Pretty, pretty please?

Pretty, pretty please?

Mommy and Daddy had to put up a unifed front last night and tried to explain to Donald, using very small words, why he couldn't have a great big wall to play with. The wall would be "expensive and ineffective" Pelosi said. “Democrats and the president both want stronger border security. However, we sharply disagree with the president about the most effective way to do it,” said Schumer. Donald also said the Santa Mexicans were going to pay for his wall and that turned out not to be true and Mommy and Daddy said we simply can't afford a $30Bn wall this year ($5.7Bn is just the downpayment to get started).

Not only that but, once you get the wall home, it's expensive to keep as you need 2,500 miles worth of guards and then there's the repair bills – which we don't pay on the other infrastructure we already bought. It's like when you let a kid take care of a goldfish before trusting him with a puppy and President Trump has given us a very dead goldfish as far as infrastructure goes and now, rather than repair roads, bridges, damns or power-lines, Trump wants a new wall to play with but, as responsible parents, we already know it's only going to end up neglected like all his other toys.

Of course, Trump's temper tantrum which is ruining the lives of 830,000 Federal Workers and the Millions of Americans who depend on their services, is not just about the wall. “This president just used the backdrop of the Oval Office to manufacture a crisis, stoke fear, and divert attention from the turmoil in his administration,” Schumer said. Democrats have urged President Trump and Congressional Republicans to support legislation that would reopen the government while they continue the debate over border security. “President Trump must stop holding the American people hostage, must stop manufacturing a crisis, and must reopen the government,” Speaker Pelosi said.

This was the first speech of Trump's Presidency from the Oval Office and, though it started out sort of Presidential, it quickly veered back to the usual fearmongering and completely made-up nonsense that comes out of any child's mouth when they are caught doing something they shouldn't be doing. To sum up Trump's speech: "Scary immigrants are coming to kill you! Drugs are coming over the border!"

As noted by Rick Wilson, Trump admitted that the idea of a glorious concrete wall from the Pacific to the Gulf of Mexico is deader than that lemur he glues on his head every morning. It will, at most, be a fence. This is not what Trump’s supporters voted for. They voted for his sales pitch of a 30-foot concrete wall with laser moats, robot alligators, and minefields, all paid for by Mexico. This speech was supposed to be about forcing the national dialogue to stay on the border wall. No such luck. He reeked of defeat, clearly didn't want to be there, and it showed.

Trump is meeting today with the House and Senate Republicans, in an attempt to prevent them from defecting and voting with the Democrats to end his shutdown. He'd better be a lot more convincing than he was last night or we may have an historic event where enough Republicans vote against the President to override his veto – and that would make Trump the lamest duck that ever sat in the oval office.

Trump is meeting today with the House and Senate Republicans, in an attempt to prevent them from defecting and voting with the Democrats to end his shutdown. He'd better be a lot more convincing than he was last night or we may have an historic event where enough Republicans vote against the President to override his veto – and that would make Trump the lamest duck that ever sat in the oval office.

On the whole, this is good for the markets as the shutdown will end, not because Trump gets his wall, but because he will be defeated in his idiotic quest and you can thank Schumer and Pelosi for coming across as responsible adults who will no let Donald get away with the crazy sort of nonsense Paul Ryan and Mitch McConnel have been allowing Trump to get away with for the past two years.

The National Academy of Sciences just did a study on immigrants and crime and their conclusion, based on actual EVIDENCE, is the exact opposite of what Trump is saying:

CRIME CONCLUSIONS: The National Academy of Sciences examined numerous academic studies on crime rates by immigrants and concluded they are less likely than the native-born population to commit crimes. It also concluded that neighborhoods with greater concentrations of immigrants have lower rates of crime and violence than comparable nonimmigrant neighborhoods. The study didn’t examine crime rates specifically among undocumented immigrants. Overall, crime rates fell in the U.S. as the size of the unauthorized immigrant population rose in the past two decades.

