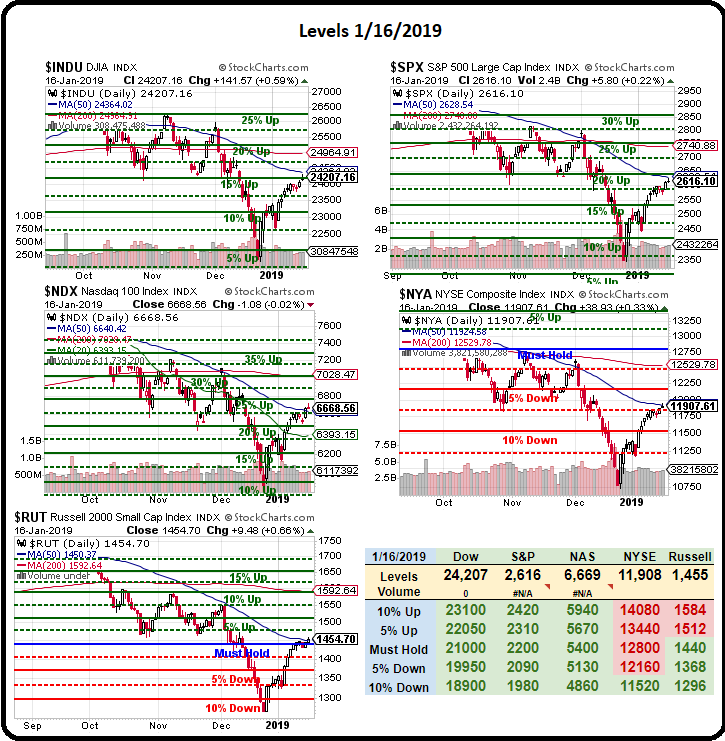

As of this morning, the 50-day moving averages are:

As of this morning, the 50-day moving averages are:

- Dow 24,364, now 24,072 on /YM

- S&P 2,628, now 2,604 on /ES

- Nasdaq (100) 6,640, now 6,650 on /NQ

- NYSE 11,924, now 11,850, (no futures)

- Russell 1,450, now 1,449 on /RTY

To say that we are at a critical inflection point in the market would be a huge understatement and, as I noted in Tuesday morning's PSW Report, we took precautions against a downturn by adding hedges to our Short-Term Portfolio in Monday's Live Member Chat Room – just in case things spiral further out of control.

On the whole though, we're still a bit optimistic, though we are looking to cash out some longs today – so we will have less to hedge against, which, in turn, makes our existing hedges more powerful (as they will be hedging a smaller amount of longs). It's going to be easier to have a positive event – like ending the shut-down or agreeing with China or a Brexit Deal – than it is likely to have an event even more negative than the damage we're causing to ourselves (maybe that strange asteriod is an alien invasion?).

Meanwhile, our current economic momentum is down so SOMETHING needs to change or things will really start falling apart. Both the US and China are suffering from Trump's idiocy and the US is also suffering from Trump's other idiocy but the UK has their own team of idiots that are ruining their economy with a little help from the idiots in the EU, who seem to flip-flop between dancing on England's grave and worrying that an unscripted Brexit will also be the beginning of the end for their Union as well.

Maybe I might have changed

And not been so cruel

Not been such a fool

Whatever was done is done

I just can't recall

It doesn't matter at allYou see it's all clear

You were meant to be here

From the beginning – ELP

The markets turned sour overnight as Trump threatened more Auto Tariffs and the US targeted Huawei in a criminal probe of stealing trade secrets and Goldman Sachs warned that we may lose a full point of GDP as rich people spend less in 2019 – because they didn't get another huge tax cut on top of last year's. Apparently, we have to give the Top 1% bigger and bigger tax cuts every year to drive our economy or maybe (as is being pushed by the Cortez Democrats) we need to rethink the whole system and go back to NOT relying on rich people to drive the economy and stimulate the bottom 90% instead. I know – CRAZY!

