Background

TED Spread: "The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt ("T-bills"). TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract. (Wikipedia)

"The size of the spread is usually denominated in basis points (bps). For example, if the T-bill rate is 5.10% and ED trades at 5.50%, the TED spread is 40 bps. The TED spread fluctuates over time but generally has remained within the range of 10 and 50 bps (0.1% and 0.5%) except in times of financial crisis. A rising TED spread often presages a downturn in the U.S. stock market, as it indicates that liquidity is being withdrawn." (Wikipedia)

Is the TED Spread Yellen?

By The Nattering Naybob at Seeking Alpha & The Nattering Naybob Chronicles

Excerpt:

TED's Talkin Loud?

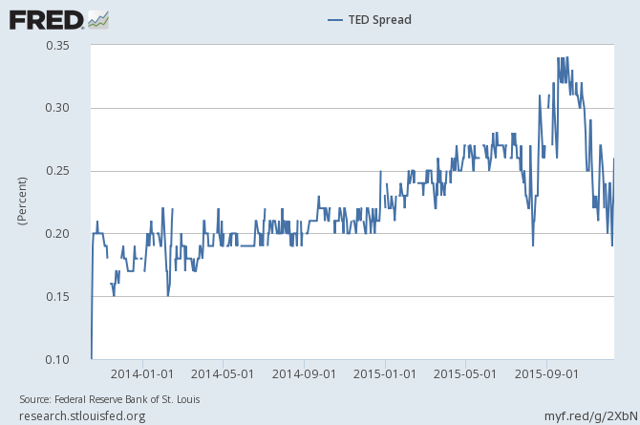

Above note the TED spread through Dec 11th. As of Friday 12/18, 3 mo Libor 0.5965 minus 3 mo T down to 0.19 = TED spread at 0.4065. The TED spread has been rising since Oct 2013, with a large spike since Dec 7th from 0.19 to 0.40.

Raising rates should encourage more interbank lending? Ceteris paribus perhaps, but in an upside down world of negative yields and swap spreads?Since the Fed raise, overnight LIBOR (the UNSECURED intrabank rate) has almost tripled from 0.135 to 0.3672. The TED spread usually runs between 10 to 50 bps and generally exceeds 50bps in times of crisis.How UPSIDE DOWN is it with the TED spread quickly rising to 40? This means that the cost for banks to borrow from each other SECURED with UST collateral is now higher than Libor, the UNSECURED bank funding rate. I have only one thing to say.

A rising TED spread can indicate an imminent downturn in the U.S. stock market, as it indicates that liquidity is being withdrawn from the market, and a growing distrust in unsecured intrabank lending.

Corporate LOC's (lines of credit) are liquidity cushions for times of market stress and ill liquidity, as in when traditional funding dries up. How does rising bank balance sheet costs and distrust in unsecured lending amongst banks bode for unfunded loc's or unsecured corporate loans from commercial banks? One would imagine, not too well as in moving forward, less wholesale liquidity in times of crisis.

Wiki: "During 2007, the subprime mortgage crisis in 2007 TED ballooned to 150-200 bps. On September 17, 2008, the TED spread exceeded 300 bps, breaking the previous record set after the Black Monday crash of 1987. Some higher readings for the spread were due to inability to obtain accurate LIBOR rates in the absence of a liquid unsecured lending market. On October 10, 2008, the TED spread reached a new high of 457 bps."

Read the full article here.