More free money!

More free money!

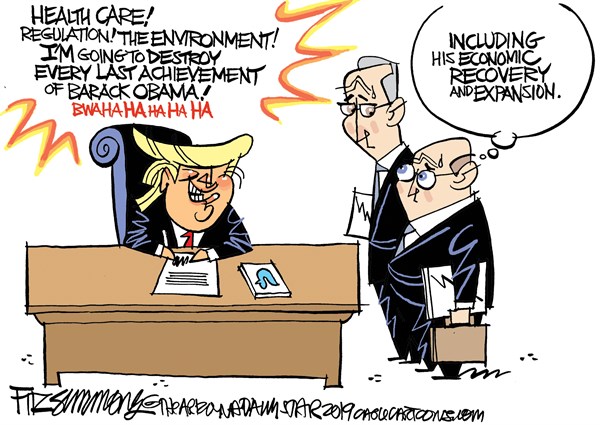

Whenever the market begins to dip, the Fed jumps into the fray to prop things up. That, of course, is not what the Fed is supposed to do – but they have morphed their mission into propping up the markets since the Banksters (which is who the Fed really works for) simply make more money in a bullish market – and these guys REALLY like money. They like money so much, they are even helping Donald Trump keep his Presidency.

Why? Because it it's not Trump in 2021 it's very likely to be Elizabeth Warren and she is one of the few people in Congress who actually understands the banking system – not as an abstract – but with a Harvard Law Professor's understanding of every little line they put into their 20-page contracts and she can clearly see how and where the money is flowing. You can't trick Elizabeth Warren and, for a profession that only exists to get people to part with their money – that's a bad, bad thing.

A Warren Presidency will cost banks BILLIONS in profits and it's likely to be no picnic for the Fossil Fuel Industry or Big Pharma either. That's why Donald Trump pulled in $125M in donations last quarter – the "Never Warren" wing of the Republican Party has vey deep pockets indeed. Those same donors are backing all the GOP Senators and Representatives too so don't get too deep in your liberal fantasies that 20 GOP Senators will walk away from their base AND their money in order to do the right thing and impeach Trump – it's very unlikely.

Either way though, the Democrats win as Trump staying on despite being obviously guilty is very likely to cause enough GOP Senators to lose their jobs to give the Democrats a majority in both houses and Trump is very unlikely to beat Warren in the General Election. So far, the only dirt Trump could dig up on Warren after 4 years of trying is that she claimed to be part Native American (and it is but a very small part), calling her "Pocahontas", which any Disney fan (or Neil Young fan) knows is actually a compliment but Trump, despite having many kids – is not the kind of Dad that sits there watching Disney with them.

If Trump is impeached, likely in March, then the Senators defending him will look like idiots and again, the Dems have a good chance of taking the Senate and the GOP has little time to prepare a candidate to run against them AND there are other contenders for the GOP ticket already – so it would be a total mess. Meanwhile, Warren and the Democrats' message to voters can be summed up in a song:

"You think you own whatever land you land on

The Earth is just a dead thing you can claim

But I know every rock and tree and creature

Has a life, has a spirit, has a name

You think the only people who are people

Are the people who look and think like you

But if you walk the footsteps of a stranger

You'll learn things you never knew, you never knew

Come run the hidden pine trails of the forest

Come taste the sun sweet berries of the Earth

Come roll in all the riches all around you

And for once, never wonder what they're worth"

Socialism! No wonder Trump hates her so much…

8:35 Update: Only 136,000 jobs were added in another anemic Non-Farm Payroll Report but that's GOOD for the market as it puts the Fed firmly bacx on the table into their Oct 30th meeting and, as I noted above, we will hear from Jerome Powell at 2pm but first Bostic at 10:25 and after Powell it's Brainard (2:10), Quarles (4pm) and George (4:45). This is, so far, all going according to plan for the week as we expected the sell-off followed by a Fed save but how much of a save (ie. bounce) are we going to get after yet another 5% drop in the indexes?

We did hold 2,850 but we expected that and that's why we called for playing the Dow for the 200-point bounce off the 26,000 line yesterday so YOU'RE WELCOME for that $1,000 per contract gain on /YM. Clearly yesterday's PSW Report was worth the $3, right?

Notice on the above chart, it's the same S&P Chart we drew up on Aug 7th using the same lines because 5% Rule™ lines are not TA voodoo that changes with the wind – they are simply math formulas that predict the likely inflection points based on prior consolidations AND current valuation models. In other words, it has a Fundamental basis that has nothing to do with TA – we simply express it on a chart to illustrate the point.

TECHNICALLY, it took all of June and most of July to get to 3,025 on the S&P 500 and then we dropped hard and fast to 2,850 and spent most of August there and then half of September getting back (not quite) and now only a week in October to lose it again. Odds still favor a broader "M" pattern is forming and we'll see that lower weak bounce tested which, I'm sad to say, would mean the base line is still 2,600 on the S&P, not 2,850 and that would mean we still have another 10% to fall from here.

We're in CASH!!! so we don't really care but you may want to short the indexes into the weekend if we don't hit our Strong Bounce lines into the close today. As of yesterday's close, we were at:

- Dow 25,000 is the mid-point and bounce lines are 25,550 (weak) and 26,100 (strong)

- S&P 2,850 is the mid-point and bounce lines are 2,880 (weak) and 2,910 (strong)

- Nasdaq 7,200 is the mid-point and bounce lines are 7,360 (weak) and 7,520 (strong)

- Russell 1,440 is the mid-point and bounce lines are 1,472 (weak) and 1,504 (strong)

We should be over the lines to start the day but it's how we finish that counts. Trump's troubles got deeper overnight as text messages surfaced showing that he clearly withheld aid to the Ukraine for dirt on Biden – whether real or manufactured with the guidance of his personal attorney (Rudi). Not only that but Trump's actions CLEARLY had repercussions in US foreign policy, just as hit request for Russia to dig up dirt on Hillary during his 2016 campaign led to him conceding many points to that country – including ignoring their interference in that election AND the 2018 election (in Trump and the GOP's favor).

Now Trump, right on the White House Lawn, has asked China to assist him in digging up dirt on Joe Biden and who knows what favors he will end up trading for that if he's allowed to continue. Impeachment is not about "getting" the President – it's about protecting our national interests from a guy who uses them to trade personal favors!

Have a great weekend,

– Phil

"I wish a was a trapper

I would give thousand pelts

To sleep with Pocahontas

And find out how she feltIn the morning

On the fields of green

In the homeland that

We've never seen" – Neil Young