.S.-rate clues from Yellen (Market Watch)

Dollar gains as investors watch for U.S.-rate clues from Yellen (Market Watch)

The dollar rose against the euro and the yen on Wednesday, driven by higher U.S. Treasury yields which rose on expectations that the Federal Reserve will increase interest rates in December.

U.S. government bond yields rose to their highest levels in nearly seven weeks on Tuesday as investors have been lightening up on their bond holdings following the Fed’s signal a week ago that a rate increase before the end of this year remains on the table.

The Tory government is rigging the energy markets (Business Insider)

The Tory government is rigging the energy markets (Business Insider)

Britain's government is putting an abrupt end to renewable energy subsidies and in turn the move could potentially kill off the sector.

Dale Vince, the boss of the world's first green energy company Ecotricity, told Business Insider exactly why he is not only not surprised that the Conservative-led government decided pull out of one of the most burgeoning developing sectors for Britain and the rest of the world but also how the country is now "embarrassing" for its lack of renewable energy support.

These Six Key Charts Show the Bank of England's Rate Conundrum (Bloomberg)

For the Bank of England, inflation is everything. Except for all the other things.

Two unexpected countries could be havens for money laundering and tax dodging (Business Insider)

Two unexpected countries could be havens for money laundering and tax dodging (Business Insider)

Germany, Luxembourg, and Spain are egregious offenders in “supporting an unjust global tax system,” according to a new report from the European Network on Debt and Development (Eurodad), a network of NGOs.

The report authors write that Germany and Luxembourg in particular “offer a diverse menu of options for concealing ownership and laundering money.”

Chinese stocks jump on hopes for new trading link (Market Watch)

Chinese stocks jump on hopes for new trading link (Market Watch)

Shares in China led Asian markets higher Wednesday, boosted by speculation that Chinese authorities will open a trading link between Shenzen and Hong Kong by year-end.

The Shenzhen Composite Index 399106, +5.12% the smaller of the mainland’s two stock markets, gained 5.1%, while the Shanghai Composite Index SHCOMP, +4.31% was up 4.3%.

Biggest IPO in Denmark's History Tempts $80 Billion PFA Fund (Bloomberg)

Denmark’s largest commercial pension fund is considering raising its stake in Dong Energy when the utility is put up for sale in what looks set to become the biggest initial public offering in Danish history.

Oil prices slide on profit-taking, but supply risks support (Business Insider)

Oil prices slide on profit-taking, but supply risks support (Business Insider)

Oil prices slipped in thin trading on Wednesday as investors took profits from the previous session's rally, while potential supply disruptions in the United States, Brazil and Libya curbed losses.

Brent futures for December delivery

had fallen 4 cents to $50.50 at barrel by 0215 GMT (9:15 p.m. EDT), after ending the last session up $1.75, or 3.6 percent.

Japan Post in Strong Stock Market Debut in Tokyo (NY Times)

Japan Post in Strong Stock Market Debut in Tokyo (NY Times)

For decades, whenever Japan’s leaders had an important project to pay for, they turned to the post office.

Whether it was a new bullet train line, aid for struggling small businesses or money to finance the national debt, politicians could call on Japan Post to assign a portion of Japanese citizens’ nest eggs to the task, through the nationwide network of savings banks it operates through its more than 20,000 post office branches.

Maersk Line to Cut Capacity, Reduce Jobs to Defend Market Role (Bloomberg)

A.P. Moeller-Maersk A/S is scaling back capacity and cutting jobs in the world’s largest shipping line to adapt to a drop in demand.

Asia follows Wall Street higher, risk appetite supports dollar (Business Insider)

Asia follows Wall Street higher, risk appetite supports dollar (Business Insider)

Asian shares rose on Wednesday, taking early cues from overnight Wall Street gains, while investors' sharper risk appetite lifted U.S. debt yields and supported the dollar.

Old Mutual Third-Quarter Sales Climb 31% on Growth in Africa (Bloomberg)

Old Mutual Plc, the U.K.-based insurer that bought Intrinsic Financial Services Ltd. and Quilter Cheviot Ltd. last year, said third-quarter sales rose to a record as the acquisitions helped boost growth. Its Johannesburg-traded stock advanced to an all-time high.

Regulators Unbundle Some Attractions of Mergers (NY Times)

Regulators Unbundle Some Attractions of Mergers (NY Times)

The Securities and Exchange Commission has quietly taken a stand against corporate inversions.

