The Fed makes their final decision at 2pm.

We'll be doing our Live Trading Webinar at 1pm, EST so we'll be reacting to the FOMC announcement live but, other than yesterday's little dip, we've been chugging along so far this week and I think only bad trade news can derail us now.

With this President, we won't know for sure until midnight on Sunday whether or not there will be another round of tariffs placed on China. Yesterday morning there was a rumor the tariffs were delayed but now the signals are back to being mixed and the situation changes by the tweet. Trump is busy at the moment, lashing out at anyone not helping to get him out of his impeachment mess but it's too late now and this will drag on into next year – but traders don't seem to care.

As it's December 11th, we only have a month to go on our "5 Trade Ideas to Make $25,000 in 5 Months" so we'd better go over them and see if it's worth risking over the volatile holidays. We hedged our Member Portfolios last week but these were just 5 trade ideas to make money to spend for Christmas – so it really is time to take them off the table:

- Sell 5 VAC April $85 puts for $5.70 ($2,850)

- Buy 7 VAC Jan $80 calls for $20 ($14,000)

- Sell 7 VAC Jan $90 calls for $12.80 ($8,960)

The net cost of the spread is $2,190 and, if successful, it pays $7,000 at $90 or higher for a gain of $4,810 (219%) in 5 months, though the short puts won't expire until April – it should get us very close to our goal by January. The ordinary margin requirement of the short puts is $5,280 so a pretty efficient way to make $4,810 in 5 months!

As you can see, VAC has blasted up to $124.98 so we are DEEPLY in the money on this one. The Jan $80/90 bull call spread is now $45.40/$35.50 so the full net $10 there ($7,000) and the short April $85 puts are not 0.85 ($425) so net $6,575 is up $4,385 (200%) and I'd leave the short puts to expire worthless as it's still $425 more to be gained.

When a stock has been as volatile as WBA, we don't have to play them to win – they just need to not go lower so we're going to engineer a spread that pays us if the stock simply holds $50 into January options expiration (17th):

- Sell 10 WBA Jan $50 puts for $3.70 ($3,700)

- Buy 30 WBA Jan $47.50 calls for $5 ($15,000)

- Sell 30 WBA Jan $50 calls for $3.60 ($10,800)

The net cost of the spread is $500 in cash and the ordinary margin requirement for the short puts is $8,918 and, if WBA is over $50 on Jan 17th, the short puts expire worthless and the spread would be $7,500 in the money for a $7,000 (1,400%) gain in 5 months.

WBA is doing exactly what we thought they'd do so it's a good thing we took such a conservative position. Understanding how options work means we don't need a stock to go up to make a lot of money and now the Jan $47.50/50 bull call spread is $11.50/9 ($7,500), which is all of the $2.50 we expected so grab that! The short Jan $50 puts are now just 0.21 ($210) and that's net $7,390 and up $6,890 (1,378%) and we're very happy with that.

Meanwhile, we can take advantage of the opportunity and put our foot down at the $20 line (even though we're a bit below it now) and set up the following options play – the 3rd in our series of 5 Trade Ideas to Make $25,000 in 5 months:

- Sell 10 LB Jan $17.50 puts for $2.80 ($2,800)

- Buy 25 LB Jan $15 calls for $3 ($7,500)

- Sell 25 LB Jan $17.50 calls for $1.85 ($4,625)

That's net $75 on the $6,250 spread so there's $6,175 (8,233%) upside potential if LB can get back over $20 by Jan 17th (option expiration day) and it's an efficient trade as the ordinary margin requirement is just $3,834 so a very good way to make $5,150 into the holidays!

Again, imagine how much money you can make if you learn how to use options to make money on stocks that go nowhere… In this case, the Jan $15/17.50 bull call spread is right at the money at net $3.15/1.40 ($4,375) and the short Jan $17.50 puts are down to $1 ($1,000) so net $3,375 is up $3,300 (4,400%) but we can do much better – almost another $3,000 – if we leave it and LB stays over $17.50 so I say go for it.

We've played THC several times over the years, usually around $15 but we're not going to be so lucky this time but all we're going to do is play them not to go lower than $20 into Jan 17th expirations and we'll be home free with the following trade:

- Sell 10 THC Jan $20 puts for $2.50 ($2,500)

- Buy 20 THC Jan $15 calls for $6.50 ($13,000)

- Sell 20 THC Jan $20 calls for $3.10 ($7,500)

That's net $3,000 on the $10,000 spread so $7,000 (233%) upside potential is not as exciting as our other trade ideas but THC is a lot more of a blue chip so possibly the least risky of the set. Margin is also light, just $2,886 according to TOS in an ordinary margin account.

Wow, way too conservative on that one though we'll obviously be making our full $7,000 as we're almost 200% in the money now. As I always say: "If we make strong, fundamental picks in the first place – the rest will usually sort itself out for us over time." At the moment, the Jan $15/20 bull call spread is $22.25/17.50 ($9,500) and the short $20 puts are 0.05 ($50) so net $9,450 is up $6,450 (215%) but the extra $550 is pretty much a sure thing in a month – so I'd leave it.

#5 of our 5 Trades to Make $25,000 in 5 months is going to be Tanger Factory Outlets (SKT), which took a deeper hit today to $14.29. I just did a whole Top Trade write-up on them on Aug 1st – $1 higher, so no need to get into that but, for the purposes of this series, the trade idea will be:

- Buy 50 SKT Jan $12.50 calls for $1.85 ($9,250)

- Sell 50 SKT Jan $14 calls for 0.95 ($4,750)

- Sell 20 SKT Jan $15 puts for $1.85 ($3,700)

That's net $800 on the $7,500 spread so $6,700 (837%) of upside potential if SKT is over $15 on Jan 17th. Since we're selling puts over the current price, the ordinary margin is $5,741, so more than we'd like but, as noted on Aug 1st, I think SKT is ridiculously under-priced.

