Uh-oh!

Uh-oh!

Early this morning the US and China announced they had made "significant progress" and have outlined "commitments in principle" with Negotiators are drawing up six memorandums of understanding on structural issues: forced technology transfer and cyber theft, intellectual property rights, services, currency, agriculture and non-tariff barriers to trade. The Chinese are even coming to Washington TODAY to continue their "fruitful" discussions of last week – actually attempting to hit the March 1st deadline for a deal.

You would think the Dow would be up at least 200 points on this news – but noooooooooooooo – it's down slightly and if a trade deal isn't going to be a good catalyst – then I am worried that we don't have a catalyst to take us any higher than we are now.

As you can see – there was a pop around midnight, when the announcement hit the wires but it has since faded out while the Russell made it right to our stopping line at 1,590 but failed there, so it's game on for the Russell Fututures (/RTX) shorts we discussed yesterday (we already had some small winners) – despite the "great" trade news.

We got a very doveish Fed Report yesterday and that didn't help much – especially considering the Dollar was down 1% – so the markets should have been much higher in yesterday's action. These are all signs of rally exhaustion and we still have our hedges in place from last week and I would strongly suggest you take some time to make sure your own portfolio is well-protected.

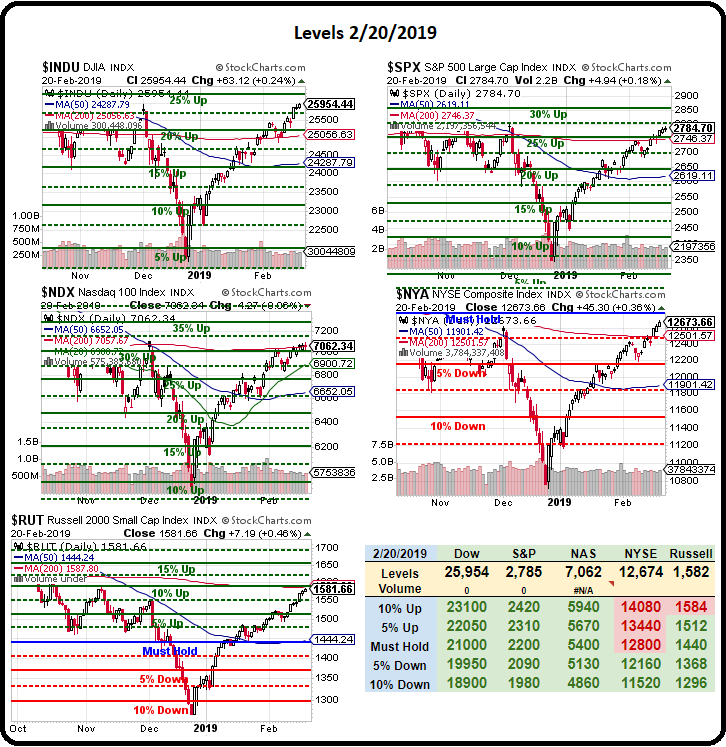

The Dow is up 1,000 points (3.7%) from the Feb lows and up 4,300 points (19.8%) from December's low of 21,700. If we call the Dow low 22,000, a 20% run would take us to 26,400 but a 4,400 point run would have an 880-point weak retrace (25,520) and a 1,760 strong retrace could take us back to 24,460 without even breaking the downtrend. On our other indexes, we should be watching:

- S&P 2,400 to 2,880 would be a 20% run and retraces would be 2,784 (weak) and 2,688 (strong)

- Nasdaq 100 6,000 to 7,200 would be a 20% run and retraces would be 6,960 and 6,720

- NYSE 11,000 to 13,200 would be a 20% run and retraces would be 12,760 and 12,320

- Russell 1,300 to 1,560 is a 20% run (that's why we're shorting them – as they are over) and retraces would be 1,508 and 1,456.

It's mostly going to be "watch and wait" into the weekend and we'll see what holds. As long as we're over those 200-day moving averages – all is well but, as I predicted earlier in the week – it was more likely going to be the top than the start of another leg higher – with or without a China deal.

IN PROGRESS