Wheeeee!!!!

Wheeeee!!!!

As you know, we love a good sell-off because we're very well-hedged but now we seem to be breaking even lower and we'll have to look at improving our hedges – just in case. We are significantly lower than 10/9's Tumblin' Tuesday and 10/2 was "Tuesday – Trouble at 1,700 for the Russell" and we're miles from that now as we are almost down to 1,500 and Sept 25th our Morning Report was: "Toppy Tuesday – Markets Bounce Back Ahead of the Fed" after 9/18's "Tariffic Tuesday – Markets Ignore Another $200Bn Drag on Global Trade". Oh, and last Tuesday was: "Tempting Tuesday – Nothing has Changed but Markets Move Higher."

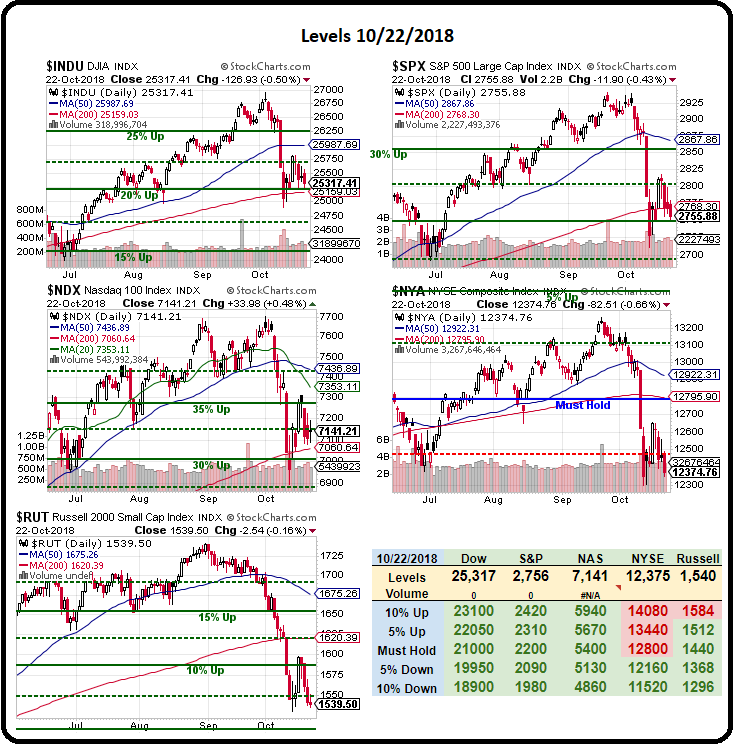

I don't do these reviews to say "I told you so" – it's my job to tell you so! Reviews are important because next time we're in a similar situation, you may recognize that that's what happened last time and that will help you make better trading decisions. That's why I started keeping a blog in the first place – to review my own thought process as I traded! Like last week, when I warned about chasing weak bounces, which we were clearly having that day. On that Monday (15th) we had posted the bounce lines for the indexes, according to our Fabulous 5% Rule:

- Dow (/YM): 25,450 (weak) and 25,700 (strong) – now 25,317

- S&P (/ES): 2,775 (weak) and 2,800 (strong) – now 2,766

- Nasdaq (/NQ): 7,100 (weak) and 7,250 (strong) – now 7,157

- Apple (AAPL): $223.50 (weak) and $226 (strong) – now $222

- Russell (/RTY): Anything below 1,552 is catastrophic – now 1,545

Those "nows" were from the morning of the 15th and, oddly enough, that's almost exactly where we finished last night and we knew that was a bad sign because "Anything below 1,552 is catastrophic" was a pretty clear warning, right?

We got back over last Tuesday but all the indexes failed to stay over their strong bounce lines (some not even weak) so it was no surprise when the correction began to resume after Friday's prop job into options expirations. I am both surprised and concerned at how hard we are falling on relatively no new news (down 350 on the Dow at 8:20) and hopefully 25,000 will hold (we tried playing it for a bounce and it failed already) but, if not, then DOOM!!!!

Not gloom, just doom because this is just a correction from a market that had gone too high and we're finally beginning to recognize SOME (not all) of the macro issues I've been ranting about all summer. Once we feel these macros are correctly factored into stock prices – we will be thrilled to go shopping – using all the CASH!!! we made from our hedges!

As noted on Thursday, when we reviewed our Money Talk Portfolio, we've been using the Nasdaq Ultra-Short ETF (SQQQ) as our primary hedge but already SQQQ is testing 15, which was the top of our range and, by coincidence, I will be on the Money Talk show tomorrow to talk about adjusting and we MIGHT flip bullish here and sell the long calls in our SQQQ June $10/15 bull call spread if we can get $5 for the $10s – as that's our goal and we don't think the Nasdaq is likely to sustain a move much lower than this because — Apple (AAPL).