Inversions occur when an American company buys a foreign company and reincorporates in that acquisition’s country, where the corporate tax rate is lower than in the United States. Pfizer’s approach to AstraZeneca of Britain last year set off a public uproar about American companies giving up their corporate citizenship. Now there are rumblings that the issue may re-emerge, with Pfizer’s apparent interest in Allergan.

Oil pulls back on worries about global crude glut (Market Watch)

Oil pulls back on worries about global crude glut (Market Watch)

Crude-oil prices pared earlier gains in early Asia trade Wednesday as worries about a swelling global glut overshadowed reports of oil-supply disruptions.

In the U.S., oil prices surged nearly 4% overnight on reports that some operations at the Colonial Pipeline, the nation’s largest refined-fuel pipeline, were halted. Supply disruptions were also reported in Brazil due to a strike by workers and in Libya as internal political strife there continues to escalate.

Marks & Spencer Raises Margin Outlook as Profit Beats Estimates (Bloomberg)

Marks & Spencer Group Plc boosted its profitability forecast, providing a fillip for Chief Executive Officer Marc Bolland as he struggles to stem the U.K. retailer’s falling clothing sales.

Glencore's Copper Output Gains 1% in Third-Quarter as Coal Drops (Bloomberg)

Glencore Plc said profit from trading commodities rebounded, putting the embattled miner on course to hit its full-year earnings target for the division as it weathers a rout in prices. The shares rallied to their highest in almost two weeks.

U.S. trade deficit sinks 15% in September but exports remain soft (Market Watch)

U.S. trade deficit sinks 15% in September but exports remain soft (Market Watch)

The U.S. trade deficit tumbled 15% in September amid a snapback in exports and a decline in imports that was tied largely to cheaper oil.

Yet the decline, which was expected, doesn’t change a murky outlook in the nation’s trade picture. Exports are 3.8% lower through the first nine months of this year compared with the same span in 2014. A strong dollar and weak growth in most other countries has stunted demand for American-made goods and has become a drag on the U.S. economy.

Shallow Bond Market Trips Modi's $1 Trillion India Wish List (Bloomberg)

GVK Power & Infrastructure Ltd., an Indian builder of airports and power plants, has about 235 billion rupees ($3.6 billion) of debt outstanding and none of that was raised selling bonds.

Lonmin Says May 'Cease Trading' If $400 Million Share Sale Fails (Bloomberg)

Lonmin Plc, the world’s third-biggest platinum producer, threatened to shut down if it doesn’t get shareholder funding, potentially becoming the biggest casualty of the commodity slump so far.

Lumber Liquidators names new CEO as sales slump continues (Business Insider)

Lumber Liquidators names new CEO as sales slump continues (Business Insider)

Lumber Liquidators Holdings Inc <LL.N> appointed board member John Presley chief executive, five months after Robert Lynch resigned following a report that the company sourced flooring laminates with harmful levels of a known carcinogen.

Asia Set to Extend Global Stock Rally as Kiwi Holds Drop on Jobs (Bloomberg)

The global stock rally looks set to live another day, with Asian equity futures foreshadowing gains from Japan to Hong Kong amid renewed zeal for riskier assets.

The US stock market has completely recovered from August’s global market meltdown (Quartz)

Remember that global market meltdown that started in mid-August? When China made asmall tweak to its currency, ruined everything for everybody, and sent the S&P 500 into a correction?

Hedge fund legend Stan Druckenmiller raved about Amazon, one of his newest investments (Business Insider)

Hedge fund legend Stan Druckenmiller raved about Amazon, one of his newest investments (Business Insider)

Legendary hedge fund manager Stanley Druckenmiller says he loves Amazon because, unlike IBM, it's not focused on short-term quarterly earnings.

"The last 19 quarters, Amazon has missed their quarterly earnings nine times. They don't give a damn," Druckenmiller said at the DealBook Conference Tuesday.

The Growing Ranks of America’s High-Earning Poor (The Atlantic)

The Growing Ranks of America’s High-Earning Poor (The Atlantic)

There’s a growing segment of the American population that earns a decent salary but lives paycheck-to-paycheck: the income-rich and asset-poor.

