By Ritesh Jain. Originally published at ValueWalk.

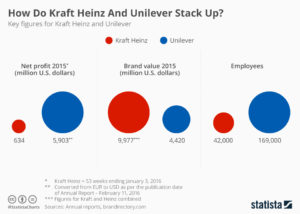

Kraft Heinz is smaller than Unilever, with a market value of $106 billion as of Thursday, it is 50.9-percent owned by Buffett’s Berkshire Hathaway Inc and 3G Capital, which also controls Anheuser-Busch InBev.

3G, known for driving profits through aggressive cost cutting, has orchestrated a string of big deals rocking the food and drink industry, including Anheuser-Busch InBev’s takeover of SABMiller and the combination of Kraft and Heinz (The Kraft Heinz Company is an American worldwide food company formed by the merger of Kraft Foods Group and Heinz in 2015. The merger was backed by 3G Capital and Berkshire Hathaway, which invested US$10 billion in the deal, making Kraft Heinz worth about US$46 billion).

A deal would offer opportunities to combine marketing, manufacturing and distribution in addition to cutting costs, but some industry analysts said Kraft might not want Unilever’s household and personal goods brands and could spin them off.

“This is cheap money meeting industrial logic,” said Steve Clayton, manager of the HL Select UK Shares fund at Hargreaves Lansdown, which owns Unilever shares.

In absence of growth (both Kraft and unilever are struggling on sales front) the only way to satisfy shareholder and executive value (read greed) is through M&A if money is cheap. Although Unilever has spurned the offer, still if this merger were to go through the merged entity will have a virtual monopoly in household brand and dont forget it will also come with laying off lot of people.

The post Kraft bids for Unilever …… is it cheap money? appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.