The markets are very moody.

The markets are very moody.

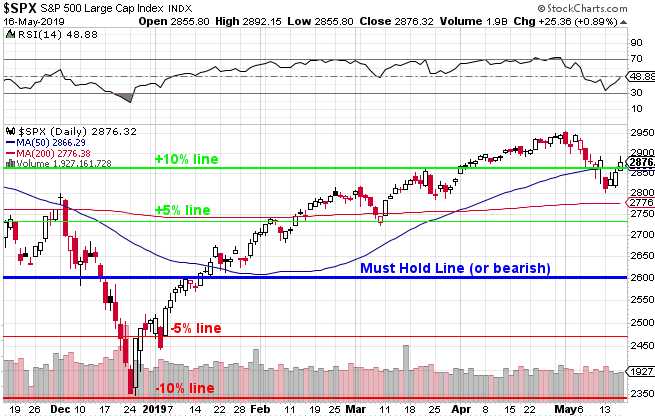

Just when we got the S&P back to our 10% line, we're down 20 points this morning and back below the 50-day moving average (2,866), back at the 2,860 line that marks the bottom of our 5% correction zone on the bounce charts we've been using all week. It's a very disappointing setback and, if this is how we're going to go into the weekend – we are going to need more hedges!

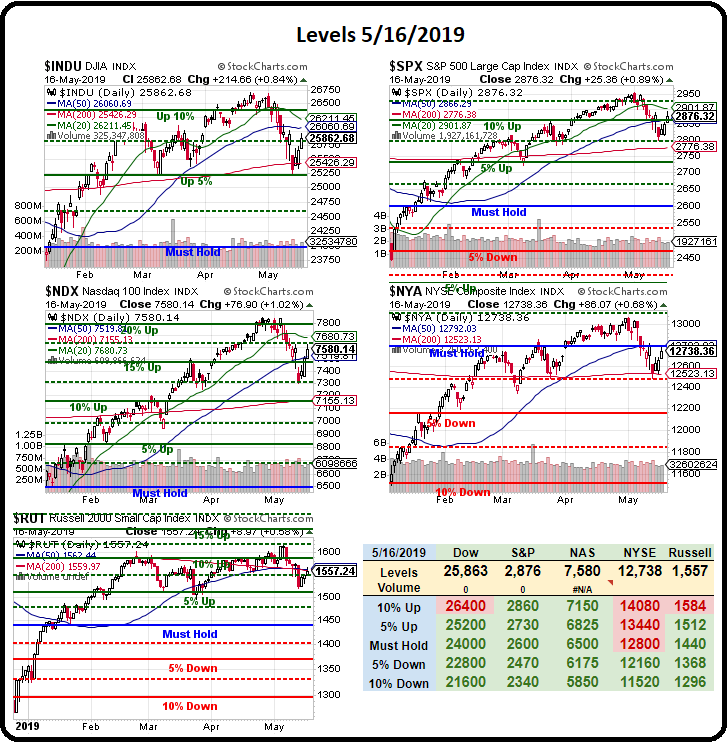

At the moment (7:30), however, the 5% Rule's™ Bounce Chart™ looks like this:

- Dow 25,200 is the 5% line and the bounce lines are 25,450 (weak) and 25,700 (strong)

- S&P 2,860 is the 5% line and the bounce lines are 2,875 (weak) and 2,890 (strong)

- Nasdaq 7,475 is the 5% line and the bounce lines are 7,540 (weak) and 7,605 (strong)

- Russell 1,550 is the 5% line and the bounce lines are 1,565 (weak) and 1,580 (strong)

We were all red except the Dow (which was at the weak bounce line) on Tuesday morning so this is still progress, but just yesterday afternoon we only had 3 red boxes left to capture and we would have been back to bullish. That's what's useful about the Bounce Chart – it keeps you from making bad decisions by making sure the rally is real before we start throwing money after what turns out to be just a dead cat bounce.

Since the S&P and the Russell are at the -5% Lines, we'll be watching them closely and, if they turn red – we're not going to wait for more evidences to bump up our hedges. Since we're talking about hedges and since I'm late with our reviews – now is an excellent time to do our Short-Term Portfolio Review!