Empty bank balances are often associated with those on the lowest rungs of the income ladder. But many members of America’s upper-middle class have almost no emergency cushion and are woefully unprepared for retirement. And years into the recovery, they are still struggling, leaving the entire economy vulnerable.

China's Big Development Plan Has Xi's Fingerprints All Over It (Bloomberg)

Chinas new development blueprint was officially handed down Tuesday by the Communist Partys Central Committee. But the details leave little doubt as to President Xi Jinpings hand in crafting the document.

Australia’s dollar pops after RBA declines to cut interest rates (Quartz)

Rates stayed up in the land down under.

Walt Disney to invest $200 million in Vice Media (Business Insider)

Walt Disney to invest $200 million in Vice Media (Business Insider)

Walt Disney Co <DIS.N> will invest $200 million in edgy video maker Vice Media, known for its coverage of current affairs for the Millennial generation, a person familiar with the matter told Reuters.

Financial Times had reported the news earlier on Tuesday.

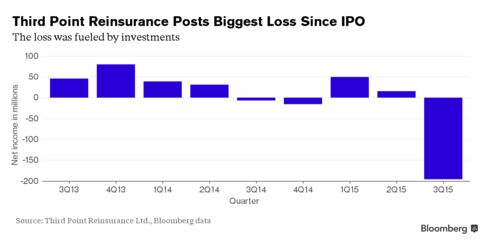

Third Point Re Posts Biggest Loss Since IPO on Loeb Investments (Bloomberg)

Third Point Reinsurance Ltd., the reinsurer that counts on Dan Loeb to oversee investments, posted its worst loss as a publicly traded company on declines in the hedge-fund managers portfolio.

Etsy plunges to all-time low after earnings (Business Insider)

Etsy shares slipped by more than 7% to an all-time low after the company reported third-quarter earnings on Tuesday.

U.S. Car Makers Log October Sales Gains (Wall Street Journal)

U.S. Car Makers Log October Sales Gains (Wall Street Journal)

Auto makers used an array of incentives and favorable economic conditions to shake off October’s traditional slowdown and appear poised to do what it takes to keep momentum rolling through the end of the year.

Light-vehicle sales increased 13.6% in October compared with the same period a year ago, according to AutoData Corp., with 1.46 million cars and trucks sold. It is the second-consecutive month that the annualized sales pace exceeded 18 million, putting the U.S. market on track for potentially the strongest annual showing in history.

Diamonds are forever, but prices have room to fall (Market Watch)

Cheaper diamond prices are good news if you’re looking for a deal on something flashy for the holidays. But from an investment standpoint, prices still have room to fall because of weaker demand from China and a supply glut.

Mylan Wins U.S. Approval for Perrigo Bid With Generics Sale (Bloomberg)

Mylan Wins U.S. Approval for Perrigo Bid With Generics Sale (Bloomberg)

Mylan NV will ask shareholders to vote on changes to its corporate governance, including the nomination and election of directors, if the drugmaker completes its hostile takeover bid for Perrigo Co.

Energy Stocks Power the Market Higher (NY Times)

Shares of King Digital, maker of Candy Crush Saga, jumped after the company agreed to be acquired by Activision Blizzard.

Herbalife earnings beat, but the stock is sliding (Business Insider)

Herbalife earnings beat, but the stock is sliding (Business Insider)

For the third quarter, Herbalife, a multilevel marketing company that sells weightloss shakes, reported adjusted EPS of $1.28 versus analyst estimates of $1.05.

Net sales for the third quarter came in at $1.1 billion.

Mexico Casts Wider Net for Oil Buyers as U.S. Interest Wanes (Bloomberg)

Mexico isn’t breaking up with U.S. oil refiners, but it sure seems like it wants to see other people.

What to watch for in Lumber Liquidators’ earnings (Market Watch)

What to watch for in Lumber Liquidators’ earnings (Market Watch)

Lumber Liquidators Holdings Inc. is slated to reveal third-quarter results on Wednesday, before the stock market opens.

Investors will be waiting to see whether the troubled hardwood-floor company LL, +1.43% can finally break its string of disappointing results, and support the recent stabilization in the stock. That would help deflect some of their ire over the scandal surrounding sales of wood flooring sourced from China with dangerous levels of a cancer-causing agent, and the company’s admission of guilt regarding theillegal importation of hardwood flooring.

Tesla goes wild after earnings (Business Insider)

Tesla goes wild after earnings (Business Insider)

Tesla's numbers are out and the stock is ripping higher.