Are you seeing a theme here? We came up with these 5 trade ideas because we were cashing in our more aggressive portfolios and we wanted to pick 5 bullet-proof stocks and then use very conservative option spreads to give us a very strong chance of winning. 3 of our 5 picks did not go higher but ALL 5 of our picks are huge winners. See how options can greatly enhance your trading performance?

The Jan $12.50/14 bull call spread is now $3.50/2.05 ($7,250) and the short Jan $15 puts are now 0.30 ($600) for net $6,650 and that's up $5,850 (731%) and yes, I'd leave $6,650 on the table to make another $850 (12.7%) in 37 days.

Notwithstanding additional greed from here, our 5 Trade Ideas have indeed made $26,875 in just 4 months so a very Merry Christmas to all of our Members!

Since 3 of our 5 Trade Ideas have gone nowhere – how about we bonus trade them into Easter?

SKT was practically our Trade of the Year for 2020 and I still love them at $16. Earnings are mid-February though so the March option contracts would be do or die on that report. I guess we'll go for it, but selling June puts – just in case.

- Buy 30 SKT March $14 calls for $2.20 ($6,600)

- Sell 30 SKT March $16 calls for 0.95 ($2,850)

- Sell 15 SKT June $14 puts for $1 ($1,500)

That's net $2,250 on the $6,000 spread but there's only 100 days to play this time. The upside potential is $3,750 (166%) and that's because we're selling puts on an upswing instead of a downswing – which is much better.

LB has options in February or May so May it is in this case:

- Sell 10 LB May $17.50 puts for $2.35 ($2,350)

- Buy 25 LB May $15 calls for $4 ($10,000)

- Sell 25 LB May $17.50 calls for $2.60 ($6,500)

That's net $1,150 on the $6,250 spread so $5,100 (443%) upside potential if LB can hold onto $17.50 into May. Next earnings are 2/26 so that's the only report we'll see ahead of our May 20th expiration.

Had WBA not popped to $60 into Thanksgiving, they would have been our Trade of the Year. $58.41 is still less than 10x their $6/share earnings – so what's not to love? We can still play it conservatively like this:

- Sell 10 WBA April $57.50 puts for $3.25 ($3,250)

- Buy 25 WBA April $55 calls for $5.50 ($13,750)

- Sell 25 WBA April $60 calls for $3 ($7,500)

That's net $3,000 on the $12,500 spread so we have $9,500 (316%) of upside potential here with earnings to look forward to on Jan 8th.

So we're cashing out or first 5 Trade Ideas which used just $6,565 in cash and $26,659 in margin with $26,875 (409%) in gains and we're putting $6,400 back to work to make another potential $18,350 (286%) by May and we're doing this using fairly straightforward, simple trade ideas in a conservative fashion.

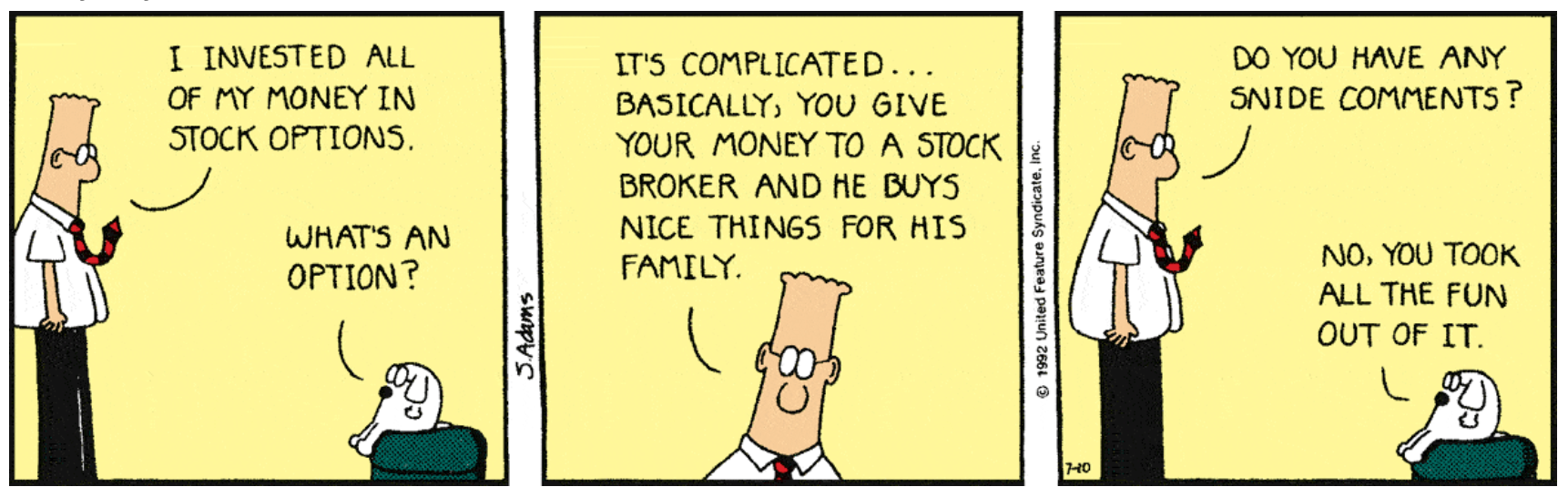

Stock Options have a bad reputation but can be a very valuable tool for any investor's tool belt – don't trade without them! Why do they work for us? Because, like a broker, we SELL options more often than we buy them so we are the ones collecting the fees and making the money!