Welcome back!

I hope everyone had a nice vacation. Seems like nothing particularly blew up over the holiday weekend yet the market gave back 100 Dow points early this morning and we're back at 25,900 on the /YM Futures and below 2,900 on the /ES Futures and let's not forget that 2,872 is where we topped out in January and that too was a big run up but then we completely collapsed back to 2,532 for a quick 10% drop in just two weeks. The high came on Jan 26th, to be exact, and that was AFTER Trump declared a Trade War for the first time that Tuesday.

This week, Trump has "fixed" Mexico, though many "fake news" analysts say it's not fixed at all and still no deal with Canada and supposedly (also you have to believe what Trump says) we will be adding another $200Bn of tariffs to China, which would more than double all the tariffs put on all countries combined to date! Yet the market seems generally unaffected – for now.

That Thursday (Jan 25th), I marvelled at the fact that only 7,826 (11.4%) out of 68,119 investors polled were bearish on the markets as we tested record highs. Now it's down to 6,243. This week's news cycle will be taken up with Kavanaugh's Supreme Court nomination hearings but it's a pretty big data week with ISM and Construction Spending this morning, Auto Sales tomorrow, Productivity, ISM Services and Factory Orders on Thursday and the Big Kahunah, Non-Farm Payroll on Friday.

September, of course, closes out the 3rd quarter and we have a Fed meeting on the 26th where the Fed is very, very likely to hike rates. As you can see on this chart, the Fed is still a hike below the average prediction of 2.25% by the end of the year and next year, the target is more like 3.25% so there's a lot of hiking ahead of us – usually not great for the market.

September, of course, closes out the 3rd quarter and we have a Fed meeting on the 26th where the Fed is very, very likely to hike rates. As you can see on this chart, the Fed is still a hike below the average prediction of 2.25% by the end of the year and next year, the target is more like 3.25% so there's a lot of hiking ahead of us – usually not great for the market.

Trade still seems to be dominating the market talk at the moment. According to Bloomberg, Trump even gave us a day of golf yesterday and instead spent the day on the phone with Canada and China, trying to avoid an all-out Trade War. Over the weekend, Trump warned Congress that it may have to accept a new version of the trade pact that excludes Canada, a prospect with almost no support in either party. Talks officially resume tomorrow and there seems to be a 90-day deadline, so this will take a while to pan out. China remains a wild card as Trump is pushing for tariffs no one in Congress seems to want.

Oil and gasoline have popped higher as Gulf of Mexico oil rigs were evactuated for the first time in two years. That's bad for our gasoline shorts but we're adding to them at $2.05 to average $2.025 but we'll take the money on the new half at $2.04, which would push our average up to $2.01 and then do it again on the next spike as the Fundamentals haven't changed and the same storm that's hitting supply will supress demand as well as flights are cancelled and car trips are not taken.

On the oil side, there are also still problems in Libya, Trump's renewed sanctions on Iran, and accident in Venezuela (and their whole economy is already a disaster) at a shipping terminal – not a good time to bet against Oil (/CL), tempting though it may be testing $72. Expect Brent (/BZ) to be rejected at $80 and that's a good reward/risk play as it's run up from $77.50 so a weak retrace should be $79.50 at least for a $500 per contract gain and hopefully $79, for $1,000 per contract gains. Weight that against the risk of stopping out at $80.06 with a $60 loss…

The strong Dollar is pushing everything lower this morning as we're back at 95.50 but still miles from the August high of 96.75 so we'll keep an eye on the action there, especially as we look to go long on Silver (/SI) when it finds a bottom (now $14.13). Basically, this is the spot to start picking up longs and for sure once Gold (/YG) crosses back over $1,200 (now $1,196) but keep in mind it's very painful to be wrong on /SI, as it is $50 per penny, per contract when it moves (so it's fun to be right too!).

It's the same drill, however – pick a line to go long on, like $14.15 and get out if it's under for a $50-$100 loss and stay in when it's over but, if you have a quick loss, then take a quick gain to make it up. You can also let Wheaton Precsious Metals do the trading for you though traders think they can't handle price fluctuations and have dropped them all the way back to $17, which puts our Long-Term Portfolio position on them near a $5,000 loss but we just doubled down on the longs, adding 20 more 2020 $15 calls at $3.75 on Friday and, so far, we haven't covered them.

Silver was this low back in late 2015 and WPM was as low as $12.50 before blasting back to $20 in April of 2016 as silver recovered so it's a great proxy for trading silver though a very rough ride while you are on it! Of course in 2015, WPM only had $648M in sales and lost $162M while the first two Qs of 2018 have shown $400M in profit already but $241M were special gains, not likely to be repeated. Still, the company makes money by streaming, not mining – so they will be buying silver contracts cheaply now and, hopefully, selling them for more later on. They've been doing this since 2004 – I don't think this little drop in silver prices is going to kill them!

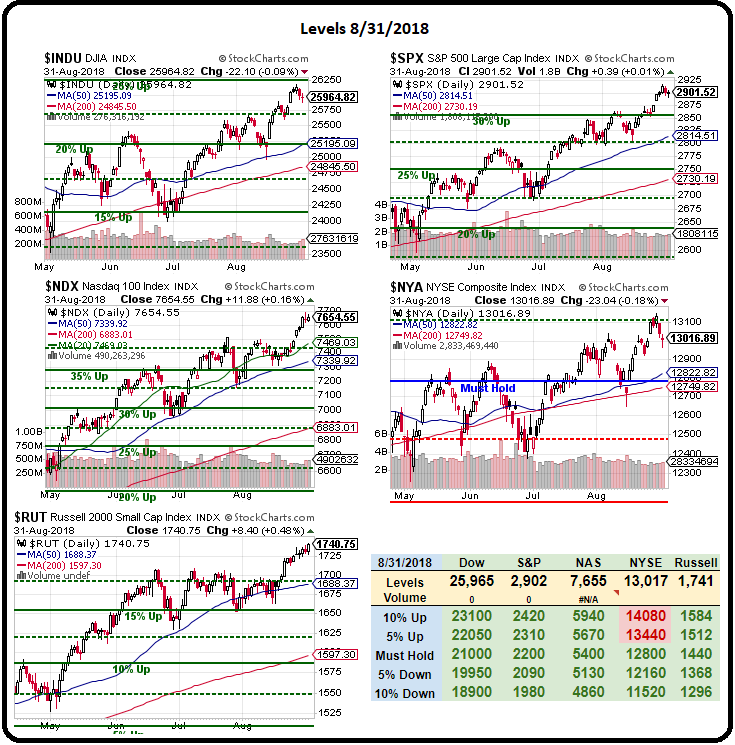

Overall, we're in no techincal danger on our indexes though watch the NYSE very closely if they come back towards that Must Hold Line at 12,800 this week. The other indexes have miles to fall before being in technical danger but that's not always a good thing for short-term traders, as they could be prone to a "flash crash" on bad news.