Tesla came in a little light on earnings while revenue was right in line with expectations.

In the third quarter, Tesla reported an adjusted loss per share of $0.58 against expectations for a $0.56 loss.

Bank Bonds Stay Strong Despite Possible Downgrades on New Rules (Bloomberg)

Returns on bonds issued by U.S. commercial and investment banks remain much stronger than the broader market, as investors digest the less onerous capital requirements being placed on the companies by the Federal Reserve.

All cash deals are at an all-time high and that's a bad sign for the market (Business Insider)

All cash deals are at an all-time high and that's a bad sign for the market (Business Insider)

Trim Tabs says cash takeovers in the US from May through October totaled $457.8 billion, the highest amount on record for a six-month stretch. The research firm notes the period of February 2007 through July 2007 was the previous peak, topping out at $406.5 billion. In addition, the month of October recorded the largest month ever for all-cash deals, reaching $97.5 billion. Trim Tabs chief executive officer, David Santschi, warns, "Merger activity tends to swell around market tops as confident corporate leaders turn to deal-making to boost earnings and revenue late in the economic cycle.”

How biotech, small-caps may determine if this stock-market rally is legit (Market Watch)

Is Wall Street is back? That is what investors might be contemplating with the three main indexes slipping back into positive territory.

Santander Plants Its Flag in the Hunt for Financial Technology (Bloomberg)

Santander Plants Its Flag in the Hunt for Financial Technology (Bloomberg)

Microsoft Corp., Google Inc., Facebook Inc. — the usual suspects — have prominent booths at the annual Dublin Web Summit of tech giants and the upstarts who want to emulate them. This year there is a surprise entrant: Banco Santander SA.

Crude oil is up 4% (Business Insider)

Crude oil spiked to the highest levels in four weeks on Tuesday.

.png)

U.S. Investors Have One More Reason to Fret About Chinese Firms (Bloomberg)

U.S. Investors Have One More Reason to Fret About Chinese Firms (Bloomberg)

A key accounting safeguard intended to protect U.S. investors who buy shares of Chinese companies is close to unraveling.

Last month, a final agreement that would have allowed a U.S. regulator to examine the audits of Chinese companies listed on American stock exchanges fell through, according to two people with knowledge of the matter. The failed negotiations are a setback for the Public Company Accounting Oversight Board, a Washington-based watchdog that has sought access to Chinese audits for years as dozens of companies such as JD.com Inc. and Alibaba Group Holding Ltd. raised billions of dollars from U.S. investors.

People were way more stressed out about the Fed two years ago (Business Insider)

Investors just aren't all that worried about the Federal Reserve anymore.

Intel Capital Investing $22 Million in 11 Different Startups (Fast Company)

Intel Capital Investing $22 Million in 11 Different Startups (Fast Company)

The giant tech capital fund is investing in a free 4G service, Braille printers, GPS alternatives, and more.

Intel Capital just announced they are investing $22 million in 11 different startups, and that the venture capital arm of the tech company is on track to invest $500 million in startups this year.

What to watch for in Facebook’s earnings (Market Watch)

What to watch for in Facebook’s earnings (Market Watch)

Facebook Inc. is set to report third-quarter earnings after the market close on Wednesday.

All eyes will be on Facebook’s FB, -0.71% growth in video, and how the company’s advertising portfolio and engagement is growing in relation to its top rivals, notably, Alphabet Inc. GOOGL, +0.14% and Twitter Inc. TWTR, -0.24%.

For Mitsubishi, Cheap Is More Than Enough (Bloomberg)

The carmaker pulls off abit of a strategic coup by undercutting a cluttered market.

Forbes sold itself last year, and now something very strange is happening (Business Insider)

Forbes sold itself last year, and now something very strange is happening (Business Insider)

This is an odd one.

According to a report in the Financial Times, the Forbes family has sued Integrated Whale Media Investment, the Hong Kong-based investment group that bought a majority stake in Forbes Media last July.

Why companies like Apple and Google are targeting your office (Market Watch)

Why companies like Apple and Google are targeting your office (Market Watch)

Consumer spending on technology has been trending in the wrong direction, and businesses are increasing tech budgets at unspectacular rates — and yet the Nasdaq has tripled since 2008.