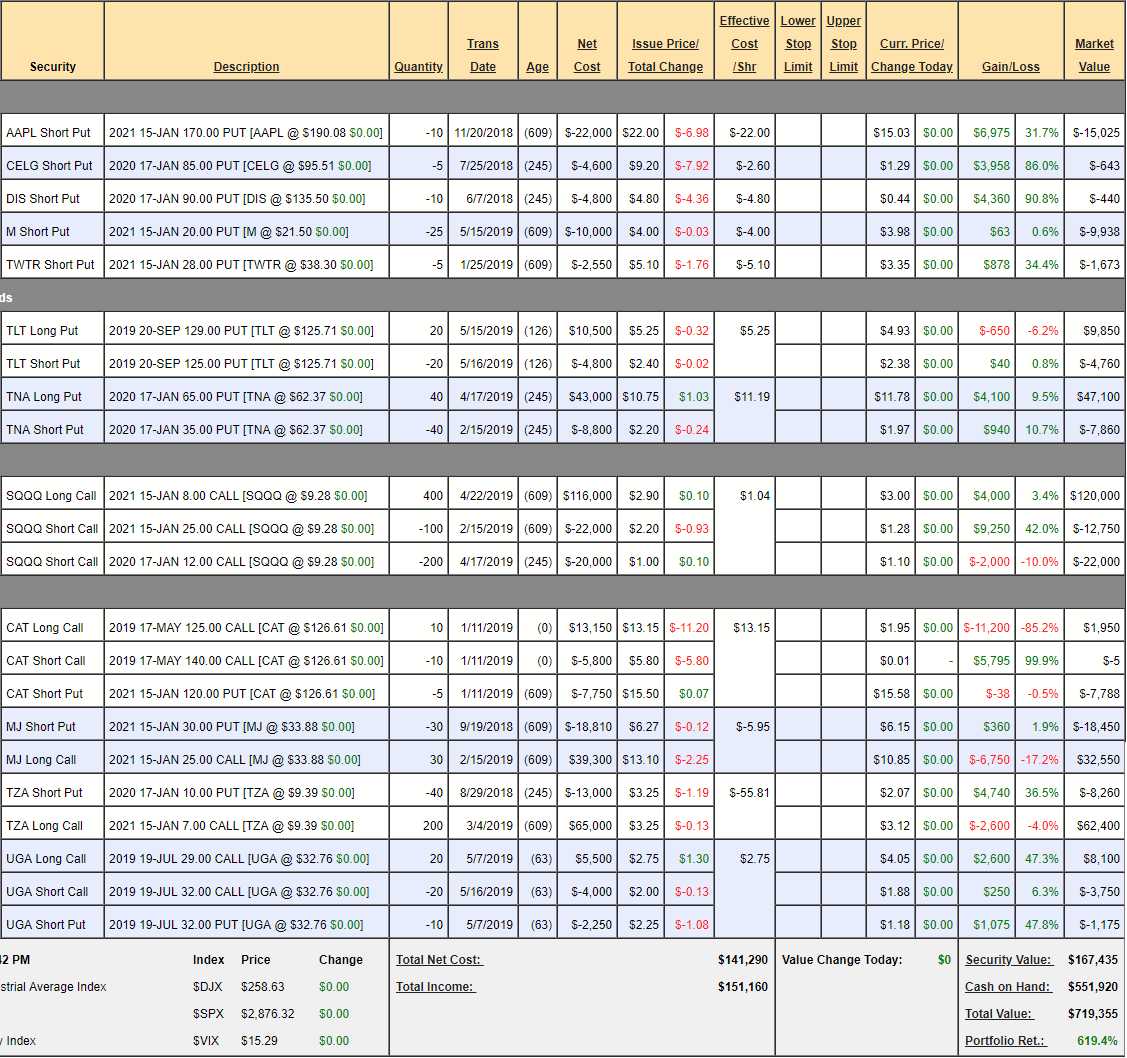

The Short-Term Portfolio (STP) is part of a paired portfolio (see our Virtual Portfolio Tab for other reviews) system we teach our Members to use and it's the defensive part of our LTP/STP strategy, where the Long-Term Portfolio gets a $500,000 alllocation and $100,000 is allocated to the Short-Term Portfolio to protect it. This forces us to have the discipline of ALWAYS being hedged as it's specifically the STP's job to be short the market at all times but not just with mindless hedges that lose money – the challenge of the STP is to try to MAKE money by finding shorts in a bull market.

Frankly, it turns out we're very good at doing that as the Short-Term Portfolio, with it's very aggressive positions, has made much more money than the Long-Term Portfolio this year (on a percentage basis), as it's up 619.4% at $719,355 from a $100,000 start on Jan 2nd, 2018 and the Long-Term Portfolio is "only" up 159.4% but that's a gain of $797,222 from the same Jan 2nd, 2018 start date.

Frankly, it turns out we're very good at doing that as the Short-Term Portfolio, with it's very aggressive positions, has made much more money than the Long-Term Portfolio this year (on a percentage basis), as it's up 619.4% at $719,355 from a $100,000 start on Jan 2nd, 2018 and the Long-Term Portfolio is "only" up 159.4% but that's a gain of $797,222 from the same Jan 2nd, 2018 start date.

While the LTP has sensible long-term positions that are meant to make slow, steady returns, the STP is very aggressive with much shorter time-frames and we take quick profits off the table and we've been fortunate enough to catch several market dips in the past 18 months – despite the general uptrend of the market – a perfect storm for our paired portfolios to prosper in:

- Apple (AAPL) – This section is for short puts we used to offset the cost of our hedges. That way, if we're wrong and the market is bullish – we get cash from the short puts to dull the pain. Of course we only sell puts against stocks we'd REALLY like to own at the net strike price and, if they do get assigned to us – they become a cheap entry to start a Long-Term Portfolio position. For instance, here we sold 10 Apple 2021 $170 puts for $22 ($22,000). That put $22,000 in our pockets in exchange for promising to buy AAPL between now and 2021 for $170 (the contract buyer can assign us at any time but it's not logical for them to do so if AAPL is over $170). If we do get assigned, our net entry is $148 ($170 less the $22 we were paid for the contract) – which is a price we'd be very happy to own 1,000 shares of AAPL for in our LTP.

