$153,498!

$153,498!

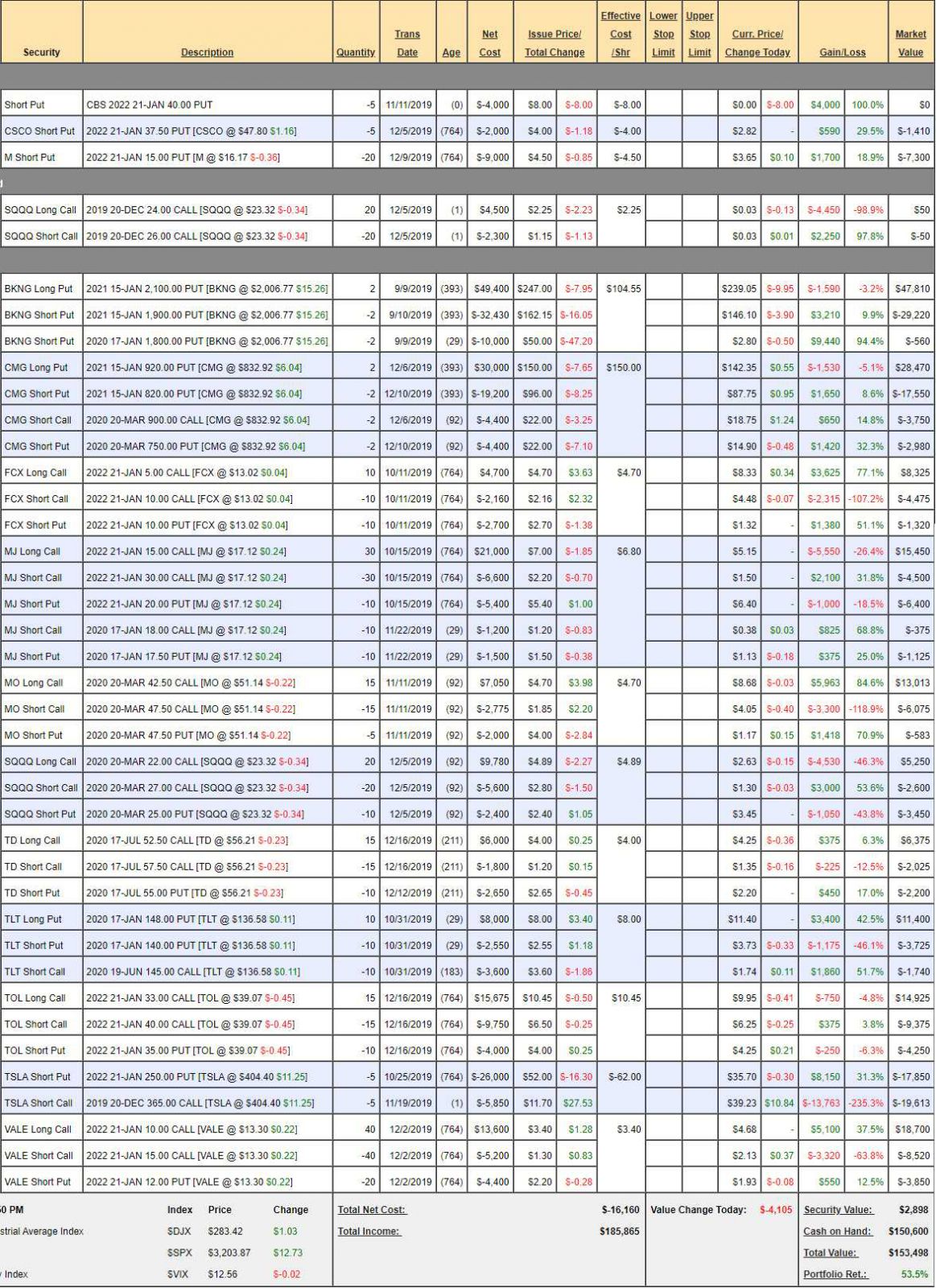

Not much action (up $1,445) since our last review on the Short-Term Portfolio and there is still no Long-Term Portfolio at the moment so the march to $1M is going very slowly at the moment. Still after being up 53.5% in 3 months - our primary goal shifted towards preserving our gains over the holidays and now we're just waiting to see if the markets hold up into earings and we can start buying again.

With the Iran situation and Trump's Impeachment and do we really have a China deal - it's hard to commit more cash into these overpriced stocks but we'll have to if they don't show any signs of slowing by the end of this month or we may miss the next ridiculous leg of this rally.

Short-Term Portfolio Review (STP): $153,498 (53.5%) is flat to the last review as our hedges killed us and so did TSLA. Still, I'd rather lock in a $50,000 gain over 3 months than risk giving it back so we got cautious after making ridiculous 2-month gains. Next month, we can start an LTP by simply renaming this one and removing the short-term plays and the hedges and putting them in a new STP - see how easy that was - we already started our LTP - and it's our STP!

- Short puts - All on track with $8,710 of additional potential.

- SQQQ - The December spread was a bet, not a hedge and offset by the CSCO puts - though it's a long time before we get this loss back. Just dead money here.

- BKNG - Very nice as we bought back the short calls and now we can sell them again. Unfortunately, we shorted BKNG over China Trade issues affecting travel (it did) but that's over now and they really aren't that expensive at $2,000.