Some call this evidence of a new tech bubble. Others, however, say commoditized hardware, open-source software and the adoption of subscription-based cloud computing services have upended the way technology is purchased, creating a technology economy that is less cyclical and better insulated from business cycles.

Uber Invests $250 Million for Expansion in the Middle East (Bloomberg)

Uber Invests $250 Million for Expansion in the Middle East (Bloomberg)

Uber Technologies Inc. is investing $250 million to expand in the Middle East and North Africa, which have some of the ride-sharing service’s fastest-growing markets.

Uber over the next several years will begin service in new cities in Saudi Arabia and Egypt and enter Pakistan, beginning in Lahore, said Jambu Palaniappan, the company’s regional general manager for the Middle East, Africa and Central and Eastern Europe. The investment will go toward paying drivers, expanding staff and enhancing Uber’s mobile application.

Politics

The Candidate Republicans Trust Most on the Economy: Trump (Business Insider)

The economy, and ways to improve it, is arguably the most important issue in the upcoming presidential election. In May, a Gallup poll showed that Americans thought the economy was more critical than foreign affairs, immigration, or terrorism.

For the almost laughably large field of GOP hopefuls, that means that the ability to convince Republican voters of their ability to manage the economy is essential in order to remain in contention.

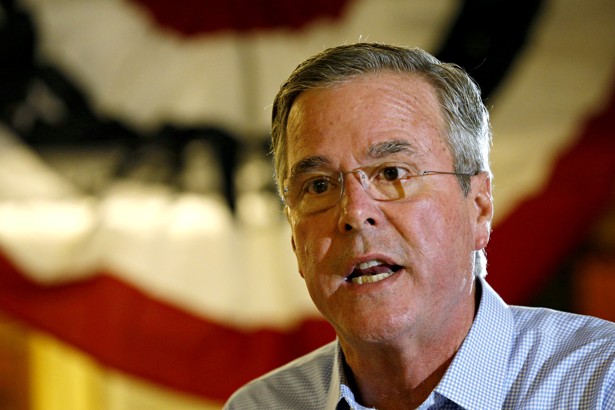

Jeb Bush’s ‘Serious’ Foreign Policy Is Not Serious (The Atlantic)

Jeb Bush’s ‘Serious’ Foreign Policy Is Not Serious (The Atlantic)

Jeb Bush fashions himself the thinking man’s Republican candidate for president. Donald Trump, he declared late last month, is “not serious.” When it comes to foreign policy, Trump hasn’t “thought these things through.” Trump is “not taking the responsibility—the possibility of becoming the president of the United States really seriously.”

Hillary Clinton calls for raising minimum wage to $12 an hour (Market Watch)

Hillary Clinton calls for raising minimum wage to $12 an hour (Market Watch)

Hillary Clinton believes the federal minimum wage should go to $12 an hour, from the current $7.25.

Clinton, the front-runner for the Democratic presidential nomination, named that figure Tuesday at a pair of Iowa campaign stops. As Reuters writes, Clinton has repeatedly said she wants to raise wages for working Americans, but she has rarely named a specific figure. “I want to raise the federal minimum wage to $12, and encourage other communities to go even higher,” she said in Coralville, Iowa. Many U.S. cities have set a higher minimum wage than the federal minimum. Bernie Sanders, Clinton’s chief challenger for the Democratic nomination, has called for raising the U.S. minimum wage to $15 an hour.

Republican Victory In Kentucky Governor's Race Is A Blow To Obamacare (Forbes)

Tea Party favorite Matt Bevin’s surprising win in tonight’s race for governor of Kentucky over Attorney General Jack Conway is a blow to the health policy initiatives of outgoingDemocrat Steve Beshear, a staunch supporter of the Affordable Care Act.

Technology

Science and Sustainable Development (Project Syndicate)

Science and Sustainable Development (Project Syndicate)

The just-adopted Sustainable Development Goals (SDGs) – which aim to end poverty, protect the planet, and foster prosperity for all by 2030 – are certainly ambitious. If they are to be realized, the world’s poorest countries must gain access to the best that science and technology can offer. Fortunately, the world has a sound model to emulate as it seeks to achieve the SDGs: the deployment of peaceful nuclear technology.

Scientists develop ultra-hard glass (BBC)

Scientists develop ultra-hard glass (BBC)

Scientists in Japan have developed a type of ultra-hard glass.