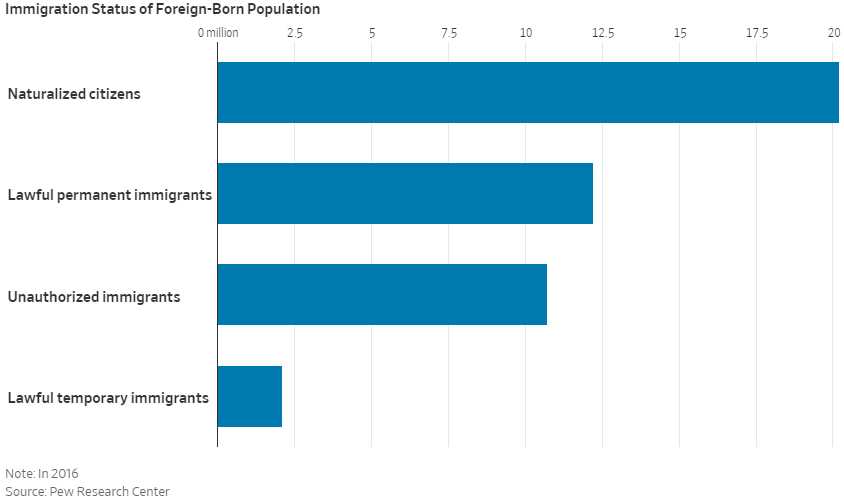

Also, as it turns out, there are only 11M unauthorized immigrants in the US TOTAL – Trump says THOUSANDS are coming across the boader every day. Even 2,000 x 365 = 730,000 a year so we know that number is complete BS too. And, if "thousands" of illegals come into our country every day – what was so special about one caravan of immigrants trying to APPLY for entry into our country? Why were they screaming about it for the months leading up to the election and, since then, nothing at all?

Also, as it turns out, there are only 11M unauthorized immigrants in the US TOTAL – Trump says THOUSANDS are coming across the boader every day. Even 2,000 x 365 = 730,000 a year so we know that number is complete BS too. And, if "thousands" of illegals come into our country every day – what was so special about one caravan of immigrants trying to APPLY for entry into our country? Why were they screaming about it for the months leading up to the election and, since then, nothing at all?

Seems a bit suspicious, don't you think?

Another bit of negative fallout from the shutdown that's hurting investors is the shutdown of the SEC, which means no one can get the go-ahead for IPOs so nothng scheduled for January is actually going to happen and then there will be a backlog – even when the shutdown ends – and then IPOs will be bunched too close together so some will have to be pulled and that means a lot of bridge financing will fall apart, which then stops other deals from moving forward. It's a mess…

It also means that companies that NEED the IPO money to move projects forward will instead, take a loss for the quarter and that's likely to make it harder for them to raise capital at the same valuation in Q2. Not only do the companies not progress but the vendors they buy things from don't get orders they were counting on. IPOs bring a lot of fresh capital into the markets from the sidelines – it's a bad time of year not to have any.

Meanwhile, without much happening, the markets continue to drift towards our predicted bounce lines. We have the Fed Minutes at 2pm but the Fed stance has clearly gotten more doveish since then, in light of our little market meltdown. We're just going to keep watching but it's very encouraging that, since Monday morning's PSW Report, we've been able to add green highlights to the Dow, Nasdaq, NYSE and the Russell so we just need the S&P to confirm and we're at 2,583 this morning – so not too far and we're almost looking good again.

- Dow 27,000 to 21,600 is 5,400 points so 1,080-point bounces to 22,680 (weak) and 23,760 (strong)

- S&P 2,950 to 2,360 is 590 points so 120-point bounces to 2,480 (weak) and 2,600 (strong)

- Nasdaq 7,700 to 6,160 is 1,540 points so 300-point bounces to 6,460 (weak) and 6,760 (strong)

- NYSE 13,200 to 10,560 is 2,640 points so 528-point bounces to 11,058 (weak) and 11,586 (strong)

- Russell 1,750 to 1,400 is 350 points so 70-point bounces to 1,470 (weak) and 1,540 (strong)

Our stop on Thursday's Nasdaq (/NQ) longs is 6,600 (up $8,000 per contract) as we don't want to be greedy and we've switched to the Russell (/RTY) Futures at the 1,400 line, looking for $3,500 per contract at 1,470 if all goes well. The Russell is what we call a "Lagger", it's the tug boat that's not falling in line with the rest and once the big ship (/ES) gets over the strong bounce line – it's inevitable that the lagging /RTY will pop back over it's weak bounce line (as long as the other tug boats hold their lines, of course).