- Celgene (CELG) – They are getting bought by BMY for $100 so we'll be able to close out this contract early.

- Disney (DIS) – So deep in the money that we're not in the least bit worried about it. We've already captured 90% of the value of the put but we don't need the margin so we can leave it on for now but, if we wanted to clear a spot, this would be the obvious choice.

- Macy's (M) – We just added this one so great as a new hedge. M is far too cheap and the implied volatility of the stock allows us to net in for $16, which is 25% below the current price.

- Twitter (TWTR) – Deeply in the money and we're not worried about this one either.

- 20-Year Treasury ETF (TLT) – We just added this spread and it's good for a new trade. We think rates will head higher from here over the summer (due to weak demand at auctions) and that will weaken TLT. The potential for this spread is $16,000 and it's still just net $5,090 so the upside potential is $10,910 (214%) in just 126 days (4 months) – this is exactly the kind of play we love in the STP!

- Small Cap 3x Bull ETF (TNA) – This is the 3x ultra-long ETF for the Russell 2000 so it will fall sharply if the Russell corrects. We picked it up near the top and it's already up $5,040 out of a potential $85,800 so it's still good for a new trade if you need a hedege as lots of room to grow if the sell-off continues but, keep in mind, these hedges are trades we EXPECT TO LOSE (now net $39,240 out of $120,000 potential) in a bull market, where the gains of the LTP should offset our losses.

- Ultra-Short QQQ (SQQQ) – This is the 3x ultra-short on the Nasdaq and it's our primary hedge. Surprisingly, it's acutally not losing money despite the Nasdaq's recovery. That's because the Nas volatility is still high, inflating the "value" of our hedge. Again, we expect to lose money on our hedges – it's like life insurance – you pay every month but you hope you're not going to get your money back! Since it's a 3x ETF, a 10% drop in the Nasdaq should make it pop 30% from $9.28 to $12.06 and that would make the $8 calls at least $4.06 x 400 contracts of 100 options each = $162,400 and the current net value of the spread is $85,250 so we get $77,150 worth of protection against a 10% drop in the Nasdaq (QQQ). Of course, it has been known to go much higer…

Notice we sold 200 SQQQ Jan 2020 $12 calls for $20,000 against our 2021 calls. That's how we hedge our hedges and, if they expire worthless, we'll collect another $20,000 selling 2021 calls so the net of the spread will drop to about $54,000 for 18 months of $162,400 worth of protection but with the bonus that we can make much, much more in a major correction (at $20, the $8 calls would be $12 each but 1/2 are covered at $12 for $80,000 while the other 200 would be $240,000 – that would offset some tremendous losses in the LTP).

- Caterpillar (CAT) – We were right about the spread but wrong about the timing as CAT just sold off from $1456 to $126 and we could have and should have cashed this spread in last month at net $7,050 with a $7,450 profit (it was a $400 credit spread). Now we have a loss but we're going to re-invest as CAT is stupidly cheap and roll the 10 May $125 calls at $2 ($2,000) to 20 Jan $130 ($9.75)/140 ($5.75) bull call spreads at net $4 ($8,000) and that will pay back $20,000 if all goes well. Hopefully that will give us enough time to resolve this trade nonsense and, if not, the hedges will be doing great!

- Alternative Harvest ETF (MJ) – Another bullish offset to the losses we expect to take on our hedges. It's down at the moment but I'm strongly bullish on the Cannabis space and expect MJ to be well over $50 by Jan 2021, whcih would return $75,000 against our current net $14,100 spread so a potential gain of $60,900 (431%) seems good to me.

- Small Cap 3x Bear ETF (TZA) – Our other major hedge has the same $12 goal as SQQQ but these would pay $5 and are uncovered so $100,000 at $12 against a current value of $54,140 and, like SQQQ, we can lower our basis by selling short calls but we'd rather be flexible into the weekend and able to take quick advantage of sudden drops. Still, only $45,860 worth of protection against a 10% drop means we'll be looking to beef up this hedge into the close.

- US Gasoline Fund (UGA) – This was featured in our May 7th PSW Morning Report along with the /RBN19 Futures at $1.92, which we just cashed out at $2.03 in yesterday's live Member Chat Room for a gain of $4,720 PER CONTRACT so congratulations to all our Futures players but UGA is a nice consolation prize for the Futures-impaired and we expect to see the full $6,000 on this spread by July.

So those are our hedges and the deteriorating trade situation between the US and China, which is also turning into a technology spat against various companies that can be even worse than a trade war and the ratcheting up of tensions in Iran leads us to think we're going to need more hedges than this but we're NOT going to do anything unless our Bounce Chart tells us to. You can't afford to be emotional or in this kind of market so it's one of the rare times we let the technicals tell us what to do.

Have a great weekend,

– Phil