The new material is thin as well as hard and is made using alumina, an oxide of aluminium.

Army Commandos First to Get Bad-Weather Vision for U.S. Copters (Bloomberg)

The U.S. Army commando unit that’s flown missions from “Black Hawk Down” to the raid that killed Osama bin Laden will be the first to get new sensor technology to help guide helicopters through sometimes deadly bad weather.

Children's Tablets: The Electronic Baby Sitter Wises Up (Wall Street Journal)

Children's Tablets: The Electronic Baby Sitter Wises Up (Wall Street Journal)

A survey released Tuesday by the nonprofit family advocacy group Common Sense Media finds Americans age 8 to 12 spend an average of an hour each day using a tablet. Add to that the time these children spend playing games and videos on smartphones and iPods, and it eclipses even the time they spend in front of a TV. Call them Generation Touchscreen.

Health and Life Sciences

Does Schizophrenia Exist on an Autism-Like Spectrum? (Scientific American)

Most people have felt depressed or anxious, even if those feelings have never become debilitating. And how many times have you heard someone say, “I'm a little OCD”? Clearly, people intuitively think that most mental illnesses have a spectrum, ranging from mild to severe. Yet most people do not know what it feels like to hallucinate—to see or hear things that are not really there—or to have delusions, persistent notions that do not match reality. You're psychotic, or you're not, according to conventional wisdom.

Gene Therapy in Dogs Shows Promise for Muscular Dystrophy (Medicine Net)

Gene Therapy in Dogs Shows Promise for Muscular Dystrophy (Medicine Net)

Using gene therapy, researchers report they've successfully treated muscular dystrophy in dogs.

They believe this could pave the way for clinical trials of the treatment in humans within the next few years.

The dogs had Duchenne muscular dystrophy, which is the most common form of the disease in humans and primarily affects boys. Patients lose their ability to walk and breathe as they get older, the researchers said.

Why are some whites dying earlier? (CNN)

Why are some whites dying earlier? (CNN)

Middle-aged white Americans are dying at a record rate, new findings suggest. And the truth is, we really shouldn't be surprised.

According to research conducted by Princeton economists Angus Deaton and Anne Case and published Monday in the Proceedings of the National Academy of Sciences, death rates among white Americans ages 45 to 54 are rising even as those among every other age, racial and ethnic group in the United States are in decline.

What happens when you go without sugar for 10 days? (CNN)

What happens when you go without sugar for 10 days? (CNN)

No one wants to hear more bad news about sugar, especially just a few days after Halloween. As a dad of three little girls, though, I found a recent study about sugar somewhat encouraging.

By cutting back sugar for your kids, you can see dramatic improvements in just 10 days. That is pretty remarkable, if you think about it.

Surprise Link Between Epilepsy And Whooping Cough: What's The Connection? (Forbes)

One of the more common concerns parents have about vaccines is the fear their child will suffer seizures following vaccination. The fear is grounded in reality: febrile, or fever-induced seizures, can occur after vaccinations. Their risk even increases when the MMR vaccine is delayed, an ironic fact for parents who delay this vaccine out of misguided safety concerns.

Life on the Home Planet

China Burns Much More Coal Than Reported, Complicating Climate Talks (NY Times)

China Burns Much More Coal Than Reported, Complicating Climate Talks (NY Times)

China, the world’s leading emitter of greenhouse gases from coal, is burning far more annually than previously thought, according to new government data. The finding could vastly complicate the already difficult efforts to limit global warming.

Afghan Widows Struggle to Survive the Long Shadow of War (Wall Street Journal)

Afghan Widows Struggle to Survive the Long Shadow of War (Wall Street Journal)

In the spring of 2013, Fereshta’s husband enlisted in the Afghan army. Three months into his deployment, he was killed.

“My youngest daughter was 40 days old,” recalled Fereshta, a mother of five who, like many Afghans, goes by only one name.

Cargo plane crash in South Sudan leaves at least 41 dead (Market Watch)

Cargo plane crash in South Sudan leaves at least 41 dead (Market Watch)

A Russian-made cargo plane crashed just after takeoff Wednesday in the South Sudanese capital of Juba, killing at least 41 people on board and in a Nile fishing village near the runway.

At least 18 people were aboard the Antonov An-12 cargo plane, including two crew members, said Ateny Wek Ateny, South Sudan’s government spokesman.