Lots Of Volatility… And A Dose Of Perspective

By James Picerno of The Capital Spectator

The US stock market this week suffered its worst four-day start to a new year in history through yesterday’s close (Jan. 7). In other words, expected return posted its biggest gain ever over the latest four-day January kick-off. It’s hard to say exactly how much expected return increased or when or if such a theoretical shift in ex ante performance will translate into real money. But at a time of heightened volatility (again) in markets around the world, the antidote to fear is a sober helping of perspective and a reasonable plan for managing risk.

Two key observations about markets are worth reconsidering as the potential for behavioral error surges. First, mean reversion—aka the value factor—for performance will likely remain a potent force for estimating expected return over medium- to long-term horizons. Second, price momentum—up and down—will probably dominate short-term results. There are other facets to consider in our investment travels, but in the cause of intelligently designing portfolios and managing risk these two aspects of the money game are bedrock principles. Results depend on how we blend these tactical and strategic sources of risk premia, of course. But at least it’s clear where to find the raw material for engineering success and locating generally reliable signals for adjusting asset allocation.

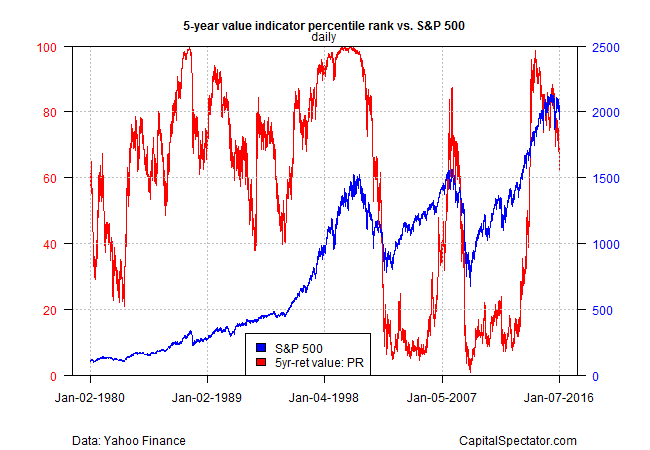

There are many ways to estimate value and momentum, of course, but a good place to start is with a set of simple approximations. For value/mean reversion, the observation that rolling 5-year return is a rough proxy offers a useful first step for developing perspective, as discussed by AQR Capital Management’s Cliff Asness and two co-authors in “Value and Momentum Everywhere” (Journal of Finance, June 2013). For instance, consider the chart below, which compares the S&P 500 with the percentile rank of the index’s rolling 5-year return. The main takeaway: peaks and valleys in performance on this time scale are useful yardsticks for estimating expected return over medium-to-long-term horizons.

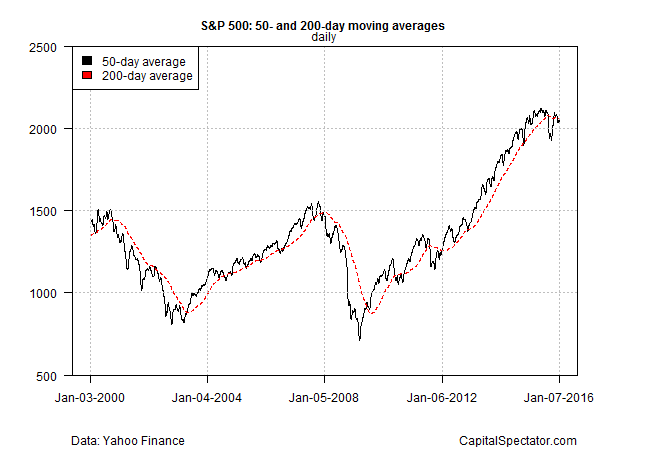

As for momentum, here too there are as many ways to slice and dice as there are Republican candidates running for President. As a quick illustration, we can look to a set of simple moving averages, such as the 50- and 200-day metrics for the S&P 500, as shown in the next chart below. In this somewhat naïve definition we can say that positive (negative) momentum is in force when the 50-day average (black line) is above (below) the 200-day average (red line).

Yes, the value and momentum proxies above require refinement for real-world investing. This, after all, is a blog post not a consulting project. Nonetheless, the merits of the two factors are clear even when using these crude definitions. For instance, it’s no surprise to see in the first chart above that equity prices weakened after the 5-year return flirted with the 100th percentile rank in recent years. Meanwhile, the second chart shows that the 50-day average slipped below the 200-day average in 2015’s second half for the first time in several years. In other words, soft equity prices shouldn’t be a total shock in the new year.

Value and momentum signals have their flaws, of course, no matter how you define them. But that’s par for the course in a world where mere mortals have no access to perfect factor strategies. The preceding observations do, however, lay the groundwork for building robust portfolios and thinking about expected return.

That’s old news, of course, but it’s no less valuable. All the more so when narrative risk and perspective-distorting media headlines threaten to lead us astray about what really matters, namely: volatility imparts opportunity… if you know where to look and how to process risk signals in an objective, enlightened framework.