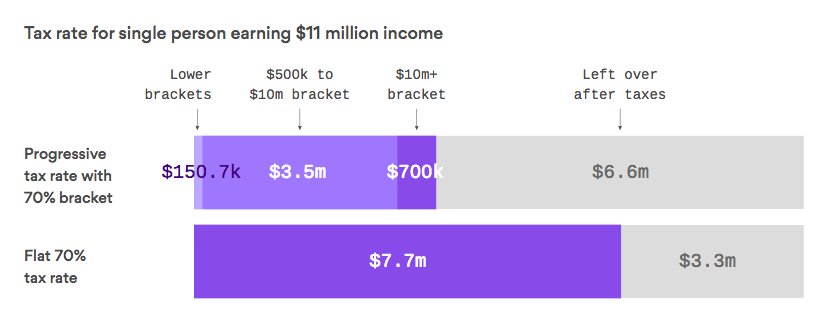

Cortez is proposing a tax of 70% on people earning more than $10M a year. This would generate about $150Bn in tax revenues enough to pay ALL the taxes of the bottom 60% of Americans or to fund Infrastructure Projects that would employ Millions – benefitting all 320M US Citizens. Remember, we're talking INCOME of $10M a year – not even Capital Gains from sales of companies and such. As noted by Slate:

Cortez is proposing a tax of 70% on people earning more than $10M a year. This would generate about $150Bn in tax revenues enough to pay ALL the taxes of the bottom 60% of Americans or to fund Infrastructure Projects that would employ Millions – benefitting all 320M US Citizens. Remember, we're talking INCOME of $10M a year – not even Capital Gains from sales of companies and such. As noted by Slate:

Multimillionaires would certainly lose money under AOC’s tax proposal. How much does that matter? Economists typically appeal to utilitarian reasoningto argue that it matters very little: The superrich can buy nearly anything under the sun either way, so a few hundred grand here or there has a negligible effect on their well-being. And just 16,000 Americans make more than $10 million per year—they’re literally the 1 percent of the 1 percent (0.05%, to be exact) — making any negative impact of the tax even tinier.

As usual, we're missing the boat because the real money the Government isn't collecting is from the Corporations, who made $9Tn last year and paid just $419Bn (4.6%) in Federal Taxes – a percentage that will become even smaller under Trump's new tax plan. Working Americans, on the other hand, paid $1.79Tn in Income Taxes and another $1.14Tn in Payroll Taxes for a total of $2,930Bn – 7 TIMES more than their Corporate Masters are paying.

As usual, we're missing the boat because the real money the Government isn't collecting is from the Corporations, who made $9Tn last year and paid just $419Bn (4.6%) in Federal Taxes – a percentage that will become even smaller under Trump's new tax plan. Working Americans, on the other hand, paid $1.79Tn in Income Taxes and another $1.14Tn in Payroll Taxes for a total of $2,930Bn – 7 TIMES more than their Corporate Masters are paying.

THAT IS WHAT'S WRONG WITH THE ECONOMY!

A simple 20% flat tax (no deductions) on Corporate Profits would generate $1.8Tn a year and still leave them with $7.2Tn to buy a better Government with but at least the rest of us would have a balanced budget – and even enough left over to begin paying down our debts. That's all it takes, one little tweak to the RIGHT Top 0.1% – not the Individuals – but the Corporations!

I'm more in favor of a Europe-style VAT Tax on of 25% on all goods and services, which would generate $5Tn in tax revenue in our $20Tn economy and no one would have to pay income tax or payroll tax at all – including Coroprations. So you would keep 100% of the money you make and things would be 25% more expensive at the store. $5Tn is $1Tn more than we need so we could pay off our Government debt in 20 years and that would then save us $400Bn a year in interest payments. Of course, in order not to hurt the Bottom 40%, who won't save any taxes (they don't make enough) but will pay at the counter – we could rebate those 64M wage-earners $4,000 each which would cost us "just" $256Bn but would give them MUCH more money to spend and that money would go right back into the economy anyway – increasing both our GDP and our VAT revenues.

There, that's the economy fixed. For my second day in office….