Wheeee, what fun!

Clearly investors do not have a clue what's going on as we are in what we like to call a "Bugs Bunny Market," where he throws a switch and everyone stampedes in and out of the theater (5:00 on this video). That's what the Fed has been doing to investors but don't blame the Fed, blame the clueless investors who have no actual investing premise other than whatever they think the Fed will do. Obviously, you can't have real price discovery when there are dozens of major stocks trading at hundreds of times earnings – the room for correction is always a huge overhang.

We're well-hedged and could really care less, though we would like to see a nice correction so we can finally go back to our Watch List and turn it into a Buy List again at reasonable prices. I called yesterday a "watch and wait" day as we expected to see some bounces and, of course, they were more than we expected but, by 3pm, in our Live Member Chat Room, we had enough watching and I made this call:

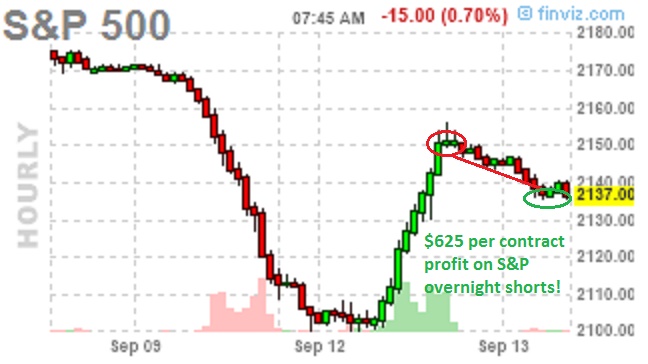

I like /ES short at 2,150, Dow 18,250, Nas 4,750 and RUT 1,225 are our other marks with /NKD 16,700 and Dollar 95.06 needs to stay above 95, of course. Oil closed at $46.20.

As you can see, at 2,137.50 we're already up a quick $650 per contract this morning (and we expect lower still). Trading Futures is one of those fun things you can do with your sidelined CASH!!! when you are bored but we had to wait PATIENTLY for the right opportunity to go short again – almost all day yesterday, in fact. Keep in mind though, that Futures trading is tricky and requires a lot of practice – we'll be doing a Live Trading Webinar tomorrow at 1pm, EST, and we'll discuss some of our Futures trading techniques but remember:

As you can see, at 2,137.50 we're already up a quick $650 per contract this morning (and we expect lower still). Trading Futures is one of those fun things you can do with your sidelined CASH!!! when you are bored but we had to wait PATIENTLY for the right opportunity to go short again – almost all day yesterday, in fact. Keep in mind though, that Futures trading is tricky and requires a lot of practice – we'll be doing a Live Trading Webinar tomorrow at 1pm, EST, and we'll discuss some of our Futures trading techniques but remember:

You've got to be crazy, you gotta have a real need

You gotta sleep on your toes, and when you're on the street

You've got to be able to pick out the easy meat with your eyes closed

And then moving in silently, down wind and out of sight

You've got to strike when the moment is right without thinkingAnd after a while, you can work on points for style

Don't knock using song lyrics and cartoons to teach lessons – they're just another form of mnemonic devices! Meanwhile, for those who haven't learned their lesson yet, we're still watching our bounce lines (as noted in yesterday's post), this time from above to see if they hold and give us a bullish signal. If not, it will be a good time to add that hedge we looked at yesterday.

The fact that the markets popped back up based on ONE Fed Governor (Brainard) saying something that contradicted what 6 others said before her is idiotic and did nothing to change our FUNDAMENTAL premise that the market is overbought and the Fed is done lowering rates and, without MORE FREE MONEY, there isn't enough gas in the tank to keep the market at these overbought levels – very simple.

The fact that the markets popped back up based on ONE Fed Governor (Brainard) saying something that contradicted what 6 others said before her is idiotic and did nothing to change our FUNDAMENTAL premise that the market is overbought and the Fed is done lowering rates and, without MORE FREE MONEY, there isn't enough gas in the tank to keep the market at these overbought levels – very simple.

You can't let a rabbit with a switch dictate how you are managing your finances and the Fed is like a bag full of rabbits – no better than a roulette wheel these days as their policy is, in turn, influenced by the market – so you are all running around chasing each other's tails while trying to figure out which way the other one is going. We prefer to look at the whole track because – in the long run – we can clearly see which way things are heading.

Take, for example, Kate Spade (KATE). KATE was our Top Trade Alert on August 11th and, as I'm sure you know, our Top Trade Alerts have an 81.1% winning percentage since their inception. Our play on KATE (which was added to our Options Opportunity Portfolio that day) was:

…If KATE never goes below $15, we simply keep the cash and don't end up owning the stock but we're more bullish than that and think the stock will go to $20 and, since we won't mind owning it for $15, we can treat the $2.30 we collected as free money and put it towards the following spread (and it will be official in the OOP):

- Sell 10 KATE 2018 $15 puts for $2.30 ($2,300)

- Buy 10 KATE 2018 $15 calls for $5.50 ($5,500)

- Sell 10 KATE 2018 $20 calls for $3.10 ($3,100)

As the net of the spread is only $2,400 and we collected $2,300 for selling the puts for net net $100 on the trade. Our net cost of Kate, if assigned, would be $14.90/share – and now we're back over our 15% discount target (15.4%). Our worst case is we own 1,000 shares of KATE for net $14,900 and our best case is KATE is over $20 and we make $5,000 less the net $100 we paid with for a $4,900 gain on a -$100 cash outlay (4,900%). The ordinary margin requirement on the short puts is only $1,500 – so no burden there either!

There hasn't been much movement yet but already the net of the spread is $400, for a $300 profit (300%) on cash in the first month but that's only "on track" for our full 4,900% profit potential if KATE is over $20 (a modest goal) in Jan 2018. This morning, Wells Fargo (WFC) caught up with us and put an Outperform Rating on KATE with a $23-24 target and it's popping back towards $19, despite the broad market sell-off. Even if you add it now, at $400, the upside is another $4,600 (1,150%) – not bad for free scraps you pick up on our old trades, right?

There's a simple example of FUNDAMENTALS driving our choices. We don't care what the Fed does or does not do – we identify stocks that are good values and we buy them when they are cheap AND we use options to give ourselves even better discounts – as well as to hedge our positions – just in case some rabbit throws a switch we don't like.

And you know what – we're HAPPY TRADERS!