While there are many overpriced stocks in the Nasdaq, AAPL is not one of them and AAPL is about 15% of the Nasdaq by weighting. Also, we had an extensive discussion on the value of Micron (MU) and decided they are far too cheap as well – though they still may endure more of a short-term correction before stabilizing.

As the angel said unto Lot: "Find me just two righteous stocks and I will spare the market" and we can certainly find 2 dozen of the Nasdaq 100 that are worth investing in so let's not throw the baby out with the bathwater or slay all the first-born children or whatever it is that Republicans like to do these days when they don't get their way…

As you can see from StJeanLuc's Big Chart (thanks), this morning we'll be failing the 200-day moving averages on the three remaining indexes that were above and the Russell and the NYSE are completing corrections that have taken them 5% below so it's very, very possible that we'll see another 5% drop in the market from here but, for the purpose of our SQQQ hedge, that only takes it to just over $16 – so no reason to panic on our short $15 calls.

Of course, if you don't have a lot of good hedges on your position then I do have to say "I told you so" because I did – over and over and over again – all summer long so I'm sorry if you didn't listen but hopefully next time you will and, even so, compared to the damage done in 2008 – you are getting off lightly with a very small slap on the wrist.

A good example of how a hedge is supposed to protect you from a drop is our Top Trade Alert of Sept 6th, in which I said:

Very interesting that Tech can't catch a break lately. MU and other chips getting hit hard. We'll see what AVGO says later.

Hedge/Gard – To hedge $1M of SPY positions, I'd go with an SDS hedge. He'd be looking to offset a $200,000 loss and SDS is at $34 so +20% (a 10% S&P drop on the 2x inverse ETF) is $42 and the March $34 ($2.60)/$40 ($1.50) bull call spread is $1.10 and pays $6 in a big drop so let's say he wants to offset $60,000 worth of damage – he can do that for $11,000 and that's the cost of insurance.

I'd pair that with some short puts on stocks he'd REALLY like to own if they get cheap, like 10 MU 2020 $42 puts at $6.40 ($6,400) which drops the net cost to $4,600 on the $60,000 spread, giving it $55,400 (1,200%) profit potential if SDS is over $40.

SDS should be close to $38 this morning, putting the March $34 calls $4 in the money at about $4.80 while the short $40 calls should be about $2.80 so the bull call spread is at net $20,000 less the 10 short MU 2020 $42 puts at $7.80 ($7,800) is net $12,200 from our net $4,600 entry is up $7,600 (165%) so far but keep in mind that, if we finish at $38 on SDS, the short calls would be worthless and we'd have $40,000 on the longs – almost a 10x return.

A hedge isn't supposed to pay you on a spike down that corrects – it pays you if there's a prolonged drop and your long positions don't recover. This particular hedge was very, very cheap ($4,600 net) compared to the potential $55,400 pay-off if SDS is over $42 in March – that would be where we are if the Dow does drop another 5% and stays down into 1.

A hedge isn't supposed to pay you on a spike down that corrects – it pays you if there's a prolonged drop and your long positions don't recover. This particular hedge was very, very cheap ($4,600 net) compared to the potential $55,400 pay-off if SDS is over $42 in March – that would be where we are if the Dow does drop another 5% and stays down into 1.

Our goal on a hedge isn't to erase all the damage – just to mitigate it. If you feel that you have to hedge so much as to erase all possibility of a loss to your long positions – THEN TAKE YOUR LONGS OFF THE TABLE DUMMY! Now THAT is good trading advice…

Even as a new trade, this SDS hedge at $7,600 still returns $60,000 for a $52,400 (689%) profit if the Dow falls another 1,000 points so it's good for a new trade as long as you REALLY want to own 1,000 shares of Micron (MU) at $42 (now $38). Otherwise, you can substitute any stock that's on sale that you REALLY would like to own down the road as your offset but, after this morning's MU discussion – I'm fine sticking with them for the long haul…

I THINK this morning's sell-off is a bit overdone given that nothing has really changed – just sentiment so we'll be looking to play Nasdaq Futures (/NQ) long at the 7,000 line (tight stops below!) and the Russell Futures (/RTY) at the good old 1,515 line along with S&P (/ES) 2,700 and Dow (/YM) 25,000 – which already failed but if it goes back over that's a good sign.

Oil (/CL) makes a nice long at $67.50 for a quick bounce, as does Gasoline (/RB) at $1.86

If those lines fail, we'll add more hedges and tomorrow we'll do a triage and see if we need to add hedges to the Money Talk Portfolio tomorrow morning.