Courtesy of Lee Adler of the Wall Street Examiner

Good guy Sam Ro, now at Yahoo, tweeted out a chart by Bank of America Merrill Lynch (BAML) this morning showing that low wage job gains have outpaced gains in high wage jobs.I happen to keep charts on wage growth by industry, so I know a little about the subject. I had my usual calm and measured response.

@bySamRo Hell NO, Sam Ro! It’s all relative, isn’t it? Tell BAML they’re full of shit. pic.twitter.com/WFtsM3Siur

— Wall Street Examiner (@Lee_Adler) August 26, 2016

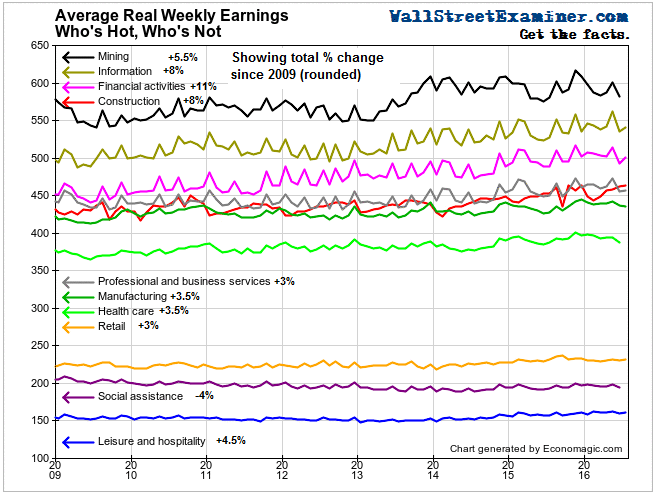

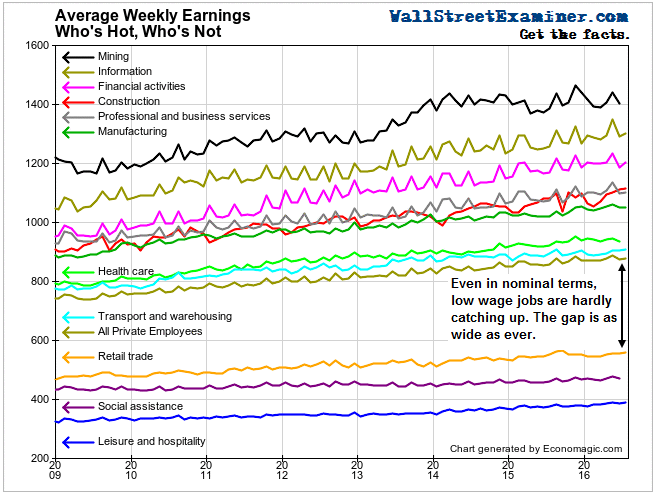

Here’s that chart again, plus another showing the changes in nominal terms.

As I always stress, charting data is a matter of perspective. If low wage jobs are showing material gains versus high wage jobs, it’s not apparent in the big picture. I know how BAML tortured the numbers to come up with their conclusion. They featured rate of change. Minimum wage boosts in many states and localities over the past couple of years make it seem that low wage workers are catching up. Prior to mid 2013 there was no difference in gains between the top 80% and the bottom 20%. The total size of the low paid workers gains is minuscule, and invisible when placed on the same total wage scale with other industries.

The idea that low wage workers are outpacing high wage workers is a scam.

And what’s the point of this argument? How do low wage jobs matter to investors? Low wage workers are merely your tired, your poor, your huddled masses yearning to make a buck. Have they made any real progress to being any more than the flotsam and jetsam of a throwaway society?

Please.

Yes, wages at the lowest end of the spectrum have risen thanks the minimum wage increases over the past couple of years. Once this wave is past, then what? Is there any reason to believe that these sectors will do any better than the long-term trends?

I don’t think so.

I went into a McDonald’s yesterday with our granddaughter. It’s been a year or so since the last time I was at a McDO, as they call them here in Quebec where I spend the summer. I can’t remember the last time I was in one at home in FL. Nevertheless, the stores have always seemed pretty consistent between Canada and the US.

In this busy store in a small town in rural Quebec, where tens of thousands of breadwinner jobs have been lost as major industrial employers have left town over the years, 3/4 of the cashiers have recently been replaced by computer screens that take your order and your payment.

Low skill, low pay jobs are going the way of the dodo bird. Medium and high skill manufacturing jobs with good pay have been shipped overseas for decades. And US companies are replacing American high skilled technicians with cheaper imported workers who are brought in under the H1B visa program.

Our society has figured out no way, nor shown any will, to counter these trends. The result has been that the US middle class has been both shrinking and losing purchasing power. The consumerist foundation of the US economy is being hollowed out, driven by central bank financial repression and financialization that benefits only the few.

This is what a society in terminal decline looks like. Meanwhile the financial markets party on as those at the top enjoy a false prosperity, thanks to the Fed’s policy of robbing hard-working savers to transfer income to speculators and banks. These policies shock the conscience. The result of such shortsighted stupidity and immorality may be a long time coming, but it will not be pretty.

I weep for America.

Copyright © 2014 The Wall Street Examiner. All Rights Reserved.